Building a private capital allocation that makes a difference to your portfolio takes time and dedication. The first step is deciding to make a meaningful allocation to private capital. Then, to implement that allocation prudently, you will need to diversify among several types of private capital investments.

Finally, the simultaneous inflows and outflows of capital over the private capital investment cycle mean that you will need to overcommit funds within your liquidity budget to reach your policy allocation.

Private equity forms an increasingly important part of the asset allocation of most long-term investors, particularly those with larger investment pools. Historically, the correlation between private capital allocation and asset size was due to the greater experience and resources possessed by larger institutions, as well as to the limited availability of good quality private capital managers and programs.

Larger institutions have been generally more willing and able to invest in less liquid strategies, which, historically, has contributed to stronger overall returns and lower portfolio risk. This is less true today, as many medium-sized and smaller institutions have embraced private capital as an important source of excess returns and diversification for their portfolios. While a prudently diversified private capital program can be a significant contributor to long-term returns for institutions both small and large, an institution should have investable assets of at least $5 million to $25 million in order to make an allocation to illiquid assets.

The Asset Allocation Decision

Private capital managers draw down commitments on an as-needed basis to fund investments, and the timing of distributions is somewhat uncertain; therefore, it is difficult to manage to a precise asset allocation target. For this reason, successful private capital investors generally set their asset allocations using two broad parameters: they work within a target range and they view the allocation over longer periods of time.

For long-term investors like pension plans, the targeted total return needs to be sufficient to ensure appropriate asset-liability matching over time. For endowment-type pools, investors seek to preserve the purchasing power of investable assets after spending and investment costs. While each plan’s specific liquidity needs must be taken into consideration, the focus in constructing the portfolio should be on total long-term risk-adjusted return.

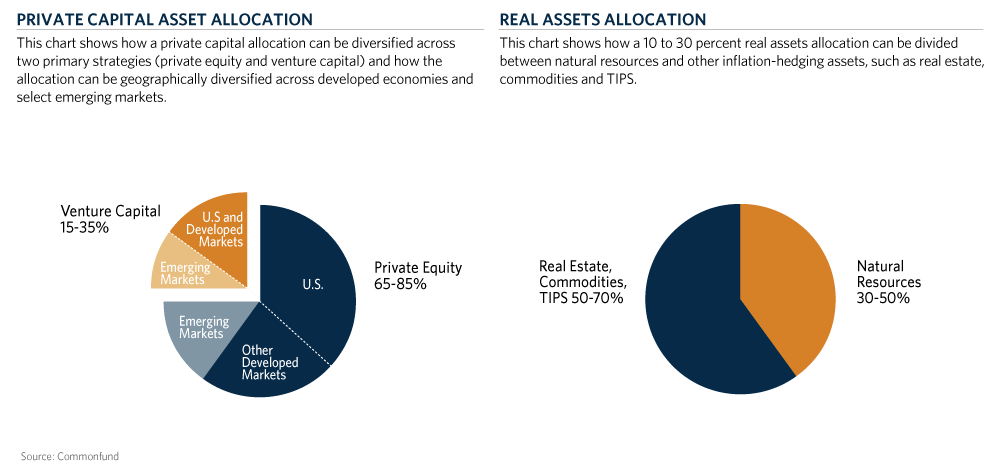

It is important that the private capital allocation be large enough to make a difference in the return of the overall portfolio. Depending on the institution’s goals and policies, Commonfund Capital normally recommends an allocation to private capital of at least 5 percent to start; over the longer term, we suggest for some plans an allocation in the 5 to 15 percent range, especially those perpetual pools of capital with longer duration liabilities. (See Above Figures) We also generally advocate a long-term commitment to real assets such as real estate and natural resources in the 10 to 30 percent range for long-term inflation protection. These allocations should also be diversified across a variety of investment strategies and vintage years.

The Importance of Diversification

It is not sufficient to make a one-time decision to invest in a single private capital fund or manager. Prudent diversification within the private capital portfolio is essential. Because of the long-term nature of the commitments required of private capital investors, even skilled managers may occasionally find themselves in an unfavorable part of the market cycle when the time comes to liquidate a particular fund’s investments. For this reason, the private capital portfolio must itself be diversified by strategy and vintage year across each two- to three-year investment cycle.

Over longer-term time horizons, the addition of a private capital allocation can increase a portfolio’s overall return by a meaningful amount. Adding private capital may also improve a portfolio’s risk characteristics, such as reducing the standard deviation of the entire portfolio and improving value at risk (VaR) and up/ down capture.

The Need to Overcommit

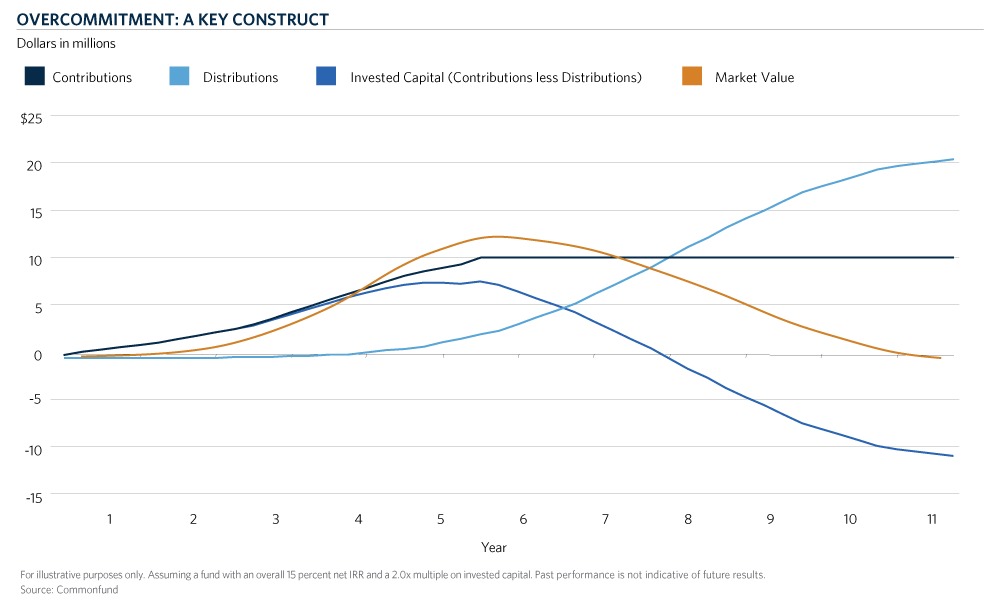

A final key concept to bear in mind is the need to overcommit. Investors rarely have more than two-thirds of their commitment at work at any one time because managers request, or call, their limited partners’ funds over a period of years and, during the same time period, distributions begin. For example, to reach an actual policy allocation of 10 percent, it may be necessary to make commitments closer to 15 percent.

The chart below, citing a $10 million commitment, shows that it is often necessary to overcommit to private capital strategies to reach your policy allocation. Note that investors’ contributions grow in the early years but, in the later years, distributions surpass contributed capital in successful partnerships.

Once an investor has made a commitment to a private capital manager, the manager draws down that commitment only as it finds suitable investments. Such investments are methodically made over a two- to three-year investment cycle. Because of the pace of investing and the fact that these investments are privately negotiated transactions, it often takes multiple years to fully deploy an investor’s commitment. (Investors are encouraged to continue to invest the unfunded portion of their commitment in a long-term fashion consistent with their asset allocation.) In addition, at some point in the life of the fund, investors begin to receive distributions on liquidated investments, often before a manager has completely invested the original commitment. At the same time, the investor’s overall portfolio may be growing, either through market appreciation and/or additional contributions, further reducing the percentage of capital invested in private markets.