A strong private capital program requires consistent, diversified investing over time. It is also necessary to have— or obtain externally— resources for research and due diligence before you invest; ongoing monitoring afterward; and useful, reliable internal reporting to ensure appropriate controls.

The top-tier private capital managers generate a disproportionately large share of returns within the industry, it is essential to have access to those managers. “Average” returns in private capital investing are likely to be mediocre or, worse, could result in losses. For this reason, the most critical factor in private capital portfolio construction is manager selection.

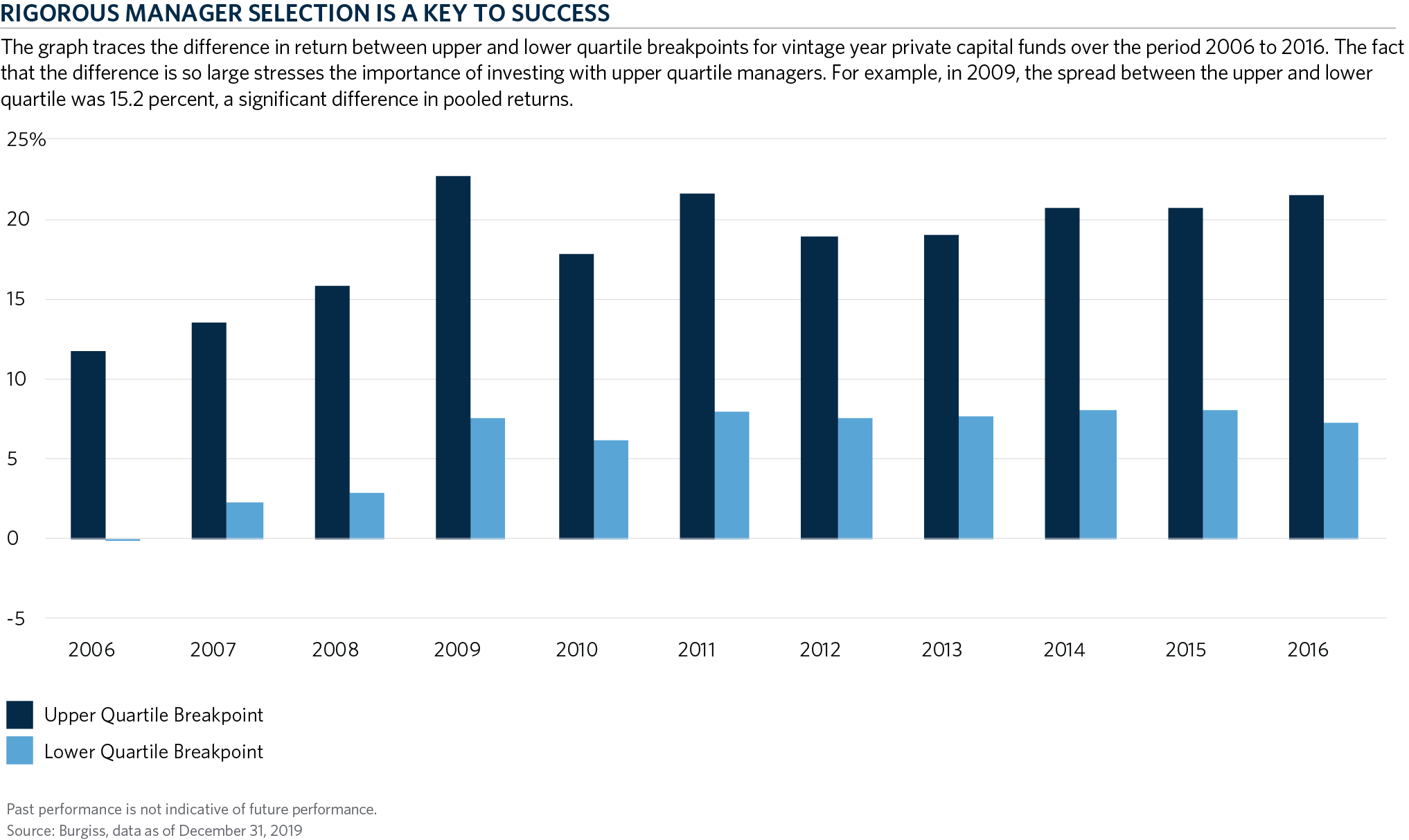

As shown in the figure below, upper quartile private capital managers have demonstrated an ability to deliver 15 to 25 percentage points in added return annually compared with lower quartile managers.

However, diversification should also be a principal goal for your private capital portfolio. Investors may obtain meaningful diversification in a number of ways.

Here are seven ways that Commonfund Capital diversifies its portfolios.

By Investment Strategy

Create a balance of private equity, venture capital, natural resources and other private programs. And, embedded in these strategies, allocate to secondary interests, co-investments, distressed/turnaround opportunities and select emerging markets exposure.

By Manager

Invest with several managers in each asset strategy over a two- to three-year cycle to capture specific expertise and hedge against the possibility of organizational risks such as the loss of key personnel.

By Style and Strategy

Identify managers whose styles and strategies are complementary within a portfolio.

By Stage of Development

Invest with managers who work with companies at different stages in the development cycle— from start-up to restructuring.

By Vintage Year

Find managers who raise funds in different vintage years, allowing you to dollar-cost average and even out the vagaries of economic and capital market cycles.

By Industry

Choose managers who participate in a range of industries as well as focused specialists who concentrate in one or two.

By Geography

Offset country- or region-specific risks and participate in strong economies both in developed and appropriate emerging markets by creating a portfolio that has broad global exposure.

Additional Considerations

Invest Consistently

Commonfund Capital believes strongly in the practice of continual commitment over time to the various private capital strategies. This process allows investors to incorporate the time-tested policy of dollar-cost averaging into their portfolios. It also recognizes the fact that returns can vary significantly by vintage year. A number of external factors make some vintage years better than others, including the state of the economy, the public and private market environment, and conditions within a particular industry.

Market Timing

Market timing is discouraged in the public securities markets and is even less effective in the private capital markets. Investors who try to time the private capital market may justify their approach by saying that too much money is flowing into a particular market, that deal valuations are too high or that the opportunity set is not especially attractive. Any or all of these factors can be cited to justify withholding funds from private capital investing and waiting for better conditions.

There are several problems with this thinking, however. One main difficulty is that it is impossible to predict today what the investment and exit environments will be like over the 10- to 12-year life cycle of a typical private capital fund.

Experienced private capital managers point out that debate is inevitable; for example, over the past two decades the high level of capital inflows has generated discussion in all but a few years. In the long run, the best strategy is to invest consistently with a diverse set of managers who have demonstrated an ability to add value over time and through economic cycles.