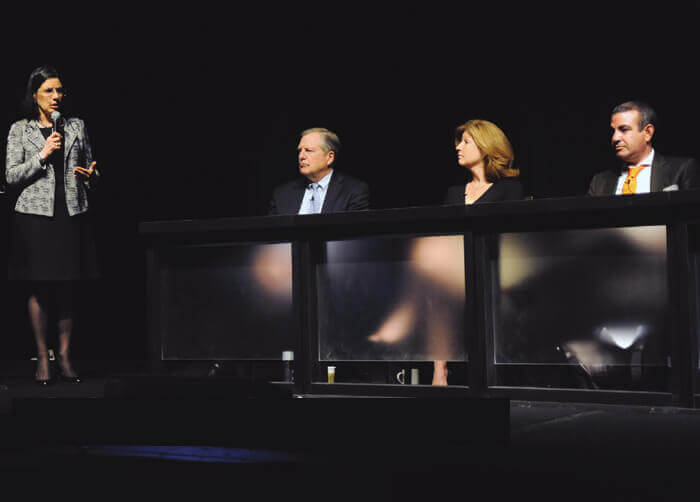

Commonfund recently convened an expert panel moderated by Myra Drucker (standing, left), Chair of the Board, TrustedPeer Inc. and former chair of the Commonfund Board of Trustees. The roundtable examined recent developments in the ongoing evolution of nonprofit governance.

Roundtable participants were (seated, left to right): JOHN GRISWOLD, Executive Director, Commonfund Institute; CINDY LOTT, Senior Counsel to the National State Attorneys General Program at Columbia Law School; and JEFFREY TENENBAUM, Partner and Chair of the nonprofit organization practice Venable, LLP, Washington, D.C. Highlights of their exchange follow.

DRUCKER: JOHN GRISWOLD, SET THE STAGE FOR US. YOU'VE BEEN AT THIS A LONG TIME. HOW HAVE YOU SEEN THE MAKEUP AND THE AGENDAS OF BOARDS AND INVESTMENT COMMITTEES CHANGE OVER THE LAST COUPLE OF DECADES?

GRISWOLD: We’ve seen enormous change over the last 15–20 years, certainly. If you’re looking at challenges, a closely related set of them has been and continues to be board size and board structure and, within that structure, whether you have the right the number of committees, led by the right chairs and staffed by the right number of members. So, all of those questions are still in play, with the caveat that the nonprofit sector is too large and diverse to risk too many generalizations. In fact, however, we are seeing fewer very large boards and fewer honorary or decorous members—those who are there solely because they’ve given a lot of money to the institution. There is room, particularly in the case of colleges and universities, for those who have supported the institution financially, but they still have to contribute and be engaged.

There is also a move toward what Dick Chait, Barbara Taylor and Bill Ryan have called “generative governance,” which is bringing one’s wisdom, experience and skill set to open discussions so that the board is more dynamic and forward-thinking, and actively engaged in deeper inquiry and the exploration of optional courses and new ideas.

In our research, we have seen that investment committees, in particular, have changed because they are more likely to be populated by professional investment and finance people, and that’s true of the finance committee as well. Audit committees very often are populated by CPAs or auditors and, sometimes, lawyers. That said, there is also more diversity on boards—in thought as well as in gender, race, age and professional background.

DRUCKER: SO, THAT BRINGS UP SOME INTERESTING ISSUES, PARTICULARLY ABOUT A MORE GENERATIVE BOARD, A BOARD THAT ACTIVELY DISCUSSES THINGS. JEFFREY, WE KNOW THAT FROM A LEGAL PERSPECTIVE THERE'S A BIG PUSH TOWARDS TRANSPARENCY AMONG BOARDS. HOW DO BOARDS BALANCE THE TENSION BETWEEN THE BIG PUSH TOWARDS TRANSPARENCY AND THE NEED TO MAKE DECISIONS THAT SOMETIMES SHOULD BE HELD IN CONFIDENCE?

DRUCKER: SO, THAT BRINGS UP SOME INTERESTING ISSUES, PARTICULARLY ABOUT A MORE GENERATIVE BOARD, A BOARD THAT ACTIVELY DISCUSSES THINGS. JEFFREY, WE KNOW THAT FROM A LEGAL PERSPECTIVE THERE'S A BIG PUSH TOWARDS TRANSPARENCY AMONG BOARDS. HOW DO BOARDS BALANCE THE TENSION BETWEEN THE BIG PUSH TOWARDS TRANSPARENCY AND THE NEED TO MAKE DECISIONS THAT SOMETIMES SHOULD BE HELD IN CONFIDENCE?

TENENBAUM: What we see in both the nonprofit and corporate worlds are swings in the pendulum over time. After Enron, WorldCom and other scandals in the corporate world, there was a real push for transparency among nonprofits. That was the buzzword—boards and staff alike needed to be more transparent with each other and with the public.

But, as often happens, things went a little too far. From my perspective as counsel to nonprofit organizations, and as any lawyer counseling a client would tell you, it’s critically important in so many circumstances to maintain confidentiality, which can have legal implications. When counsel is giving advice to a nonprofit—to staff, officers or directors—you want to maintain attorney/client privilege, i.e., the protection you get when an attorney is counseling his or her client. That protection can be jeopardized and may well be lost if the legal advice is shared with third parties.

Sometimes clients will ask us, “Should we have open board meetings? Should we allow anyone from our constituency to attend?” I’m not a fan of that. I think that in order for nonprofit boards and other leadership bodies within a nonprofit organization to govern effectively, there has to be a certain amount of confidentiality.

—John Griswold, Executive Director, Commonfund Institute

DRUCKER: SO HOW CAN REGULATORS ACTUALLY FIGURE OUT WHAT'S GOING ON? WHAT ARE THE RED LIGHTS FOR REGULATORS?

LOTT: There is a short answer and a longer answer to that. One of the tough jobs for board members is trying to figure out how to navigate all the different compliance issues they confront. It’s important to recognize that the states actually have a lot of jurisdiction in this area. Board members need to be aware that their state’s attorney general and, sometimes, obscure agencies have oversight regarding charities in their state. It’s not all about the IRS. Every state has common law authority over the nonprofit sector and they can ask lots of questions of boards and are empowered to do so.

Now, of course, the IRS is going to require certain types of disclosures that the state can also utilize. Everyone is very familiar with the “not so new 990.” The governance issues that the IRS decided to address in the 990 give the states the benefit of public disclosure. There are more than 1 million nonprofits in this country but I can tell you that there are probably only 100 or so regulators on the beat at the state level devoted to nonprofit oversight—I’m doing a research study right now to find out exactly what the number is. That means the odds of finding out that something is amiss are in your favor. But what generally happens is that a whistle-blower—sometimes a disgruntled board member, former employee or donor—steps forward and triggers an investigation by the state’s attorney general. I might say, as an aside, that one of things we are trying to do at Columbia is sensitize state regulators to the factors that make the nonprofit sector unique, because once an issue becomes public a lot of donor dollars dry up.

GRISWOLD: Let me comment on that because it brings up an interesting point. We’ve seen this happen a number of times where a whistle-blower sees something they don’t like and instead of bringing it up at the board and having what used to be a private conversation, they turn to social media or write a blog. It’s very opinionated and espouses one point of view. It is not a balanced discussion, but it immediately goes viral and blows up into an enormous reputational problem. What has happened in politics has happened in the nonprofit world—an accusation is made and then the accused spends weeks, months and even years trying to repair the damage. So, that is one aspect of transparency that is not necessarily for the better.

DRUCKER: LET ME ASK YOU, JEFFREY, IF THIS HAPPENS TO A WELL-MEANING BOARD, WHAT DO THEY DO? IN HINDSIGHT, WHAT COULD THEY HAVE DONE DIFFERENTLY IF ANYTHING?

TENENBAUM: I’ve probably represented a dozen or more nonprofits in connection with state attorneys general investigations and hundreds in connection with IRS audits or federal agency investigations. The vast majority of those cases are sparked by publicity—bad press. To me, one of the most challenging times to be a nonprofit board member is when your board is going through a crisis like that. That’s when confidentiality and attorney/client privilege become very important. But having helped shepherd nonprofits through that process, there are lessons that can be learned and there are things you can do proactively in advance to help prevent them.

An example is related party transactions, excessive compensation or a board populated with friends and family of the CEO. In one such instance, we were brought in to clean house. We replaced the board, put in new policies and procedures, changed contractual relationships, and ordered valuation studies of past transactions. In that case, we repaired the mess before it was exposed publicly.

LOTT: Governance has been a murky issue for a very long time and, sometimes, there are vested interests wanting to keep it murky. There was a recent case in New York about this, and it revolved not around what you did as a board, but rather what you didn’t do. In a day and age when information is currency, there is no such thing as saying, “I didn’t know.” You can’t say you didn’t know if it’s already been on Twitter.

TENENBAUM: One thing to add to that: There’s no question that boards need to exercise their fiduciary duties of care, loyalty and obedience. Board members can be held personally liable if they’re asleep at the switch. They have to exercise a kind of aggressive oversight and due diligence in overseeing the affairs of the organization. At the same time, we have seen instances of weak staff leadership that leads to a tendency for the board to micromanage. That’s not healthy, in my judgment. There needs to be a balance between active oversight and letting staff do its job. What that really means is hiring and retaining strong staff to begin with and creating a culture that encourages the right balance.

— Cindy Lott, Senior Counsel to the National State Attorneys General Program at Columbia Law School

DRUCKER: LET'S TALK ABOUT BOARD CULTURE. THE POWER THAT WE HAVE AS BOARD MEMBERS IS ASKING THE QUESTIONS AND NOT ALWAYS COMING UP WITH THE ANSWERS.

DRUCKER: LET'S TALK ABOUT BOARD CULTURE. THE POWER THAT WE HAVE AS BOARD MEMBERS IS ASKING THE QUESTIONS AND NOT ALWAYS COMING UP WITH THE ANSWERS.

GRISWOLD: I agree. That goes back to my earlier comment about generative governance but it also goes to board education and orientation. If you don’t have an educated and effectively oriented board that understands their roles as fiduciaries and leaders of the institution, I don’t believe they will be able to ask the right questions. They’ve got to be at the point where they can say, “Well, this doesn’t look right,” about anything from a program, a plan or a relationship with a particular constituency. A big part of the board chair’s job is to educate new members as to their responsibilities and accountability to the organization and to the public.

LOTT: Changing board culture is a long-term proposition. But I believe there are two points in time when you can have impact. One is when you bring people on. I think there’s a tendency to lowball expectations in terms of how much may be demanded of the prospective trustee. Stepping up to the plate and being candid about the job at hand and the board’s expectations will ultimately serve the organization better. Most board members want to be active. It galls them to think that their expertise will not be put to good use. The other opportunity is annual training sessions to keep board members growing in their capabilities and up to date with evolving thinking in governance practices and policies.

DRUCKER: WHAT DO YOU THINK ABOUT NON-BOARD MEMBERS SERVING ON COMMITTEES? NON-BOARD COMMITTEE MEMBERS CAN BE VERY HELPFUL, PARTICULARLY ON AUDIT AND INVESTMENT COMMITTEES WHERE THE BOARD ITSELF MAY NOT HAVE SPECIALIZED EXPERTISE.

TENENBAUM: The place to start is your state of incorporation. It doesn’t matter where your nonprofit is located; it’s where you are incorporated that will dictate which state’s nonprofit corporation laws govern the organization. State nonprofit corporation statutes are critical because they regulate the governance of the organization. It doesn’t matter what’s in your articles of incorporation or your bylaws. If they are inconsistent with the laws of your state of incorporation, those provisions have no legal effect.

One of the areas that the state laws regulate is committees, who can serve on committees, how they get appointed and what function and legal role those committees serve in the governance of an organization. In many states—including New York, which recently overhauled its nonprofit corporation statute—if a board wants to delegate duties to what we call a committee of the board then those committees have to be composed solely of board members. This is an important distinction between committees of the board and non-committees of the board because it has to do with the board’s ability to delegate its fiduciary responsibility so that the whole board doesn’t have to get into the weeds on every issue. The board is allowed to rely on what particular committees are doing if they are committees of the board. If you’re in a state that says a committee that’s going to carry out board functions has to be composed solely of board members, then it doesn’t matter what we think is a best practice. That’s what you’re going to have to do. That doesn’t mean that you can’t have other committees that are not committees of the board that are more advisory in nature, such as a task force. Keep in mind, as well, that things like the attorney/client privilege oftentimes are not going to apply if there are non-board members at the table.

LOTT: I would gray up this area a little bit. I agree that state of incorporation counts. But I can tell you that a lot of states don’t have nearly the robust statutory landscape of a New York or 10 or 12 others. Many states are going to wind up using basic jurisdiction here, and one of the most fundamental concepts in cases such as these is the notion of agency, or third parties of any sort aiding or working with nonprofits. If a state thinks there is something askew—even if it’s not the state of incorporation—it will find a way to make sure they have oversight. In the recession, for instance, a lot of organizations did not want to hire, so they turned to using consultants. You should be aware that there are very basic legal tenets here that can allow states to invoke jurisdiction in this area.

— Jeffrey Tenenbaum, Partner and Chair of the nonprofit organization practice Venable, LLP, Washington, D.C.

DRUCKER: I HAPPEN TO SERVE ON A NUMBER OF INVESTMENT COMMITTEES OF NONPROFITS FOR WHICH I AM NOT A TRUSTEE. WHAT DO I HAVE TO WORRY ABOUT?

TENENBAUM: You still have the same fiduciary duties as a trustee—the duties of care, loyalty and obedience. The duty of loyalty is one I would like to focus on because we’ve been talking about scandals and crises that some nonprofits go through. But many nonprofits never experience them. Still, one of the challenges in the governance area that we see all the time—even in the most well-run organizations—is the duty of loyalty and conflicts of interest. It’s a very difficult area because conflicts may arise from very well-meaning, well-intentioned boards and committee members. Not all conflicts are inherently bad.

LOTT: It may be cold comfort to board members, but no one really believes that you won’t have conflicts. It’s okay and, frankly, it would be strange if you did not have any. The issue that counts, as Jeff said, is the process by which you make sure everyone understands what the conflict is and how you resolve it, i.e., process over outcome. At the state level the issue is not so much the decision you made, but being able to indicate how you made it. The most important thing you can do to protect your board and your entity is simply to be able to show how you arrived at a decision.

TENENBAUM: Process really does matter, even the process by which a board makes a difficult decision. It’s called the business judgment rule and it basically says that if a board or a committee of the board makes a poor decision—one that ends up costing the organization hundreds of thousands of dollars—board members cannot be held personally liable as long as they went through the right process in making that decision…they did their homework and their due diligence and they asked the right questions.

GRISWOLD: There is a distinction that should be made here, and it’s between conflict of interest and what’s called duality of interest. Duality of interest may occur when a person serves on multiple boards. Many people serve on more than one board; that’s perfectly normal. But you want to be sure you don’t serve one entity’s interests to the detriment of the other. For instance, in fund-raising, do you aggressively raise funds for one organization but not the other? Relationships that may compromise your service to an organization should be disclosed, and the board may want to have a discussion about the entire topic.

DRUCKER: MAYBE WE CAN CONCLUDE BY AGREEING THAT GOOD GOVERNANCE IS VERY SIMPLE: IT'S HAVING THE RIGHT PEOPLE MAKING THE RIGHT DECISIONS ABOUT THE RIGHT ISSUES AT THE RIGHT TIME.