Topic: Perspectives

Common Misconceptions about Endowments

In recent months, institutional endowments, particularly those within higher education, have been subject to heightened scrutiny. This attention has, at times, created tension and contributed to the...

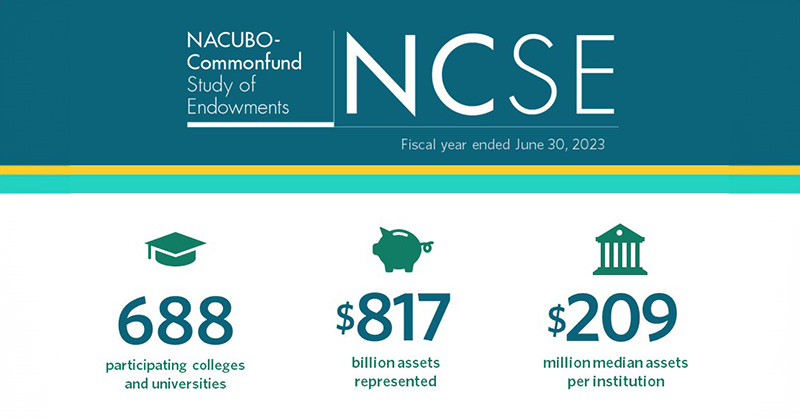

FY25 NACUBO-Commonfund Study Released

U.S. Higher Education Endowments Report Stable Returns, Increase Spending to $33.4 Billion in FY25 The NACUBO-Commonfund Study of 657 colleges and universities reports a 10-year average return of...

CF Private Equity Announces the Final Close of its Fifth Co-Investment Fund at $187M, Exceeding its Target

CF Private Equity Co-Investment Opportunities V, L.P. held its final closing on January 12th, 2026 Norwalk, CT, January 13, 2026: CF Private Equity today announced the final closing of CF Private...

2025 HEPI Report Released

Inflation for U.S. Higher Education Institutions Rises 3.6% in Fiscal 2025, Up from Fiscal 2024 Rate Norwalk, Conn., December 11, 2025 – Data from the annual Higher Education Price Index® (HEPI) show...

Winter Reading List 2025: Stories to Warm the Season

Commonfund Institute is excited to share the latest edition of our winter recommended reading list, featuring thought-provoking memoirs, compelling historical fiction, and inspiring leadership...

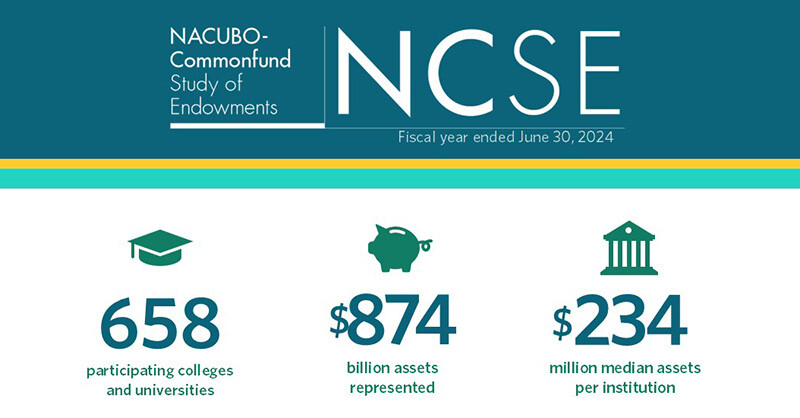

A Closer Look at Higher Education Endowments Less Often in the Spotlight

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2024 NACUBO-Commonfund Study of Endowments (NCSE, or,...

A Closer Look at Private Family Foundations

Commonfund, in partnership with the Council on Foundations (COF), recently released the 2024 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations...

Four Takeaways from the 2025 Nest Climate Campus Event

At this year’s Nest Climate Campus event, held September 23-25, 2025, during NYC’s Climate Week, the conversation around climate shifted—from ideals to execution, and from rhetoric to financial and...

What a Government Shutdown Means for the Nonprofit Sector: Why It Matters to Boards

At midnight on October 1st, the U.S. government shut down after Congress failed to pass a short-term funding bill. The shutdown is a culmination of contentious policy differences between Republicans...

Commonfund Holds Third Convening for Foundations that Support Higher Education

Last month, Commonfund hosted its third Commonfund Convenes event dedicated to advancement of investment knowledge for institutionally-related foundations (IRFs). The latest workshop focused...

Higher Ed in 2025: Top 5 Business Concerns and How Institutions Can Respond

For the past four years, NACUBO has surveyed chief business officers and other financial and administrative professionals about the challenges that confront them—and how they are working to support...

A Closer Look at Health Conversion Foundations

Commonfund, in partnership with the Council on Foundations (COF), recently released the 2024 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations...

Health Conversion Foundations: Preserving Community Health in a Changing Landscape

In the evolving terrain of American healthcare, health conversion foundations, also known as health legacy foundations, have emerged as powerful stewards of community well-being. These philanthropic...

Growing Use of OCIO by Private and Community Foundations

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data show concerns are rising regarding the ability to...

Themes from the 2025 FAOG Conference for Community Foundations

Last week in Oklahoma City the 2025 FAOG (Finance, Administration & Operations Group) Conference convened experts and over 300 delegates from community foundations around the country to explore the...

A Closer Look at Long-term Returns

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data was collected on longer-term returns for the first...

Study of Foundations - Key Highlights [Infographic] 2024

In this infographic, we report the key highlights from the 2024 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2024, participating foundations produced...

Foundations' Endowed Portfolios Produced Double-Digit Investment Returns in 2024

Long-Term Return Data Also Positive Council on Foundations-Commonfund Study finds Outsourcing on the rise; gifts to community foundations increased Wilton, Conn. (August 27, 2025) — In the volatile...

In Memoriam: Mamak Shahbazi

It is with great sadness that we announce the passing of Commonfund Board Member, Mamak Shahbazi. Mamak was a dedicated and talented board member and a great friend to the firm, its clients, and...

Fiscal Year-End and Mid-Year 2025 Market and Investment Review

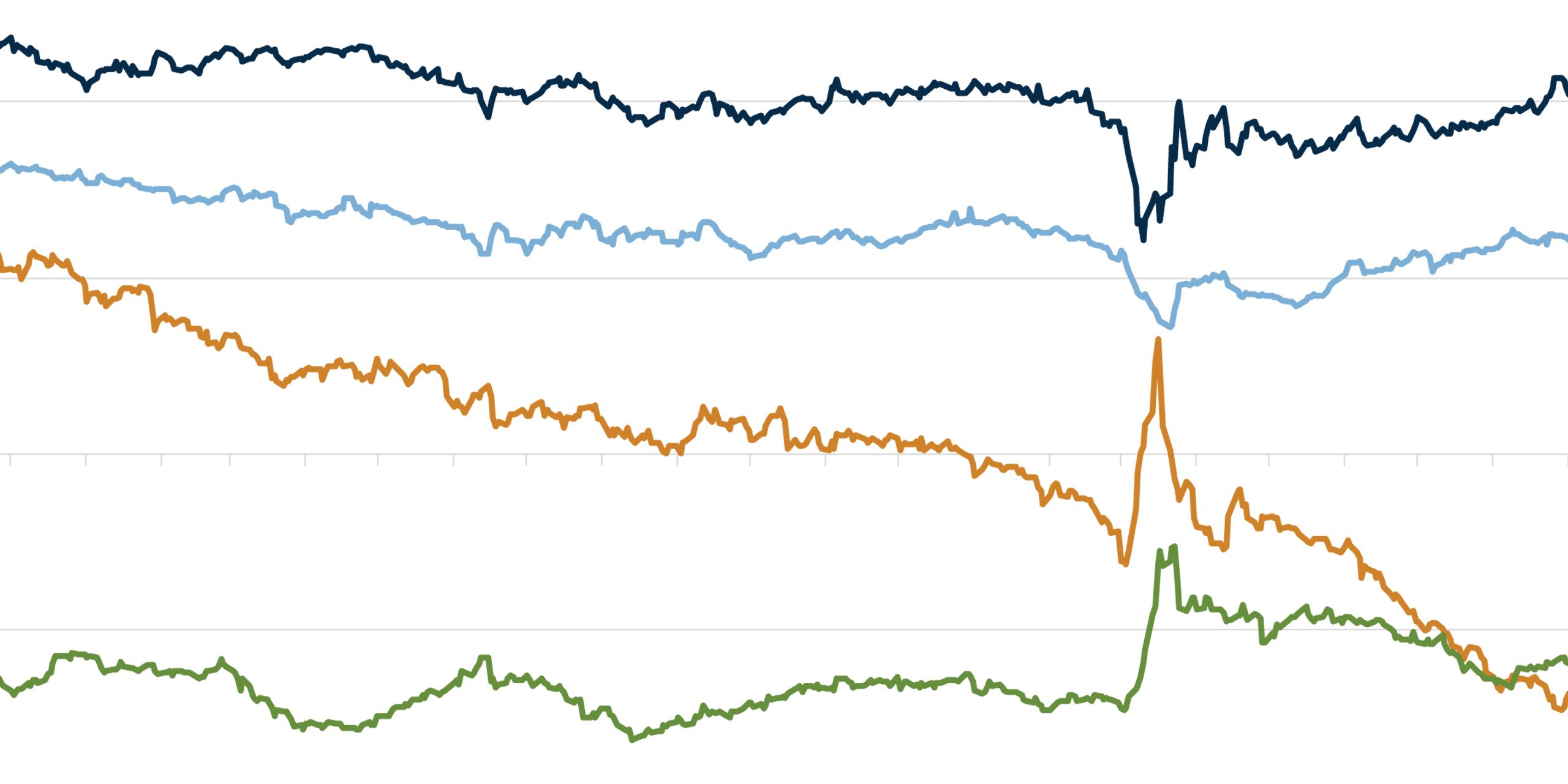

Institutional investors aim to construct long-term asset allocations to withstand bouts of short-term volatility and periods of market uncertainty. This concept was certainly tested in fiscal year...

Summer Literary Journeys: A Pathway of Pages into Growth, Grit, and Collective Imagination

Commonfund Institute is excited to share our annual summer reading list, thoughtfully curated with recommendations from our Commonfund colleagues. Inspired by the spirit of the summer solstice –...

Investment Stewardship Academy: Takeaways for Navigating an Evolving Landscape

For over 30 years, Commonfund Institute has hosted the Investment Stewardship Academy (ISA) to bring institutional investors together to learn, collaborate, and better support the missions they...

CF Private Equity Announces Leadership Changes

Ethan Levine appointed Head of Secondaries | Dan Connell elevated to Co-Head of Real Assets and Sustainability Wilton, CT, June 24, 2025: CF Private Equity, Inc. (CFPE) today announced that Ethan...

A Closer Look at Minority-Serving Higher Education Institutions

Following the release of the 2024 NACUBO-Commonfund Study of Endowments (NCSE), Commonfund conducted a focused analysis of data reported by the 97 participating Minority-Serving Institutions (MSIs)....

Grove City College: Conservative, Christian, Committed to Excellence and Affordability

Grove City College is an institution of higher learning where values and value are inseparable.

CIO Roundtable: Meeting Complexity and Uncertainty with Clarity

A foundation, a university and an insurance company operate in different worlds and have different priorities—but make investment decisions in the same environment Institutions depend on their...

The Power of We: How Collective Learning and Data Sharing Make Us Stronger

In the midst of today’s volatile economic and policy landscape, collective learning has become not just beneficial but essential for institutional investors. The nonprofit sector as a whole is facing...

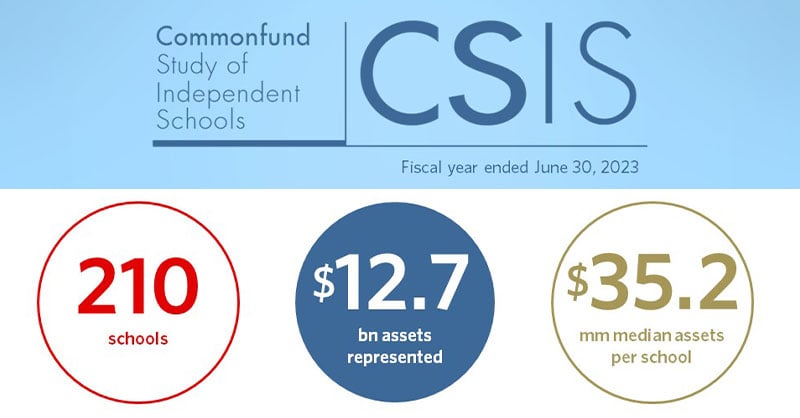

Study of Independent Schools Marks its 20-Year Milestone

In 2005, what was then called the National Business Officers Association (now NBOA: Business Leadership for Independent Schools) had reached the seventh anniversary of its founding. Having its...

Chief Investment Officers Share Their Thoughts at Forum 2025

Commonfund hosted its annual Commonfund Forum 2025, March 9-11th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Key Takeaways from the 2025 CASE Conference for College & University Foundations

Commonfund Institute provides analysis and thought leadership across the nonprofit institutional investing space. But investments don’t happen in a vacuum – they are part of the institutional...

Increased Use of OCIO for Independent Schools

Data from the 2024 Commonfund Benchmarks Study of Independent Schools (CSIS) show that schools across the size spectrum reported an increase in use of an outsourced chief investment officer (OCIO)...

In Pursuit of Intergenerational Equity: Inflation is the Big Headwind

For all the differing goals and objectives laid out by colleges and universities for their endowments, one that is universally shared is intergenerational equity, or the concept that endowed...

A Closer Look at Religious Independent Schools

Earlier this year, Commonfund Institute released the 20th annual Commonfund Benchmarks Study of Independent Schools (“CSIS” or the “Study”), reporting on key investment governance trends and insights...

Four Challenges Impacting Nonprofits Today

Commonfund OCIO President and CEO, Tim Yates, sat down with panelists, Janine Anthony Bowen, Trustee of Georgia State University Foundation and Partner at BakerHostetler, Dr. Alison Morrison-Shetlar,...

Reflections on the NACUBO-Commonfund Study of Endowments 2024

Mid-February can be a challenging time of year. For sports fans, the lull between the end of the football season and the beginning of baseball season can feel like an eternity. For many, February...

The Seismic Shifts Impacting Nonprofits Today

Commonfund recently hosted its 27th annual Commonfund Forum, March 9th-11th, in Orlando, Florida. This Forum Spotlight explores the financial and operational implications of these major shifts,...

Institutional Investors Split on U.S. Economic Outlook, Commonfund’s Annual Market Sentiment Survey Finds

Sixty eight percent of institutional investors surveyed (representing over $800 billion in total assets) expect the S&P 500 Index to have lower or negative returns in 2025, compared to the 10-year...

Independent Schools Increasingly Depend on Endowments for Operations

Amidst concerns about student enrollment, fundraising, inflation, market volatility, and more, independent schools are relying more on their endowments to cover any gaps. Data from the 2024...

Key Takeaways from Forum 2025

Commonfund Forum 2025, held in Orlando, brought together registrants from some 370 institutions with more than $800 billion in endowed assets representing 42 states and five foreign countries in a...

Forum 2025 Key Statistics [Infographic]

Commonfund recently hosted its 27th annual Commonfund Forum, March 9th-11th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

Top Concerns in Higher Education

In the 2024 NACUBO-Commonfund Study of Endowments, a new area of inquiry was asked to participating institutions to identify their top two concerns from an inclusive list of 20 alternatives from...

Study of Independent Schools - Key Highlights [Infographic] 2024

For fiscal year 2024, independent schools reported an average return (net of fees) on their endowment assets of 12.3 percent. In this infographic, we report the key highlights from the 2024...

A Closer Look at Historically Black Colleges and Universities

Earlier this year, in partnership with the National Association of College and University Business Officers (NACUBO), Commonfund released the 2024 NACUBO-Commonfund Study of Endowments (NCSE). The...

Study of Endowments - Key Highlights [Infographic] 2024

For fiscal year 2024, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 11.2 percent. In this infographic, we report the key highlights from the...

Commonfund Study of Independent Schools Released for FY2024

Back-to-Back Positive Years: Independent Schools Report 12.3% Return on Endowment Assets for FY2024; 10-Year average returns hold steady at 6.7% Returns Positive; New Gifts to Endowments Fell, Use of...

2025 Policy Outlook: What Endowments and Foundations Should Know

On January 30th, Commonfund Institute, in partnership with the National Association of College and University Business Officers (NACUBO), the Council on Foundations (COF), and the Council for...

2025 Policy Outlook: What Endowments and Foundations Should Know

Looking back at 2024, uncertainty was the name of the game: inflation, interest rates, market volatility, emerging technology, recession potential, and geopolitical risks all played a role. As we...

Winter Wonders: Warming Reads for the Season

Commonfund Institute is excited to share our annual winter reading list, curated by our colleagues. These selections explore themes of personal transformation, resilience, and identity with stories...

Celebrating Native American Heritage Month: A Resource Guide

Commonfund, in conjunction with our Native American Heritage Month subcommittee, has created a resource guide to help all of us celebrate the contributions of Native Americans and Indigenous people...

Viewpoint | Top Concerns for Community Foundations: Donor-Advised Fund Regulations

Potential regulations on donor-advised funds (DAFs) and their effect on the philanthropic sector was the most-cited concern among community foundations in this year’s Council on...

Council on Foundations-Commonfund Study of Foundations 2023 Results

In a recent webinar, Commonfund Institute and the Council on Foundations reviewed the highlights from the Council on Foundations-Commonfund Study of Foundations 2023 Results.

How Nonprofits Eliminate the Noise to Strategically Achieve Long-Term Success

Commonfund has been partnering with boards and investment committees to design and implement investment structures that support and maintain intergenerational equity, the purchasing power of their...

Celebrating Hispanic Heritage Month: A Resource Guide

National Hispanic Heritage Month (Spanish: Mes Nacional de la Herencia Hispana) is an annual celebration commemorating the history, contributions, and culture of U.S. Latino and Hispanic communities.

Foundations' Endowed Portfolios Produced Higher Returns in 2023

One-year returns recovered, OCIO use increased, gifts and responsible investing moderated Wilton, Conn. (September 4, 2024) — In the improved market environment of 2023, average annual returns on...

Commonfund Convenes: Foundations that Support Higher Education

Last month, Commonfund OCIO hosted an inaugural convening of institutionally-related foundations (IRFs) - foundations that are a separate entity and serve as administrative and often fundraising...

Investment Stewardship Academy 2024: Lifetime Learning for Nonprofit Leaders

Commonfund Institute’s Investment Stewardship Academy (“ISA”), an intensive workshop for institutional investors and leaders that has been convening since 1993, came together on Yale’s campus in New...

Fiscal Year-End and Mid-Year 2024 Market and Investment Review

Over the last 12 months, the global stock markets demonstrated remarkable resilience and growth despite several challenges, including persistently high interest rates, geopolitical instability, and...

Policy Areas Impacting Endowments and Foundations Today

Commonfund Institute aims to lift up and provide insight into how significant policy developments may impact nonprofit institutional investors. In the prior article, we covered implications of the...

Discover Your Next Summer Read!

Summer 2024 is finally here, and Commonfund has curated a list of illuminating books to make your sunny days even brighter! Perfect for beach days or cozy retreats, these selections celebrate the...

Celebrating Pride Month: A Resource Guide

Pride month is the promotion of the self-affirmation, dignity, equality and increased visibility of lesbian, gay, bisexual, transgender, intersex and asexual people (LGBTQIA+) as a social group....

A Closer Look at Historically Black Colleges and Universities

Earlier this year, in partnership with the National Association of College and University Business Officers (NACUBO), Commonfund released the 2023 NACUBO-Commonfund Study of Endowments (NCSE),...

Celebrating Asian American and Pacific Islander Heritage Month

Asian American and Pacific Islander Heritage Month got its start as a congressional bill, inspired by Black History Month and Hispanic Heritage Month, with the mission of bringing attention to the...

A Closer Look at Community Colleges

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2023 NACUBO-Commonfund Study of Endowments (NCSE),...

The Role of the Endowment in Transforming Trinity College

Commonfund hosted its annual Commonfund Forum, March 10-12th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. In this Forum Spotlight,...

Key Takeaways from the 2024 CASE Conference for College & University Foundations

Commonfund Institute provides analysis and thought leadership across the non-profit institutional investing space. But investments don’t happen in a vacuum – they are part of the institutional...

A Closer Look at Religious Independent K-12 Schools

Earlier this year, Commonfund Institute released the 2023 Commonfund Benchmarks Study® of Independent Schools (CSIS), reporting on key investment governance trends and insights over the July 1, 2022...

Tour de World: Global Equity Investing Now

Better valuations. Innovation hotspots. Opportunities to add value. Geopolitical tensions. Debt burdens. Trade imbalances. Equity investing outside the U.S. holds its attractions—and risks. A report...

Insights from CF Private Equity Roadshow: Real Assets & Sustainability

Over the last few months, the CF Private Equity RAS team members Ethan Levine, Head of Real Assets and Sustainability and Dan Connell, Managing Director hosted two roundtable lunch discussions with...

CIO Roundtable

Commonfund hosted its annual Commonfund Forum, March 10-12th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Topline Findings from the FY2023 CSIS

Commonfund Institute's Director, Allison Kaspriske and Amanda Novello, Senior Policy and Research Analyst joined Elizabeth Dabney, Senior Director of Research and Data Analysis at NBOA for an...

Will AI Save the World or Ruin It?

Commonfund hosted its annual Commonfund Forum, March 10-12th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Viewpoint | Top Concerns for Independent Schools

For the first time since the inception of the Study, the FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) report asked respondents to identify the top concerns for their...

Commonfund Survey Finds Investors Remain Optimistic in 2024

Institutional Investors Remain Optimistic in 2024 Despite Macroeconomic Headwinds, Commonfund’s Annual Market Sentiment Survey Finds Seventy seven percent of institutional investors surveyed...

Viewpoint | The Main Purpose of Independent School Endowments

The FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) prompted survey respondents to select the main purpose of their school’s endowment for the first time.

Commonfund Forum 2024: 5 Key Takeaways

Commonfund Forum 2024 brought together 500+ attendees representing institutions with $890 billion in endowed assets in a 2.5-day conference. The event, themed “With Intention”, featured a...

Study of Independent Schools - Key Highlights [Infographic] 2023

For fiscal year 2023, independent schools reported an average return (net of fees) on their endowment assets of 9.2 percent. In this infographic, we report the key highlights from the 2023 Commonfund...

Study of Endowments - Key Highlights [Infographic] 2023

For fiscal year 2023, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 7.7 percent. In this infographic, we report the key highlights from the...

Commonfund Study of Independent Schools Released for FY2023

Independent Schools Report 9.2% Return on Endowment Assets for FY2023, Marking Reversal from Last Year’s -11.3% Loss Returns Rebound; New Gifts to Endowments Fall, Responsible Investing Tempers...

FY23 NACUBO-Commonfund Study Released

U.S. Higher Education Endowments Report 7.7% Return for FY23 While Spending More in Support of Their Missions 50th anniversary NACUBO-Commonfund Study shows participating colleges and universities...

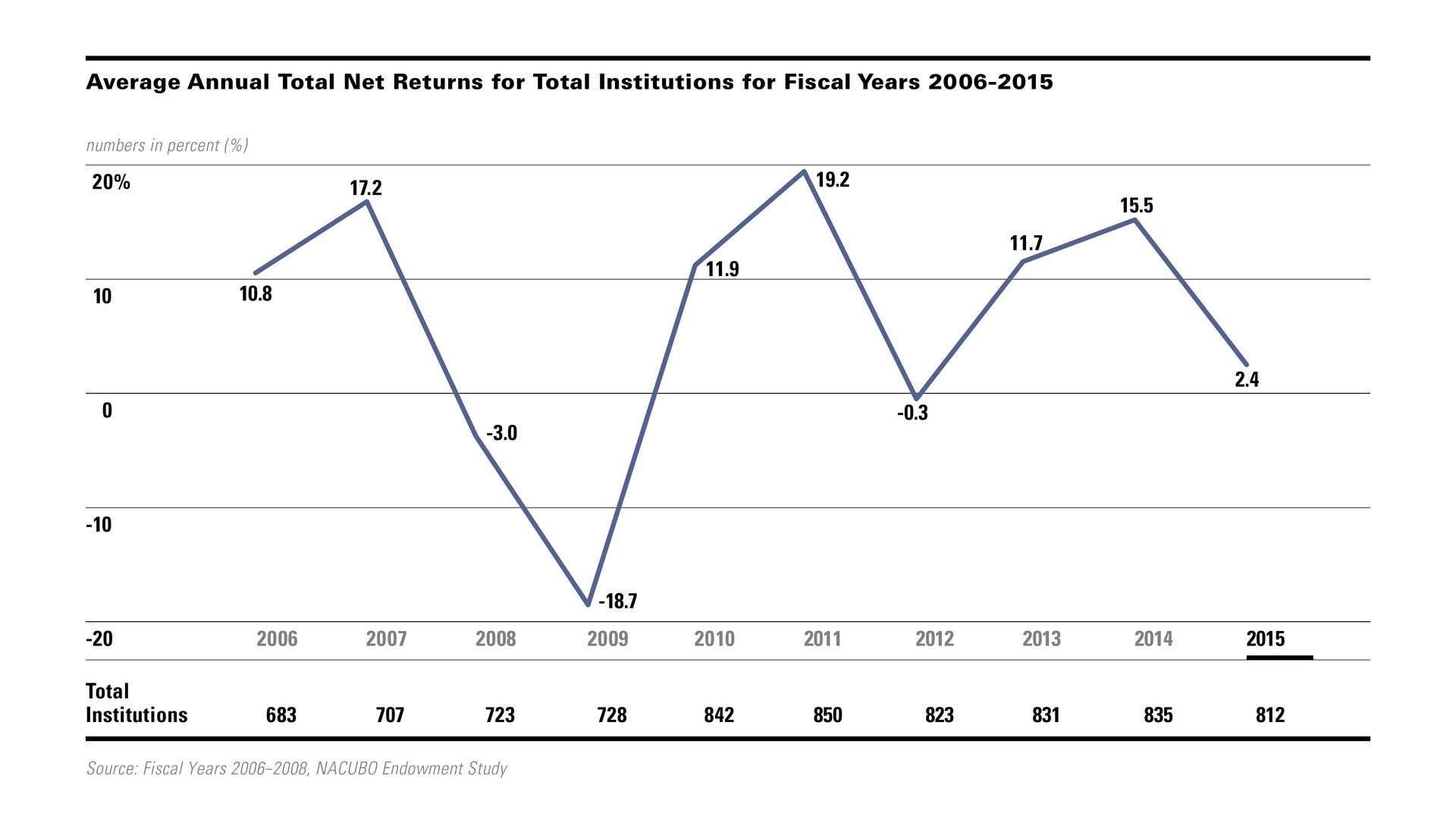

The NACUBO Endowment Study: A 50-Year Retrospective

Documenting a Period of Unprecedented Change The NACUBO-Commonfund Study of Endowments (NCSE) for fiscal year 2023 marks the 50th consecutive year that NACUBO has published a Study of the endowments...

Celebrating Black History Month: A Resource Guide

Black History Month is an annual celebration of achievements by African Americans and a time for recognizing their central role in U.S. history. Also known as African American History Month, the...

A Winter Wonderland of Books to Warm Your Soul and Inspire Creativity!

Commonfund Institute is excited to share our staff-curated reading list this winter, filled with stories that warm the heart and spark imagination. We extend our warmest wishes for a season filled...

Viewpoint | Analyzing Community Foundation Data by Region

For the 2022 Council on Foundations - Commonfund Study of Foundations, we provided an analysis of community foundation data by five geographic regions. Community foundations lend themselves to this...

Commonfund on the Road: Insights from our Portland Roundtable

For over 50 years, Commonfund has been working with boards and committee members on designing and implementing an investment structure that supports maintaining intergenerational equity or the...

Foundation Leaders Highlight Successful Long-Term Investment Strategies during Turbulent Times

On September 27, 2023, Commonfund Institute hosted a webinar, “Highlights of the 2022 CCSF: A Deep Dive with Foundation Leaders.” The panel featured Elizabeth McGeveran, Director of Investments at...

Bright Spots for Foundations in 2022 and Early 2023

In a period where individual giving was down, historic levels of inflation put pressure on markets and the real economy, private and community foundations were asked to provide more resources to...

Study of Foundations - Key Highlights [Infographic] 2022

In this infographic, we report the key highlights from the 2022 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2022, participating foundations reported an...

Observations from the 2023 NACUBO Annual Meeting

Last month, I had the pleasure of attending the NACUBO Annual Meeting in Orlando, FL, where nearly 2,000 representatives from higher education institutions across North America came together to share...

Affirmative Action: Implications for Endowments, Foundations, and the Broader Industry

Affirmative action, a practice used since the 1960s to edge toward equity and address historical and ongoing injustice through higher education attainment, was struck down last month by the Supreme...

The Value of Collective Learning: Takeaways from the Commonfund Institute 2023 Investment Stewardship Academy

In June 2023, the Commonfund Institute hosted 36 nonprofit leaders on the campus of Yale University for our premier educational event – the Investment Stewardship Academy (ISA). Much has changed...

Commonfund on the Road: Insights from our Seattle Roundtable

Commonfund OCIO recently hosted a roundtable luncheon in Seattle, WA, for local nonprofit leaders. During our time together, we discussed how institutions can attain intergenerational equity in their...

Fiscal Year-End and Mid-Year 2023 Market and Investment Review

The end of fiscal year 2023, and mid-point of the calendar year, marks the end of the pandemic years. At this point, many have returned to the workplace, at least part time, in-person meetings have...

Soak Up Some Sun with One of Our Favorite Books!

Commonfund Institute is excited to share our must-reads for summer 2023. These books are the perfect partner for some fun in the sun, or some time relaxing in the shade. We hope you have a great...

The Investment Stewardship Academy Returns to Yale This June

The Investment Stewardship Academy, Commonfund Institute’s three-day intensive academic program is set to resume in-person June 20-23 for the first time since 2019.

Celebrate! 25 Years of NBOA: The Endowment Landscape

A deep dive into independent school endowment's trends FY2005-FY2022, including analysis of asset allocation, performance, spending and contributions, plus a perspective on future developments....

Taking a Regional Perspective

The Commonfund Benchmarks Study® of Independent Schools (CSIS) report provides and analysis of the investment and governance policies and practices of U.S. independent day and boarding schools. For...

Study of Independent Schools - Key Highlights [Infographic] 2022

For fiscal year 2022, independent schools reported an average return (net of fees) on their endowment assets of -11.3 percent. In this infographic, we report the key highlights from the 2022...

NACUBO and Commonfund Partner on Higher Education Endowment Research

Partnership to produce 50th annual Study of Endowments WILTON, CT, and WASHINGTON, DC, March 13, 2023 – Commonfund and the National Association of College and University Business Officers (NACUBO)...

Celebrating Women's History Month

Women's History Month 2023 | Celebrating Women Who Tell Our Stories Women’s History Month is an annual declared month that highlights the contributions of women to events in history and contemporary...

Commonfund Survey Finds Investors are Optimistic in 2023

Institutional investors representing $849 billion in total assets attended this year’s Commonfund Forum. Survey respondents cite ongoing interest rate hikes and geopolitical tensions as top economic...

Forum 2023 Key Statistics [Infographic]

Commonfund recently hosted its 25th annual Commonfund Forum, February 13-15th, in Boca Raton, Florida. The event brought together institutional investors to engage in a three-day conference to...

Commonfund Forum 2023: 5 Key Takeaways

Commonfund recently hosted its 25th annual Commonfund Forum in Boca Raton, Florida. The event, themed “Still We Rise”, brought together 500+ attendees representing institutions with almost $850...

Commonfund Renames Its Two Core Businesses

The move will bring added clarity to an expanding range of offerings JANUARY 3, 2023, Wilton, CT - Commonfund is introducing new names for its two core businesses that will enhance clarity while...

Community Foundations - Challenges & Opportunities - Commonfund Coffee Talk

Community Foundations - Challenges & Opportunities

Impact and Values-Aligned Investing - Commonfund Coffee Talk

IMpact and Values-aligned investing The second session in our Commonfund Coffee Talk series focuses on the opportunities that foundations have in the impact and values-aligned investing spaces....

The State of Private and Community Foundations - Commonfund Coffee Talk

The State of Private and Community Foundations Our 2022 Commonfund Coffee Talk series kicked off with a focus on the challenges facing private and community foundations, what they are doing to...

Get Cozy This Winter with One of Our Favorite Books!

Commonfund Institute is excited to share our most recent picks for our annual winter reading list, gathered from our Commonfund colleagues. We send you our warmest wishes for the holidays and can’t...

Investment Objectives? Not Always.

The 2021 Council on Foundations—Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) marked our tenth year in collaboration with the Council on Foundations. The...

Seven Promising Practices for the Future of Higher Education

Even before the pandemic, the college/university business model was under scrutiny. With rising tuition costs outpacing living wages, and student debt burdens crippling students, institutions of...

2021 Council on Foundations-Commonfund Study of Foundations Released

Security of Foundations’ Missions Strengthened by Good Investment Returns in 2021, National Study Reports

21st CASE Commonfund College and University Foundation Award

Since 2001, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

In Remembrance: Laurance (Laurie) R. Hoagland, Jr.

The Commonfund community was saddened to learn of the recent passing of Laurie Hoagland. Laurie served as a member of the Commonfund Board from 2000-2012 and was Board Chair from 2010-2012.

The Great Reset: The Emerging Age of Re-imagination, Reconnection and Renewal – and Generation RE

A great reset is now upon us. Less obvious is the reality that the world was quietly being reset prior to the pandemic. The rules of business were being rewritten by an extraordinary cadre of...

10 Key Takeaways from Commonfund Forum 2022

Commonfund recently hosted its 24th annual Commonfund Forum in Orlando, Florida. The event brought together 200+ institutional investors from the U.S., the Virgin Islands, and Canada in a 2.5 day...

Viewpoint: The Move in Marketable Alternative Strategies

In the 2021 Commonfund Benchmarks Study® of Independent schools we continue to see the allocation to marketable alternative strategies decline, raising questions about why and whether it will...

Forum 2022 Key Statistics [Infographic]

Commonfund recently hosted its 24th annual Commonfund Forum, March 16-18th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

Viewpoint: The Short and Long of It

There’s a lot to consider in each annual Commonfund Benchmarks Study® of Independent Schools, e.g., asset allocation, spending, gifts and donations, responsible investing and more. This year is no...

Commonfund Perspective on the Russian Invasion of Ukraine

Key Takeaways As widely anticipated, Russia invaded Ukraine on Thursday, February 24th, causing volatility to spike across the capital markets globally. By the closing bell in the U.S., however,...

Celebrating and Honoring Rev. Dr. Martin Luther King Jr.

On January 17, 2022, the nation will celebrate the legacy and leadership of Rev. Dr. Martin Luther King Jr. Dr. King—a graduate of Morehouse College—was a Baptist minister, a peace seeking civil...

Commonfund Asset Management Announces Organization Changes

As a leading Outsourced CIO firm serving nonprofit organizations, we consistently re-evaluate our organization and processes looking for opportunities to improve how we work and serve our clients. To...

In Remembrance: Verne O. Sedlacek

A Gentle Giant The Commonfund community was shocked and saddened this week by the news of the sudden passing of our former President and CEO, Verne Sedlacek at the age of 67.

Ten Tips for Successful Meetings

On November 9, 2021, Commonfund Institute held its first virtual Investment Stewardship Academy session since the program began nearly 30 years ago. The course focused on committee decision-making...

The Price of Liquidity - Commonfund Coffee Talk

The Price of Liquidity for Perpetual Investors Our third and final Coffee Talk focused on the most important and impactful decision endowments and foundations can make within their strategic asset...

Asset Allocation and Risk - Commonfund Coffee Talk

ASSET ALLOCATION AND RISK | LOOKING BEYOND VOLATILITY Our second Coffee Talk focused on asset allocation and risk, and the key factors and inputs that maximize the likelihood of achieving...

Good Governance in a Crisis - Commonfund Coffee Talk

Good Governance as the Guardrails in a Crisis | What Does It Look Like for Nonprofits? Our first Coffee Talk webinar focused on good governance practices as key to surviving a crisis and thriving in...

Viewpoint | The Climate for Responsible Investing is Changing

Climate change is a source of concern around the world—from environmental scientists to government policymakers to ordinary citizens. In a more figurative sense, the climate for responsible investing...

Viewpoint | Diverse Managers

The inclusion of diverse managers in institutional portfolios offers access to a broader array of investment talent. Data indicate that foundations are beginning to recognize and act on this...

The Women’s Foundation of Minnesota: A Pioneer for 38 Years and Counting

If a pioneer is the first to open new ways of thought and action, the Women’s Foundation of Minnesota (WFMN) fits the definition perfectly. Founded in 1983, WFMN became the first statewide women’s...

Commonfund Celebrates 50 Years of Service

On July 1st, 1971, The Common Fund for Nonprofit Organizations commenced operations with a $2.8 million grant from the Ford Foundation under the leadership of President George Keane and the Board of...

Endowment Management and the Three Primary Responsibilities of a Board

The fourth blog in the “Six Ps of Investment Stewardship” series addresses People, specifically how boards function within an organization. To learn more about the first four principles in the series...

How to Invest in Diverse Managers

A U.S. capitalist system where approximately one percent of all capital is managed by women and people of color, who make up 70 percent of the population, perpetuates and increases inequality and...

In Memoriam: George F. Keane

George F. Keane, 91, of 7408 Eaton Court, Sarasota, FL, founder of The Common Fund, and noted philanthropic investment strategist, passed away Thursday, May 20, 2021, peacefully in the Spring Meadows...

CASE Commonfund College and University Foundation Award 20th Anniversary

For the past 20 years, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

The CASE Commonfund College and University Foundation Award | Twenty Years of Celebrating Leadership

CASE Online Conference | General Session | March 30-31, 2021 Commonfund Institute Executive Director, George Suttles, joined past CASE Commonfund award recipients in a discussion celebrating twenty...

Commonfund Award Presentation and Leadership Discussion

Commonfund has been a partner and supporter of CASE for the past several decades. Our aligned missions of serving educational institutions and enhancing resources for ongoing financial success are...

Commonfund Trustee, Dr. David A. Thomas, Wins 62nd Annual HBR McKinsey Award

Commonfund's Trustee, Dr. David A. Thomas, wins the 62nd Annual HBR McKinsey Award, for co-authoring the article titled "Getting Serious About Diversity: Enough Already with the Business Case." The...

How Your Organization Can Nurture Innovation While Balancing Risk

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Fareed Zakaria Dissects the Challenges Shaping the Post-Pandemic World

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Spending at Independent Schools Impacted by COVID-19

The effects of COVID-19 have been felt across the entire nonprofit sector and the independent schools’ community is no different. For the Commonfund Benchmarks Study® of Independent Schools (CSIS)...

Managing Financial Challenges During Crisis – A Checklist for Higher Education

Many educational institutions are facing unpredictable financial challenges as a result of the COVID-19 pandemic. Costs associated with implementing technologies for virtual learning, decreased...

A Fireside Chat with Darren Walker | From Generosity to Justice

Forum 2021 keynote speaker and Ford Foundation President, Darren Walker, shares his bold vision for the future of philanthropy. Since his arrival in 2013, Mr. Walker has transformed the venerable...

Infinite Challenges, Endless Opportunities, Finite Resources

Board members, trustees and others that have oversight of endowed portfolios have well-documented fiduciary duties that govern how they carry out those responsibilities. In times of relative calm,...

Promoting Gender Equity in Leadership Roles

Dr. Kellie A. McElhaney is on faculty as a Distinguished Teaching Fellow and the Founding Director of the Center for Equity, Gender and Inclusion (EGAL) at the Haas School of Business at the...

Viewpoint | Why are Gifts to Endowments Declining?

For the third straight year, Commonfund Benchmarks Study® of Independent Schools (CSIS) participants reported average new gifts to endowment declined, this year falling to an average of $1.2 million...

From Generosity to Justice | Observations from the President of Ford Foundation

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Viewpoint | The Ever-Evolving 80/20

On average over the past decade, independent schools participating in the Commonfund Benchmarks Study® of Independent Schools have maintained an asset allocation that stays within a few percentage...

Exploring Foundations’ Response to COVID-19

Earlier in February at the 2021 Yale Philanthropy Conference, our own George Suttles, Executive Director of Commonfund Institute hosted a panel which included Tim Yates, President and CEO of...

2021 Private Markets Investor Sentiment Survey

Institutional investors continue to increase allocations to private strategies. Commonfund Capital’s fourth annual private markets investor sentiment survey shows trends continue despite the pandemic...

Board of Trustees and Investment Committee Roles and Responsibilities

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship”– Purpose, Policy, Process, Portfolio, People and...

Investment Governance | Are You Asking These Three Questions?

In the midst of a global pandemic, many non-profit business models are being challenged which has put significant pressures on staff, governing boards and committees. These pressures on time and...

Foundation Spending Strategy – Meeting the Moment in 2020 and Beyond

This year has been incredibly difficult. One of the most contentious and turbulent presidential elections and transitions in American History. COVID-19 and the consequential social and economic...

Implications of Increased Spending for Foundations

In this Commonfund Xchange, Commonfund Institute Executive Director, George Suttles, moderated a discussion with two leading practitioners: Mary Reynolds Babcock Foundation Chief Finance and...

How to Measure Private Equity Investments

Private capital investors use a particular set of quantitative and qualitative measures to assess performance. While the standard benchmarks used for marketable securities are sometimes applied to...

Top Ten Tips for Better OCIO RFPs

A tightly run RFP process can help ensure your organization will find an ideal investment partner to help you fulfill your organization’s mission. As the second installment of our blog series on the...

Top Hedge Fund Investors - Ten Years Later

In July 2010, I published the book Top Hedge Fund Investors: Stories, Strategies, and Advice. My co-author and I interviewed nine leading allocators to hedge funds, including one Mark Anson, who...

Balancing Purpose, Payout, and Permanence: A Strategy Guide for Foundations

In partnership with the Council on Foundations, the National Center for Family Philanthropy has released Balancing Purpose, Payout, and Permanence: A Strategy Guide. Commonfund Institute is very...

Chart of the Month | Inflation Expectations Surge, Driving Real Interest Rates Down

Chairman Powell’s speech at Jackson Hole during the last week of August confirmed the Fed’s dovish policy stance, giving investors ample support in terms of low rates and a flexible inflation...

Resource Management for College and Universities

William Massy has spent his entire career at the intersection of academia and administration, as a microeconomist; professor, dean and CFO at Stanford University; author; and now, an independent...

Increasing Giving During COVID-19: Thoughts for Philanthropy

The Council on Foundations has acted to support its members, their nonprofit partners, and the people and communities hit hardest by the impacts of COVID-19 by asking members to sign a pledge of...

Higher Ed in the Age of COVID-19

Commonfund convenes an expert panel to take on the short- and intermediate-term threats that higher education confronts in the face of a national emergency the likes of which have not been seen for...

How Can Trustees Achieve Intergenerational Equity in the Face of Rising Costs?

The Commonfund Higher Education Price Index® (HEPI) is an inflation index for colleges and universities. It has been calculated since 1983 and includes inflation data going back to 1961. Commonfund...

Viewpoint | Responsible Investing Practices: Evolution, Not Resolution

In recent years, responsible investing has received mounting levels of attention from all quarters of the investment management field, from institutional investors large and small to global asset...

Optimize Luck

"Instead of just optimizing for skill, why don’t we optimize for luck? " Optimize Luck originated in a group discussion I facilitated for the Investment Institute, a membership organization for...

2020 Investor Survey: Private Markets Sentiment

For the third year in a row, Commonfund Capital conducted a year-end annual survey of institutional investors to gauge their sentiment about private market investments. Survey responses totaled 267...

Commonfund Forum Goes Global

During the week of October 14th, 2019 Commonfund Institute hosted our first Forum outside of the United States in Tokyo, Japan. We were honored to be joined by many leading Japanese institutional...

Viewpoint: Actions Speak Louder than Data

In this Council on Foundations-Commonfund Study of Foundations viewpoint, it's about analyzing and interpreting the data we've collected. What do they tell us? What trends are emerging? How are...

An Investor’s Private Equity Guide

Commonfund recently hosted a panel discussion focused on the current state of private equity and venture capital, with an emphasis on the investor’s perspective of the industry today. The three...

Dynamic Workforce = Dynamic Portfolios

The Surprising Outcomes When Diverse Groups and Homogeneous Groups Tackle the Same Problem In late 2018, Commonfund established a Diversity Office with the objective of benefiting from the strengths...

The Global Economy and the Return of Risk

How to think about tariffs, deficits, valuations, leverage, growth and other issues What signals should institutions be mindful of as they make portfolio decisions in the current environment? A panel...

Viewpoint: Looking Back, Moving Forward - A Decade of Insight from CSIS

Fiscal 2009 was an epochal year. In March, the stock market decline wrought by the financial crisis and Great Recession reached its nadir as investors sensed the worst had passed. With the turn in...

Commonfund Partner Spotlight | Widener University

President and CEO, Commonfund Asset Management, Tim Yates, interviews Dr. Julie Wollman, President of Widener University. In this wide-ranging discussion Dr. Wollman describes how Widener is...

Rust College

Rust College: Where tomorrow’s leaders are students today In the wake of the Civil War, Rust College was founded in 1866 to provide an education for newly-freed slaves. Located in Holly Springs,...

The Lincoln University

Founded in 1854, The Lincoln University is the nation's oldest degree-granting institutions for persons of African descent. Lincoln is committed to maintaining a nurturing and stimulating environment...

Flagler College

Energetic youth in ‘America’s oldest city’. St. Augustine is the oldest continuously occupied European-established settlement in the continental U.S., having been founded in 1565. Flagler College is...

They dig plants at the Botanical Research Institute of Texas

Hundreds of thousands of plant species are scattered all over the earth, but if the plant world had a headquarters it might be the Fort Worth, Texas home of the Botanical Research Institute of Texas...

University of the Virgin Islands

These Buccaneers pursue a different treasure. There was a time when pirates plied the waters of the Caribbean in the pursuit of gold and other treasure. The Buccaneers mascot of the University of the...

University Corporation for Atmospheric Research

The Sky's No Limit. It doesn't issue public weather forecasts, but it tracks weather around the globe. It isn't the national hurricane center, but it studies hurricanes as well as other extreme...

Western Washington University

Active minds changing lives. Right-sized, well balanced, with an extensive range of strong academic programs and some enlightening stats that speak to all of it: Western Washington University (WWU)...

Viewpoint: Being Objective

Every year, the NACUBO-Commonfund Study of Endowments® (NCSE) reports new data—on investment returns, asset allocation, risk management, donations and gifts, and much more. But some data points are...

Nonprofit Board Governance Best Practices

Since our founding in 1971, a core element of the Commonfund mission has been to provide insights on a broad range of governance, policy and investment challenges. An engaged governing board is...

What’s the Difference? Time-Weighted Return vs. Internal Rate of Return

Investors often ask about the difference between time-weighted return (“TWR”) and internal rate of return (“IRR”). In general, TWR is used by the investment industry to measure the performance of...

Northampton Community College Foundation

The dictionary defines a foundation as “an underlying base or support.” Of course, there’s another type of foundation, defined as “funds given for the support of an institution.” Northampton...

Hedge Fund Land: An Expensive Amusement Park?

In a series of articles, we have addressed two recent investment “fatigues” experienced by institutional investors: Active vs. Passive; and Global (ACWI) vs. US benchmarks. In this article, we tackle...

The Absent Superpower

In this Commonfund Forum 2017 Spotlight, geopolitical strategist and author Peter Zeihan examines how the hard rules of geography are eroding the American commitment to free trade; how much of the...

Viewpoint: Counting the Cost

How much does investment management cost? Fiduciaries, donors and stakeholders at endowed institutions have a strong interest in finding a good answer to this question, particularly in this era of...

No More Gatekeepers

In this Commonfund Forum Spotlight, founder of DonorsChoose.org Charles Best shares how as a 24-year-old teacher at a Bronx high school, he created a model of giving hailed as "the future of...

Monkeynomics

In this Commonfund Forum 2017 Spotlight, Dr. Laurie Santos demonstrates that primates have much to teach us about our own economic decision-making. Both monkeys and humans know a bargain when they...

Center for Natural Lands Management

These words—to protect, preserve and defend—come from the oath of office sworn by the President of the United States. At the Center for Natural Lands Management (CNLM), they refer to an unwritten but...

Viewpoint: A Firmer Foundation

How long is the long term? A year ago, private and community foundations appeared to many observers to have recovered from the losses suffered in the 2008–09 global financial crisis. Double-digit...

The William Penn Foundation

Fast Philly facts: The city is the site of the first library, hospital, medical school, stock exchange and zoo in the U.S. It’s the only World Heritage City in the U.S. William Penn founded the city...

The Big Picture: Integrating Investments, Finance and Development

Most things function a lot better when all the moving parts work together—nonprofit institutions included. The synergies afforded by collaboration across organizational boundaries may be the most...

The One World Schoolhouse: Education Reimagined

Sal Khan is the founder of the Khan Academy, a nonprofit with the mission of providing free, high-quality education to “anyone, anywhere” in the world. A former hedge fund analyst with degrees from...

Viewpoint: Seven Years On

How long is the long term? A year ago, endowments appeared to many observers to have recovered from the losses suffered in the 2008-09 global financial crisis. Double-digit investment returns had...

Impact Investing: Balancing the Best of Responsibility & Opportunity

Impact investing is showing growth around the world. According to the most recent J.P. Morgan/Global Impact Investing Network Impact Investor Survey, the number of institutional investors engaging in...

Viewpoint: Changing Our Minds

It is often said that we live in a world of change, but it is surprising how slowly that change can occur. Seven years after the onset of the Great Recession, many business school students are still...

Smart money, crowded trades?

For investors building multi-manager portfolios, a look at an alternative hedge fund beta. Approaches to stock selection vary widely across the hedge fund universe, even among managers practicing the...

Greenhouse Effect

Investment returns of less well-diversified portfolios have flourished in the accommodative market environment created by central banks. But what will happen when rates rise? In the last five years,...

Working capital: challenge and opportunity

On campus, the thinking about operating asset management is changing with the times. In the wake of the 2008 financial crisis and Great Recession, liquidity was the primary concern on university...

Viewpoint: A Different Kind of Climate Change

How have cultural, religious and social service institutions’ investment portfolios changed in response to the financial and market environment that has prevailed over the last several years? While...

How Liquid are Private Capital Investments?

In the wake of the Global Financial Crisis, institutional investors were rightfully concerned about the liquidity profiles of their long term portfolios. Although markets have recovered substantially...

ESG and Your Institution: Doing Well by Doing Good

Investing according to environmental, social and governance principles is maturing into a distinct discipline. Robust research results dispute the conventional wisdom about performance trade-offs. If...