The COVID-19 pandemic continues to impact the world in unprecedented ways. There is still much uncertainty including about when a vaccine will be ready and how schools reopening in the fall will fare.

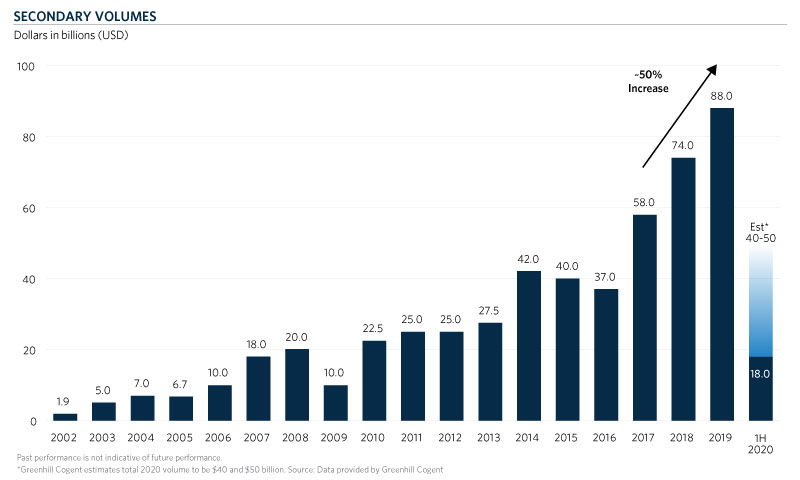

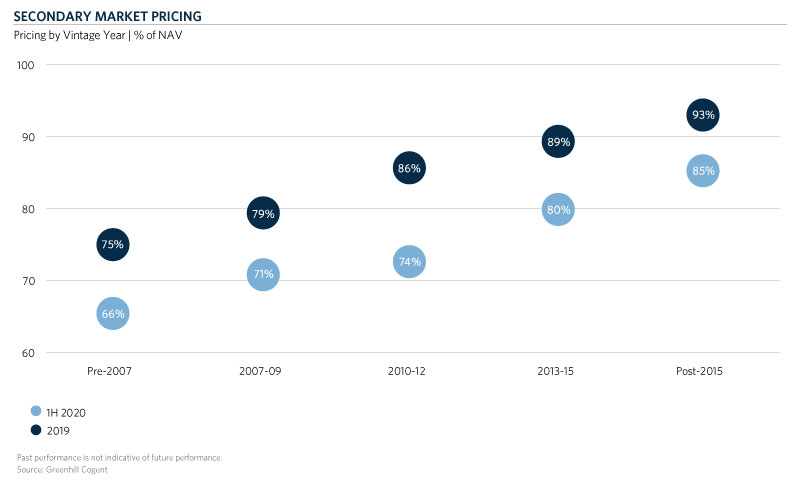

As predicted, the secondary market saw volumes drop by 57 percent YoY in the 1H20 to $18 billion (Greenhill Cogent). Average pricing for all transactions also declined to 80 percent of NAV, an 800-basis point decline from 2019 (Greenhill Cogent). There was significant dispersion in how general partners valued their funds at the end of Q1, with some managers being more aggressive with their markdowns while others took a more conservative approach. For the knowledgeable, opportunistic buyer, we believe this variation in marks and quality led to some very attractive investments. We continue to believe the uncertainty around COVID-19, the election and continued market volatility will lead to further secondaries opportunities in 2H20 and 2021, especially at the small end of the market. Smaller secondary players were less impacted by the contraction in deal flow in 1H20 as there were many small transactions by number in the market. Sellers proved more willing to complete those smaller transactions. Given these dynamics and our focus, Commonfund closed on more transactions in the first half of 2020 than we did in the first half of 2019.

SECONDARIES MARKET IMPACT

Volume

In April, Commonfund predicted that the secondary market would decline to between $40-55 billion in 2020. We continue to believe that the secondary market will fall into this range for 2020. According to Greenhill Cogent, 1H20 saw $18 billion of secondary transaction volume, and they expect the market will be between $40-50 billion for 2020.

While there continue to be many transactions at the small end of the market, we are seeing fewer larger transactions of diversified LP portfolios. Still, some transactions with higher quality assets have been completed. Notably, CPPIB and Ottawa Avenue Private Capital (an affiliate of the DeVos family office) were both able to complete $1+ billion secondary sales since the pandemic began.

As a whole, the market was slower in the second quarter given the larger bid-ask spread as buyers and sellers waited for Q1 and Q2 marks. This parallels the trends in secondary deal volume seen during the global financial crisis and was largely expected. During these periods, sellers who brought transactions to the market were typically looking to get out of unfunded commitments for redeployment elsewhere, or had other liquidity needs. As Greenhill Cogent noted, 81 percent of 1H20 secondary transaction volume was in 2013 and newer vintage funds. Many sellers were looking to free up unfunded capital to redeploy into current vintages while others were driven to sell parts of their private portfolio to address general liquidity needs. While the pandemic has certainly exacerbated liquidity concerns for some investors, these sellers exist in all market conditions as liquidity issues are not necessarily correlated to macro conditions, particularly with high net worth individuals and smaller family offices. We have seen a number of these investors selling in 1H20 at the small end of the market.

According to Greenhill Cogent, GP-led transaction volume fell to $6 billion in 1H20 (from $14 billion in 1H19) with many deals failing or being postponed. GP-led transactions represented 33 percent of 1H20 volume versus 30 percent of volume in 2019, according to Greenhill Cogent. This data suggests that the pandemic similarly impacted GP-led and LP-led transaction volumes.

We continue to expect 2021 to be a record year for the secondaries market and believe market volumes will surpass the $88 billion closed in 2019, in part due to a significant existing pipeline of sellers.

Pricing

Pricing of secondaries transactions dropped significantly in the first half of 2020 versus 2019. As you can see from the chart below, pricing dropped by 8 to 12 percent of NAV depending on vintage year. Commonfund saw some transactions drop by nearly 20 percent of NAV relative to where the transaction would have traded before the lockdowns and market dislocation at the end March 2020.

Commonfund believes that the current secondaries market is attractive, especially given the pricing dislocation noted above. Below we highlight specific areas of the market:

Tail-end (pre-2010): Tail-end portfolios have historically traded at substantial discounts based on the shorter duration, lower capital appreciation before exit and typical seller motivations unrelated to price and more focused on relieving administrative burdens. Today, these dynamics are further enhanced with buyers and sellers realizing that exits are likely to be delayed by 12-24 months. Older fund-of-funds/ secondary funds and fatigued investors will still need and want to liquidate their portfolios.

Recent Vintages (post-2015): Recent vintages with unfunded capital have become more attractive to buyers in the current environment. Buyers gain visibility in the portfolio and platform investments along with comfort that the additional capital available can be utilized both offensively and defensively. High-quality GPs with available capital viewed as capable of navigating the market dislocation are particularly attractive.

GP-led Transactions: The amount of tail-end funds and older assets seems to have only increased with the potential that the COVID-19 pandemic might further lengthen the time for exits. High quality GPs have continued to utilize the secondary market to retain high performing companies while also providing existing limited partners an option for liquidity. The GP-led market has led the rebound of secondary transactions with a number being launched over the summer.

Single Asset Transactions: General Partners continue to look for ways to hold onto their best companies, as evidenced by the increasing number of single asset transactions in high-quality companies. One-way secondary investors can mitigate concentration risk is by diversifying across their funds. In the COVID-19 environment, single assets transactions are especially appealing as it is easier to measure the impact of COVID-19 on a single company versus a diversified portfolio.

Conclusion

Secondaries remains an attractive investment opportunity. Given the recent market dislocation, continued volatility, a pending election and the ongoing pandemic, the secondary market has seen lower prices and more opportunities in younger assets. The secondary market should see substantial increases in volume in the second half of 2020 and into 2021. Commonfund believes that 2021 will be another record year for secondary transaction volume. Given the uncertainty in the market, secondaries may see more attractive pricing which could lead to better opportunities and enhanced returns.

This is a follow-up to the article from April 2020, Private Capital Secondaries: An Overview