The natural resources sector is often characterized as cyclical, as producers and service providers experience underlying exposure to and commensurate volatility of commodities in the oil and gas, mining and agriculture sectors. After a couple of years of challenging sector returns, some institutional investors are questioning what the role of investing in natural resources should be in a portfolio and if now is a good time to invest in the asset class.

At Commonfund, we continue to believe in the strategic role of natural resources and the three core reasons for inclusion in a well-diversified portfolio:

- Growth and potential for alpha generation

- Diversification

- Inflation hedging potential

Let’s take a closer look at each attribute.

Growth and alpha exposure to essential commodities

While it is possible to directly invest in commodities via futures contracts, investing in operating businesses (public or private equity) that focus on commodity-related areas (e.g. oil and gas producers like Shell, oilfield service companies like Baker Hughes or mining companies like Rio Tinto) can offer similar exposure, but with the potential for realizing operating leverage, earning the equity risk premium and in the case of private investments, an additional illiquidity premium. In contrast, while investing directly in commodity futures offers investors explicit exposure to macro supply and demand dynamics, marginally higher correlation to inflation and lower correlations to other asset classes they come with lower return expectations due to the lack of inherent cash flow and growth associated with owning the commodity future (outside of potential positive price movements). Further, negative roll yields associated with futures markets in contango1 can lead to negative returns in flat commodity price environments. Alternatively, public or private companies can generate positive cash flows in flat price environments. This is a critical consideration for long term investors with real return objectives of approximately 5 percent.

Additionally, natural resource inputs underlie many facets of the economy. These inputs come in many forms: oil inputs in transportation, natural gas inputs in electricity, and metals and mining inputs in manufacturing, infrastructure and technology, for example. While each individual commodity experiences its own volatility based upon their respective supply and demand curves, there are opportunities to generate attractive relative returns by targeting higher growth and/or lower marginal cost investment opportunities, which can be resilient regardless of the point in the cycle and offer greater return potential.

Diversification

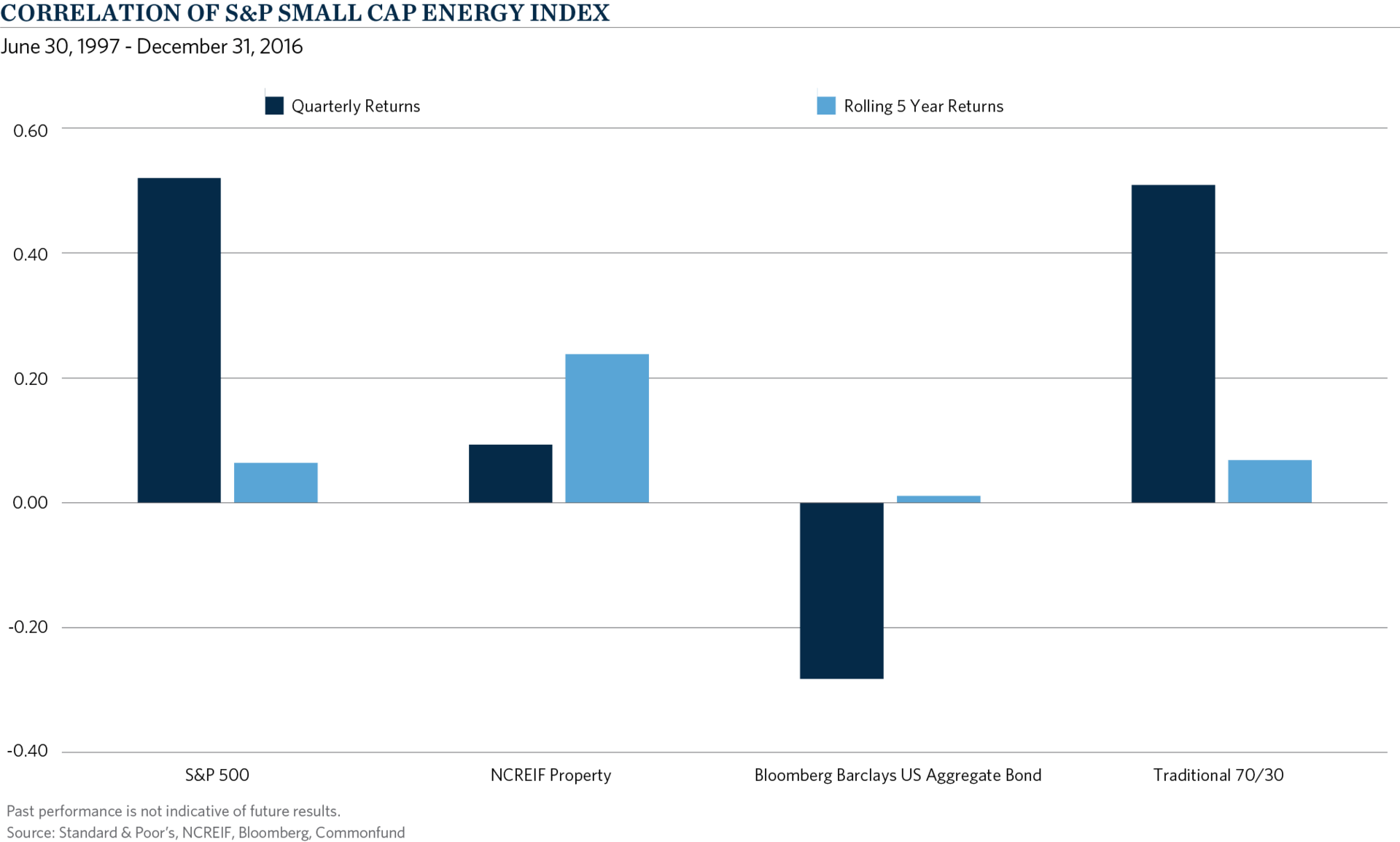

Natural resource related assets have historically shown positive diversification benefits relative to traditional asset classes. As shown in the below chart, we compare the quarterly and rolling 5 year returns of the S&P Small Cap Energy index relative to common asset class indices. Both data series indicate strong diversification properties particularly versus a traditional S&P 500 and Bloomberg Barclays US Aggregate Bond portfolio with rolling 5 year correlations close to zero.

Inflation hedging potential

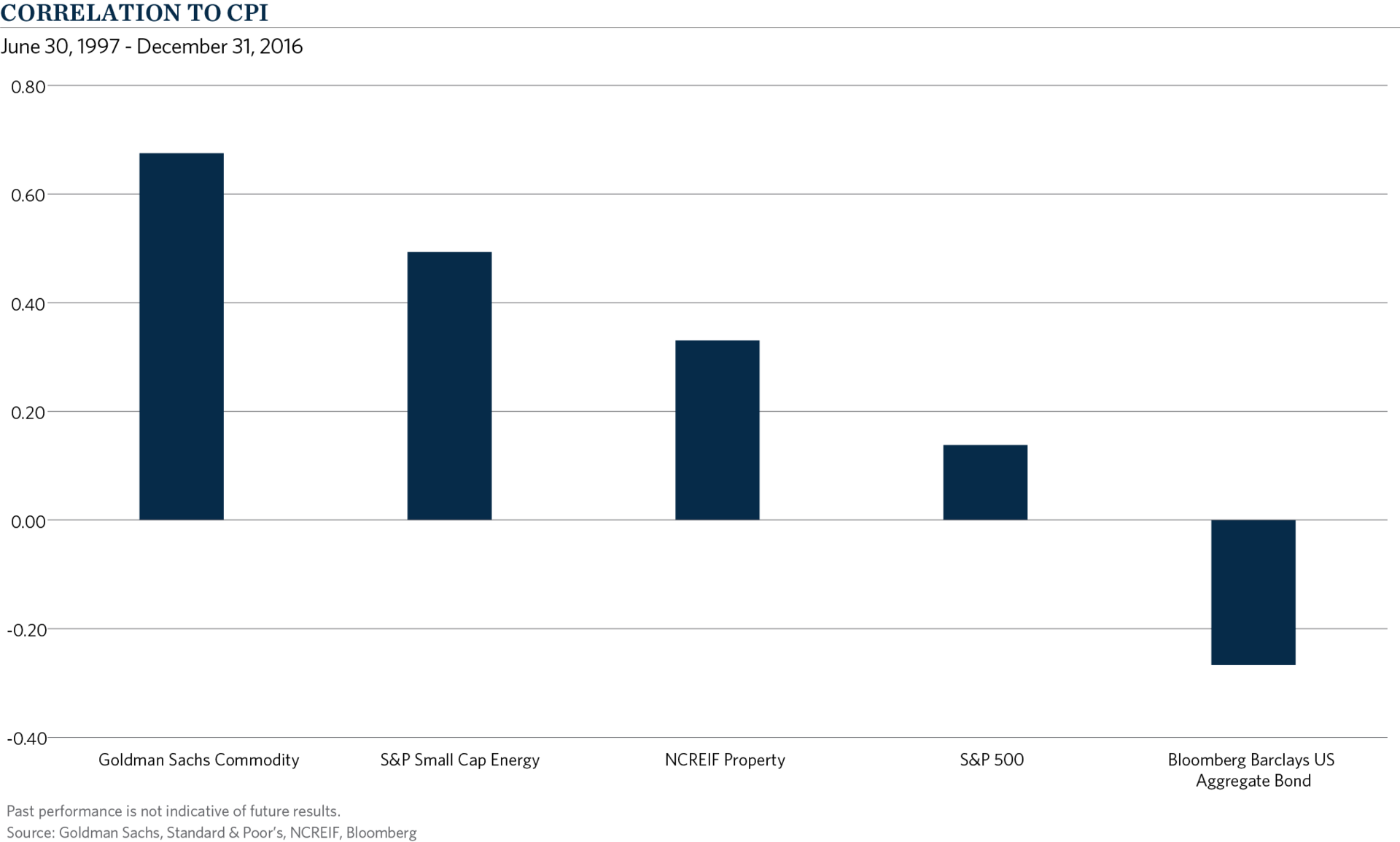

Natural resource related assets have historically shown a positive relationship with inflation. In the chart below, we show correlations relative to the Consumer Price Index (“CPI”) to indicate how well a particular asset class might historically perform relative to inflation. While there are no pure hedges to inflation (i.e. correlation of 1), natural resources, as represented by the S&P Small Cap Energy Index, have exhibited a higher correlation relative to other asset classes. While pure commodities have historically demonstrated an even higher correlation, this comes at a cost to long term returns.

Tactical considerations

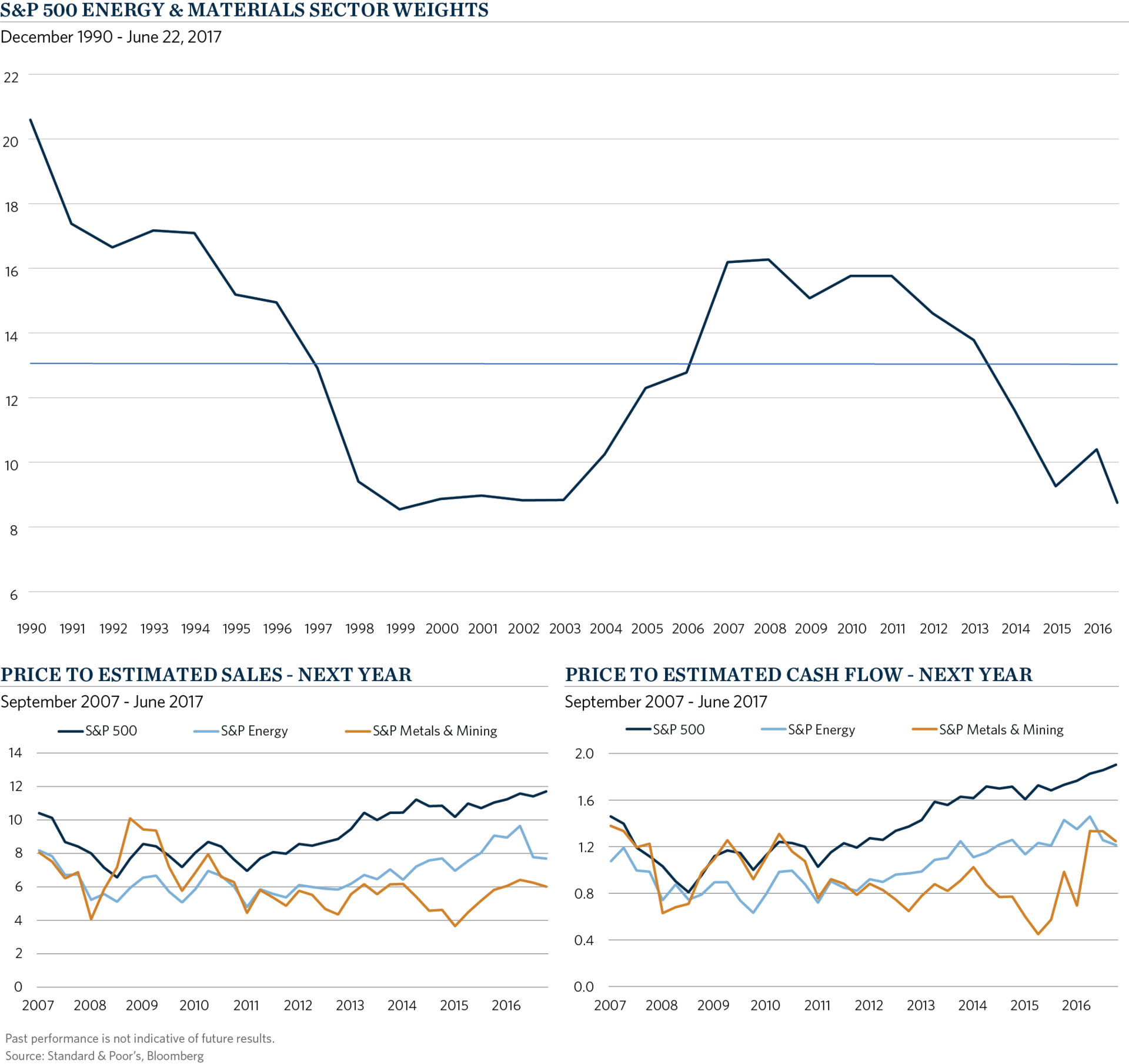

While we counsel long term strategic allocations to the sector, recent relative underperformance has driven the natural resource sectors market weights well below their longer term average. This potentially increases the risk to traditional portfolios to an inflationary environment as the sectors with the highest positive correlation to CPI have been reduced. Additionally, we show the price multiples for the broad S&P 500 index and the S&P 500 Energy and Metal & Mining sectors indicating pricing may present a good relative entry point.

The combination of these three attributes – growth and potential alpha generation, diversification and inflation hedging – offers natural resources a unique role within a portfolio. While natural resources businesses can exhibit inherent volatility with the pricing fluctuations of the underlying commodities, in our experience it is exceedingly difficult to exactly time these cycles. Some years will always perform better than others. But, if an investor stays consistent in allocating a portion of the portfolio to the space with a bias towards advantaged producers and service providers, one can not only expose the portfolio to these cycles, but potentially take advantage of them.

- Contango occurs when the current futures price of an asset (as quoted in the futures market) is higher than the current spot price of the underlying asset.