In a period where individual giving was down, historic levels of inflation put pressure on markets and the real economy, private and community foundations were asked to provide more resources to support communities in need. Findings from the recently released 2022 Council on Foundations-Commonfund Study of Foundations (CCSF) indicate a dramatic down swing in endowment investment returns, but that was only one part of the triple whammy of inflation and decreased gifts throughout the year. Private foundations posted annual average returns on their endowments of -12.0 percent, and community foundations reported -13.3 percent. In a year when the S&P 500 fell by double digits, and 3-month Treasury Bills averaged 2 percent, a rate well below inflation, these figures are not surprising.

But there were positive signs in the Study in terms of long-term returns, spending, and risk-return outcomes. Data show that, despite challenges, organizations delivered on their commitment of meeting the moment and their missions. Further, more recent evidence in markets and the nonprofit sphere cast a more optimistic light on what’s to come in 2023.

Positive signs in the 2022 CCSF

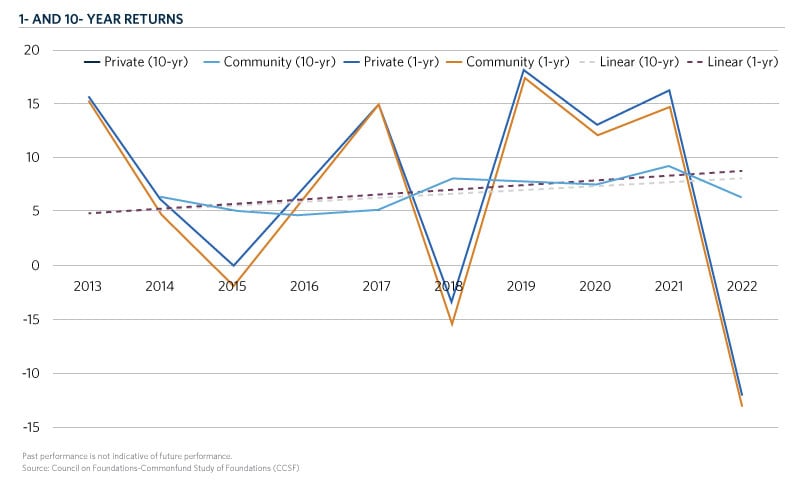

Longer-term returns. In seven out of the past ten years, returns for both private and community foundations have been positive, and in five out of ten, those one-year returns were more than 10 percent. Even with the lowest annual reported returns in almost a decade in 2022, long-term returns for both private and community foundations fell only mildly from their highest point (2021), back to levels similar to 2019 and 2020, and the trend in long term returns is decisively positive.

Spending. A majority of foundations in the Study reported that they did not change their spending (65 percent of private foundations and 73 percent of community foundations reported no change in spending) in response to the inflationary environment. This shows the institutional understanding that long term returns are what helps bolster spending and the ability to meet mission every year.

Balancing risk and return. Aligned with prior Studies, larger institutions fared slightly better than smaller ones in terms of investment returns. In 2022, the largest private foundation cohort had 3.8 percentage points higher returns on average than the smallest private foundation cohort (-9.1% vs. -12.9% returns on average). That gap was smaller, 2 percentage points, between the largest and smallest community foundations (-12% vs -14% returns on average). In line with the CCSF Viewpoint, “The Yin and Yang of Risk and Return,” this may indicate larger institutions’ ability to take on more risk –related to illiquid assets that tend to outperform public markets over time.

Positive signs in more recent data

If year to date evidence is any indication of how 2023 will shape up, foundations and their stakeholders may have a reason to be optimistic. Despite significant headwinds – an interest rate regime aimed at reducing economic demand, banking uncertainties, the debt ceiling debacle – markets and the economy more broadly have been resilient. GDP has been low but positive, enough to sustain a low rate of unemployment (July 2023) that has held steady since December 2022, and inflation is still elevated but falling closer to target.

Financial markets have followed with a tepid but significantly more positive outlook than last year. Equities rebounded, producing double digit positive returns in the first half of this year, with a few key sectors leading the positive turn. Growth in private markets has slowed, but it is yet to be seen how that will translate to the segment’s returns.

There is early evidence that foundations are benefiting from a more favorable market. Median foundation investment returns were up 11.3 percent year over year as of June 2023, according to a FoundationMark analysis. This tracks with the roughly 11 percent increase in the S&P 500 over the same time period, and more than 16 percent increase since the beginning of 2023.

Foundation asset returns may be indicative of returns in alternative investments too, which comprise half of all private foundation asset allocations, according to 2022 CCSF data. According to our CCSF trend analysis, these alternative asset allocations continue to climb and we don’t see signs of slowing. With inflation cooling and interest rates still high, there may be opportunities worth exploring in the private markets for institutional investors as we move into Q4 2023 and into 2024.

Since 64 percent of giving comes from individual donations (e.g., high net worth individuals), market returns often correlate with giving and donations overall. Last year, in addition to inflationary pressures on households, that led to giving being down (CCSF findings reflected the industry more broadly). So, in a better market and inflationary environment this year, it’s likely to be a better year for giving. There are signs that this might be the case this year, but as economic uncertainties remain, we will continue to monitor what happens with this important indicator of nonprofit financial wellbeing.

As Q3 proceeds and we move into Q4, the Institute will continue to gauge how this year is shaping up for nonprofit investments and provide thought leadership on our findings. We encourage foundations to keep participating in our studies so that we can continue adding critical insight and analysis to the field.