In the context of rising resource security concerns amid the energy transition, legislators and regulators across the developed West are making a concerted effort to re-orient resource supply chains. This push comes amidst growing Sino-Western trade conflicts and broader resource security concerns in the wake of the Russian invasion of Ukraine.

The United States (“U.S.”) has placed a particular focus on its ability to bolster supply chain resilience in areas like renewable energy and information technology. Elements of several pieces of legislation in the U.S., such as the Inflation Reduction Act (the “IRA”) and the CHIPS Act and Science Act, are geared to promote domestic investment in, or adoption of, the supply chain feeding renewables markets. Investors evaluating the implications of these efforts are left to wonder: how might one approach the market? How does this environment potentially shift the risk – and reward – balance for investments in the supply chain? When evaluating the implications for various subsectors within the energy transition, it is important to note distinct differences. Some markets – like the solar market, described in further detail below – were well established and active prior to recent legislation. This suggests a comparative maturity to other industries – like the hydrogen economy – which, while promising and also addressed by this legislation, remain more nascent and likely more existentially reliant on such regulatory support. The distinction between accelerant and requirement is crucial for investors assessing risk.

The Inflation Reduction Act One(ish) Year Later

Signed into law on August 16, 2022, the IRA provides $370 billion in energy security and climate spending over the next decade.1 The legislation supports a range of climate and clean energy projects such as broad domestic manufacturing, adoption of electric vehicles, renewable natural gas projects, and much more. The IRA’s 45X production tax credit (“PTC”) and 48C investment tax credit (“ITC”) supports onshoring solar, wind, and battery component supply chains by incentivizing domestic production. The limitation on these incentives is a timeline for funding, with facilities required to be operational by 2032 to capture such credits. Over the past year many companies have announced their intention to shift some portion of their manufacturing back to the U.S. in a variety of renewables industries including wind, solar and battery storage components.

Close Up – The Solar Supply Chain

The U.S. solar market has seen tremendous growth over the last decade, measured by an annual growth rate of 24 percent.2 Falling component costs and a low interest rate environment combined with existing regulatory incentives to drive adoption. The deployment of these systems – from smaller residential units to larger utility scale solar projects – expanded in markets like the U.S. as the sources of component supply grew increasingly concentrated.

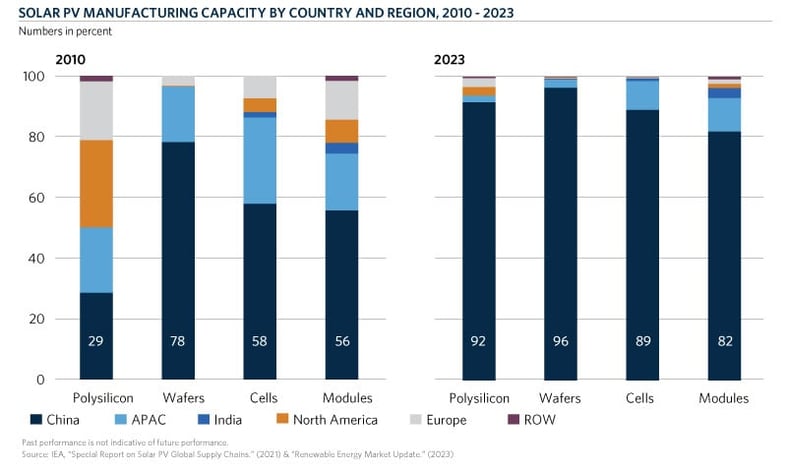

Consider solar panels themselves, the primary energy capture element of a solar project. Panel manufacturing starts with the production of polysilicon, and then the conversion into ingots, wafers, and cells, culminating with panel/module assembly.

![]()

By 2010, China was a major producer of modules, cells and wafers. Today, roughly 80 percent of solar inputs (polysilicon, ingots, wafers, cells and modules) are sourced from Chinese manufacturers.3 A 2021 study conducted by the International Energy Agency showcases the distribution of global suppliers within the photovoltaic (“PV”) market, noting the concentration of Chinese suppliers across the solar value chain.

Reflecting on the recent energy security lessons in Europe, the industry and regulators alike view this level of market dominance as a significant risk. The IRA in part sought to address this risk, promoting the re-shoring of component manufacturing and assembly in supply chains like solar. In the roughly 16 months that have followed, the response from investors and industry participants has been robust.

Response to the IRA – Solar Supply Chain

After the passing of the IRA, the largest panel-maker in the U.S., First Solar, announced up to $1.1 billion investment for a new 3.5 GW manufacturing facility in Louisiana.4 First Solar wanted to add incremental manufacturing capability and was initially considering Europe or India rather than the U.S. due to high costs and lack of policy support. However, the company pivoted after the release of the IRA as tax incentives offered an economical avenue for manufacturing in the states versus abroad. Since then, a number of module manufacturers followed suit including (but not limited to) Hanwa Q Cells, Silfab Solar, Maxeon, Meyer Burger, and Trina Solar. According to the Solar Energy Industries Association (“SEIA”), solar companies have committed nearly $20 billion for domestic PV manufacturing, including 85 GW of solar panel capacity, 43 GW of solar cells, and 20 GW of silicon ingots and wafers.5 This is a notable shift from 2022 where the U.S. had no ingot, wafer or cell manufacturing capacity and imported ~23 GW of modules.6

Future of United States Solar Market

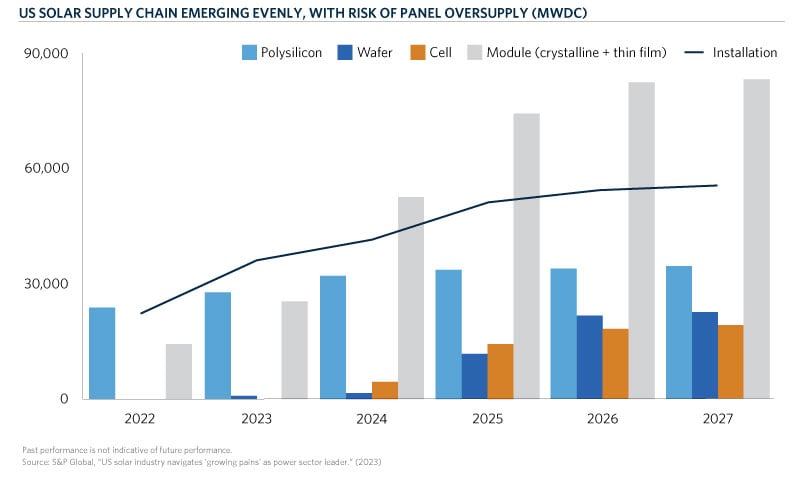

While support exists in the United States, several factors could influence the solar markets transition toward domestic component production. Today, many manufacturing announcements post-IRA are disproportionately weighted towards incremental module capacity. There is a risk that this will lead to overproduction of modules in the short-term as the domestic supply chain catches up to demand (see below).

Such efforts have and likely will continue to elicit responses from China, Europe and others as they seek to establish footholds in sectors like solar that are increasingly seen as central to a broader economic growth trend. Chinese manufacturers have announced 515 GW of investments in response to U.S. incentives for domestic manufacturing.7 Europe passed the Green Deal Industrial Plan (“GDIP”) and in the process of legislating the Net-Zero Industry Act as countermeasures to the IRA.8 The European Union (“EU”) has also allowed member governments to match American or International subsidies for the manufacturing of batteries, solar panels, and wind turbines that might otherwise be diverted away from Europe.9

Beyond competition and market responses, ambiguity in rules in markets like the U.S. remain a key challenge to unlocking the full benefit of this recent spate of legislation. As it stands, developers can receive a 10 percent tax credit so long as 40 percent of the cost for manufactured products are produced in the United States and 100 percent of iron and steel used is domestically produced. Domestic manufactures and project developers have expressed concerns with current guidance as it remains difficult to satisfy given the complexity in calculating the cost of products made in U.S. factories and their origins.10 Industry participants are still working out the best methods to monetize the PTC, which qualifies for cash payments, also known as direct pay. The direct pay guidance is marginally more restrictive around joint ventures and partnerships and most of these projects are partnership based.

Contextualizing the Implication – What Works Better and What Just Works?

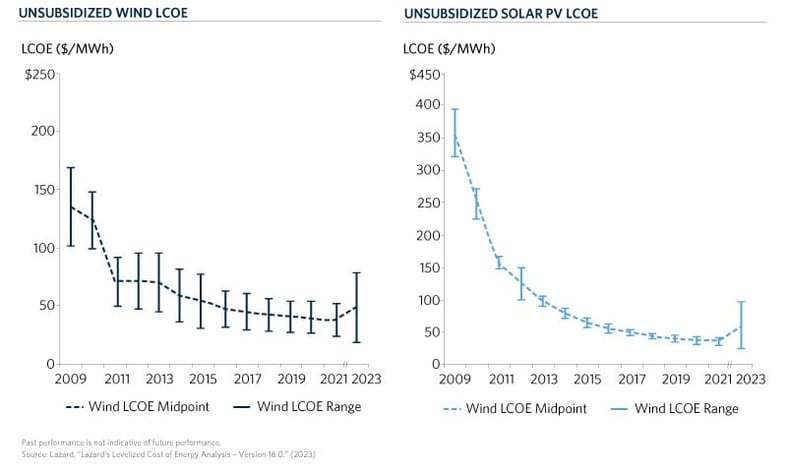

Key to evaluating the impact of enhanced tax credits and other incentives is assessing the relative viability of different segments on a standalone basis. In the case of established technologies like solar and wind, a rapid decline in their Levelized Cost of Energy (“LCOE”) made them increasingly cost competitive with conventional generation technologies before the introduction of the IRA.11 Conversely, emerging technologies like certain forms of hydrogen production and Carbon Capture Utilization and Storage (“CCUS”) remain relatively nascent technologies with limited demonstrated commercial traction outside of the oil and gas industry. The IRA aims to strengthen these emerging technologies and has created a new PTC for hydrogen (45V) at $3/kg depending on the overall carbon footprint and enhanced the tax credit for CCUS (45Q) to $85 per metric ton of sequestered carbon.12 Such examples – well established technologies with proven commercial deployment versus those that are innovative but unproven – present markedly different risk/reward for investors.

The distinction between accelerant and requirement is crucial for investors assessing risk.

Goldman Sachs believes that the hydrogen PTC could be competitive in replacing the historical fossil fuel-based hydrogen production market.12 However, it is important to note that these credits are only available for projects upon reaching Final Investment Decision (“FID”). Perhaps more importantly, the ultimate implication is that such projects likely do not work absent support. As a result, Goldman Sachs estimates approximately 67 percent of the total tax incentives from the IRA will be directed towards more established renewables.12 The estimated spending for programs that target nascent technologies such as CCUS and hydrogen are comparatively smaller.

Bottom Line

A little over a year on, the IRA is increasingly viewed as likely to encourage significant incremental investment in a range of energy transition sectors. Some of this investment – perhaps much of it – will be in the broader supply chain for well-established technologies like solar. As investors evaluate the landscape, they’ll need to carefully consider the relative maturity of the subsector they’re targeting – and comparative reliance on regulatory support.

- https://www.mckinsey.com/industries/public-sector/our-insights/the-inflation-reduction-act-heres-whats-in-it

- https://www.seia.org/solar-industry-research-data

- https://www.iea.org/reports/solar-pv-global-supply-chains/executive-summary

- https://investor.firstsolar.com/news/news-details/2023/First-Solar-Breaks-Ground-on-1.1-Billion-3.5-GW-Louisiana-Manufacturing-Facility/default.aspx

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-solar-industry-navigates-growing-pains-as-power-sector-leader-77513226

- S&P Global, "PV Module Manufacturing in the United States." (2023)

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/ira-at-1-us-heralds-clean-energy-manufacturing-renaissance-76610817

- https://ec.europa.eu/commission/presscorner/detail/en/ip_23_510

- https://www.wsj.com/articles/eu-to-compete-with-u-s-clean-tech-tax-breaks-by-loosening-subsidy-rules-87a7d334

- https://www.projectfinance.law/publications/2023/may/domestic-content-bonus-credit/

- Lazard, “Lazard’s Levelized Cost of Energy Analysis – Version 16.0.” (2023)

- Goldman Sachs, “US Inflation Reduction Act – What’s transformational what’s supportive, what’s underappreciated.” (2022)