![]()

Investment Strategy | Insights Blog

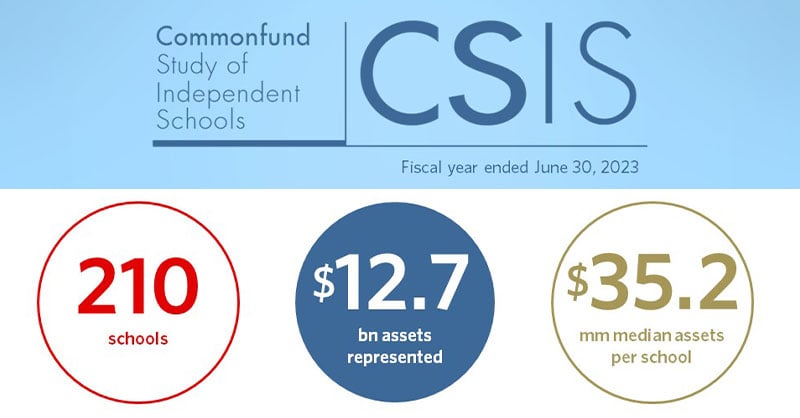

For the first time since the inception of the Study, the FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) report asked respondents to identify the top concerns for their...

![]()

Investment Strategy | Insights Blog

The FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) prompted survey respondents to select the main purpose of their school’s endowment for the first time.

![]()

Perspectives | Insights Blog

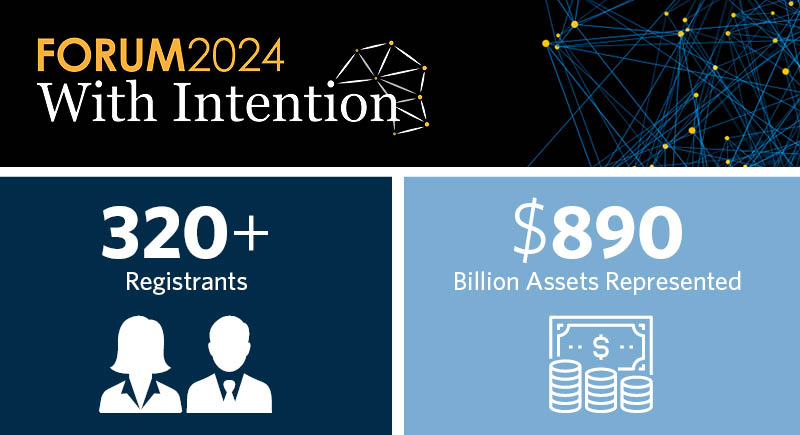

Commonfund Forum 2024 brought together 500+ attendees representing institutions with $890 billion in endowed assets in a 2.5-day conference. The event, themed “With Intention”, featured a...

![]()

Perspectives | Insights Blog

Commonfund recently hosted its 26th annual Commonfund Forum, March 10th-12th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

![]()

Perspectives | Insights Blog

For fiscal year 2023, independent schools reported an average return (net of fees) on their endowment assets of 9.2 percent. In this infographic, we report the key highlights from the 2023 Commonfund...

What's Driving Surprisingly Low Volatility in Energy Markets?