Beginning in the second half of 2015, there was growing caution that started to impact pricing and investment activity in early 2016. This valuation cooling period and subsequent shift in mindset appears to have been brief and private valuations have generally held steady, particularly in early-stage. The market appears to be bifurcating where companies in large markets that are growing with attractive unit economies are able to close financings at high valuations while companies with average performance are experiencing protracted fundraisings at mixed valuations. As a result, we continue to see more money going into fewer and higher profile winners.

Early stage investment activity pace has moderated from the early 2015 highs. Late stage venture has further declined in terms of activity, although high-quality assets continue to raise capital and wait out the exit environment. ”Unicorn” formation ($1 billion start up club) pace has also slowed. In 2015, approximately 43 unicorns were created in contrast to the 13 that have developed as of November 8, 2016. The accessibility of capital in later stage rounds or “quasi-IPO” type financing events continues to enable high quality companies to raise significant amounts of capital at high valuations and, as an example, during the third quarter of 2016, 22 percent of total venture capital dollars were invested in unicorns.

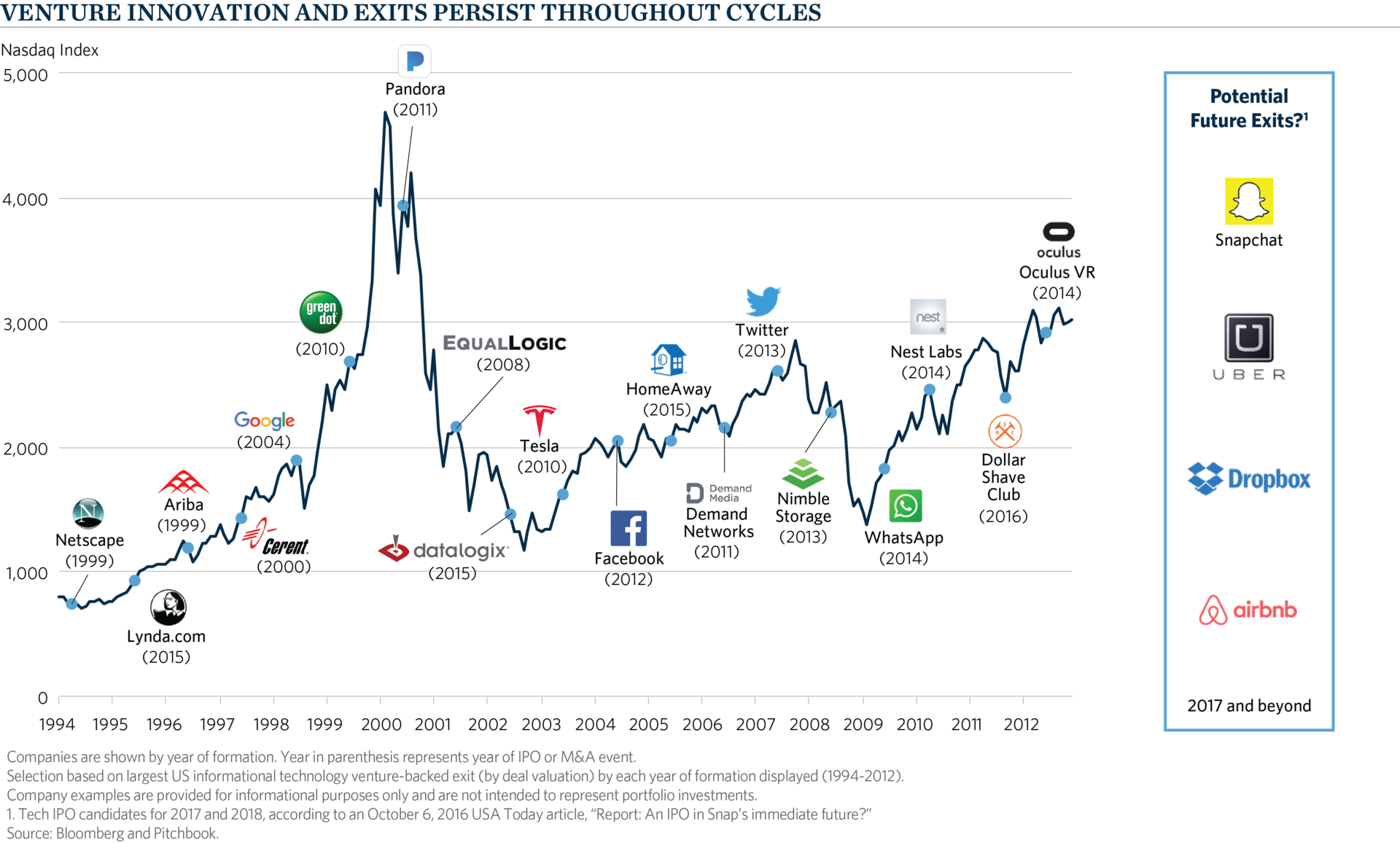

The initial public offering (IPO) window has improved in the third quarter after limited issuance in the first half of 2016, albeit at low historical levels. Likewise there are signs that 2017 could open up given improving investor demand. There is a strong pipeline of companies currently looking to enter the public markets. Combined with large corporations flush with cash, we believe the exit environment could improve over the coming year.

While there are ongoing concerns and questions regarding the U.S. economy, unpredictable political environment, the Feds’ reaction, and global market volatility, great venture-backed companies do continue to emerge, and as history has shown, disruptive companies are formed during both up and down markets. We believe disruptive innovation will be agnostic to capital market cycles and that a select set of managers can build companies to capitalize and ultimately monetize on this innovation.