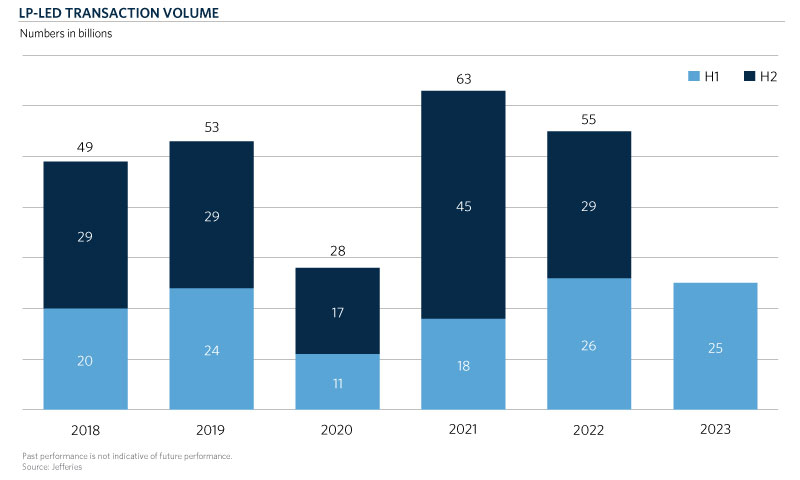

In the 1st half of 2023, global secondary market volume was down 25 percent year-over-year (“YoY”), decreasing from $57 billion to $43 billion1. This was partially driven by the 24 percent YoY decline in LP-led secondary volume, decreasing from a record $33 billion to $25 billion1. Given this market backdrop, one might overlook the possibility that LP-led secondary volume in 2023 could be headed for a record year.

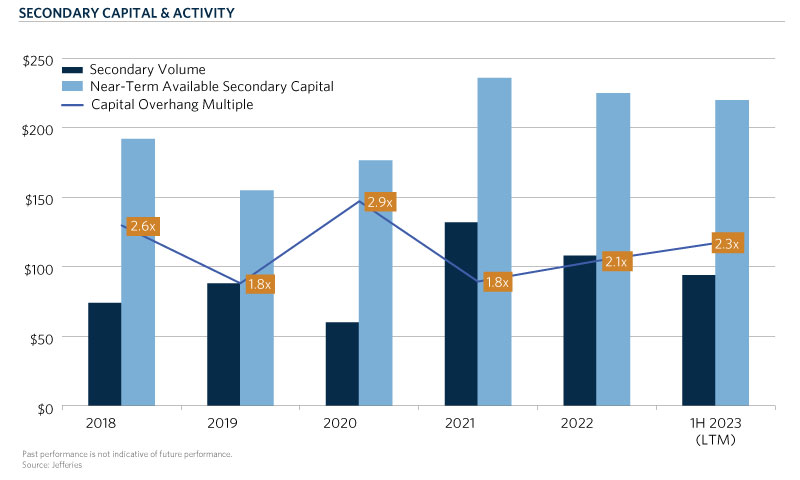

Four factors are likely to drive robust deal flow in the 2nd half of 2023: (1) Pricing has rebounded from the lows of 2022; (2) Distributions remain slow; (3) Limited partners remain focused on managing their portfolios and not missing manager re-ups or vintage years; and (4) Available secondary capital to LTM secondary volume remains steady at 2.3x with $220 billion available to invest in secondaries1. In 2021, the last record year for LP-secondary transactions at $64 billion, LP volume for the first half of the year was $19 billion, while volume for the second half was $45 billion2.

Market Volume

The 1st half of 2023 proved to be a mixed bag for the secondary market, as global secondary volume of $43 billion represented a 25 percent decline from the record setting $57 billion of volume which transacted in the 1st half of 20221. In the 1st half of 2023, LP-led secondary volume represented 58 percent of the market1, and the consensus amongst secondary advisors is that there are an influx of large LP portfolios expected to come to market or closing in the second half of 2023. This continued flow of LP secondaries may trump the volume seen in the 2nd half of 2022, signaling the continued proliferation of LP secondary volume.

LP-Led

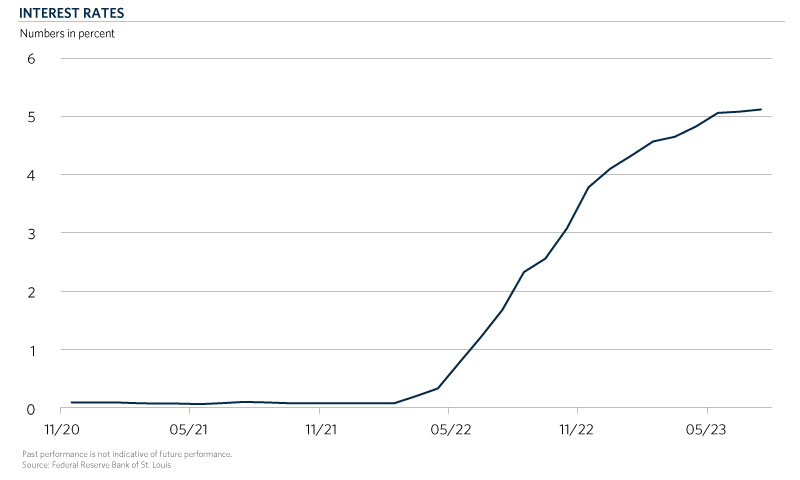

As discussed in our 2nd half of 2022 article, LP-led secondary transactions are core to the secondary market. Limited partners want to manage their portfolios. Lessons learned from the global financial crisis suggest that one should not skip vintage years nor miss an opportunity to get into access-constrained managers, especially when investors are tighter with their primary dollars and may be reducing their commitment sizes. When distributions are slow and private equity returns have been outperforming the public markets, investors may find themselves fully allocated to private equity and seeking liquidity to make new investments.

With interest rates rising rapidly over the last year and a half, CIOs may look to change allocation targets across the portfolio and be more willing to hold fixed income investments3. In recent years, some investors have continued to increase their private equity targets in search of outsized returns.

Secondary Capital Available

While secondary volume for the 1st half of 2023 was down compared to the 1st half of 2022, the dedicated capital available to invest in the secondary market remained nearly unchanged, decreasing by a mere 2 percent1. As of the 1st half of 2023, there is approximately $220 billion of available capital to invest in the secondary market from dedicated players, according to Jefferies1, which is in line with the volume potential from institutions seeking liquidity.

LP Secondary Market

Limited partner secondary transactions could be poised for a record year in 2023. LP volume for the 1st half of 2023 was $25 billion and accounted for 58 percent of total global secondary market volume in the 1st half of 20231. While this is down from the 1st half of 2022, it represents a strong start to a year where aggregate volume is muted compared to the prior record year. The resiliency and resurgence seen in the public markets may have helped alleviate some of the denominator effect issues investors faced and brought forth more supply to the market. At the same time, the lack of distributions may have caused investors to seek liquidity in an effort to manage their portfolios. Investors don’t want to miss opportunities to allocate to difficult to access managers nor do they want to skip out on vintage years. Investors continue to sell for non-economic reasons such as fund lives ending, overallocations and fatigue. As discussed in our 2nd half of 2022 article, LP-led secondaries are the core of the market and a critical tool for limited partners to actively manage their private equity portfolios.

Limited partners are willing to sell a wider range of vintage years in today’s market as they seek out specific headline pricing. Investors are expected to sell a record amount of limited partner secondaries in the 2nd half of 2023, based on consensus amongst secondary advisors, with one advisor seeing many similarities between the 2nd half of 2021 and the projected 2nd half of 2023. Following a depressed pricing environment in 2022, pricing has begun to increase in the 1st half of 2023 as the average price of LP transactions across all strategies was 84 percent of NAV, a 600-basis point increase from the 2nd half of 20221. If the 2nd half of 2023 looks anything like the 2nd half of 2021, we are racing to a record LP market.

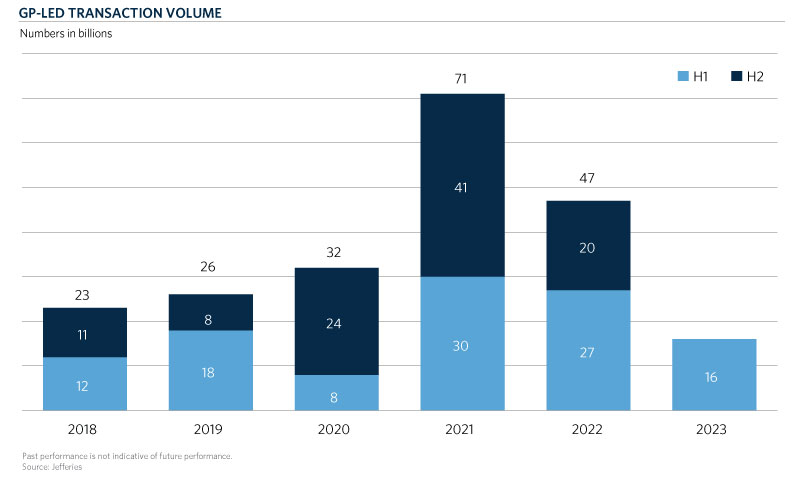

GP-led Market

Serving as a complement to the LP-led market, the GP-led market will be a key component of the secondary market for many years to come. This segment of the market is largely replacing sponsor-to-sponsor transactions. It allows for GPs to hold on to their crown jewel assets or best companies, rather than sell them to a competitor. GP-led transaction volume was down in the 1st half of 2023, potentially because GP-led solutions are brought to the entire LP base and aren’t initiated by the limited partners1. Limited partners in today’s market may be more likely to prefer finding their own liquidity solutions proactively, rather than being reactive to liquidity solutions presented to them. GP-led transactions need to be highly compelling for both the buyer, the seller, and for a broad LP base, which could make it difficult to find the right price to transact.

Conclusion

Even though the 1st half of 2023 saw a more muted secondary market compared to the record volumes achieved in 2021 and 2022, LP-led transactions continue to dominate the current secondary market environment and look to potentially be heading for a record year. The secondary market remains small relative to the overall private capital market, and there remains ample opportunity for the secondary market to continue to grow.

- Jefferies 1H 2023 Global Secondary Market Review July 2023; Jefferies 1H 2022 Global Secondary Market Review July 2022

- Jefferies 1H 2021 Global Secondary Market Review July 2021; Jefferies Global Secondary Market Review January 2022

- “Federal Funds Effective Rate.” FRED, 1 Aug. 2023, fred.stlouisfed.org/series/FEDFUNDS.