In recent months crypto markets have experienced extreme volatility and drawdowns, and it is self-evident that the next “crypto winter,” or prolonged bearish period, is upon us. However, these price movements have not altered the long-term thesis venture capitalists have in blockchain technology. Venture capitalists have high conviction in the “Web3” opportunity set, which they believe will usher in a new era of the internet that is decentralized, less extractive, community-owned and enabled by blockchain technology and cryptocurrencies.

In Web3, the combination of decentralization and modern software functionality has the potential to unlock a new wave of creativity, business models and industries. Volatility and conflicting sentiment are not uncommon in crypto markets, and history has shown that, irrespective of price movements, the innovation cycle persists—rewarding thoughtful, long-term oriented investors. To these investors, market cycles create attractive investment opportunities, and we believe that long-term oriented venture investors offer the best strategy to capitalize on this new era of the internet.

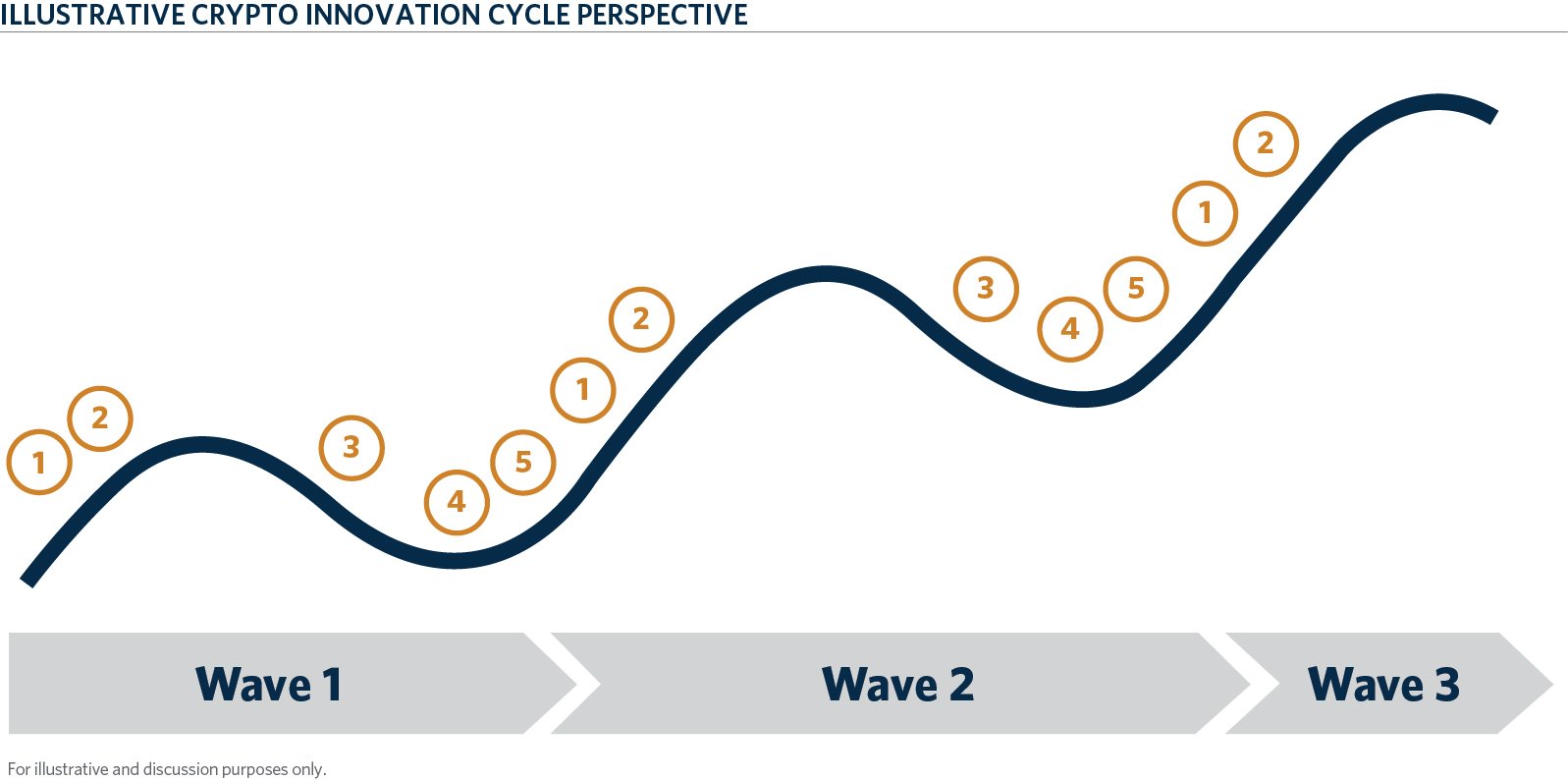

Seasoned blockchain-focused venture capitalists have invested through several market waves and are experienced in navigating different types of environments. In 2017, the crypto asset class was in its infancy, but recognition of the promise of Bitcoin as a store of value and Ethereum as a general programming platform for decentralized applications triggered exponential price movements, until a subsequent drawdown in 2018. Crypto then traded sideways until 2020, when active decentralized finance (“DeFi”) use cases emerged, again driving prices upward until a subsequent retracing. 2021 marked the onset of the third wave: use case potential for nonfungible tokens (“NFTs”) across a swath of industries triggered a rally, which drove the global crypto market cap briefly above $2 trillion. While each of these waves may look different and unorderly at the surface, a deeper look presents a consistent pattern of higher peaks and higher troughs—a feedback loop and cycle.

Phase 1: Newly launched blockchain use cases attract investors and entrepreneurs causing prices to rise.

Phase 2: Venture capitalists fund new ideas while developer teams begin creating projects that have the potential to further expand the ecosystem.

Phase 3: Prices decline, resulting in weaker projects failing, and survival of the fittest improves the overall quality of the ecosystem.

Phase 4: Markets overcorrect, creating opportunity for savvy investors to purchase quality assets at discounts relative to fundamental traction.

Phase 5: Projects previously funded by venture capitalists launch, leading to renewed interest in new blockchain use cases and driving prices upward. Rising prices further attracts new investors and entrepreneurs and the cycle repeats.

Crypto markets are currently undergoing a significant drawdown and, through the lens of previous waves, we could be in phase 3 or 4 of the innovation cycle. It’s not clear how long this crypto winter may last, or what use cases will eventually emerge that could reverse market sentiment, but what is clear is that crypto markets follow cycles (which we’ve seen before) based on a feedback loop between price, interest and innovation. Today, numerous catalysts for future growth exist which may potentially include the imminent Ethereum 2.0 merge, further DeFi winners emerging, crypto gaming on-ramping hundreds of millions of users to Web3 or Decentralized Autonomous Organizations (“DAOs”) uprooting modern company organizational structures. Furthermore, talent continues to flock to the space and strong developer teams continue to build novel products with potential for further innovation and disruption.

It is still early days in crypto, however one should anticipate further user adoption, more project experimentation and the ultimate emergence of new use cases. While attempting to time crypto markets is likely a fool’s errand, investors that remain patiently in the market are best positioned for when reversals occur – and we believe venture is the most effective strategy for capturing long-term value in the space. As with other periods of erratic price swings, naysayers will declare the “death of crypto,” but those who are able to recognize the repeating crypto market pattern might expect to see a stronger, and deeper, overall industry emerge with the potential for attractive investment entry points and the best teams to build, create value and pull ahead.