Founded in 1971, Commonfund is an asset management firm dedicated to enhancing our clients’ financial resources through access, performance, and values.

$0

billion in assets under management

0

years of operation

0

institutional clients

0

employees

At Commonfund, our employees are our greatest asset. As a nonprofit organization, we work together to make a difference in the lives of our clients and the communities they serve. Since our founding in the 1970s, Commonfund has been a leader among institutional investors when it comes to integrating responsible practices into our firm.

Commonfund is cognizant of the challenges associated with sustainable investment, including data collection, consistency and measurement. Yet, we remain committed to supporting our clients' goals to align their investment activity to the mission of their organization.

From Commonfund’s earliest days a central element in its mission has been thought

leadership, promulgation of best practices and professional development. Commonfund commenced operations in 1971 funded by $2.8 million grant from the fort foundation. Of the total, $500,000 was set aside for a program of research and publishing.

At Commonfund, employees are our greatest asset. We strive to attract talent from the broadest pool to foster innovative thinking and unique points of view. Fostering an inclusive work environment that is welcoming and safe, where employees can bring their whole self to work every day has always been a priority.

Commonfund partners with other organizations that are committed to diversity, equity and inclusion initiatives and principles that we believe are important. These relationships extend the reach of our influence and allow us to collaborate with other leading organizations that embrace shared ideals. These relationships include:

In our annual Corporate Responsibility Report, we highlight our work in Mission-Aligned Investing, Thought Leadership, and fostering diversity of talent, geographies, cultures and ideas among the investment managers with whom we work and our employees. As a nonprofit, mission-driven organization, Commonfund has always been distinct among asset managers. Beginning with our founding in 1971, we have faithfully pursued our mission to strengthen the financial resources and investment management practices of the institutions we serve. Today, the initiatives described here are integral to who we are—responsibility has been embedded in our mandate and expected by our clients from the very beginning. We take this responsibility seriously and are proud of our continued commitment to being thoughtful stewards of both financial and human capital. We also take pride in the metrics we share, which promote transparency and keep us accountable to our mission.

As a firm, we are committed to responsible practices across everything we do, including investing, thought leadership, people and more. But, we know that we cannot rest on any laurels or past accomplishments. Every day presents a new challenge for Commonfund and the clients whom we serve, and we must rise up to meet that challenge. We, our clients, and society more broadly, are on a long journey to make this world a better place in which to live and work. At Commonfund, we look forward to it.

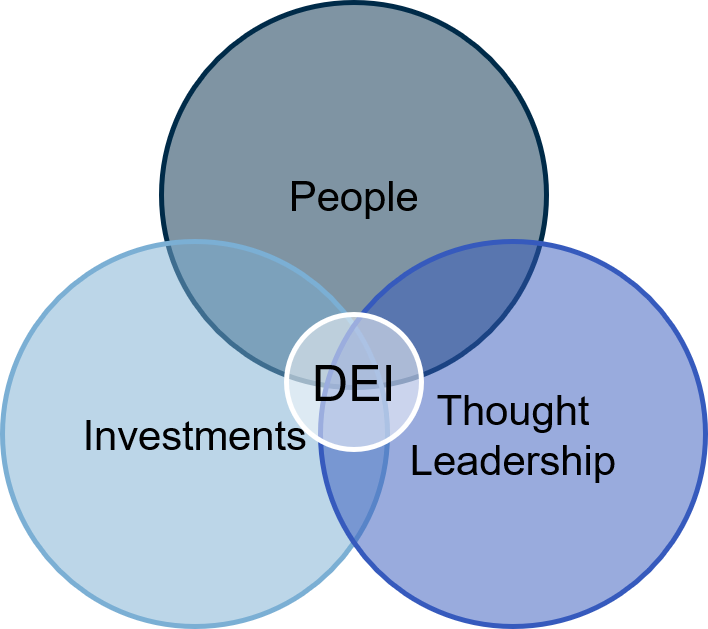

The mission of the DEI office is to intentionally promote and foster inclusion and equity across Commonfund and our investment process, thought leadership, and professional and organizational development. We strive to:

Foster the inclusion of diverse managers within investment portfolios; Promote thought leadership, focusing on the importance of diversity and inclusion; Serve as the central clearinghouse for information on diversity and inclusion in the asset management industry, and; Provide firm-wide opportunities for professional and organizational development.

We are proud to be a part of an organization where corporate responsibility and sustainability are woven into the fabric of everything we do. We are committed to strengthening our culture and creating more responsible practices.