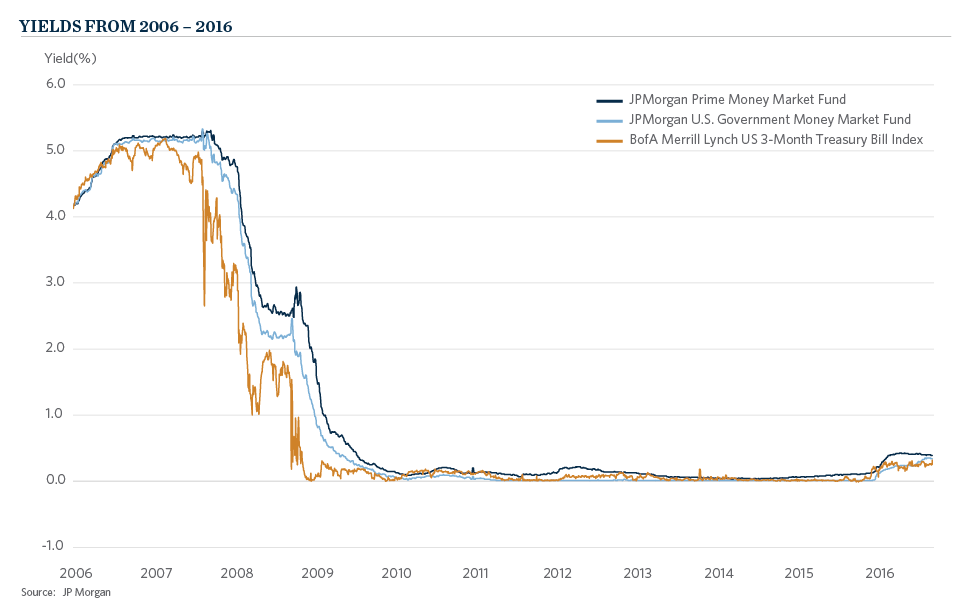

Treasury managers face a new challenge to an old problem. Their institutions historically have relied on operating investment income to provide a necessary influx to operating budgets. Prior to 2008, risk free or minimal risk investments provided support for operations with returns that are currently unimaginable. The concept of a risk-free instrument yielding anything significantly above 0 percent in the future does not take into account the post crisis world of capital markets, specifically cash markets. So, the world of five percent cash returns is gone, and has little chance of re-emerging. This leaves a shortfall in how treasury managers balance budgets and fund capital initiatives going forward.

The current environment has been evolving since 2009 and the last piece of this return free market – structural and operational changes for money market funds – will be implemented this October by the SEC, completing a seven year process. With this final change, the SEC has made it extremely difficult to generate significantly higher than 3-month U.S. Treasury bill returns from a stable value fund. This means that Endowments and Foundations that manage operating cash cannot “do nothing” and expect an adequate return on cash investments. Rather, they will have to develop and execute a broader investment policy to try to earn higher returns. Making the issue more complicated, money market and traditional short-dated fixed income instruments will continue to be challenged in the coming years, stemming from a restart of the process to normalize interest rates by the Federal Reserve.

This paradigm mandates that treasury managers and overseers of operating cash manage risk and returns in a manner appropriate for operating assets. Becoming an investor requires identifying the acceptable risk and executing a strategy that gets the organization to its stated goal(s).

— John Glavin, Vice President for Administration and Treasurer, Delaware County Community College

This brings us to three options for today’s treasury manager.

Option one is to adopt the “old school” methodology, or take what the risk free market gives you. Some would categorize this as the “do no harm” option. In the current markets, and the new structure of cash investments, this option gives the investor no reward for accumulated reserves. The fallacy of this mindset is that this option is truly risk free. If we learned anything in 2008, it is that assumed liquidity and risk free options can be illusionary in times of stress. Assuming any asset is truly risk free is the most significant risk within the world of the treasury manager.

Option two is the “Reaching for Yield” strategy, which is predicated on the hope that higher yields won’t come with any downside. In actuality, this strategy incorporates two risks, duration and credit. Investors in the 1990’s and early 2000’s enjoyed periods in which putting 50 percent of your cash in short duration strategies added between 25 to 75 basis points annually with only a few periods of lower returns. Unfortunately, the advantageous environment for fixed income is slowing tremendously as the bull market for fixed income securities is showing signs that it is ending. Six-month Treasury bill yields have increased about 30 basis points during the past year to 55 basis points, while 10-year Treasury yields have backed up about 35 basis points from their 1.32 percent intra-day low in early July 2016. As we move toward a rising rate environment this option will have many “bumps in the road” or periods when short duration could underperform cash.

Option three for the treasury manager is to construct a diversified portfolio that adds resources over time while maintaining appropriate risks. At Commonfund, we define this option as the Treasury+ Model. Each organization has its own unique goals and risk tolerance to reach those goals. This model takes those unique characteristics into account.