Investors often ask about the difference between time-weighted return (“TWR”) and internal rate of return (“IRR”).

In general, TWR is used by the investment industry to measure the performance of funds investing in publicly traded securities. By contrast, IRR is normally used to gauge the return of funds that invest in illiquid, non-marketable assets—such as buyout, venture or real estate funds.

Investors want to know why public and private investment returns are reported differently and how the calculation methodologies differ.

Therefore, this article will:

- Explain why public and private investment performance is reported differently,

- Define TWR and IRR, and

- Highlight the differences between IRR and TWR by calculating both numbers from the return stream of a hypothetical

While investor knowledge of TWR is widespread given its broad adoption with marketable investments, familiarity with IRR continues to be less extensive. However, IRR remains the standard for private investments.

Why Public and Private Securities Returns are Reported Differently

Managers of public securities funds typically do not control investor cash flows. Investors in these funds enter and exit at will. On the other hand, investors in many private or alternative funds face restrictions on their ability to invest additional assets or to redeem existing assets. These restrictions can take the form of multi-year “lock-ups” or no ability to achieve liquidity absent the sale of underlying assets1.

As discussed below, this difference in the nature of fund cash flows constitutes the main reason why public and private securities returns are reported differently.

Time-Weighted Return, What Is It?

TWR measures a fund’s compounded rate of growth over a specific time period. (Fabozzi, Frank, Investment Management, © 1995, pp 611-618).

While TWR measures the return of a fund’s investments, it does not consider the effect of investor cash moving in and out of a fund. Thus, TWR is suitable for measuring the performance of marketable investment managers because they do not control when investor cash enters or exits their funds.

According to the CFA Institute, “Time-weighted rate of return allows the evaluation of investment management skill between any two time periods without regard to the total amount invested at any time during that time period. The measure is independent of the total amount invested because the manager normally does not control the inflow and outflow of money.”

How Time-Weighted Return Works

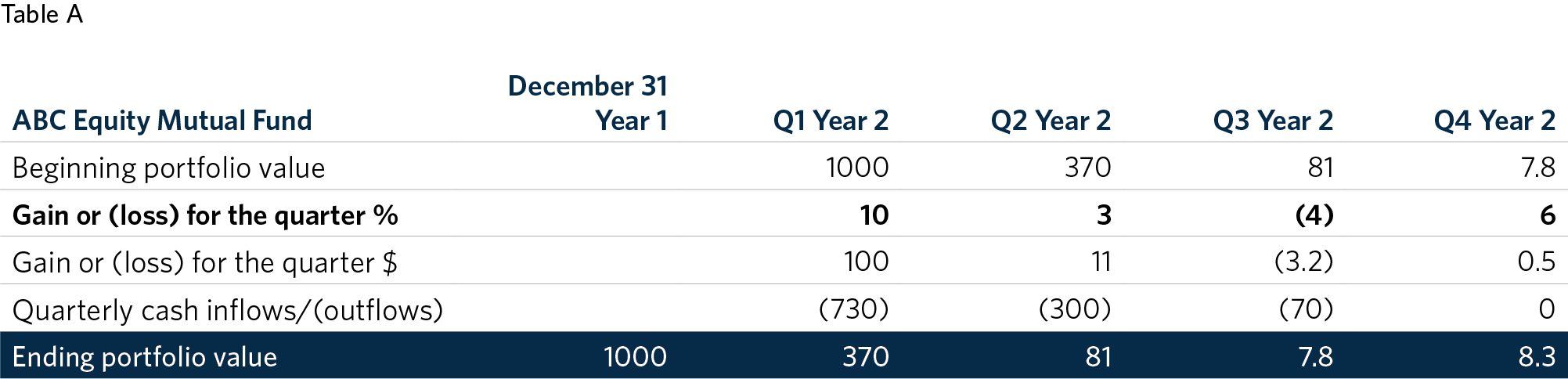

The example below illustrates the mechanics of TWR for the hypothetical ABC Equity Mutual Fund (numbers in bold are used for the TWR calculation).

On December 31, Year 1, ABC had $1000 in assets. During the first quarter of Year 2 it had a 10% return, but this return ranked far below its peers, so $730 exited the fund. In the second quarter, ABC earned 3% and $300 more dollars came out. In the third quarter, the fund lost 4% and $70 was withdrawn. In the fourth quarter, ABC gained 6% and did not lose assets.

What is the annual TWR for ABC Equity Mutual Fund?

The TWR formula in this case is:

[(1+R1)(1+R2)(1+R3)(1+R4)] –1 = TWR, where R is the quarterly return.

Using the quarterly return numbers from above gives the following result:

[(1.1)(1.03)(.96)(1.06)] –1 = 15.3% = Annual TWR

Thus, ABC earned a 15.3% return. Note that the fund’s cash outflows had no impact on performance.

Now let’s turn our attention to IRR, a measure for which fund cash flows have major significance.

Internal Rate of Return, What is it?

According to the CFA Institute, IRR is the annualized implied discount rate calculated from a series of cash flows. It is the return that equates the present value of all invested capital in an investment to the present value of all returns, or the discount rate that will provide a net present value of all cash flows equal to zero.

Said differently, IRR is the discount rate that equates the cost of an investment with the present value of the cash generated by that investment.

The CFA Institute recommends that IRR be used to measure the return of investments in private securities. A major reason for this recommendation is that private investment managers typically exercise a greater degree of control over the amount and timing of their funds’ cash flows. How private managers exercise this control is crucial in assessing their investment skill.

Thus, private fund managers need a return calculation method that takes into account their control over fund cash flows. IRR does this.

How Internal Rate of Return Works

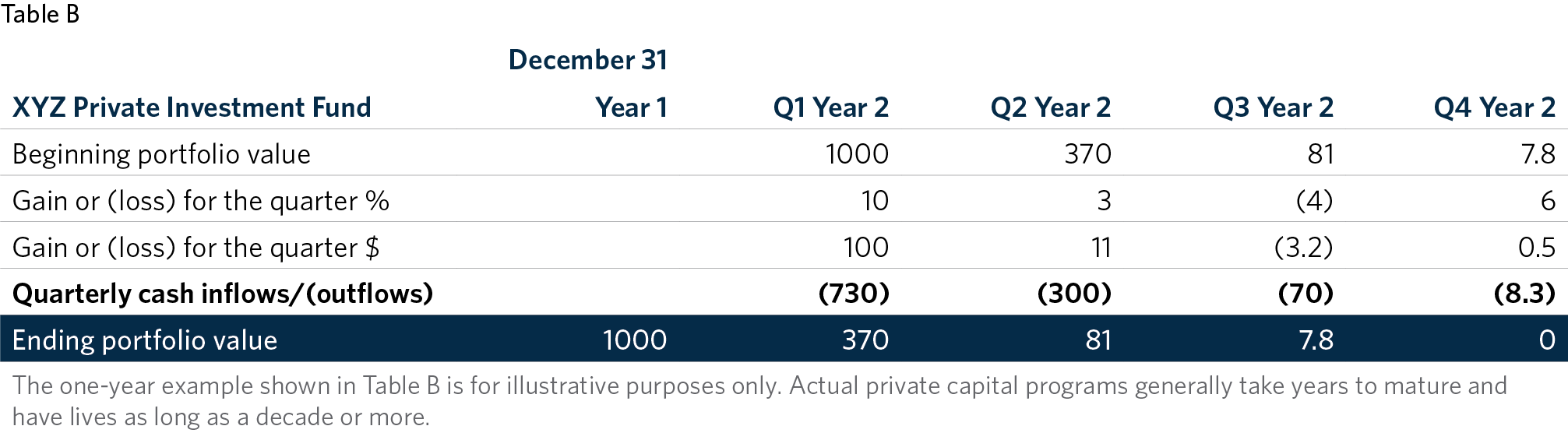

To see the importance of cash flows in the IRR calculation, let’s use the same quarterly returns and cash flows presented above to calculate the IRR of the hypothetical XYZ Private Investment Fund (numbers in bold are used for the IRR calculation).

As will be seen, IRR uses different numbers than TWR.

In this case, on December 31, an investor makes a $1000 investment in XYZ. In the first quarter, XYZ’s investments are written up in value by 10% and the fund distributes assets to investors totaling $730. In the second quarter, XYZ’s investments are written up 3% and $300 of portfolio assets are distributed. In the third quarter, XYZ writes down investments by 4% and distributes $70 worth of assets. In the fourth quarter, remaining fund investments are written up 6% and distributed at $8.3.

What is the IRR on this investment?

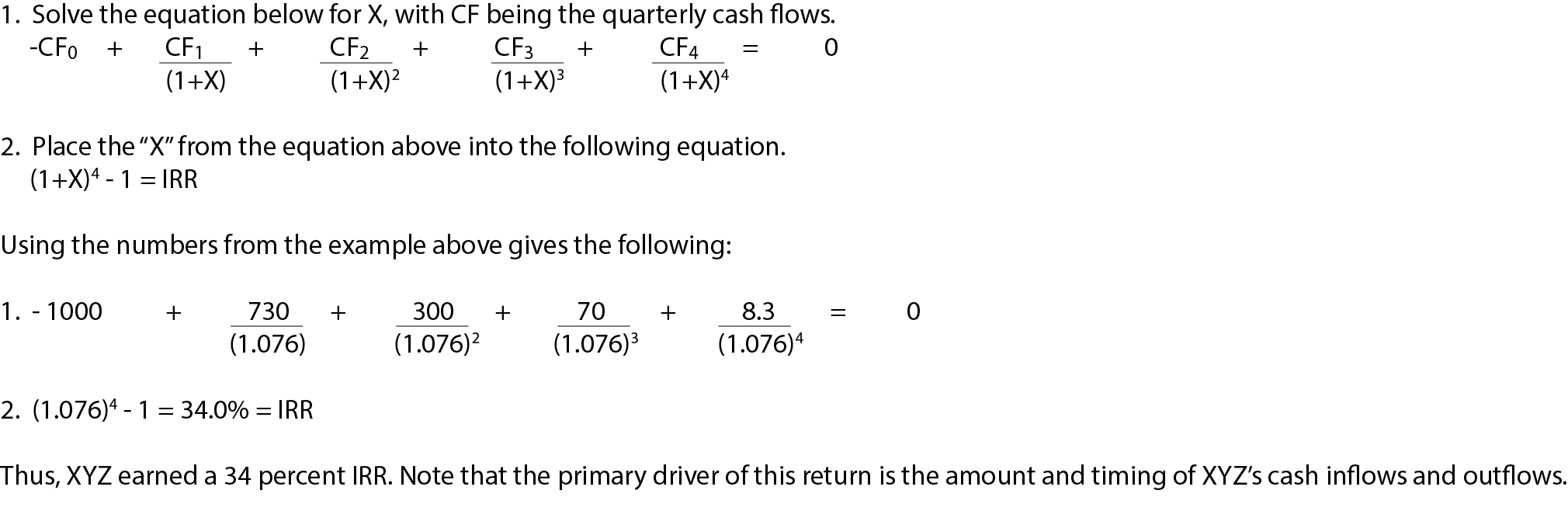

The IRR formula in this instance involves two steps: 3

Analysis of the Differences Between Time-Weighted Return and Internal Rate of return in the Examples

In the foregoing examples, we demonstrated TWR using hypothetical returns of the ABC Equity Mutual Fund, and we showed IRR using hypothetical cash flows of the XYZ Private Investment Fund.

These two methods reflect the differing nature of cash flows for public and private fund managers. Public fund managers do not control their funds’ cash flows, and TWR does not account for the timing of these flows. Private fund managers, on the other hand, exercise a degree of control over the timing and magnitude of their funds’ cash flows, and IRR takes these flows into account.

In the two examples, IRR was roughly twice the TWR. However, TWR and IRR will not always differ. Sometimes the two may be similar, depending on returns and cash flows.

IRR was higher than the TWR due to the “front loading” and strongest quarterly return in the initial quarter of XYZ Private Investment Fund’s cash outflows, i.e., most of the cash ($730) was returned to investors in the first quarter.

- An additional means of achieving liquidity is through a secondary sale, which is not within the scope of this paper and often can require taking a significant discount to net asset value to enable such a sale.

- Step one calculates the subperiod IRR from the quarterly cash flows. Step two annualizes this number. Many spreadsheet programs have IRR calculation functions as a standard feature.