History has shown corrections can be a catalyst for opportunity

The news cycle and leading economic factors have caused institutional investors to ponder their portfolio allocations in the short run and raised questions on how to navigate this market. Venture capital investing seeks to capitalize on long-term, secular trends; however, the continued economic uncertainty and market volatility has triggered concerns and significant drawdowns within institutional portfolios. That said, short-term dislocations can create opportunities, so recent pressures highlight the importance of foresight and long-term perspectives.

Looking back, a decade of economic stimulus and low interest rates accelerated the velocity of capital deployment in venture, which in turn led to increased investment activity, particularly from non-traditional capital sources. Hedge funds, cross-over funds, buyout funds, corporates and sovereign wealth funds migrated into the venture market seeking returns. With a low cost of capital, valuations and investment activity surged to decade highs.

Today, the venture market is markedly different with a higher cost of capital and falling valuations, as well as normalizing industry inflows. In 2022, dollars invested in U.S. startups fell 30 percent compared to 2021 - in line with the funding percentage pullback after the Global Financial Crisis (“GFC”) in 20091. Moreover, we are experiencing a slowdown in deployment pace, rationalization of entry valuations and more attractive deal terms.

While during the GFC we saw drawdowns, portfolio rebalancing and a risk-off mentality, we also saw uncertainty create both private and public market opportunities. Today, we are experiencing a not-so-dissimilar scenario. The influx of newly minted venture firms has slowed and, more importantly, capital is amassing with experienced managers who have navigated economic cycles and are well-versed in building enduring companies. The reduced competition has led to a drop in entry valuations across stages, but particularly for later-stage companies. The median pre-money valuation for later-stage rounds (Series D and beyond) has declined by 70 percent from their recent peak, while the Series A median pre-money valuation has decreased by 40 percent1.

Looking ahead, the funding landscape for venture startups is likely to become more discerning and circumspect, which is healthy. As a result, we believe market attention will revert to category-defining companies while the sea of lower quality competitors will likely face funding challenges if they are unable to achieve sustainable unit economics and profitability. Moreover, looking back at 35 years of portfolio data, we expect portfolio company loss rates should revert to historical levels, which is historically twice as much as we see today. There will be winners and losers – that is the nature of venture – but we believe the power law of venture remains intact (where 10 percent of companies generate 90 percent+ of industry returns)2.

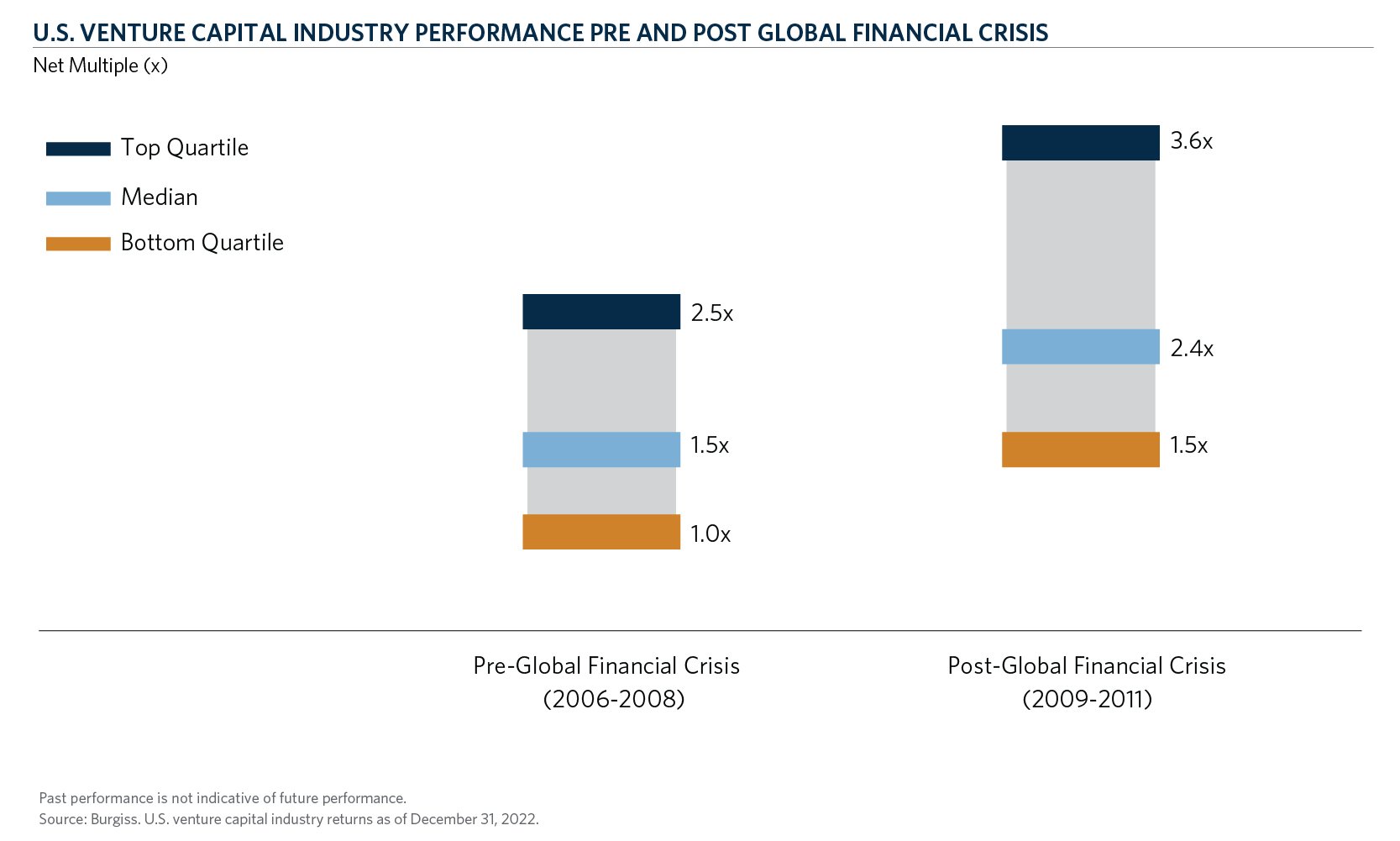

Warren Buffet once said, “be fearful when others are greedy and greedy when others are fearful.”3 Market conditions are evolving, but we are in a decades-long innovation cycle. If you evaluate venture fund vintages during the Global Financial Crisis (“GFC”), the industry experienced outperformance compared to the years leading up to the recession. Across the entire U.S. venture industry, the median return of funds raised in 2009-2011 was 60 percent higher than funds raised in the years 2006-2008.

There are many factors that contributed to venture industry out-performance following the GFC. In hindsight, investors enjoyed a favorable environment with less competition, more attractive entry valuations and the emergence of an innovation super cycle resulting from mobile and cloud computing. The drum beat of innovation does not follow the public market or forward yield curve. Category defining companies like Airbnb and Uber were formed during the market downturn. We believe consistent allocation over cycles is what enables investors to gain exposure to the next iconic venture-backed company that should drive the power law of industry returns.

But where are we in the innovation super cycle? We would argue the technology market is still in the early stage of the digital transformation of the global economy – and the landscape of opportunity is ever broadening with transformative and novel technologies. Artificial Intelligence (“AI”) has captured the imagination and excitement of consumers and enterprises alike. We also anticipate persistent growth in enterprise cloud software, new opportunities in the intersection of technology and healthcare sectors, and economic transformation from frontier technologies, including automation and robotics. New business models and use cases will emerge from AI and blockchain technology that have the potential to disrupt and rewrite industries while unlocking substantial value for venture investors. Furthermore, the global innovation flywheel is accelerating in large and growing markets including Southeast Asia and Latin America. The ecosystems in Europe, Israel, China and India continue to innovate and present exciting local and global opportunities. The menu of opportunities is large and growing – and global.

The combination of factors we see today - novel technological innovation, secular technology change, a growing pool of global technical talent, an attractive funding environment, and a market reset – creates a potentially compelling deployment period for venture capital investing. Savvy contrarian investors will underwrite long-term secular trends rather than focus on the short-term. Perhaps a simple way to evaluate the opportunity is to ask yourself this: do you expect technology to play an increasing role in our lives, or a decreasing role? If the answer is more, then now is the time to seek venture exposure.

FOOTNOTES

- As of March 31, 2023. Source: Pitchbook. US data.

- Source: CF Private Equity Internal Database.

- Source: Bill Murphy, “This 1986 Warren Buffett Quote Is the Key Advice You Need Today”, Inc. Magazine, April 19, 2020, https://www.inc.com/bill-murphy-jr/this-1986-warren-buffett-quote-is-key-advice-you-need-today.html