The Commonfund Benchmarks Study® of Independent Schools (CSIS) report provides and analysis of the investment and governance policies and practices of U.S. independent day and boarding schools. For the first time, the FY2022 CSIS presented a regional breakout of data that has previously been collected and only reported at the national level. The differences among the geographies is not profound, but there are wrinkles that are worth noting.

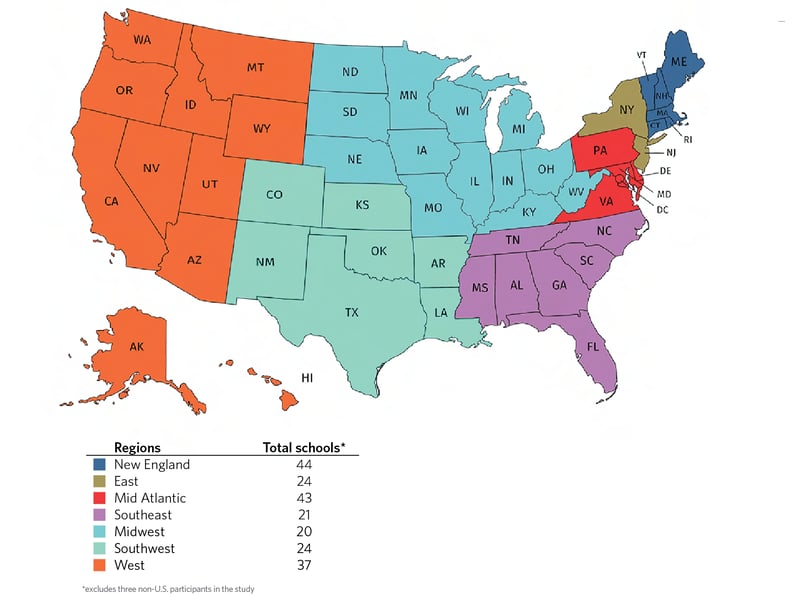

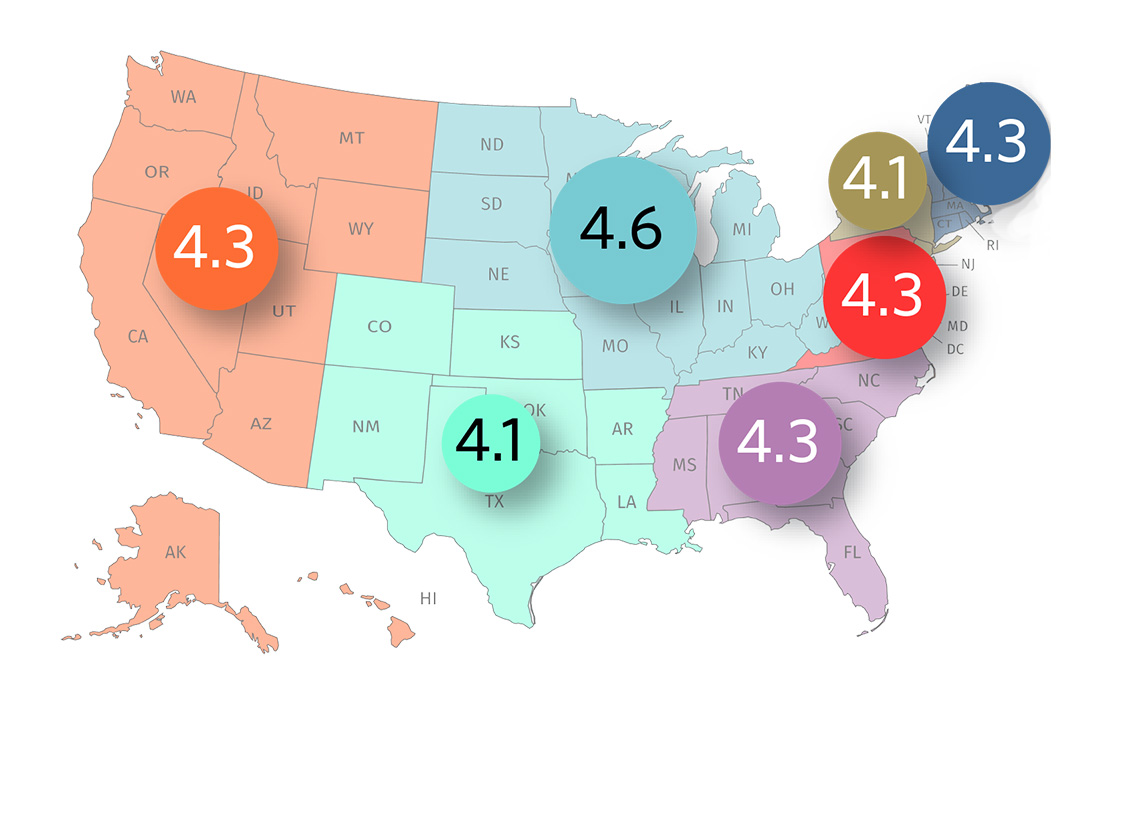

The National Association of Business Officers (NBOA) segments the nation into seven regions shown in the map below. For this analysis the data were segmented along the same lines and the focus was on selected topline findings: investment returns, asset allocation, policy spend rate, new gifts to endowment, and support for the operating budget from annual giving and from the endowment. Note: Total Schools for all tables included in the Regional Analysis section only includes those 213 schools that are based in the U.S. Two schools from Canada and one from Singapore are not included here.

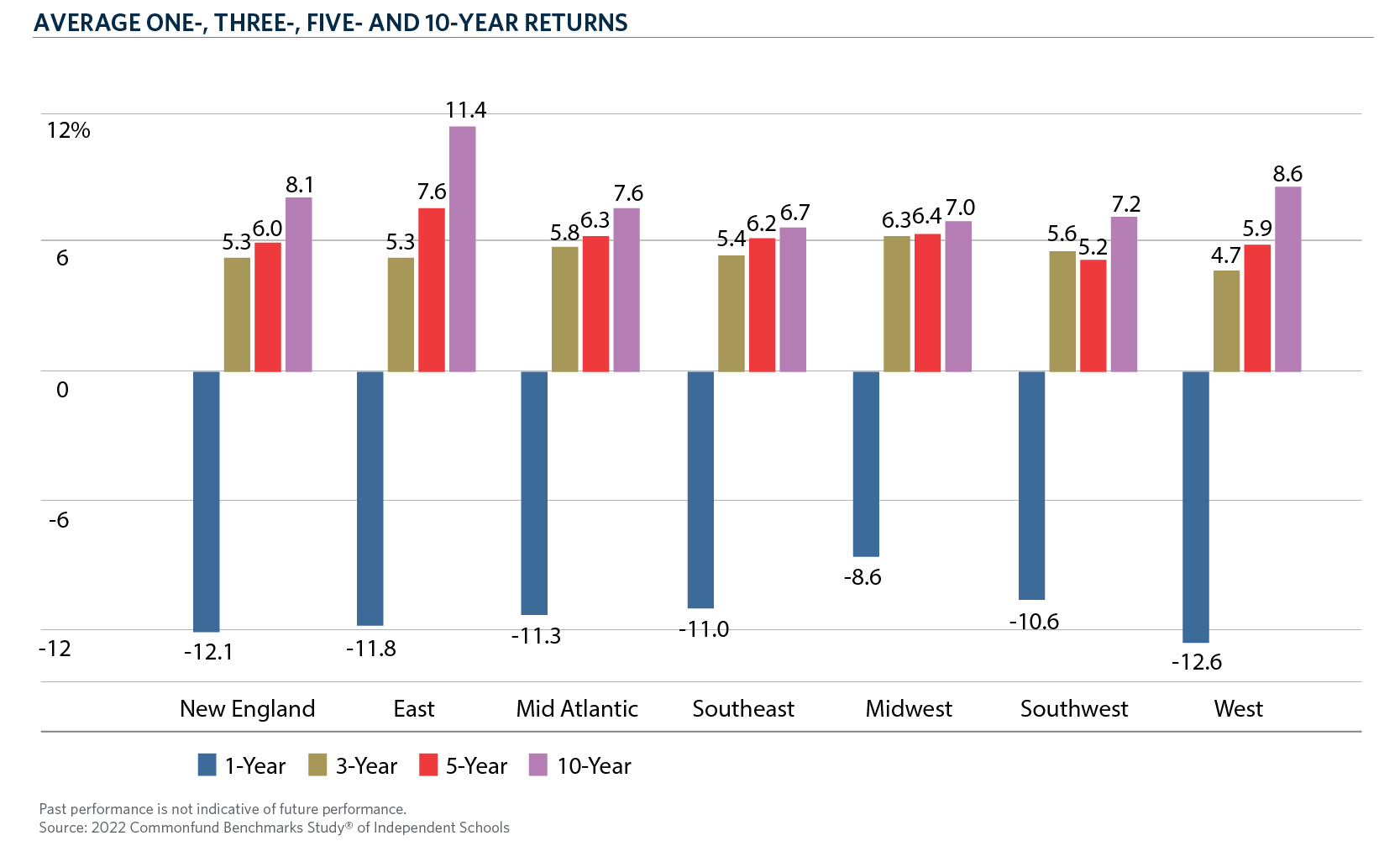

Investment Returns

On average, participating schools in every region reported negative returns in FY2022, but the Midwest fared the best on a relative basis with a return of -8.6 percent. All other returns were losses in the lower double digits. Long term, however, schools in the East region produced the best 10-year return at 11.4 percent, 280 basis points annually ahead of 8.6 percent in the West region.

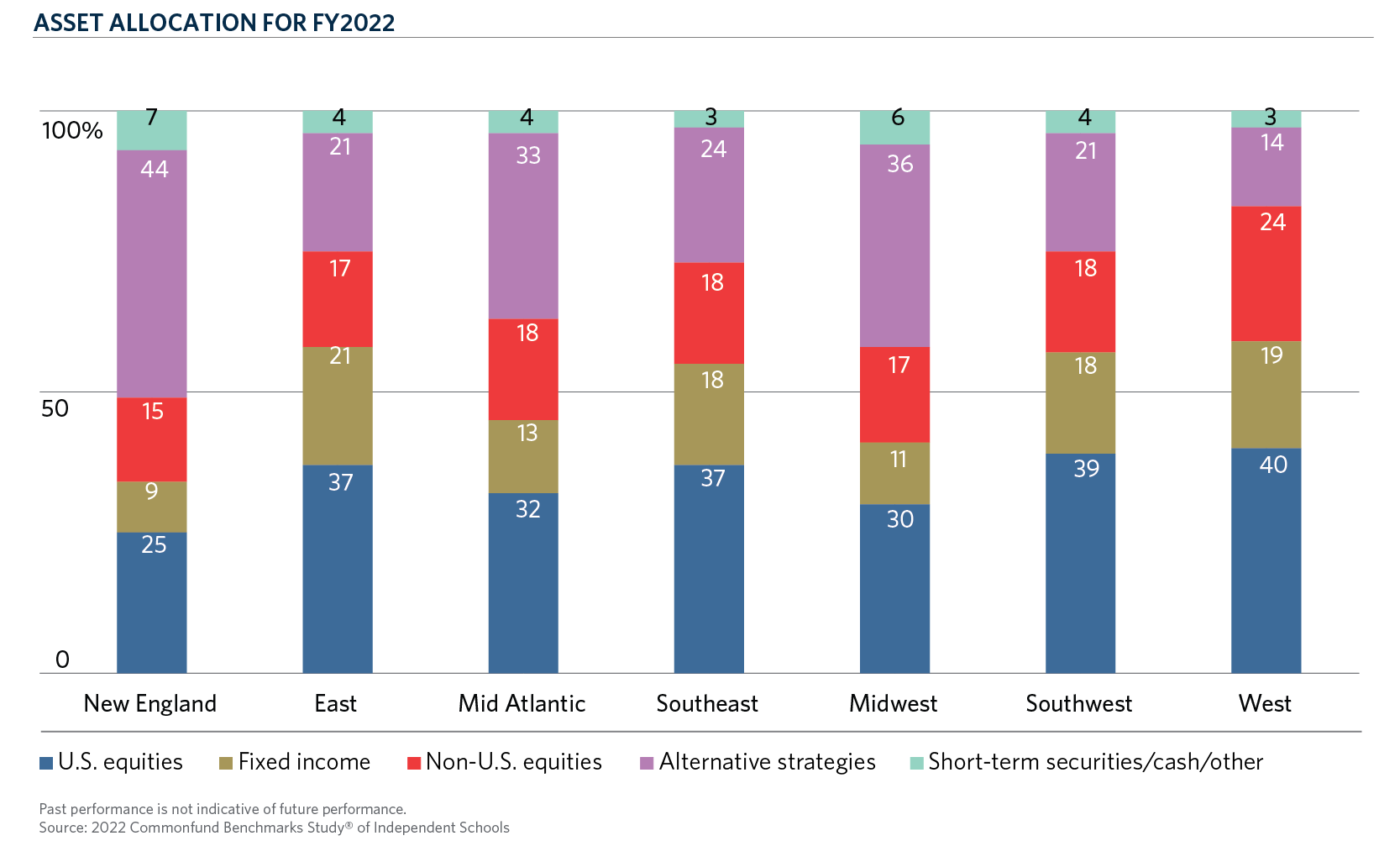

Asset Allocation

As is to be expected, there were some fairly wide variations across the five asset classes/strategies and seven regions. One of the most interesting was schools in the West region—home of Silicon Valley and other tech hot spots—reporting the lowest average allocation to alternative strategies, 14 percent. The highest was 44 percent in the New England region. The West did have the largest allocations to traditional equities, however—namely, U.S. and non-U.S. equities. Schools in the East had the largest fixed income allocation, 21 percent, while New England schools had the smallest, 9 percent.

Policy Spending Rate

In general, stated policy spending rates were fairly consistent across regions, the one standout being a higher 4.6 percent rate in the Midwest region. The Midwest region was also distinguished by having the lowest share of schools with a spending policy, 90 percent. The next-closest were 92 percent of schools in the West and 93 percent of schools in the Mid-Atlantic. Only the East region had 100 percent of participating institutions with a spending policy.

AVERAGE STATED POLICY SPENDING RATE FOR FY2022

Numbers in percent

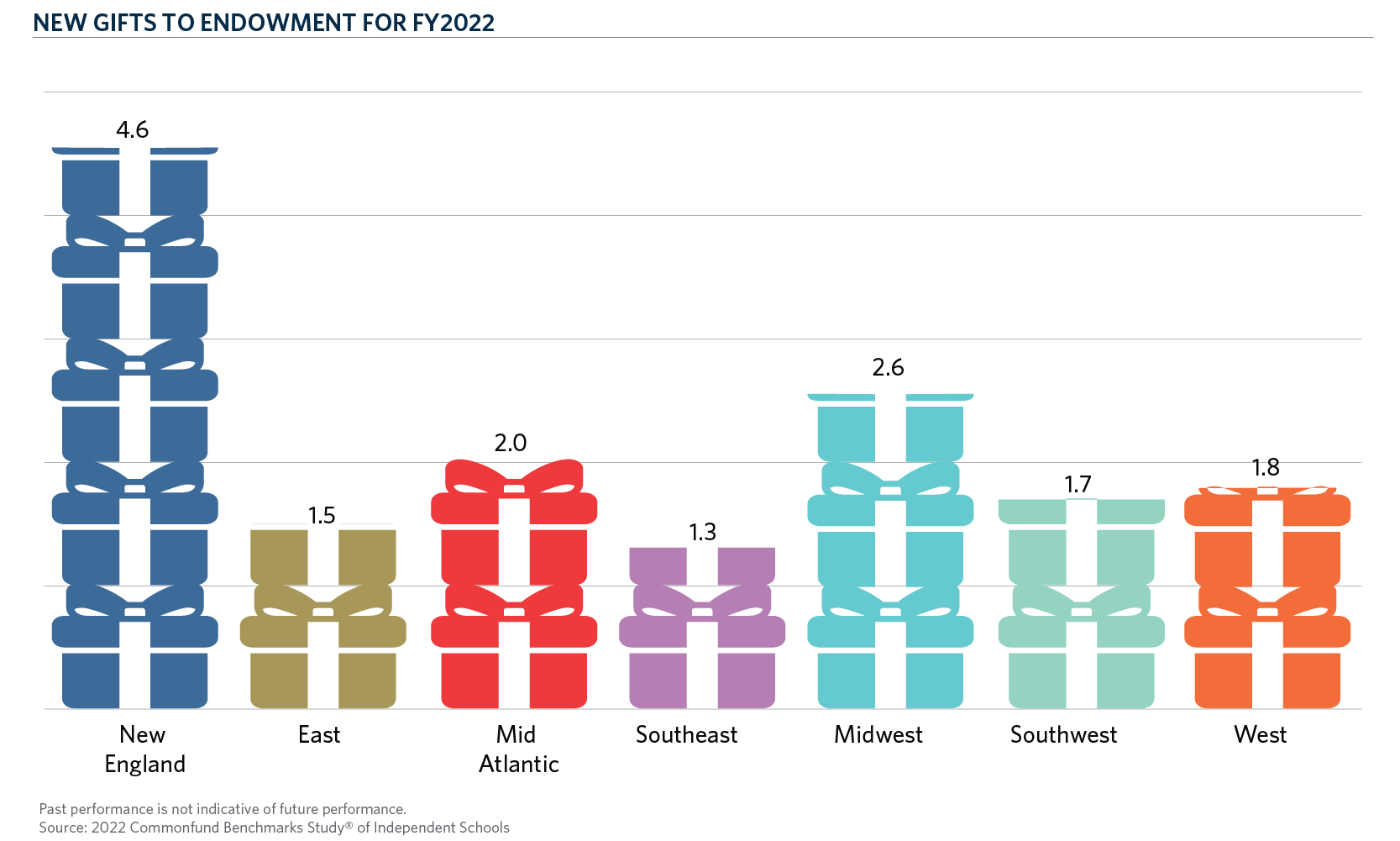

New Gifts to Endowment

The New England region stood out for having by far the highest average new gift to endowment, $4.6 million. The lowest were $1.3 million in the Southeast and $1.5 million in the East. After New England, the highest average new gift to endowment was $2.6 million in the Midwest.

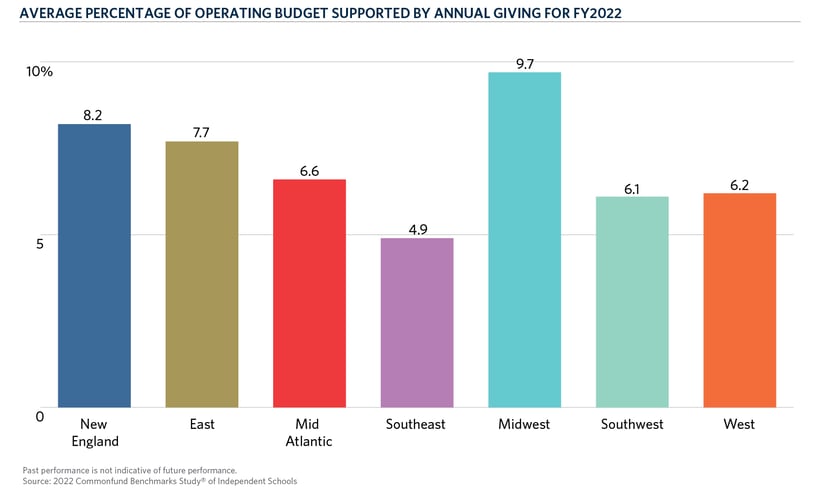

Operating Budget Support from Annual Giving

The Midwest reported the highest average and median percentages of the operating budget supported by annual giving, 9.7 percent and 7.6 percent, respectively. After that, the second highest was New England at 8.2 percent and 7.2 percent, respectively.

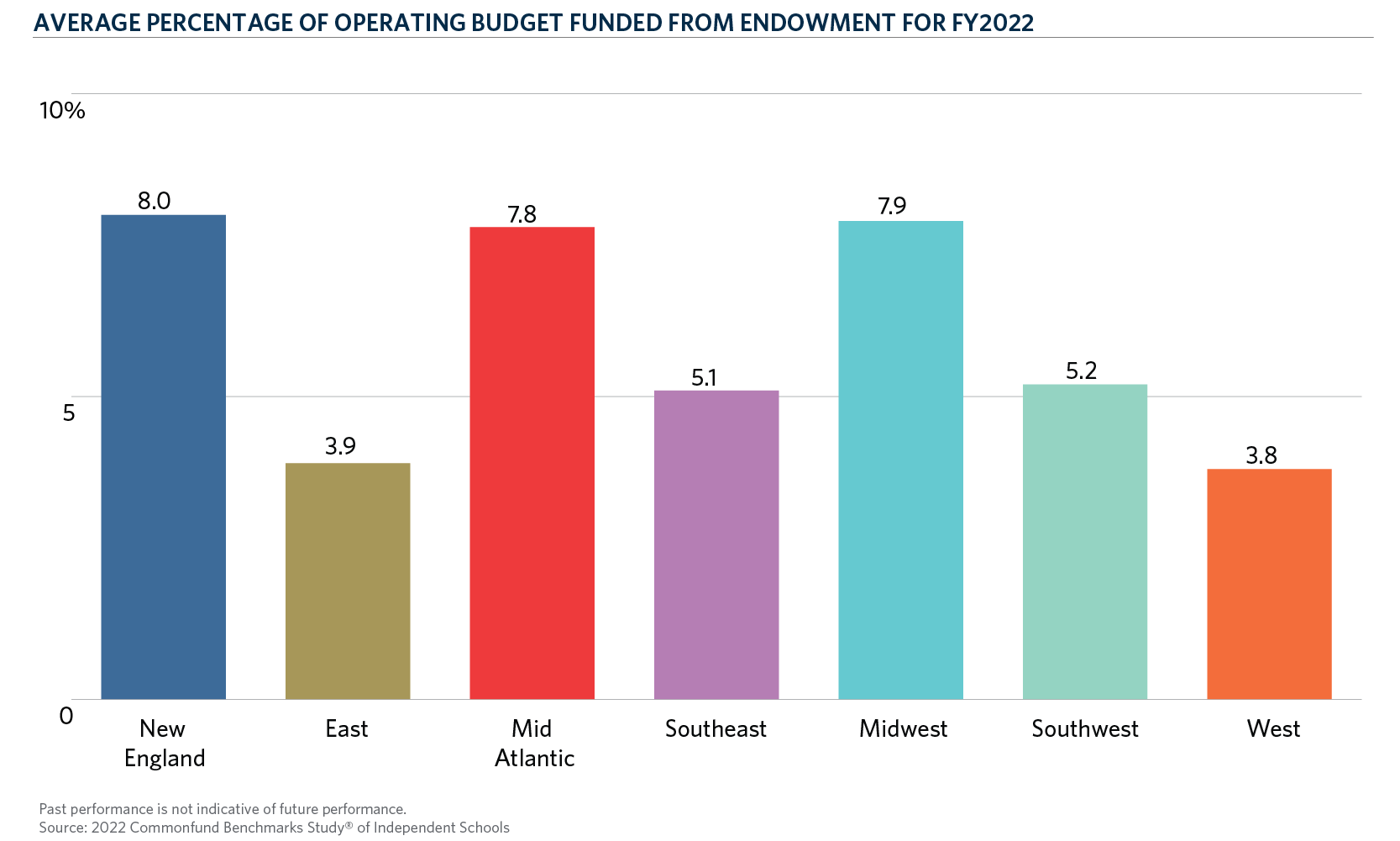

Operating Budget Funded from Endowment

Schools in three regions were close in the share of their operating budget funded by the endowment: 8.0 percent of the budget for schools in New England, 7.9 percent for schools in the Midwest and 7.8 percent for schools in the Mid-Atlantic. The lowest average share of the operating budget funded through endowment was 3.8 percent in the West.