Section of the Internal Revenue Code that designates an organization as charitable and tax-exempt. Organizations qualifying under this section include religious, educational, charitable, amateur athletic, scientific or literary groups, organizations testing for public safety and organizations involved in prevention of cruelty to children or animals. Most organizations' seeking foundation or corporate contributions secure a Section 501(c)(3) classification from the Internal Revenue Service (IRS).

Strategies intended to be market neutral (i.e., not dependent on the overall direction of the markets) which include such underlying strategies as: distressed debt, merger arbitrage, fixed income arbitrage, convertible bond arbitrage and equity market neutral (i.e., offsetting long and short positions).

"(see passive investing; passive management) The management of a portfolio whose investments may be traded at any time."

The MSCI World ex-U.S. Index is a capitalization-weighted index of equities in the entire developed world other than the United States. The designation of a country as developed arises primarily as a measurement of GDP per capita. There are 22 countries within this index. Active (long) equity investment strategies in listed stocks of exchanges in developed economies excluding the U.S. Such international investments typically use the Morgan Stanley Capital International World ex-U.S. Index (MSCI World ex-U.S.) or a comparable index as a benchmark.

Used in finance as a measure of performance, is the excess return of an investment relative to the return of a benchmark index.

A broad classification of investments that includes any investment that is considered less traditional or non-traditional (traditional assets include stock instruments and debt instruments, such as direct investments or mutual fund investments in equities, bonds, and money market instruments). Specific examples of alternative strategies include private equity, venture capital, hedge funds, distressed (or private) debt, and “real assets” (such as real estate, oil and natural gas, timber and commodity funds). Alternative investments often have a low or negative correlation to traditional assets, can contribute to lower portfolio risk (as measured by volatility), and can contribute to a higher expected return.

A trust that pays an agreed-upon sum of money at agreed-upon intervals, drawing from the trust’s principal when income from the trust is insufficient to make the agreed-upon payments.

A financial transaction or strategy that seeks to profit from a perceived price differential with respect to related instruments and typically involves the simultaneous purchase and sale of those instruments.

Allocating investments among different asset classes (e.g., stocks, bonds, and real estate) to find the optimal risk/reward mix. Tactical asset allocation implies a relatively short-term, and strategic asset allocation a longer-term, approach.

The proportions of a portfolio invested in various types of investments, such as common stock, bonds, guaranteed investment contracts, real estate and cash equivalents.

A fixed income instrument comprising collateralized assets that pay interest, such as consumer credit cards and automobile loans.

A mutual fund manager whose investment policy is to balance the fund’s portfolio by investing in more than one asset class—typically stocks, bonds, and cash—to obtain a good return, while minimizing risk.

A spending rule pursuant to which the annual dollar amount of spending grows by a designated rate of inflation, subject to upper and lower limits to the total spending rate expressed in percentage terms. For example, the rule may call for last year’s spending to be increased by HEPI each year but to be not below 3 percent nor above 6 percent of assets in any given year.

An index that covers the U.S. investment-grade, fixed-rate bond market with index components for government, corporate, mortgage pass-through and asset-backed securities.

One one-hundredth of a percentage point.

See risk relative to benchmark.

A type of donation or gift, typically via a decedent’s will or estate. Bequests and gifts are awards with few or no conditions specified. Gifts may be provided to establish an endowment or to provide direct support for existing programs. Frequently, gifts are used to support developing programs for which other funding is not available. The unique flexibility, or lack of restrictions, makes gifts attractive sources of support.

A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), a model that calculates the expected return of an asset based on its beta and expected market returns.

A type of mandatory grant where the recipients (normally, states) have substantial authority over the type of activities to support, with minimal federal administrative restrictions. The basic premise is that states should be free to target resources and design administrative mechanisms to provide services to meet the needs of their citizens.

Evidence of a debt on which the issuing company usually promises to pay holders a specified amount of interest for a specified length of time and to repay the principal on the maturity date. A bond represents debt and its holder is a creditor of the corporation and not a part owner as is a shareholder. Utility bonds are usually secured by mortgages.

A portfolio for which the investment manager buys securities, usually bonds, with the intention of holding them for a long period of time, usually until maturity, in contrast with an actively managed portfolio. The term may also apply to common stocks such as those held by an index fund.

Profit on the sale of an investment, which may include common stock, corporate and government bonds, real estate and other real assets. There are long- and short-term capital gains, as defined in the Internal Revenue Code. Capital losses may also occur.

Markets in which capital funds (debt and equity) are issued and traded. Included are private placement sources of debt and equity, as well as organized markets and exchanges.

Assets with maturities of less than one year (e.g., Treasury bills, commercial paper, certificates of deposit and nonconvertible bonds) which are highly liquid and comparatively risk-free.

Bank services designed to help a company manage its cash more efficiently. These services include payable-through drafts, zero-balance accounts, remote disbursement accounts, account reconciliation, lockboxes, depository transfer checks, freight payment plans, wire transfers, concentration accounts, information reporting and cash management consulting.

A grant that provides monies in response to monies from other sources, usually according to a formula. A challenge grant may, for example, offer two dollars for every one that is obtained from a fund drive. The grant usually has a fixed upper limit, and may have a challenge minimum below which no grant will be made. This form of grant is fairly common in the arts, humanities, and some other fields, but it is less common in the sciences. A challenge grant differs from a matching grant in at least one important aspect. The amount of money that the recipient organization realizes from a challenge grant may vary widely, depending on how successful that organization is in meeting the challenge. Matching grants usually award a clearly defined amount and require that a specific sum be obtained before any award is made.

A contract between the donor and a charity in which the donor transfers assets to the charity. The charity agrees to pay a specified sum of money each year to the donor, for a fixed period (usually life). The assets exceed the present value of the expected payments to the donor, and the charity receives the surplus (mortality tables are used to make this calculation). The donor can claim as a charitable tax deduction the difference between the present value of the expected payments and the value of the assets.

A trust in which the donor transfers income-producing assets to a trustee and instructs the trustee to pay a fixed amount or annual percentage to charity for the term of the trust. At the end of the trust term, assets remaining in the trust are conveyed to the donor or his/her beneficiary or beneficiaries. The donor can claim as a charitable tax deduction the present value of the expected payments to charity.

A trust that pays the donor or the donor’s beneficiary an agreed-upon annual income for the life of the donor or for a specific term. The principal remaining from this type of trust eventually passes to a qualified charity.

The assets left in a charitable trust, gift annuity, or pooled income fund that eventually pass to a qualified charity. The present value of the charitable remainder is equal to the charitable tax deduction.

Under Internal Revenue Code Section 664(d)(2) and the regulations thereunder, there are three variations of the unitrust:

In its traditional legal meaning, the word “charity” encompasses religion, education, assistance to the government, promotion of health, relief of poverty or distress and other purposes that benefit the community. Nonprofit organizations that are organized and operated primarily to further one of these purposes generally will be recognized as exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code and will be eligible to receive tax-deductible

A structured mortgage bond, backed by a pool of mortgages that serves as collateral for the bond, that pays interest and principal in maturity succession. The bond is repaid in series from the mortgage proceeds (i.e., principal payments go against the Series A bond {lowest interest and maturity} until it is paid off, at which time all payments go against the next series bond {Series B}). This procedure acts as call protection against a series bond with a higher interest rate and a longer maturity, since it cannot be called until the prior series is paid off.

Securities that represent an ownership interest in a corporation. A common stockholder is not a creditor of the corporation, so he or she assumes greater risk than does a creditor but shares in earnings and growth through dividends and price appreciation.

A 501(c)(3) organization that makes grants for charitable purposes in a specific community or region. The funds available to a community foundation are usually derived from many donors and held in an endowment that is independently administered; income earned by the endowment is then used to make grants. Although a community foundation may be classified by the IRS as a private foundation, most are public charities and are thus eligible for maximum tax-deductible contributions from the general public.

An organized community program which makes annual appeals to the general public for funds that are usually not retained in an endowment but are instead used for the ongoing operational support of local agencies.

The possibility that existing procedures do not adequately ensure that a fund and its managers adhere to the regulations and requirements of governmental and regulatory bodies and industry standards of practice or that the record-keeping of compliance documentation is not sufficient to show that the fund and its managers have been in compliance with those standards.

A grant to one institution in support of a project in which any programmatic activity is carried out through a collaborative arrangement between or among the recipient institution and one or more other institutions or organizations which are separate legal entities, administratively independent of the recipient. The involvement of the non-recipient (collaborating) institutions is that of actually performing a portion of the programmatic activity.

A strategy that seeks to take advantage of the pricing inefficiencies of the embedded option in a convertible bond. It is generally characterized by a long convertible position and corresponding short position in the underlying stock. Convertible arbitrage may also use leverage.

A bond or preferred stock that can be turned into common stock at a predetermined conversion rate, frequently at predetermined times. Conversion is often forced by the issuer by calling the bond or preferred stock prior to its maturity.

A portfolio, closely resembling the structure and risk of the total market, that can be actively or passively managed.

A fixed income security issued by a corporation to evidence borrowing, usually with a term in excess of five years.

A private foundation (company-sponsored) that derives its grant-making funds primarily from the contributions of a profit-making business. The company-sponsored foundation often maintains close ties with the donor company, but it is a separate legal organization, sometimes with its own endowment, and is subject to the same rules and regulations as other private foundations.

"A grant-making program (direct giving) established and administered within a profit-making company. Gifts or grants go directly to charitable organizations from the corporation. Corporate foundations/giving programs do not have a separate endowment; their expense is planned as part of the company’s annual budgeting process and usually is funded with pre-tax income. Annual grant totals generally are directly related to company profits."

A principal to a foreign exchange, swap, or other derivative instrument, as opposed to an agent such as a broker.

The potential that the issuer of a security may default or fail to honor their financial obligations to the fund or its client. The risk that a counterparty (or participant in a securities transaction) does not meet its financial obligation, thereby resulting in a financial loss for the transaction.

A cultural institution is an operating nonprofit (or a foundation that directly supports such an entity) that supports the arts and other cultural endeavors (e.g., museums, art galleries, symphonies, libraries). These are not grant-making organizations; rather, they are typically recipients of grants from private and public foundations.

A portfolio of debt-oriented investments (e.g., real estate mortgages) or fixed income securities (e.g., corporate bonds).

Required interest and principal payments made on debt.

A portfolio of debt-oriented securities that is structured to meet a specific liability such as the payment of benefits to a group of retirees for the remainder of their life. The portfolio is dedicated to the objective of meeting the identified liability.

A charitable gift annuity in which payments to the donor are deferred until such time as they can be made at a higher rate (shorter life expectancy) and may be taxable at a lower rate.

A financial instrument whose value depends upon the value of another instrument or asset (typically an index, bond, equity, currency or commodity). Examples are futures, forwards and options.

Publicly held and traded debt and equity securities, as well as bank loans, of companies and governments that are in financial “distress.” Financial distress is indicated by having filed or being near to filing for protection under Chapter 11 of the U.S. Bankruptcy Code. Distressed public debt and related bank loans trade at risk premiums generally in excess of 10 percentage points to U.S. Treasury securities of comparable duration.

The committee responsible for making grant decisions. For community foundations, the distribution committee is intended to be broadly representative of the community served by the foundation.

Commonfund diverse managers are generally defined as investment firms with 25 percent or more diverse leadership, as measured by ownership, profit participation or executive leadership, and 25 percent or more investment team diversity, which may include members of the leadership team. Diverse managers include women, Black/African American, Latinos/Hispanic, Asian, people of indigenous descent, veterans and people with disabilities and other diverse persons potentially not captured in these categories.

Divestment of fossil fuels is to actively rid an investment portfolio of holdings in fossil fuel companies. Divestment of fossil fuel companies is a type of exclusionary screening strategy through which investors exclude companies involved in fossil fuels from their portfolio.

Also called the internal rate of return (IRR); the interest rate that makes the present value of the cash flows from all the subperiods in an evaluation period plus the terminal market value of the portfolio equal to the initial market value of the portfolio.

Transfer of equipment, money, goods, services, and property with or without specifications as to its use. Sometimes donation is used to designate contributions that are made with more specific intent than is usually the case with a gift, but the two terms are often used interchangeably.

A fund held by a community foundation or other qualified sponsoring organization where the donor, or a committee appointed by the donor, may recommend eligible charitable recipients for grants from the fund. The community foundation’s governing body must be free to accept or reject the recommendations.

A fund held by a community foundation where the donor has specified that the fund’s income or assets be used for the benefit of one or more specific public charities. These funds are sometimes established by a transfer of assets by a public charity to a fund designated for its own benefit, in which case they may be known as grantee endowments or agency funds. The community foundation’s governing body must have the power to redirect resources in the fund if it determines that the donor’s restriction is unnecessary, incapable of fulfillment or inconsistent with the charitable needs of the community or area served.

The Europe, Australia, and Far East Index from Morgan Stanley Capital International. An unmanaged, market-value weighted index designed to measure the overall condition of overseas markets.

The distribution for spending divided by the beginning market value (endowment value on or around the beginning of the fiscal year), net of any fees or expenses for managing and administering the endowment. The distribution for spending is the dollar amount withdrawn from the endowment to support the institution’s mission.

A fund that consists of the stocks of emerging growth companies, typically higher risk stocks in defined market segments such as high tech and medical technology.

The stock of a relatively small company that is growing very rapidly but is not large enough or has not been in business long enough to be of investment quality.

A fund that consists of investments in markets of emerging countries, such as some of those in Southeast Asia and Central and South America.

The principal amount of gifts and bequests that are accepted subject to a requirement that the principal be maintained intact and invested to create a source of income for a foundation. Donors may require that the principal remain intact in perpetuity, or for a defined period of time, or until sufficient assets have been accumulated to achieve a designated purpose.

The permanent funds of a nonprofit institution, consisting of cash, securities or property. Income from endowment is used to help finance the ongoing operations of the institution. “True” endowment is that portion of the funds that are commonly restricted as to use of principal and/or income. Not all endowments are true endowments, as some may be funds functioning as endowment by vote of the governing board.

An investment practice that involves integrating the three ESG factors into fundamental investment analysis to the extent that they are material to investment performance.

Any financial instrument, such as options or futures, priced off of individual stocks or groups of stocks.

A strategy designed to exploit equity price inefficiencies. It typically involves using balanced long and short positions in equity markets to insulate the portfolio from overall market risk. Equity market portfolios are often designed to be neutral relative to beta, sector, industry, market capitalization, and style, among other factors. Leverage may be applied to enhance returns.

A portfolio of equity-oriented securities such as common stock or equity real estate.

The ownership interest possessed by shareholders in a real estate investment.

Seeks to take advantage of anticipated corporate events and to capture price movement generated by these events. Two of the better known event driven strategies are merger arbitrage and distressed debt.

An independent private foundation whose funds are derived from members of a single family. Family members often serve as officers or board members of family foundations and have a significant role in their grant-making decisions.

A person, committee or institution that holds assets in trust for another. The property may be used or invested for the benefit of the owner, depending on the agreement.

The potential exposure of fiduciaries to legal and regulatory actions precipitated by a breakdown in controls, or the failure to execute due diligence on behalf of the beneficiaries.

The possibility that a bond issuer will default, i.e., fail to repay principal and interest in a timely manner. Also called default risk.

Accounting period covering 12 consecutive months, 52 consecutive weeks, 13 four-week periods, or 365 consecutive days at the end of which the books are closed and profit and loss are determined. An institution’s fiscal year is often, but not necessarily the same as the calendar year.

A strategy to capture the disparities of pricing across the global fixed income markets and related derivatives. Some of the more common fixed income arbitrage strategies find opportunity in yield curve anomalies, volatility differences and bond futures versus the underlying bonds. Leverage is often used to enhance returns.

A portfolio of fixed income securities, such as marketable bonds, private placements, real estate mortgages and guaranteed investment contracts.

The IRS forms filed annually by public charities and private foundations, respectively. The letters PF stand for private foundation. The IRS uses this form to assess compliance with the Internal Revenue Code. Both forms list organization assets, receipts, expenditures and compensation of officers. Form 990-PF includes a list of grants made during the year by the private foundation.

An entity which exists to support a charitable institution and which is funded by an endowment or donations.

An approach to investing in which a manager invests in various funds formed by other investment managers. The benefits of this approach include diversification, the expertise of the fund-of-funds manager, access to hedge fund managers who may be otherwise unavailable and a less intense commitment of staff resources by the investor.

An independent private foundation that awards grants in many different fields of interest.

Gifts and bequests are awards given with few or no conditions specified. Gifts may be provided to establish an endowment or to provide direct support for existing programs. Frequently, gifts are used to support developing programs for which other funding is not available. The unique flexibility, or lack of restrictions, makes gifts attractive sources of support.

A global, top-down approach to investing in which managers will take long or short positions in fixed income, equity, currency and commodity markets.

An investment portfolio (of equities or bonds) that can invest in U.S. and non-U.S. markets. government bond A security issued by a federal, state, or city government to evidence borrowing, with a term usually in excess of 10 years.

A security issued by a federal, state, or city government to evidence borrowing, with a term usually in excess of 10 years.

A type of financial assistance awarded to an organization for the conduct of research or other program as specified in an approved proposal. A grant, as opposed to a cooperative agreement, is used whenever the awarding office anticipates no substantial program involvement with the recipient during the performance of the archives.

A report detailing how grant funds were used by an organization. Many corporate grantmakers require this kind of report from grantees. A financial report generally includes a listing of all expenditures from grant funds as well as an overall organizational financial report covering revenue and expenses, assets and liabilities. Some funders may require an audited financial report.

Stock in a company that has shown better-than-average growth in earnings and is expected to continue to do so. It can pay little or no dividends but is expected to have growth potential over an extended period of time.

See marketable alternative strategies [hedge funds]

The Commonfund® Higher Education Price Index® (HEPI), which reports price information for the goods and services purchased by colleges and universities for their current operations. Colleges and universities use these measures to analyze the impact of inflation on their operations as a starting point for securing additional revenues to meet expected higher costs, so as to preserve their purchasing power.

A lower-quality rated bond, rated BB or lower by Standard & Poor’s and Ba or lower by Moody’s, is called high yield because the interest rate is higher than average to compensate investors for taking higher-than-average risk.

A Bill introduced to Congress in 2001, designed to provide incentives for charitable contributions by individuals and businesses, to improve the effectiveness and efficiency of government program delivery to individuals and families in need, and to enhance the ability of low-income Americans to gain financial security by building assets.

Contributions or assistance in a form other than money. Real property, equipment, materials, or services of recognized value that are offered in lieu of cash. international index fund (see index fund) A portfolio of stocks structured to replicate an index of international securities such as the MSCI World ex-U.S. Index or MSCI EAFE Index.

A percentage of the total withdrawal set aside in a separate fund to be used to augment spending in a down year. Employed as a smoothing device to lessen any decrease in the transfer to operating budget in a given year.

These private foundations are usually founded by one individual, often by bequest. They are occasionally termed “non-operating” because they do not run their own programs. Sometimes individuals or groups of people, such as family members, form a foundation while the donors are still living. Many large independent foundations, such as the Ford Foundation, are no longer governed by members of the original donor’s family but are run by boards made up of community, business and academic leaders. Private foundations make grants to other tax-exempt organizations to carry out their charitable purposes. Private foundations must make charitable expenditures of approximately 5 percent of the market value of their assets each year. Although exempt from federal income tax, private foundations must pay a yearly excise tax of 1 or 2 percent of their net investment income.

A portfolio of stocks structured to replicate the performance of a commonly used index, such as the S&P 500.

A passive investment strategy in which a portfolio is designed to mirror the performance of a stock index, such as the S&P 500. Also, tying taxes, wages or other measures to an index.

The probability that the portfolio's purchasing power is preserved for future generations of constituents after accounting for the institution’s spending rate and inflation.

A portfolio of stocks structured to replicate an index of international securities such as the MSCI World ex-U.S. Index or MSCI EAFE Index.

An investment portfolio (of equities or bonds) that can invest only in non-U.S. markets.

The total amount that an investor or an investment fund earns from its investments, including both realized and unrealized capital gains (appreciation/depreciation) and income (dividends and interest).

See high yield bond.

A cash management practice whereby an institution invests in bank certificates of deposit which mature at regularly spaced intervals thereby ensuring that it has access to ready cash while still being able to protect its capital and earn some current income.

A fund that invests in stocks with larger market capitalizations, generally $5 billion or more.

Covers the failure to maintain sufficient funds (cash and marketable securities) to meet short-term obligations. Also, market liquidity risk is the difficulty in liquidating certain investments due to the lack of active markets in these securities.

Long/short equity funds take long and short positions in listed equities—generally with a net long position. Managers seek to find (buy) stocks which are “undervalued” by the market and short stocks whose prices are “overvalued” by the market.

Macro managers use long and short strategies based on their view of the overall market direction as influenced by major global economic trends and events. Investments can include stocks, bonds, currencies, and commodities in the form of cash or derivatives instruments of both developed and emerging economies. Macro strategies often use moderate amounts of leverage.

A firm, committee or individual, inside or outside an institution responsible for making decisions to buy, hold or sell assets. May also be called a money manager or investment adviser.

The possibility of loss due to large movements in market prices (e.g., due to changes in interest rates, foreign exchange rates, volatility, correlation between markets, capital flows).

A fund, usually a limited partnership, used by wealthy individuals and institutions. Hedge funds are allowed to use aggressive strategies including selling short, leverage, program trading, swaps, arbitrage and derivatives. Since most are restricted by law to less than 100 investors, the minimum investment is typically $1 million. The general partner usually receives performance-based compensation and invests significantly in the partnership.

Publicly traded securities, such as stocks, bonds or notes, which, as such, are easily bought and sold in the marketplace and readily convertible to cash.

A grant that requires a specified portion of the cost of the supported item of equipment or project be obtained from other sources. The required match may be more or less than the amount of the grant. Some matching grants require that the additional funds be obtained from sources outside the recipient organization. Many matching grants are paid in installments, the payments coinciding with the attainment of pre-specified levels of additional funding. Matching grants are very common in the sciences, especially for equipment. They are the standard practice in some government agencies.

Long and short positions are held in both companies that are involved in a merger or acquisition. Merger arbitrageurs are typically long the stock of the company being acquired and short the stock of the acquirer. The principal risk of this strategy is deal risk.

A fund that specializes in stocks with market capitalizations generally in the range of $2 billion to $10 billion.

The potential for loss due to actions taken or to policies implemented based on views of the world, in general, and the investment community, in particular, that are derived from improper models. These views are derived from representation(s) of reality that do not capture all significantly relevant information or are inappropriately applied throughout the investment program.

A fund managed by an investment banking firm, investment manager, or insurance company, in which short-term funds of individuals, institutions, and corporations may be invested. These funds are invested in money market instruments.

A short-term debt security, including Treasury bills, bank CDs, commercial paper, Eurodollar CDs, and Yankee CDs, among others. Money market instruments have maturities of a year or less.

A security for which investors receive payments out of the interest and principal on the underlying mortgage.

A fund providing exposure, in a single investment, to several investment styles and strategies in addition to a disciplined asset allocation process and ongoing rebalancing. A multi-strategy fund seeks to add alpha over a full market cycle, while providing significant risk reduction through diversification of manager and investment styles.

An investment company or trust in which a number of investors pool their funds and receive units in the fund that are priced daily. There are many types of mutual funds: stock funds, bond funds, money market funds, and closed- and open-end investment funds. Participants in these funds also cover a wide range of investors (e.g., individuals, pension funds, and trust funds).

A portfolio construction process that attempts to avoid investment in certain stocks or industries through negative screening according to defined ethical guidelines.

A 501(c)(3) organization classified by the IRS as a private foundation whose primary purpose is to conduct research, social welfare, or other programs determined by its governing body or establishment charter. An operating foundation may make grants, but the amount of grants awarded generally is small relative to the funds used for the foundation’s own programs.

The potential for discontinuity due to the possibility of a breakdown in operational procedures particularly as they relate to a process breakdown; this is distinct from the design, implementation, and maintenance of computerized information systems, e.g., errors resulting from a lack of reviewer function to catch errors, from incorrect data and/or lack of adequate staffing/backup.

An account of stocks and/or bonds that is not actively managed.

See active management; indexing; passive management.

A process that creates a portfolio of stock or bonds, not actively traded, that will replicate as closely as possible the performance of standard market indices such as the S&P 500 for stock or the Barclays Aggregate Index for bonds.

See active management; indexing; passive investing.

Assets that are not traded actively but set up and held in an index fund.

Equity investment strategies in the Morgan Stanley Capital International World ex-U.S. Index (MSCI World ex-U.S.) or a comparable index. The MSCI World ex-U.S. Index is a capitalization-weighted index of equities in the entire developed world other than the United States. The designation of a country as developed arises primarily as a measurement of GDP per capita. There are 22 countries within this index.

Various techniques for measuring the total rate of return (income received plus or minus changes in market value between two dates) of a pension or profit-sharing plan and of investment managers, generally in comparison with other plans and managers having similar investment objectives.

Philanthropy is defined in different ways. The origin of the word philanthropy is Greek and means love for mankind. Today, philanthropy includes the concept of voluntary giving by an individual or group to promote the common good. Philanthropy also commonly refers to grants of money given by foundations to nonprofit organizations. Philanthropy addresses the contribution of an individual or group to other organizations that in turn work for the causes of poverty or social problems—improving the quality of life for all citizens. Philanthropic giving supports a variety of activities, including research, health, education, arts and culture, as well as alleviating poverty.

A portfolio of investment assets designed to achieve the financial and investment objectives of an institution over the long term. Policy portfolios are typically established by an investment committee which sets target percentages for each asset class and strategy selected for inclusion.

The inclusion of a non-correlated strategy (i.e., one whose returns are independent of market performance) within an existing portfolio in order to improve risk-adjusted returns. The word “portable” is used because the strategy can be applied without affecting the style under which a particular portfolio is being managed.

Combined holdings of multiple stocks, bonds, commodities, real estate investments, cash equivalents or other assets by an individual or institutional investor. The purpose of a portfolio is to reduce risk by diversification.

An analytical performance measurement approach that segregates a manager’s investment performance into components such as value added from securities selection and value added from market timing.

A process whereby an investor’s bond portfolio is restructured to match anticipated cash inflow and outflow. Some reinvestment of early cash receipts is allowed.

The rebalancing of a large volume of equity in a portfolio at one time by selling baskets of stock and reinvesting the proceeds in other equity, debt, or cash securities.

A class of favored stock whose holders have a claim on the company’s earnings before payment can be made to common stockholders. Preferred stockholders are usually entitled to dividends at a specified rate, when declared by the board of directors, before payment is made to common stockholders, and they usually have priority if the company is liquidated; however, preferred stockholders generally do not have voting rights.

The price/earnings ratio of a stock is calculated by dividing the current price of the stock by its trailing 12 months’ earnings per share. The P/E ratio relates the price of the stock to the per-share earnings of the company. High P/E generally indicates that the market is paying more to obtain the stock because it has confidence in the company’s ability to increase its earnings. Conversely, a low P/E often indicates that the market has less confidence that the company’s earnings will increase rapidly or steadily, and therefore will not pay as much for its stock. In most cases, a fund with a high average P/E ratio has paid a premium for stocks that have a high potential for increased earnings. If the fund’s average P/E is low, the manager may believe that the stocks have an overlooked or undervalued potential for appreciation. A P/E ratio calculated using a forecast of future earnings is called a forward P/E.

A nongovernmental, nonprofit organization with funds (usually from a single source, such as an individual, family, or corporation) and program managed by its own trustees or directors. Private foundations are established to maintain or aid social, educational, religious, or other charitable activities serving the common welfare, primarily through the making of grants.

Developed by Prof. Kaplan with Antoinette Scholar of MIT, PME calculates a market-adjusted multiple that allows comparison of private investments to a public market index.

A private foundation that uses the bulk of its resources to provide charitable services or run charitable programs of its own. It makes few, if any, grants to outside organizations and, like private independent and private family foundations, it generally does not raise funds from the public.

A distribution of securities (including interests in commingled funds) made in a private manner and only to qualified investors. A private placement does not require registration with the SEC and is not offered to the public.

philanthropic purposes and interests.

In an effort to improve the transparency of proxy voting by mutual funds and other registered investment vehicles, the SEC now requires registered investment management companies to provide disclosure about how they vote proxies relating to portfolio securities they hold. These amendments require registered investment management companies to disclose the policies and procedures that they use to determine how to vote proxies relating to portfolio securities. The amendments also require registered investment management companies to file with the Commission and to make available to shareholders the specific proxy votes that they cast in shareholder meetings of issuers of portfolio securities. The intent of the rule is to encourage funds to become more engaged in corporate governance of issuers held in their portfolio.

A proxy statement is a document that provides shareholders with information about issues to be discussed and voted upon at a stockholders’ meeting. Shareholders may attend the meeting and register their votes in person or vote by sending in proxy ballots on the various matters scheduled to come before the meeting. As investors and shareholders, nonprofits are frequently confronted with the issue of whether they should vote their shares as recommended by the company’s management or analyze each issue in light of the institution’s mission. Some nonprofits have adopted policies by which they either (i) vote their own proxies, (ii) assign the responsibility to a third party or (iii) have their investment managers vote the proxies, usually in accord with guidelines provided by the institution.

A nonprofit organization that qualifies for tax-exempt status under section 501(c)(3) of the Internal Revenue Code and that derives its support from broad-based public sources. Public charities are the recipients of most foundation and corporate grants. Some public charities also make grants. Religious, educational and medical institutions are deemed to be public charities.

Legally classified as “public charities,” public foundations are publicly supported nonprofit organizations and are predominantly funded by contributions from individuals, corporations, governmental units and private foundations. As distinguished from most public charities, public foundations focus more on grant-making than on providing direct charitable services.

There are two public support tests, both of which are designed to ensure that a charitable organization is responsive to the general public rather than a limited number of persons. One test, sometimes referred to as 509(a) (1) or 170(b)(1)(A)(vi) for the sections of the Internal Revenue Code where it is found, is for charities like community foundations that mainly rely on gifts, grants, and contributions. To be automatically classed as a public charity under this test, organizations must show that they normally receive at least one-third of their support from the general public (including government agencies and foundations). However, an organization that fails the automatic test still may qualify as a public charity if its public support equals at least 10 percent of all support and it also has a variety of other characteristics—such as a broad-based board—that make it sufficiently “public.” The second test, sometimes referred to as the section 509(a)(2) test, applies to charities, such as symphony orchestras or theater groups, that get a substantial part of their income from the sale of services that further their mission, such as the sale of tickets to performances. These charities must pass a one-third/one-third test. That is, they must demonstrate that their sales and contributions normally add up to at least one-third of their financial support, but their income from investments and unrelated business activities does not exceed one-third of support.

The Economic Recovery Tax Act of 1981 made available a planned giving vehicle which is similar to a qualified charitable remainder trust, but without the stringent technical requirements. A person can establish a “qualified terminal interest property trust” (Q-TIP trust) for the benefit of his/her spouse, with the remainder to the foundation. There is no charitable income tax deduction and the trust is not tax-exempt, because it is not a charitable remainder trust. However, the entire trust qualifies for the marital deduction in the first spouse’s estate and for the charitable deduction in the second spouse’s estate, and thus generates no tax with respect to either spouse’s life interest or the charitable remainder trust. A Q-TIP trust with a charitable remainder is flexible. For example, trust payments to the surviving spouse need not be limited to an annuity or uni-trust amount, but may be determined by the needs of the surviving spouse.

Expenditures of a private foundation made to satisfy its annual payout requirement. These can include grants, reasonable administrative expenses, set-asides, loans and program-related investments, and amounts paid to acquire assets used directly in carrying out tax-exempt purposes.

A portfolio management approach using computer-based models or other quantitative methods to select securities and/or structure a portfolio.

See endowment, term endowment, true endowment.

Endowment that is composed of unrestricted funds functioning as endowment by the vote of the Board of Trustees. These funds are distinct from the operating cash and reserves of the institutions, which has the effect of sheltering them from ad hoc spending. Nevertheless, these funds can be spent, by vote of the Board, for any purpose.

Land, including land improvements, structures and appurtenances thereto, but excluding movable machinery and equipment.

Both operating and grant-making nonprofits that are either directly affiliated with a church or religious order, or are strongly influenced by one.

See socially responsible investing (SRI), environmental, social and governance investing (ESG), impact investing and divestment of fossil fuels.

An investment approach using one or more of SRI, ESG, impact investing, divestment of fossil fuels, and other related strategies.

Designated by a donor or board of trustees for a specific purpose, and cannot be used for any other purpose.

Total return measures the annual return on an investment including the appreciation and dividends or interest. Total returns are calculated by taking the change in investment value, assuming the reinvestment of all income and capital gains distributions (plus any other miscellaneous distributions) during the period, and dividing by the initial investment value. These returns are not adjusted for sales charges, but they are adjusted for management, administrative and other costs that are automatically deducted from fund assets.

The procedures necessary to manage exposure to various types of risk associated with transacting business or investments.

The potential for losses due to unintended bets or a breakdown in due diligence; the impact of investment initiatives that were not fully understood at the outset and had the potential of unintended consequences; or the monetary impact (to the portfolio and the fund) of managers who violate guidelines, engage in unauthorized transactions, develop excessive concentrations (high trading error), commit fraud, etc.

Standard & Poor’s Corporation

A popular stock market index composed of 500 stocks selected by Standard & Poor’s Corporation to represent the entire market and used by many funds to compare the investment performance of their equity-oriented managers.

The private-equity secondary market (also often called private-equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments and/or assets to/from private equity general partners, limited partners, or other alternative investment funds.

The average return earned in excess of the risk-free rate per unit of volatility or total risk.

A charitable gift annuity based and paid on the life of one person.

A fund that specializes in stocks with lower market capitalization; small cap stocks are usually $2 billion or less in market capitalization.

A social services organization is an operating nonprofit (and the category includes foundations that directly support them) that provides social programs to the public or that conducts research to benefit humanity (e.g., Boys and Girls Clubs, Blood Center, various research institutes). These are not grant-making organizations (rather they are typically recipients of grants from private and public foundations).

A portfolio construction process that attempts to avoid investments in certain stocks or industries through negative screening according to defined ethical guidelines.

See sharpe ratio.

A variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset's standard deviation of negative asset returns.

The guideline established by the board which determines the amount of the annual transfer of monies from the investable assets to the operating budget. Examples include: a) spend all income; b) spend 5 percent of a three-year moving average market value; c) increase spending by inflation each year.

See effective spending rate.

The amount of spending specified by the board from the investable assets, usually expressed as an annual percentage of the beginning market value of the fund.

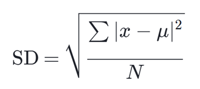

The measure of dispersion of a set of values relative to its mean.

To calculate the Standard Deviation, 1: Find the mean; 2: For each data point, find the square of its distance to the mean; 3: Sum the values from Step 2; 4: Divide by the number of data points; 5: Take the square root. (Calculating Standard Deviation Step by Step - Khan Academy)

The management of assistance programs to be exercised by federal officials. Grants management officials oversee the process of evaluating and awarding grants and actively participate in the management of grants to ensure that funding is properly and prudently utilized, that all applicable laws and regulations are followed, and that the mission of the sponsor is furthered.

See equity.

A policy that specifies a termination date in the life of a nonprofit institution, such as a foundation or operating charity. The bylaws of many nonprofits do not address a termination date and they are therefore assumed to operate in perpetuity. An operating charity or foundation having a sunset policy would cease operations and distribute all its assets by a specified date. A high-visibility example is the Bill and Melinda Gates Foundation, which has specified that all of the foundation’s resources will be spent within 50 years of Bill and Melinda Gates’ deaths.

A charitable gift annuity arranged during the donor’s lifetime. A payment is made to the donor for life, then to the designated survivor for the rest of his/her life.

Sustainable investments are typically designed to seek investment returns commensurate with unconstrained public equity or private equity investments while incrementally capturing measurable environmental or other societal benefits.

Institutional policies and practices that attempt to meet the material needs of present generations of users, without compromising the ability of future generations to enjoy a similar standard.

The risk that current system designs or implementations are inappropriate or ineffective to the extent that information obtained from or disseminated through the system environment is incorrect or incorrectly perceived, and the decisions made based on that information are sub-optimal. In addition, this includes the security of information in response to unauthorized access and disaster.

The process by which all new gifts are assessed their proportionate share of the cost of managing the total endowment pool.

Research to identify mispriced securities that focuses on recurrent and predictable stock price patterns and on proxies for buy or sell pressure in the market.

See endowment, quasi-endowment, true endowment.

Endowment that is restricted for a period of time, after which any remaining unused funds may become unrestricted (or quasi-endowment).

A trust established by the will of its creator for the benefit of survivors. This trust comes into being only after the death of the person whose will creates it. The will must be probated to bring the trust into existence.

See in-kind contribution.

The value of non-cash contributions directly benefiting a grant-supported project or program that are provided by non-federal third parties to the recipient, the sub-recipient, or a cost-type contractor under the grant or sub-grant without charge. In-kind contributions may be in the form of real property, equipment, supplies and other expendable property, and goods and services directly benefiting and specifically identifiable to the project or program.

See endowment, quasi-endowment, term endowment.

Endowment made up of funds that are restricted (usually by donor mandate) as to the use of principal or income, or both. Funds dedicated to scholarships or faculty support are the most common types of restricted endowments.

A legal agreement by which something of value is owned by a person or persons for the benefit of another. In practice, this means that a person transfers assets to a trust, which, for tax purposes, is a separate legal entity (this is not true, however, for revocable trusts).

A foundation board member or officer who helps make decisions about how grant monies are spent. Depending on whether the foundation has paid staff, trustees may take a more or less active role in running its affairs.

See UPMIFA.

First promulgated in 1972, the Uniform Management of Institutional Funds Act (UMIFA) has been replaced by the Uniform Prudent Management of Institutional Funds Act (UPMIFA).

An individual “true” or restricted fund that has a market value that has decreased below its historic dollar value as defined by the Uniform Management of Institutional Funds Act (UMIFA). Historic dollar value is the aggregate fair value in dollars of (i) an endowment fund at the time established, (ii) subsequent contributions to the fund, and (iii) other additions to the fund required by the donor or law.

See unitized accounting.

A division of quantity accepted as a standard measurement of exchange. For example, in the commodities markets a unit of wheat is a bushel; the unit of U.S. currency is the dollar.

A method of managing an investment pool whereby the pool is divided into “units” which are assigned an arbitrary value (e.g., $10 per unit) at a particular point in time. Thereafter, each unit fluctuates in value according to the performance of the fund and the aggregate value of all the units is equal to the fund’s current market value. Any new additions to or distributions from the fund are made in units and are assigned a value derived by dividing the total market value of the fund by the number of units.

Monies with no requirements or restrictions as to their use or disposition.

This new uniform law, which was approved by the National Conference of Commissioners on Uniform State Laws in 2006 and has now been enacted in 49 states, and in the District of Columbia, clarifies previously existing standards for the investment and expenditure of all types of charitable endowment funds. UPMIFA was designed to replace the existing Uniform Management of Institutional Funds Act (UMIFA), which dates from 1972. UMIFA was a pioneering statute, providing uniform and fundamental rules for the investment of funds held by charitable institutions and the expenditure of funds donated as “endowments” to those institutions. Those rules supported two general principles: 1) that assets would be invested prudently in diversified investments that sought growth as well as income, and 2) that appreciation of assets could prudently be spent for the purposes of any endowment fund held by a charitable institution. UPMIFA continues to follow these principles, while clarifying previously existing standards for the investment and expenditure of all types of charitable endowment funds. UMIFA in its original form excluded all trusts, a gap which led to the passage of the subsequent Uniform Prudent Investor Act and Uniform Principal and Income Act in most states. UPMIFA is intended to eliminate the need for multiple statutes by applying consistent investment and spending standards to all forms of charitable funds, whether held by institutions that are incorporated, unincorporated or organized as charitable trusts (i.e., trusts with a beneficial purpose but no named beneficiaries). It strengthens the concept of prudent investing, refining it further by means of specific guidelines for fiduciaries. It applies the rule of prudence to charitable spending, eliminating outmoded concepts such as historic dollar value while providing an optional section to restrain levels of spending that are deemed imprudently high. Finally, it facilitates the release or modification of restrictions on a fund, consistent with the recognition and protection of donor intent. Taken as a whole, UPMIFA establishes a stronger and more unified basis for charitable fund management.

A stock that is considered to be a good stock at a great price, based on its fundamentals, as opposed to a great stock at a good price. Generally, these stocks are contrasted with growth stocks that trade at high multiples to earnings and cash.

Two types of hybrid spending rule, used by the respective institutions named. There are two parts to the calculation of the Yale rule. The first part, considered the stabilizing factor, takes the previous year’s spending dollars and adjusts that figure for inflation (usually CPI or HEPI, but a school may also, like Yale, calculate its own inflation figure). This amount is given a weighting of 80 percent in the calculation. To this is added 20 percent of the figure that results when a targeted long-term spending rate (in Yale’s case, 5.25 percent) is applied to a four-quarter market average of the endowment value. The Stanford rule is also a weighted average that uses the previous year’s dollar spending, adjusted for inflation, and a targeted spending rate multiplied by the endowment value. The Stanford rule differs from the Yale rule in that it applies a lower weighting to the previous year’s spending levels (60 percent), and a higher weighting to the targeted spending value (40 percent). In addition, Stanford’s target spending rate is lower, at 5 percent, versus 5.25 percent for the Yale rule, and uses a single fiscal year-end valuation date.

The return on a security or portfolio, in the form of cash payments. Most yield comes from dividends on equities, coupons on bonds, or interest on mortgages. In general, yield is defined in terms of the component of return that is taxable as ordinary income. Consequently, since the capital gain on a Treasury bill or other discount note is viewed for tax purposes as a form of interest, it is also included in the definition of yield. Yield is usually described in percent terms (e.g., 7 percent per annum).

The comparison of yield differential among varying types of fixed income securities. Professional investors watch for changes in normal yield spreads among many types of issues to identify overpriced situations (where they might sell securities they own) and underpriced securities (where they might buy).

The rate of return on a bond until its due date, including both interest payments and price changes. It is greater than the current yield when the bond is selling at a discount and less than the current yield when the bond is selling at a premium.