Institutional investors continue to increase allocations to private strategies – but with some caution and an increasingly targeted approach.

Commonfund Capital’s fifth annual private markets investor sentiment survey shows trends continue despite the potential investment speedbumps ahead in 2022.

Over the last few weeks, Commonfund Capital conducted its annual, year-end private markets survey of institutional investors and advisors. Survey responses totaled 225 investors, representing 415 institutions and over $1.2 trillion of investable assets. The survey covered three areas:

- Headline industry concerns related to private equity and private capital investments

- Allocation trends to various private capital strategies

- Performance potential of commitments made in 2022 to various private capital strategies

The following is a summary of the results and implications.

HEADLINE CONCERNS

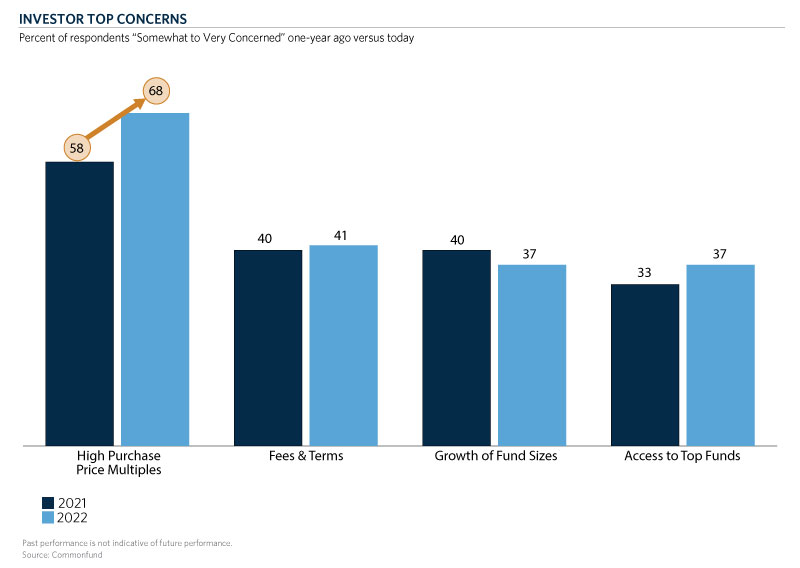

The survey’s respondents generally identified four main concerns that are specific to the private capital markets:

- High purchase price multiples: 68 percent of respondents indicated this was somewhat-to-very concerning, up from 58 percent last year, suggesting a heightened concern

- The overall direction of industry fees and terms: 41 percent of survey participants are somewhat-to-very concerned, which is similar to the sentiment expressed a year ago

- Growth of the industry’s fund sizes: 37 percent are somewhat-to-very concerned, again, in line with the prior year’s survey responses

- Difficulty in identifying and accessing top funds: 37 percent are somewhat-to-very concerned. Investors were more concerned about access this year versus last year

We share these views and factor them into our portfolio positioning and investment point-of-view across primaries, secondaries, and co-investments. For example, within the buyouts arena, we have observed better pricing in the smaller end of the market and, as a result, our recent private equity portfolios have a distinct tilt toward small- and medium- sized funds that are focused on smaller companies.

In this year's survey, we received a record number of additional comments relaying investor concerns, both specific to the private markets and to the investment environment more generally. Over twenty percent of survey participants took the time to share supplementary observations; five themes are worth noting.

- Geopolitical and economic tensions with China

- Inflation’s impact on the markets

- How the current pandemic will end, as well as how future pandemics will be managed

- The threat of increasing cyber security breaches

- Climate change

While we share the importance of understanding, modeling, and managing these risks, we also believe that each of these areas may present a robust set of investment opportunities when partnering with skilled private capital managers.

ALLOCATION TRENDS

Despite investor concerns, the year-over-year survey data reflect an overall increase in planned allocations to private market strategies. This is a continuing trend that we have witnessed in recent surveys.

Looking more closely at the data, 93 percent of survey participants indicated that their allocations to US private equity small / medium sized sector specialist funds would be trending up or flat, 89 percent of participants indicated that their allocations to co-investments would be trending up or relatively flat

The leading single sub-strategy where investors reported their planned allocations would be trending up the most was venture capital, where 43 percent of the participants indicated an increased allocation this year. Venture capital was followed by small- and medium-sized funds in U.S. private equity (led by small/medium sized sector specialist buyout funds at 40 percent, followed by small/medium size generalist funds at 35 percent). These were followed by increased allocations to private equity-styled environmental sustainability at 32 percent and co-investments at 30 percent.

Regarding environmental sustainability, we note a significant 39 percent upward trend over the prior year, when 23 percent indicated an increasing allocation versus 32 percent anticipating a higher allocation in 2022. Contributing to this are investor policies addressing climate change and actions to reduce carbon impact, and due diligence procedures that embrace select ESG and impact strategies, particularly within environmentally sustainable sectors.

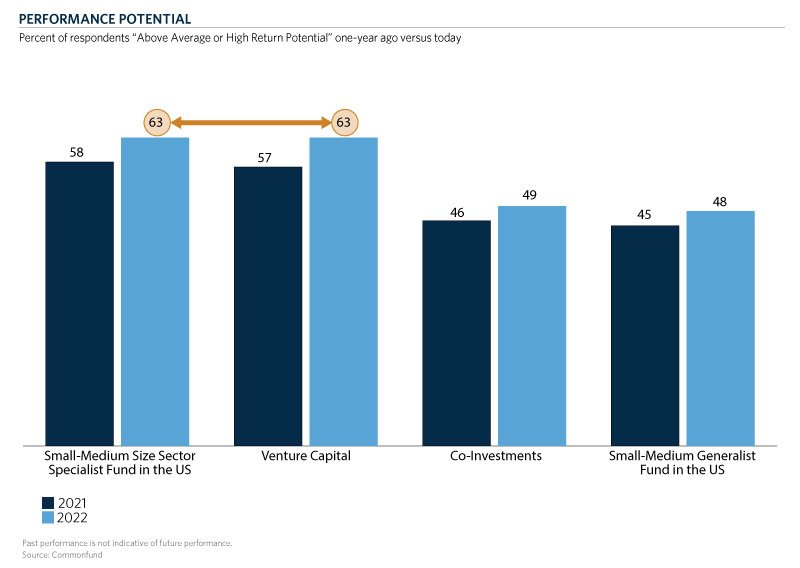

PERFORMANCE POTENTIAL

Investors again ranked small- and medium-sized sector specialist U.S. buyout funds and venture capital as highest in terms of performance potential for commitments made this year, with 63 percent of survey participants anticipating above average or high return potential. Performance potential expectations for both sub-strategies are up from last year's survey, where 58 percent indicated above average or high return potential for sector specialist buyout managers, and 57 percent suggested above average or high return potential for venture capital. Following these two strategies with high return potential are co-investments and small/medium size generalist buyout funds at 49 percent and 48 percent respectively. We believe, in part, that the return potential for these two sub-strategies is driving the increase in the asset allocation targets.

As noted, investors shared that they continue to see more robust return potential when working with sector specialist firms where general partners take a more “hands-on” approach with their portfolio companies over generalists. We agree — and we practice this active management theme across our buyout strategies, venture capital and real assets & sustainability.

SUMMARY OBSERVATIONS

In looking more closely at the risks and concerns, upward trends in allocations, and sub-strategies where investors see more return potential, we observed four, interrelated characteristics:

- A growing number of organizations that have recently adjusted upward their target ranges for private capital strategies are being more targeted in their planned commitments and execution

- Increasingly, we see limited partners understanding the need to be consistent investors cycle over cycle and not to try to time markets, public or private

- We see a distinct and growing interest in finding and accessing sector specialists with more modest fund sizes that target small and medium-sized companies; and

- The data, comments and conversations indicate a growing number of investors seeking to both (i) manage risk and (ii) secure attractive returns in the private markets as opposed to the public markets this cycle. It is the point of view of many investors that more active management may contribute not only to returns this cycle but also serve as a risk management factor to more passive elements of their total portfolios.

Editor’s Note: Commonfund would like to thank the members of the Commonfund Capital Advisory Committee for their guidance in this survey and the investors who took the time to share their input; please know that your participation is valued and appreciated.