When investors open their second quarter investment reports, many will be shocked by the magnitude of stock market gains in the second quarter. Their surprise could be voiced by a rhetorical question such as: “If I told you that close to 50 million Americans will file for unemployment in 3 months, the unemployment rate in June will be hit 11.1 percent, that personal consumption will decline by 11 percent in the first 5 months of the year and GDP will decline by 35 percent (annualized rate, estimated) in the second quarter, would it possible that U.S. and global equities could gain 20.5 and 19.2 percent in the second quarter, respectively, and only be down by 3.1 and 6.3 percent year-to-date?”

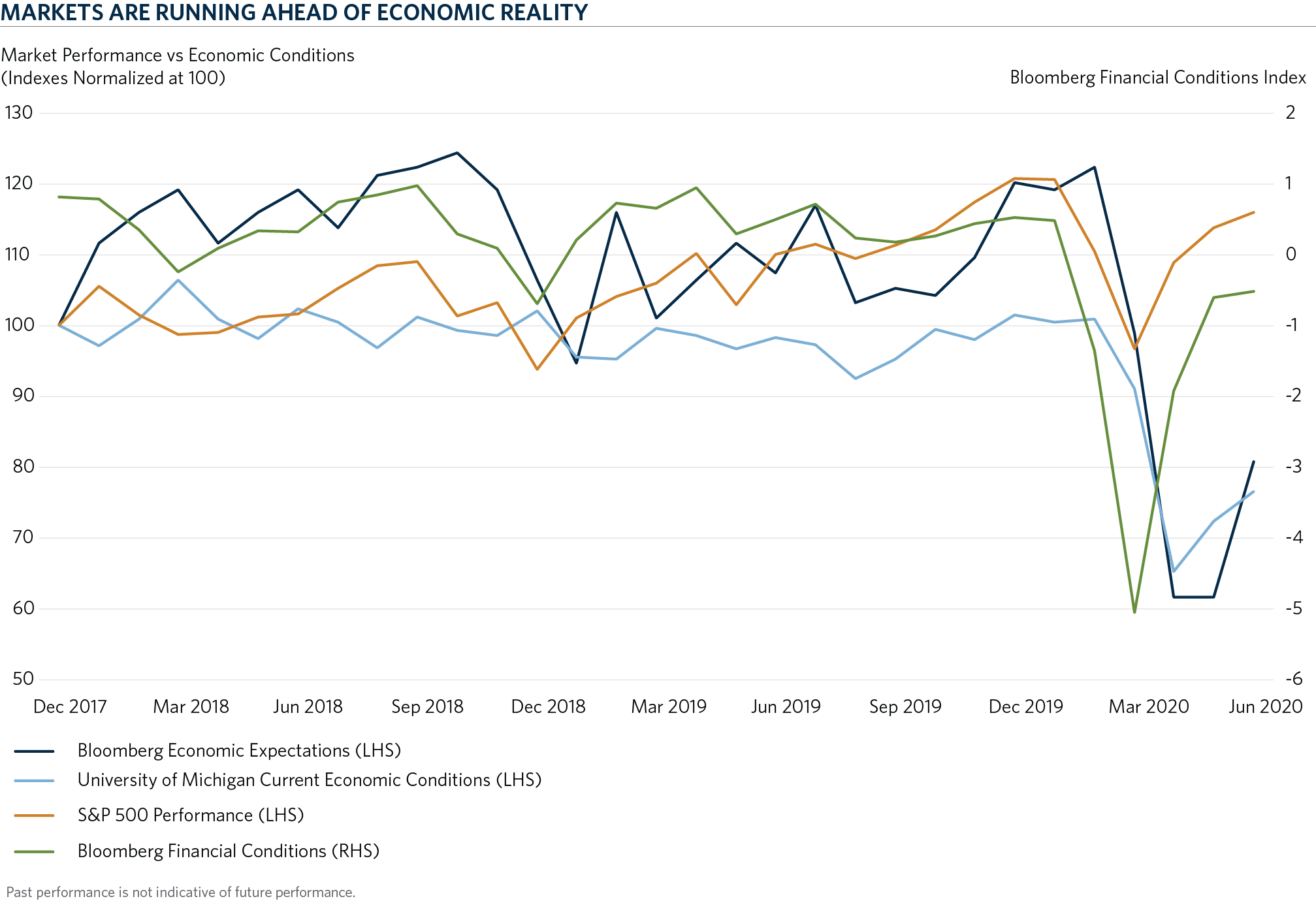

This month’s chart shows the disconnect between the speed of the recovery in the S&P 500, which has rebounded 39.3 percent from the lows on March 23, and economic conditions that are recovering at much slower pace. While investors owe much gratitude to the Fed for coming to the rescue with never-before-seen speed and magnitude, and economies around the world have started to re-open, we feel it is too early to declare victory.

There are still several key risks that we are monitoring, including a potential second wave of COVID-19 infections, a looming presidential election, credit market distress and the deglobalization trend. Furthermore, we are likely to continue to experience disinflationary pressure from slack in industrial capacity utilization and tightening bank lending standards which will affect earnings growth in the short term. Considering the balance of increasing efforts by the Fed to support consumption and acknowledging the present risks, we continue to favor a neutral position versus strategic investment policy targets.