Common Misconceptions about Endowments

In recent months, institutional endowments, particularly those within higher education, have been subject to heightened scrutiny. This attention has, at times, created tension and contributed to the...

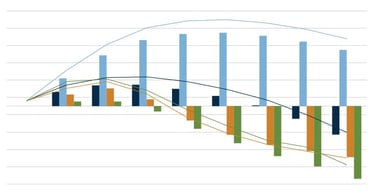

The New Era of Market Concentration

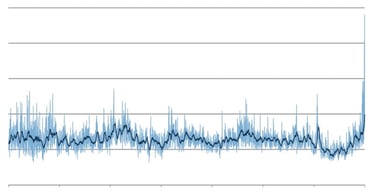

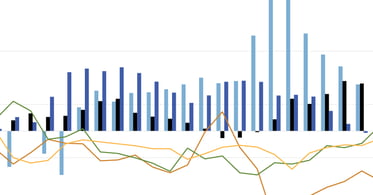

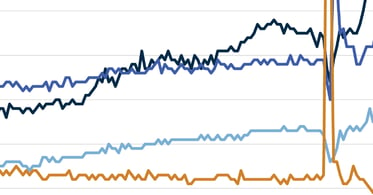

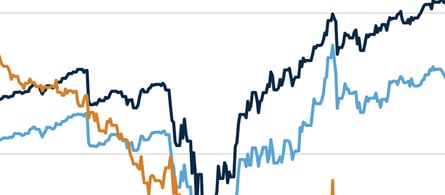

Market concentration has become a key theme, with the top 10 companies constituting more than 40 percent of the S&P 500 Index by market capitalization. This comfortably surpasses market concentration...

Implications of the U.S. Arrest of Venezuelan President Nicolas Maduro

This past weekend U.S. Special Forces launched a large-scale military operation in Venezuela and in the process captured and arrested Venezuelan President Nicolas Maduro and his wife, Cilia Flores....

Year-End Update and 2026 Investment Outlook

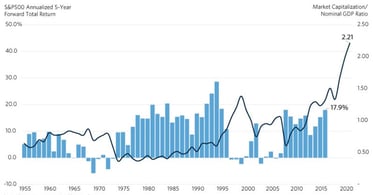

Calendar year 2025 delivered strong equity market returns globally, continuing the outsized performance of the past two years. In the U.S., the S&P 500 index returned 17.9 percent. Not to be outdone,...

Winter Reading List 2025: Stories to Warm the Season

Commonfund Institute is excited to share the latest edition of our winter recommended reading list, featuring thought-provoking memoirs, compelling historical fiction, and inspiring leadership...

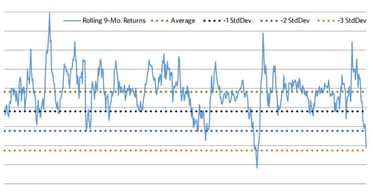

Why the Way You Count Matters and Why Comparing One-Year Returns Does Not

As we near the end of the performance reporting season for larger higher ed institutions this year, I am once again struck by the focus the media and others place on a single fiscal year return.

U.S. Government Shutdown Ends: Economic Impact and Next Steps

After 43 days of political deadlock, the longest government shutdown in U.S. history finally ended when Congress recently passed a last-minute funding bill signed by President Trump. The standoff,...

A Closer Look at Higher Education Endowments Less Often in the Spotlight

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2024 NACUBO-Commonfund Study of Endowments (NCSE, or,...

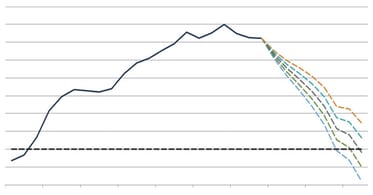

More Than Multiples: Understanding the Broader Drivers of Equity Valuations

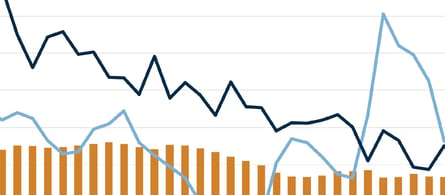

The S&P 500 has produced a ~25 percent annualized return for the three successive years ending September 2025, a banner period of performance.

A Closer Look at Private Family Foundations

Commonfund, in partnership with the Council on Foundations (COF), recently released the 2024 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations...

Four Takeaways from the 2025 Nest Climate Campus Event

At this year’s Nest Climate Campus event, held September 23-25, 2025, during NYC’s Climate Week, the conversation around climate shifted—from ideals to execution, and from rhetoric to financial and...

What a Government Shutdown Means for the Nonprofit Sector: Why It Matters to Boards

At midnight on October 1st, the U.S. government shut down after Congress failed to pass a short-term funding bill. The shutdown is a culmination of contentious policy differences between Republicans...

Commonfund Holds Third Convening for Foundations that Support Higher Education

Last month, Commonfund hosted its third Commonfund Convenes event dedicated to advancement of investment knowledge for institutionally-related foundations (IRFs). The latest workshop focused...

Higher Ed in 2025: Top 5 Business Concerns and How Institutions Can Respond

For the past four years, NACUBO has surveyed chief business officers and other financial and administrative professionals about the challenges that confront them—and how they are working to support...

A Closer Look at Health Conversion Foundations

Commonfund, in partnership with the Council on Foundations (COF), recently released the 2024 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations...

Health Conversion Foundations: Preserving Community Health in a Changing Landscape

In the evolving terrain of American healthcare, health conversion foundations, also known as health legacy foundations, have emerged as powerful stewards of community well-being. These philanthropic...

AI and the Productivity Paradox: Are We Finally Seeing the Payoff?

Artificial Intelligence (AI) remains the most compelling theme in global markets today. With OpenAI and Anthropic recently valued at $300 billion and $183 billion, respectively, and tech giants, like...

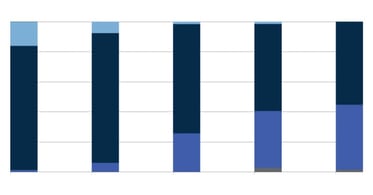

Growing Use of OCIO by Private and Community Foundations

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data show concerns are rising regarding the ability to...

Themes from the 2025 FAOG Conference for Community Foundations

Last week in Oklahoma City the 2025 FAOG (Finance, Administration & Operations Group) Conference convened experts and over 300 delegates from community foundations around the country to explore the...

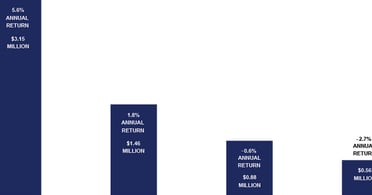

A Closer Look at Long-term Returns

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data was collected on longer-term returns for the first...

Study of Foundations - Key Highlights [Infographic] 2024

In this infographic, we report the key highlights from the 2024 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2024, participating foundations produced...

Tariff Worries Are Likely Here to Stay

Over the last five months, tariffs have fluctuated as deadlines have come and gone. Deals have gotten done, the frameworks of deals have been announced and for countries less willing to negotiate,...

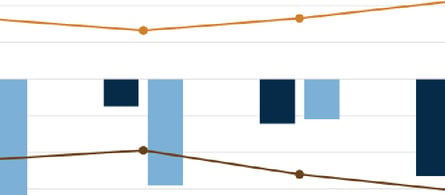

Deficit Spending Remains a Constant Despite a Change in Leadership

A few years ago, Commonfund published a commentary on the budget battles in Washington. The world was navigating a pandemic. Joe Biden had just been elected and needed to offset the economic impact...

Endowments, Nonprofit Sector Face Major Shifts Under New Federal Tax and Education Law

Congress’s newly passed reconciliation bill, H.R.1, introduces sweeping changes that will reshape education financing, nonprofit operations, and endowment management. Here we summarize key provisions...

Aligning Capital with Mission: Insights for Nonprofit Institutional Investors

In today's investment landscape, many institutions are reckoning with a fundamental question: Are our investments aligned with our mission? At this year’s Investment Stewardship Academy, Commonfund...

In Memoriam: Mamak Shahbazi

It is with great sadness that we announce the passing of Commonfund Board Member, Mamak Shahbazi. Mamak was a dedicated and talented board member and a great friend to the firm, its clients, and...

Fiscal Year-End and Mid-Year 2025 Market and Investment Review

Institutional investors aim to construct long-term asset allocations to withstand bouts of short-term volatility and periods of market uncertainty. This concept was certainly tested in fiscal year...

Summer Literary Journeys: A Pathway of Pages into Growth, Grit, and Collective Imagination

Commonfund Institute is excited to share our annual summer reading list, thoughtfully curated with recommendations from our Commonfund colleagues. Inspired by the spirit of the summer solstice –...

Investment Stewardship Academy: Takeaways for Navigating an Evolving Landscape

For over 30 years, Commonfund Institute has hosted the Investment Stewardship Academy (ISA) to bring institutional investors together to learn, collaborate, and better support the missions they...

Tax Regime of Higher Education and Nonprofits Set to Change

On May 12th 2025, the House Ways and Means Committee released its budget proposal that includes major tax changes that, if passed, would apply to many endowments and foundations as described below....

Nonprofit-Dedicated OCIO

Providing nonprofits with customized investment strategies and specialized expertise, a nonprofit-dedicated OCIO can ensure mission-aligned financial stewardship. By concentrating on the nonprofit...

Considerations for Foundations to Meet the Moment

In response to the current political, social, and economic challenges, numerous foundations are increasing their support and adapting their strategies to address pressing issues. There have been...

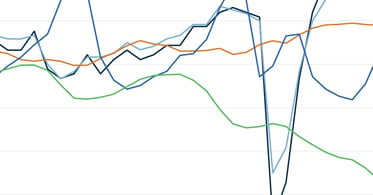

Fiscal Policy Impacts on the Economy: Maybe too early to tell….

We are now more than 100 days into the Trump administration and six weeks past the “Liberation Day” tariff announcements. In that time the S&P 500 has reached it’s all time high, sold off more than...

A Closer Look at Minority-Serving Higher Education Institutions

Following the release of the 2024 NACUBO-Commonfund Study of Endowments (NCSE), Commonfund conducted a focused analysis of data reported by the 97 participating Minority-Serving Institutions (MSIs)....

The Power of We: How Collective Learning and Data Sharing Make Us Stronger

In the midst of today’s volatile economic and policy landscape, collective learning has become not just beneficial but essential for institutional investors. The nonprofit sector as a whole is facing...

Study of Independent Schools Marks its 20-Year Milestone

In 2005, what was then called the National Business Officers Association (now NBOA: Business Leadership for Independent Schools) had reached the seventh anniversary of its founding. Having its...

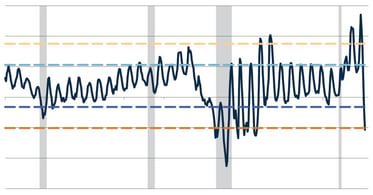

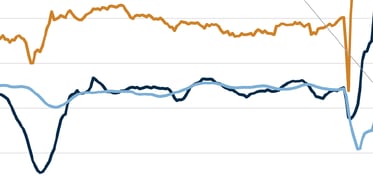

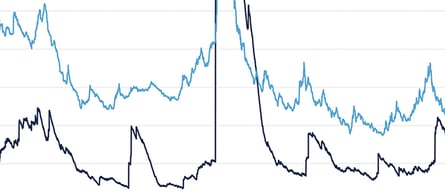

Policy Uncertainty Impacts All Assets (Not Just Equities!)

Since the February peak in the S&P 500, reams of newsprint have been dedicated to the volatility in the equity markets and to a lesser extent the U.S. Treasury markets – but what about the U.S....

Key Takeaways from the 2025 CASE Conference for College & University Foundations

Commonfund Institute provides analysis and thought leadership across the nonprofit institutional investing space. But investments don’t happen in a vacuum – they are part of the institutional...

Fiduciaries Guide to Mission-Aligned Investing

At Commonfund Forum 2025, Caroline Greer, Managing Director, Commonfund OCIO and George Suttles, Executive Director, Commonfund Institute sat down with panelists, Margot Brandenburg, Senior Program...

Increased Use of OCIO for Independent Schools

Data from the 2024 Commonfund Benchmarks Study of Independent Schools (CSIS) show that schools across the size spectrum reported an increase in use of an outsourced chief investment officer (OCIO)...

In Pursuit of Intergenerational Equity: Inflation is the Big Headwind

For all the differing goals and objectives laid out by colleges and universities for their endowments, one that is universally shared is intergenerational equity, or the concept that endowed...

A Closer Look at Religious Independent Schools

Earlier this year, Commonfund Institute released the 20th annual Commonfund Benchmarks Study of Independent Schools (“CSIS” or the “Study”), reporting on key investment governance trends and insights...

Four Challenges Impacting Nonprofits Today

Commonfund OCIO President and CEO, Tim Yates, sat down with panelists, Janine Anthony Bowen, Trustee of Georgia State University Foundation and Partner at BakerHostetler, Dr. Alison Morrison-Shetlar,...

A Closer Look at Community Colleges

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2024 NACUBO-Commonfund Study of Endowments (NCSE). The...

Investment Committees: Preparing for the Unforeseen

In the world of investing, crises are inevitable. Yet, many investment committees find themselves unprepared when these crises strike because they haven’t taken the necessary time to scenario plan....

Reflections on the NACUBO-Commonfund Study of Endowments 2024

Mid-February can be a challenging time of year. For sports fans, the lull between the end of the football season and the beginning of baseball season can feel like an eternity. For many, February...

Independent Schools Increasingly Depend on Endowments for Operations

Amidst concerns about student enrollment, fundraising, inflation, market volatility, and more, independent schools are relying more on their endowments to cover any gaps. Data from the 2024...

Key Takeaways from Forum 2025

Commonfund Forum 2025, held in Orlando, brought together registrants from some 370 institutions with more than $800 billion in endowed assets representing 42 states and five foreign countries in a...

Forum 2025 Key Statistics [Infographic]

Commonfund recently hosted its 27th annual Commonfund Forum, March 9th-11th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

Top Concerns in Higher Education

In the 2024 NACUBO-Commonfund Study of Endowments, a new area of inquiry was asked to participating institutions to identify their top two concerns from an inclusive list of 20 alternatives from...

Study of Independent Schools - Key Highlights [Infographic] 2024

For fiscal year 2024, independent schools reported an average return (net of fees) on their endowment assets of 12.3 percent. In this infographic, we report the key highlights from the 2024...

A Closer Look at Historically Black Colleges and Universities

Earlier this year, in partnership with the National Association of College and University Business Officers (NACUBO), Commonfund released the 2024 NACUBO-Commonfund Study of Endowments (NCSE). The...

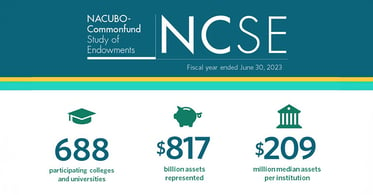

Study of Endowments - Key Highlights [Infographic] 2024

For fiscal year 2024, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 11.2 percent. In this infographic, we report the key highlights from the...

2025 Policy Outlook: What Endowments and Foundations Should Know

On January 30th, Commonfund Institute, in partnership with the National Association of College and University Business Officers (NACUBO), the Council on Foundations (COF), and the Council for...

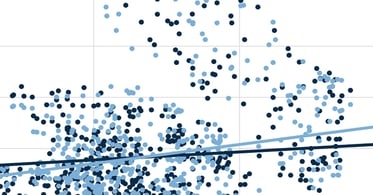

Determinants of Portfolio Returns – It Depends…

Asset allocation decisions have traditionally been associated with being the major determinant of portfolio returns. The Brinson, Hood, Beebower study of 19861 estimated that nearly 90 percent of...

The Housing Market Paradox

The U.S. housing market stands at a critical juncture as sectors adjust to the anticipated Trump administration. While various industries are pricing in different expectations, housing faces unique...

Commonfund’s Investments with Diverse Managers Continue to Grow

Commonfund continues to build exposure to diverse managers1 as a source of return and diversification for our clients. In 2024, we closed the year with allocations to 50 different diverse managers,...

Winter Wonders: Warming Reads for the Season

Commonfund Institute is excited to share our annual winter reading list, curated by our colleagues. These selections explore themes of personal transformation, resilience, and identity with stories...

Responsible Investing: Terminology and Background

In recent years there has been a rise in available investment strategies and governance considerations to help investors adapt to evolving challenges in the responsible investing space. Norms and...

U.S. Trade Deficit Reaches Record High Amid Global Trade Shifts

As of September 2024, the U.S. trade deficit stands at $84.4 billion, marking the highest level since the onset of the Russia-Ukraine war in 2022. During that period in the conflict, the deficit...

Understanding OCIO Partnerships: Key Insights and Best Practices

A Chief Investment Office “down the hall.” That’s what we aim to be at Commonfund. Our Mission As an OCIO, our goals are aligned with the institutions we work with and focused on how we can best...

Three Things You Should Know About Inflation and the Higher Education Price Index

The Higher Education Price Index (HEPI), produced annually by Commonfund Institute, is an inflation measure designed specifically for educational institutions. It is comprised of eight key components...

The Case for the Seventh P: Progression in Nonprofit Investment Stewardship

At Commonfund Institute, we’ve long adhered to the six guiding principles of nonprofit investment stewardship, often referred to as the "6 Ps": Purpose, Policy, Process, Portfolio, People, and...

Celebrating Native American Heritage Month: A Resource Guide

Commonfund, in conjunction with our Native American Heritage Month subcommittee, has created a resource guide to help all of us celebrate the contributions of Native Americans and Indigenous people...

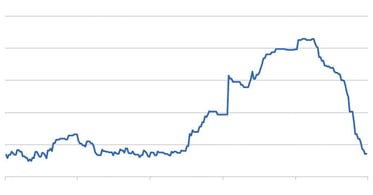

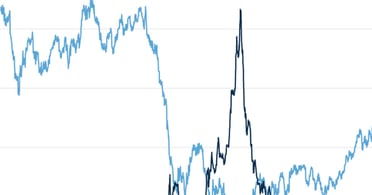

The Pivot Heard Around the World

A U.S. Federal Reserve (“Fed”) pivot is felt throughout global markets, affecting economies worldwide.

Key OCIO Evaluation Factors

When choosing an Outsourced Chief Investment Officer (OCIO), there are eight key factors an organization should consider for increasing the likelihood of a good fit and successful partnership. These...

Considerations for Smaller Institutions Seeking OCIO

Recent data from the Commonfund Benchmarks Studies indicate that smaller nonprofit institutions are using an Outsourced Chief Investment Officer (OCIO) for investment management more often than their...

Stay the Course: Long-Term Investing Beyond Election Volatility

Presidential elections often beget new theories about how candidates might influence financial markets. This year is especially pivotal, with nearly half of the global population participating in...

How Nonprofits Eliminate the Noise to Strategically Achieve Long-Term Success

Commonfund has been partnering with boards and investment committees to design and implement investment structures that support and maintain intergenerational equity, the purchasing power of their...

Celebrating Hispanic Heritage Month: A Resource Guide

National Hispanic Heritage Month (Spanish: Mes Nacional de la Herencia Hispana) is an annual celebration commemorating the history, contributions, and culture of U.S. Latino and Hispanic communities.

Is Your Portfolio Positioned for Lower Rates?

Until recently, investors were no doubt pleased with the continued strong equity performance in 2024 that resulted in new highs in the major domestic indices and strong returns globally.

Understanding the OCIO Governance Model

Explore the intricate governance dynamics within Outsourced Chief Investment Officer (OCIO) models and how they shape investment outcomes.

Educational Alpha Podcast: A Conversation with Mark Anson

In this episode of the "Educational Alpha Podcast" host Bill Kelly sits down with Mark Anson, CEO and CIO of Commonfund to explore the evolution of the endowment model and its ongoing relevance in...

How Long Can the Yen Carry Trade Carry On?

Since Japan's economic crash in the 1990s, the Bank of Japan (BOJ) has maintained extremely low interest rates to combat deflation. For nearly a decade, Japan's benchmark rate has been negative,...

Commonfund Convenes: Foundations that Support Higher Education

Last month, Commonfund OCIO hosted an inaugural convening of institutionally-related foundations (IRFs) - foundations that are a separate entity and serve as administrative and often fundraising...

Why do Nonprofit Investors Seek an OCIO?

According to data from Commonfund's Benchmarks Studies, Outsourced Chief Investment Officer (OCIO) usage is on the rise among private and community foundations and higher education over the past 10...

Investment Stewardship Academy 2024: Lifetime Learning for Nonprofit Leaders

Commonfund Institute’s Investment Stewardship Academy (“ISA”), an intensive workshop for institutional investors and leaders that has been convening since 1993, came together on Yale’s campus in New...

Fiscal Year-End and Mid-Year 2024 Market and Investment Review

Over the last 12 months, the global stock markets demonstrated remarkable resilience and growth despite several challenges, including persistently high interest rates, geopolitical instability, and...

Discover Your Next Summer Read!

Summer 2024 is finally here, and Commonfund has curated a list of illuminating books to make your sunny days even brighter! Perfect for beach days or cozy retreats, these selections celebrate the...

Key Takeaways from Commonfund’s 5th Annual Diverse Manager Day

On May 15th, 2024, Commonfund held its 5th annual Diverse Manager Day. While Commonfund investment teams meet with hundreds of diverse managers each year, this one day is dedicated to due diligence...

The Fed and Markets Expectations Start to Align

It took six months, but the FOMC and the short-term rates markets are finally in alignment with respect to the level of the Fed Funds rate as we approach the second half of 2024. Since the beginning...

Celebrating Pride Month: A Resource Guide

Pride month is the promotion of the self-affirmation, dignity, equality and increased visibility of lesbian, gay, bisexual, transgender, intersex and asexual people (LGBTQIA+) as a social group....

A Closer Look at Historically Black Colleges and Universities

Earlier this year, in partnership with the National Association of College and University Business Officers (NACUBO), Commonfund released the 2023 NACUBO-Commonfund Study of Endowments (NCSE),...

Celebrating Asian American and Pacific Islander Heritage Month

Asian American and Pacific Islander Heritage Month got its start as a congressional bill, inspired by Black History Month and Hispanic Heritage Month, with the mission of bringing attention to the...

A Closer Look at Community Colleges

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2023 NACUBO-Commonfund Study of Endowments (NCSE),...

Adding Alpha through Emerging Investment Managers

Commonfund Forum 2024 convened a panel of emerging investment managers to spotlight their unique investment approaches. Moderated by Caroline Greer, managing director at Commonfund OCIO, the...

Key Takeaways from the 2024 CASE Conference for College & University Foundations

Commonfund Institute provides analysis and thought leadership across the non-profit institutional investing space. But investments don’t happen in a vacuum – they are part of the institutional...

A Closer Look at Religious Independent K-12 Schools

Earlier this year, Commonfund Institute released the 2023 Commonfund Benchmarks Study® of Independent Schools (CSIS), reporting on key investment governance trends and insights over the July 1, 2022...

What's Driving Surprisingly Low Volatility in Energy Markets?

In the current geopolitical environment, we would have historically expected much more volatility in the energy complex. Oddly, that has not been the case over the last 6 months. In fact, crude oil...

Viewpoint | Top Concerns for Independent Schools

For the first time since the inception of the Study, the FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) report asked respondents to identify the top concerns for their...

The Economic Equation: Solving for the Unknowns

2 + 2 = ? In the world of economics—a lot of variables may mess with the answer. Two sessions early in the agenda at Commonfund Forum 2024 brought into focus the range of scenarios in play for...

Viewpoint | The Main Purpose of Independent School Endowments

The FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) prompted survey respondents to select the main purpose of their school’s endowment for the first time.

Commonfund Forum 2024: 5 Key Takeaways

Commonfund Forum 2024 brought together 500+ attendees representing institutions with $890 billion in endowed assets in a 2.5-day conference. The event, themed “With Intention”, featured a...

Study of Independent Schools - Key Highlights [Infographic] 2023

For fiscal year 2023, independent schools reported an average return (net of fees) on their endowment assets of 9.2 percent. In this infographic, we report the key highlights from the 2023 Commonfund...

Study of Endowments - Key Highlights [Infographic] 2023

For fiscal year 2023, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 7.7 percent. In this infographic, we report the key highlights from the...

The NACUBO Endowment Study: A 50-Year Retrospective

Documenting a Period of Unprecedented Change The NACUBO-Commonfund Study of Endowments (NCSE) for fiscal year 2023 marks the 50th consecutive year that NACUBO has published a Study of the endowments...

China Continues to Drag Emerging Markets into 2024

2023 marked the third year of drawdowns for the Chinese equity markets, reflecting a country still trying to emerge from the pandemic period. A combination of factors continued to hamper the once...

Celebrating Black History Month: A Resource Guide

Black History Month is an annual celebration of achievements by African Americans and a time for recognizing their central role in U.S. history. Also known as African American History Month, the...

Commonfund Announces 2024 Diverse Manager Day

Commonfund begins the New Year with the exciting prospect of continuing to build out our diverse manager commitments. In 2023, we hit a milestone, reaching 10.9 percent of assets under management...

Four Things we Learned from Foundation Leaders

Following the release of the Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations (the “Study”), Commonfund Institute hosted a three-part Coffee...

Bad News is “Good” for Markets to Close 2023

As we inch closer to 2024, domestic markets have been largely driven by shifts in sentiment surrounding the macroeconomic environment, leading many to question the relationship between “bad news” and...

A Winter Wonderland of Books to Warm Your Soul and Inspire Creativity!

Commonfund Institute is excited to share our staff-curated reading list this winter, filled with stories that warm the heart and spark imagination. We extend our warmest wishes for a season filled...

Key Factors in Asset Allocation Decisions for Endowments

There are several broad subjects that an effective investment policy statement (IPS) should include in its contents and address clearly and specifically as they relate to an endowed institution. This...

City of the Big Shoulders: Key Takeaways from our Chicago CIO/CFO Roundtable

For more than 50 years, Commonfund has been working with boards and investment committees to design and implement investment structures that support and maintain intergenerational equity - the...

Increasing Use of OCIO Relationships Requires New Governance Considerations

More and more endowments and foundations are entering outsourced chief investment officer (OCIO) relationships as long-term mission-aligned investing becomes mired in the complexity of rapidly...

Viewpoint | Analyzing Community Foundation Data by Region

For the 2022 Council on Foundations - Commonfund Study of Foundations, we provided an analysis of community foundation data by five geographic regions. Community foundations lend themselves to this...

Yield Curve Dynamics in Focus to Close 2023

After a relatively tame summer, significant cross-asset volatility has returned with both the MOVE and VIX indices increasing by 37 and 48 percent respectively, after approaching the lows for 2023 in...

Private Credit Today

On September 27th, Commonfund OCIO hosted an event in Minneapolis at the O’Shaughnessy Distilling Co. Following a tour and tasting at the facility, Nicole Melwood, Director, and Vincent Kravec,...

Commonfund on the Road: Insights from our California Roundtables

For over 50 years, Commonfund has been working with boards and committee members helping endowments and foundations to sustain their missions over many generations and promoting best practices in...

Commonfund on the Road: Insights from our Portland Roundtable

For over 50 years, Commonfund has been working with boards and committee members on designing and implementing an investment structure that supports maintaining intergenerational equity or the...

Foundation Leaders Highlight Successful Long-Term Investment Strategies during Turbulent Times

On September 27, 2023, Commonfund Institute hosted a webinar, “Highlights of the 2022 CCSF: A Deep Dive with Foundation Leaders.” The panel featured Elizabeth McGeveran, Director of Investments at...

Real Estate and Negative Leverage – The long and the short of it...

The recent rise of the U.S. 10-year interest rate will likely prove difficult for most real estate assets given that the historic inversion in the yield curve has provided some refuge from the sharp...

Lagarde Offers Little Comfort Amidst All Time High ECB Rates

Last Thursday marked the tenth hike of the European Central Bank (“ECB”) deposit rate.

Bright Spots for Foundations in 2022 and Early 2023

In a period where individual giving was down, historic levels of inflation put pressure on markets and the real economy, private and community foundations were asked to provide more resources to...

Study of Foundations - Key Highlights [Infographic] 2022

In this infographic, we report the key highlights from the 2022 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2022, participating foundations reported an...

Global Currency Returns Diverge

A year ago, the dollar was approaching multi-decade highs as global currencies coped with the most aggressive FOMC hiking cycle of the last forty years.

Observations from the 2023 NACUBO Annual Meeting

Last month, I had the pleasure of attending the NACUBO Annual Meeting in Orlando, FL, where nearly 2,000 representatives from higher education institutions across North America came together to share...

Three Fundamental Duties of Nonprofit Boards

It is essential that trustees of endowed portfolios hold themselves accountable to a set of standards in order to maintain sound governance practices. Fiduciary duty is an important part of the...

Markets Signal Higher for Longer Interest Rates

Market sentiment on bonds continues to trend lower, leaving the overall open interest in short-dated U.S. Treasury futures net short at an unprecedented level. There is the potential that these short...

Commonfund on the Road: Insights from our Seattle Roundtable

Commonfund OCIO recently hosted a roundtable luncheon in Seattle, WA, for local nonprofit leaders. During our time together, we discussed how institutions can attain intergenerational equity in their...

Fiscal Year-End and Mid-Year 2023 Market and Investment Review

The end of fiscal year 2023, and mid-point of the calendar year, marks the end of the pandemic years. At this point, many have returned to the workplace, at least part time, in-person meetings have...

Soak Up Some Sun with One of Our Favorite Books!

Commonfund Institute is excited to share our must-reads for summer 2023. These books are the perfect partner for some fun in the sun, or some time relaxing in the shade. We hope you have a great...

Midyear Rally or Multiple Expansion?

The long-awaited decline in earnings growth appears to be upon us nearly halfway through 2023. Expectations for S&P 500 year-end earnings per share (EPS) growth range from flat to a tepid 1 percent.

Is Commercial Real Estate the Next Shoe to Drop?

Over the last year, there has been relentless reporting that the next shoe to drop for the economy and banking system is commercial real estate. The drumbeat runs counter to what we are hearing from...

The Investment Stewardship Academy Returns to Yale This June

The Investment Stewardship Academy, Commonfund Institute’s three-day intensive academic program is set to resume in-person June 20-23 for the first time since 2019.

Unemployment Appears Poised to Increase

Other than the impending recession, one of 2023’s most anticipated economic changes has been a labor market slowdown, with both economists and investors expecting a deceleration in economic activity...

Including Risk Management in Your Investment Policy Statement – Where to Begin

Investment policy statements usually contain a section that purports to define the institution’s risk tolerance. But they frequently only gesture in the direction of risk, without actually examining...

Yesterday's Sector Laggards are Today's Leaders

Much to the surprise of market participants, global stocks have risen at an impressive pace year to date despite significant macroeconomic headwinds and regional bank troubles. In what can be deemed...

Shaping Your Board - Key Considerations for Success

The structure of a board can help, or hamper, its effectiveness, and consideration of these matters is important to improving a board’s performance. Factors such as size, board chair, diversity and...

Drafting Your Investment Policy Statement: 10 Critical Issues

Endowed institutions differ in their missions, capabilities and resources, and investment policy statements naturally mirror these differences. In that sense, there is no single ‘right’ investment...

Bond Market Expectations Take a Wild Ride

In today’s environment, commentary can seemingly become stale in periods as short as hours, let alone days. Just last month, we wrote how despite tightening lending conditions from banks, other...

Study of Independent Schools - Key Highlights [Infographic] 2022

For fiscal year 2022, independent schools reported an average return (net of fees) on their endowment assets of -11.3 percent. In this infographic, we report the key highlights from the 2022...

Celebrating Women's History Month

Women's History Month 2023 | Celebrating Women Who Tell Our Stories Women’s History Month is an annual declared month that highlights the contributions of women to events in history and contemporary...

Spending Policy | Old Technology Still Dominates

Every year I eagerly await the release of the NACUBO Study of Endowments (NTSE) and, when I finally get it, I read it cover-to-cover. Despite reading all 195 pages, the two most frequent questions I...

Forum 2023 Key Statistics [Infographic]

Commonfund recently hosted its 25th annual Commonfund Forum, February 13-15th, in Boca Raton, Florida. The event brought together institutional investors to engage in a three-day conference to...

Commonfund Forum 2023: 5 Key Takeaways

Commonfund recently hosted its 25th annual Commonfund Forum in Boca Raton, Florida. The event, themed “Still We Rise”, brought together 500+ attendees representing institutions with almost $850...

Rate Hikes are Impacting Bank Lending Behavior

As investors grapple with adjusting to 450 basis points of rate hikes (and likely more in sight), the debate on just how quickly monetary policy will transmit through the real economy has returned to...

Markets Rally to Close 2022, but Sentiment Remains Dismal

Strong Fourth Quarter for Global Markets Following three quarters of bleak performance, global markets staged a rally to close what was a tumultuous 2022.

Excellent Boards Are Made, Not Born

Boards that are exemplary for their adherence to best governance practices have certain identifiable traits. But this is no accident—they have taken steps to elevate their practices and maintain them...

Get Cozy This Winter with One of Our Favorite Books!

Commonfund Institute is excited to share our most recent picks for our annual winter reading list, gathered from our Commonfund colleagues. We send you our warmest wishes for the holidays and can’t...

Supply Chains Take a Wild Ride

In 2021, the word was transitory. This described the expectations of Fed officials and many other prognosticators that elevated inflation would quickly return to the pre-COVID level of at or around 2...

Is Spending Policy the Other “Free Lunch” in Investing?

We believe spending policy not only should influence strategic asset allocation but should be thought of as the other "free lunch" of long-term endowment investing alongside diversification.

Diversity and Inclusion: Ways to Make a Change

Throughout American history, discrimination has not only been ever present, but era-defining. In each of those eras, however, there have been pivotal moments where activists organized, made...

Why Governance Matters to ESG

According to the Financial Times “Investing within an ESG framework is now the fastest-growing segment of the asset management industry.” In line with this growth is the increasing number of...

Real Estate Takes a Hit from the Fed

In this chart of the month, it is commonly cited that monetary policy tightening has a lagged impact on economic activity. However, as the Federal Reserve drives the cost of capital higher, the...

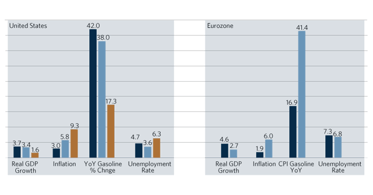

Chart of the Month | The Shape of Inflation

The Consumer Price Index continues to surprise central bankers, commentators, and market participants alike. The latest headline reading of 8.2 percent, which reflects year-over-year price increases...

The Endowment Model Proves Its Worth (Again)

Unless you’ve been on a remote island with no Wi-Fi for the past nine months, you are well aware that it has been a rough start for capital markets. In fact, it has been a historically rough start to...

Investment Objectives? Not Always.

The 2021 Council on Foundations—Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) marked our tenth year in collaboration with the Council on Foundations. The...

Asset Allocation: Controlling for the Variables

Our 2021 Council on Foundations-Commonfund Study of Foundations marked our 10th year in collaboration with Council on Foundations and the Commonfund Institute to measure, analyze and document the...

The Trouble with Europe

As U.S.-based investors, our clients tend to focus on issues closer to home when evaluating portfolio positioning. Most conversations are focused on the political climate, FOMC actions, localized...

Research Shows 10-Year Returns for Foundations Reach Highest Point

Our 2021 Council on Foundations-Commonfund Study of Foundations marked our 10th year in collaboration with Council on Foundations and the Commonfund Institute to measure, analyze and document the...

Better Benchmarking: What Makes Your Institution Unique Matters

There is no doubt that benchmarking is a good practice for institutions to follow – we publish studies each year for various nonprofit sectors for that reason. While we think that benchmarking is...

Four Hot Topics of Operational Support

Middle and back office operational support is often considered the glue that keeps organizations on track. While perhaps not the most glamorous of topics, the oversight of accounting, tax reporting,...

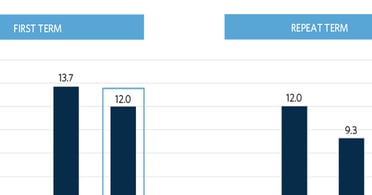

Key Governance Factors for Higher Education Prove to Be Quantifiable

A board self-assessment is one of the most commonly used tools to evaluate how effectively a board performs. The purpose of a board self-assessment is to help board members analyze their present and...

Evolving Our Definition of Diverse Managers

Investing in diverse managers has evolved considerably over the last five years, catapulted by client demand, broad social concern over events such as the murders of George Floyd, as well as a...

Aligning Spending Policy with Your Institution’s Long-Term Goals

Commonfund has designed a set of questions to help guide a committee—and staff—toward selecting the most appropriate spending policy. We have used these questions as a guideline for conversations...

Endowment Management: The Business of Independent Schools

Commonfund is proud to contribute a chapter to NBOA’s new book “The Business of Independent Schools – A Leader’s Guide” – a new edition of “By the Numbers and Beyond.” This publication provides...

Don’t Let Inflation be a One-Two Punch for Your Endowment

Investment committees overseeing the endowments of higher ed institutions need to think about inflation for two fundamental reasons.

Diversity and Diversification: The People Edge in Portfolios

Can diverse people managing investment portfolios deliver an edge in performance? A growing body of research shows that diverse managers—defined by gender, race, ethnicity or other...

The “Divorcification” of Stocks and Bonds

It has been a difficult start for traditional portfolios of stocks and bonds in 2022 as the usual diversification benefits of these asset classes have failed to materialize. As high inflation remains...

21st CASE Commonfund College and University Foundation Award

Since 2001, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

In Remembrance: Laurance (Laurie) R. Hoagland, Jr.

The Commonfund community was saddened to learn of the recent passing of Laurie Hoagland. Laurie served as a member of the Commonfund Board from 2000-2012 and was Board Chair from 2010-2012.

Real Estate Today … and the Trends Likely To Shape Tomorrow

As it burst onto the world scene in 2020, COVID-19 impacted asset classes and investment strategies across the board. While real estate was no exception, the industry managed a generally strong...

Diversifying Your Fixed Income Portfolio With a Private Credit Allocation

Inflation, rising interest rates, inversion in the yield curve and the war in Ukraine combined to make 1Q22 a challenge for many asset classes and strategies. While there was the isolated shelter...

Are Stagflation Fears Justified?

Stagflation fears are growing among investors as inflation recently accelerated at the same time 2022 GDP growth projections declined due to weaker consumer sentiment and increased risk aversion. A...

Is your Spending Policy Getting the Attention it Needs?

Spending policy is the most overlooked aspect of endowment management and many are likely not employing the optimal calculation for their institution. Many investment committees review "strategic...

10 Key Takeaways from Commonfund Forum 2022

Commonfund recently hosted its 24th annual Commonfund Forum in Orlando, Florida. The event brought together 200+ institutional investors from the U.S., the Virgin Islands, and Canada in a 2.5 day...

Hitting the Hot Buttons: Investing for the Next 2 to 4 Years

Commonfund Forum 2022 featured an expert panel representing diverse perspectives to probe beyond the headline-grabbing news that has been driving financial markets in recent months. The accompanying...

Forum 2022 Key Statistics [Infographic]

Commonfund recently hosted its 24th annual Commonfund Forum, March 16-18th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

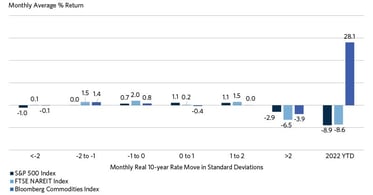

Is this Time Different? Risk Assets and Real Rate Moves

February ended in the same fashion as January, with elevated volatility across a wide spectrum of asset classes. Equities, fixed income, currencies, commodities, and cryptocurrencies all swung...

Commonfund Perspective on the Russian Invasion of Ukraine

Key Takeaways As widely anticipated, Russia invaded Ukraine on Thursday, February 24th, causing volatility to spike across the capital markets globally. By the closing bell in the U.S., however,...

Commonfund's Third Annual Invitational Diverse Manager Day

From February 9th-11th, Commonfund held its third Diverse Manager Day event, with 20 managers identified through its Diverse Manager Portal and other sources. These diverse managers1 cover a broad...

Tech Stocks Lead the Market Decline in Early 2022

2022 began with one of the worst market performance periods since 2009. While the tech-heavy NASDAQ index looks to finish January with a loss of around 10 percent, value equities will likely record...

Celebrating and Honoring Rev. Dr. Martin Luther King Jr.

On January 17, 2022, the nation will celebrate the legacy and leadership of Rev. Dr. Martin Luther King Jr. Dr. King—a graduate of Morehouse College—was a Baptist minister, a peace seeking civil...

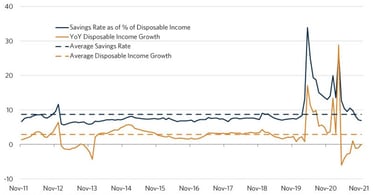

Consumer Savings and Disposable Income Under Pressure

As 2021 comes to an end, we enter 2022 with a good dose of uncertainty in the markets as the Fed begins to reduce and ultimately removes its accommodative policy which has been in place since the...

In Remembrance: Verne O. Sedlacek

A Gentle Giant The Commonfund community was shocked and saddened this week by the news of the sudden passing of our former President and CEO, Verne Sedlacek at the age of 67.

Sky High Valuations Could Spell Weaker Forward Returns

When we look for potential roadblocks that could spoil the breakneck pace of capital markets, the first risk that comes to mind is record-high valuations. While inflation risks have become more...

Ten Tips for Successful Meetings

On November 9, 2021, Commonfund Institute held its first virtual Investment Stewardship Academy session since the program began nearly 30 years ago. The course focused on committee decision-making...

Chart of the Month | Fed Remains Patient on Rate Hikes Despite Market Expectations For A More Aggressive Move

In its latest meeting on November 3rd, the Fed announced its decision to begin scaling back its historic bond purchasing program, marking the beginning of the end of the program that was aimed at...

Exiting the Recovery Phase

Third Quarter 2021 Economic Outlook The end of the third quarter 2021 marks a turning point in the economic cycle. It’s the point where, despite the pandemic still being a part of daily lives,...

Chart of the Month | Are We on the Verge of a Global Energy Crisis?

It is hard to imagine that in the short span of less than 18 months, energy markets went from a state of overabundance to one of severe shortages and skyrocketing prices. In April 2020, Brent oil...

Chart of the Month | The Confusing State of the Labor Market

The U.S. labor market continues to recover from one of the worst declines in employment since the 1930s. In the early days of the pandemic last April, demand for labor plummeted and the unemployment...

Viewpoint | Diverse Managers

The inclusion of diverse managers in institutional portfolios offers access to a broader array of investment talent. Data indicate that foundations are beginning to recognize and act on this...

OCIO Operational Services: Four Questions to Consider

When properly implemented, outsourcing the investment of nonprofit assets can help institutions establish governance processes, manage a complex portfolio, and navigate operational complexity and...

Chart of the Month | Home Prices Are Up 32 Percent In Five Years – And Still Climbing

Housing demand appears to be slowing down in the first half of 2021, yet home prices have continued to climb at an accelerated pace. This month’s chart highlights the supply and demand factors...

Commonfund Celebrates 50 Years of Service

On July 1st, 1971, The Common Fund for Nonprofit Organizations commenced operations with a $2.8 million grant from the Ford Foundation under the leadership of President George Keane and the Board of...

Chart of the Month | Supply Chain Woes as the Pandemic Recedes in the U.S.

Supply chain woes continue to wreak havoc for retailers who are grappling with a strong rebound in consumer spending. Average six-month spending on durable goods, spurred by over $5 trillion in...

Endowment Management and the Three Primary Responsibilities of a Board

The fourth blog in the “Six Ps of Investment Stewardship” series addresses People, specifically how boards function within an organization. To learn more about the first four principles in the series...

ESG and Sustainable Investing

ESG and environmentally sustainable investment are increasingly capturing the attention of the institutional investment community. To assess the state of ESG and sustainable investing and how they...

Chart of the Month | Emerging Markets Trail the Pack Despite Rising Demand and Commodities Prices

As growth continues to rebound around the world and investors return to their pre-pandemic way of life, global market performance is beginning to reflect the divergent speed of normalization within...

How to Invest in Diverse Managers

A U.S. capitalist system where approximately one percent of all capital is managed by women and people of color, who make up 70 percent of the population, perpetuates and increases inequality and...

Digging Deeper into Inflation Fears

The current debate about whether the spike we are seeing in inflation is “transitory” should be reframed as “reflation vs sustained inflation.” Just like many other economic data points (ISM,...

In Memoriam: George F. Keane

George F. Keane, 91, of 7408 Eaton Court, Sarasota, FL, founder of The Common Fund, and noted philanthropic investment strategist, passed away Thursday, May 20, 2021, peacefully in the Spring Meadows...

Constructing Investment Portfolios for Endowments

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship” – Purpose, Policy, Process, Portfolio, People and...

A New Chapter for the Economy

The key driver of the economy, and of public sentiment, has been the aggressive distribution and acceptance of the COVID-19 vaccines. A litany of measures reflects the improved outlook for the U.S....

CASE Commonfund College and University Foundation Award 20th Anniversary

For the past 20 years, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

Commonfund Trustee, Dr. David A. Thomas, Wins 62nd Annual HBR McKinsey Award

Commonfund's Trustee, Dr. David A. Thomas, wins the 62nd Annual HBR McKinsey Award, for co-authoring the article titled "Getting Serious About Diversity: Enough Already with the Business Case." The...

Chart of the Month | The Surprising Relationship Between Money Supply and Inflation

The potential for rising inflation is becoming a top concern for many investors and consumers. Many believe that inflation is already here as evidenced by price increases in commodities, homes,...

Top 5 Ways OCIO Fees Mislead

Fees are frequently overemphasized by Investment Committees when evaluating an Outsourced Chief Investment Officer (“OCIO”). Committees often believe that fees are a quantifiable and tangible way to...

How Your Organization Can Nurture Innovation While Balancing Risk

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Fareed Zakaria Dissects the Challenges Shaping the Post-Pandemic World

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Spending at Independent Schools Impacted by COVID-19

The effects of COVID-19 have been felt across the entire nonprofit sector and the independent schools’ community is no different. For the Commonfund Benchmarks Study® of Independent Schools (CSIS)...

Managing Financial Challenges During Crisis – A Checklist for Higher Education

Many educational institutions are facing unpredictable financial challenges as a result of the COVID-19 pandemic. Costs associated with implementing technologies for virtual learning, decreased...

What Does the NTSE One-year Number Tell You? As it Turns Out, Not Much.

I love the NACUBO-TIAA Study of Endowments. Every year, I eagerly await the annual report from the National Association of College and University Business Officers on the investment performance and...

Viewpoint | Why are Gifts to Endowments Declining?

For the third straight year, Commonfund Benchmarks Study® of Independent Schools (CSIS) participants reported average new gifts to endowment declined, this year falling to an average of $1.2 million...

From Generosity to Justice | Observations from the President of Ford Foundation

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

What Strategic Decisions are Investment Committees Focused On?

Independent schools have been faced with fundamental shifts in their business model and have adapted to stay true to their educational missions. This year has been particularly difficult for many...

Chart of the Month | The Stock Market Rally May Finally Be Broadening Beyond Tech Names

The trend of improving performance of sectors most sensitive to the strengthening economy remained on track in February 2021. For the most part of 2020, the traditional S&P 500 market-cap-weighted...

Commonfund’s Second Invitational Diverse Manager Day

Earlier this month, Commonfund held its second invitational Diverse Manager Day with 19 managers identified through our Diverse Manager Portal. These diverse managers1 , from historically...

Chart of the Month | Are Bonds Still a Good Hedge for Equity Market Declines?

In the middle of January, the Biden administration announced the details on a new $1.9 trillion stimulus package, including enhanced unemployment benefits, an increase in the minimum wage, and...

Chart of the Month | Beware of High Yield Bonds

Income-hungry investors continued to push yields on speculative grade bonds to new lows despite the challenging business conditions this year. The yield on the Bloomberg Barclays Corporate High Yield...

Board of Trustees and Investment Committee Roles and Responsibilities

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship”– Purpose, Policy, Process, Portfolio, People and...

Investment Governance | Are You Asking These Three Questions?

In the midst of a global pandemic, many non-profit business models are being challenged which has put significant pressures on staff, governing boards and committees. These pressures on time and...

Foundation Spending Strategy – Meeting the Moment in 2020 and Beyond

This year has been incredibly difficult. One of the most contentious and turbulent presidential elections and transitions in American History. COVID-19 and the consequential social and economic...

Chart of the Month | Are Value Stocks Finally Going to Make a Run?

The month of November saw a sharp rotation into value equities at the expense of technology and communication services companies, causing investors to wonder whether the long-run dominance of growth...

A Financial Framework for the COVID Crisis

Despite the fall semester looking much better than the worst-case scenarios contemplated in early summer, higher education in America continues to grapple with the enormous challenges that the...

Chart of the Month | Recession Impacts on Employment and Wages

It may come as a surprise to many that average disposable personal incomes have increased by 6.6 percent from February prior to the pandemic through August. This is down from a high of 9.8 percent in...

The Key Endowment Questions for Challenging Times

During this time of unprecedented challenges, the financial health of colleges and universities is a critical concern. Boards, investment committees, institutional leaders, and their advisors must...

Top Ten Tips for Better OCIO RFPs

A tightly run RFP process can help ensure your organization will find an ideal investment partner to help you fulfill your organization’s mission. As the second installment of our blog series on the...

Chart of the Month | Low Rates Make Record Government Debt Manageable – For Now

Few people would have predicted that U.S. equity markets would be higher today than at the start of 2020 if told that a virus would infect over 7.0 million people in the U.S., cause over 200,000...

Is It Time to Issue an Investment Manager RFP for Your Nonprofit?

Best practice for nonprofits is to issue a Request for Proposal (“RFP”) for an investment management partner every market cycle. Typically, that is at least every 7 to 10 years, or as it is...

Balancing Purpose, Payout, and Permanence: A Strategy Guide for Foundations

In partnership with the Council on Foundations, the National Center for Family Philanthropy has released Balancing Purpose, Payout, and Permanence: A Strategy Guide. Commonfund Institute is very...

Chart of the Month | Inflation Expectations Surge, Driving Real Interest Rates Down

Chairman Powell’s speech at Jackson Hole during the last week of August confirmed the Fed’s dovish policy stance, giving investors ample support in terms of low rates and a flexible inflation...

Investing in Racial Equity: A Primer for University & College Endowments

Commonfund and Commonfund Institute are very happy to contribute to the new report from Intentional Endowments Network (IEN), “Investing in Racial Equity: A Primer for University & College...

Observations on Diverse Manager Selection Across Asset Classes

At Commonfund, we believe diverse managers offer clients access to investment talent and valuable investment opportunities and therefore should be explored and invested in. Overlooking the merits of...

Capturing Credit Opportunities in Times of Crisis

Key takeaways During periods of dislocation in high-quality credit, investors should stay the course within fixed income portfolios and maintain active risk to benefit from the inevitable rebound...

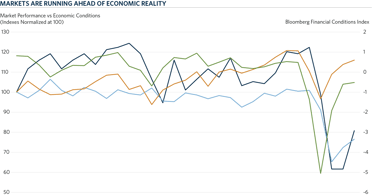

Chart of the Month | Markets are Running Ahead of Economic Reality

When investors open their second quarter investment reports, many will be shocked by the magnitude of stock market gains in the second quarter. Their surprise could be voiced by a rhetorical question...

Real Estate – Can’t Touch This!

Few markets have been as heavily impacted by the onset of the global pandemic as real estate. Real estate is considered a hard asset that “you can touch and feel”, but during a pandemic no one wants...

Balancing Risk and Return

Risk surrounds us, and for investment fiduciaries it is inescapable if meaningful real returns are to be sought. While risk and return constitute the axes upon which investment portfolios are built,...

Chart of the Month | Measuring Social Distancing with Mobility Trends

We continue to monitor the level of social distancing as an indicator for business activity and improvement in consumer sentiment. Personal spending experienced the largest month-over-month drop on...

When Will this Crisis End? 3 Keys to Recovery

When will this crisis end? Following are three key issues fiduciaries should keep in mind concerning COVID-19 and this pandemic recession and recovery. The path and trajectory of COVID-19 This is...

Stewardship During This Crisis: Five Things for Boards to Consider

As the world continues to grapple with the social, economic, and public health implications of the current COVID-19 crisis, nonprofit organizations and their boards are working tirelessly to...

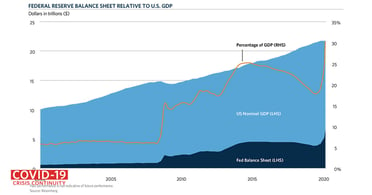

Chart of the Month | The Fed Rides to the Rescue

The Federal Reserve is determined to support the economy and the normal functioning of capital markets during the COVID-19 pandemic. As of April 29th, the total asset size of the Fed’s balance sheet...

Crisis Response: A Framework for Strategic Decisions

With the equity markets retracing some of the losses that occurred in the first calendar quarter of 2020, endowment market values are likely recovering more quickly than we may have feared during the...

Five Key Points of the Investment Policy Statement

The central document guiding the management of a nonprofit institution’s endowment—essentially, the strategic plan of the investment committee—is the investment policy statement (IPS). The IPS should...

COVID-19 and Nonprofits | Five Observations from China

Although the full effects of the COVID-19 pandemic on U.S. nonprofits will not be known for some time there may be something to learn from what we’re seeing in China. China was the first country to...

Do Bear Markets Favor Active or Passive Investing? It Depends.

In the ongoing debate about active versus passive investing, conventional wisdom posits that active investing outperforms passive in recessionary or bear market environments. The question is: Will...

Chart of the Month | The Dangers of Timing a Bear Market

It has been well documented that trying to avoid market downturns by selling out of stocks and moving to cash can be damaging to long-term portfolio values. And while there are strong behavioral...

10 Tips for Stewarding People Remotely

Six key words – Purpose, Policy, Process, Portfolio, People, and Perspective – form a framework for effective endowment stewardship. As trustees, investment committee members, and senior management...

Coronavirus: Five Key Questions for Nonprofit Institutions

There is no question that we are in unprecedented times and will likely remain so for longer than we anticipated even a few weeks ago. The speed at which a new reality has been imposed on all of us...

Chart of the Month | A Price War Erupts in the Oil Market

Oil prices declined over 21 percent on March 9, 2020, the largest single-day decline since January 1991 during the Gulf War[1]. There was optimism prior to the OPEC (Organization of Petroleum...

Market Commentary: Impact of the Coronavirus on Markets and Portfolios

After a strong calendar year 2019, the S&P 500 reached its most recent all-time high on February 19, up nearly 5 percent since the year began. Now, a week later, the global equity markets have fallen...

Chart of the Month | Central Banks Increasingly Accommodative

World markets appeared to be returning to their upward trend in the beginning of February after a volatile start of the year. While concerns about global growth caused by the coronavirus outbreak are...

Long-Term Equity Investors: A Global Perspective

Over the past decade U.S. equities have consistently outperformed international markets, leading many investors to question the role of non-U.S. equities in their portfolio. While the current cycle...

Commonfund’s First Invitational Diverse Manager Day

On January 16th Commonfund held its first invitational Diverse Manager Day. The day was made possible as a result of the success we had from submissions to the Diverse Manager Portal launched last...

Chart of the Month | Election Year Market Trends

As we enter the 12th year of economic expansion since the Great Financial Crisis, investors continue to wonder whether 2020 will be the year when equity markets finally experience a correction....

Impact Investing Trends - A Market Matures

Investment strategy influenced by altruistic intentions – broadly, impact investing – has long held sway in a small number of portfolios. Historically, impact investing has failed to gain significant...

Purpose: What is an Endowment?

A critically important asset for many nonprofit organizations is their endowment, sometimes referred to by a different name such as long-term investment fund. So important is this pool of financial...

The Economy and Markets March On

Summary Positive signs on trade drove recent new highs in the U.S. equity markets The Fed continues to be accommodative and employment is strong Growth is slowing but is supported by the consumer,...

Tactical Allocation: Winning Strategy or a Fool’s Game?

Institutional investors overseeing long-term pools of capital typically define their strategic asset allocation with specific targets and bands or ranges around those targets, which allow for...

Announcing the Commonfund Diverse Manager Portal

In the fall of 2018, Commonfund announced the creation of its Diversity and Inclusion Office with the mission to “intentionally promote and foster inclusion and equity across Commonfund and our...

Looking at Gender Lens Investing

What is Gender Lens Investing? Gender lens investing has garnered significant traction in the last decade. Broadly speaking, it aims to achieve financial returns and benefit women. Given the breadth...

Traits of High-performing Boards … and Steps Toward Becoming One

When this was published, Tom Hyatt was a partner in the Washington. D.C. law firm of Dentons US LLP and an authority on nonprofit governance. This blog is excerpted from a presentation he made at the...

Back to Basics: The ABCs of Nonprofit Governance Models

When this was published, Tom Hyatt was a partner in the Washington. D.C. law firm of Dentons US LLP and an authority on nonprofit governance. This blog is excerpted from a presentation he made at the...

Emerging and Diverse Manager Programs: Worth Doing Well

Michael Rowland was the Commonfund Institute Summer Intern in 2019. When this was published he was a rising senior at Case Western Reserve University majoring in Finance and Accounting. What are...

Recession – Maybe This Time is Different

The July Federal Open Markets Committee (FOMC) meeting signaled the end of central bank rate normalization with the first rate cut in more than a decade. The last time the FOMC cut rates was in...

Commonfund Hosts Girls Who Invest at NYC Event

Girls Who Invest (GWI) is an organization focused on bringing more women into the field of asset management, a goal that Commonfund strongly supports. Every year, GWI invites rising juniors into...

The 5 Top Stewardship Imperatives

Christopher K. Merker, PhD, CFA, is a financial advisor and director of Private Asset Management at Robert W. Baird & Co. and an adjunct professor at Marquette University. He is also the co-author of...

Higher Ed: Philanthropy is an Adjunct, Public Policy Deserves Tenure

In the last few months, high profile nonprofit institutions have come under intense scrutiny for ethical dilemmas pertaining to the stewardship of resources meant to support mission. This is Part...

The Case for Using the Higher Education Price Index® (HEPI) to Define Inflation for Colleges

When calculating return targets for an endowment portfolio, a conventional piece of the equation is often the Consumer Price Index (CPI). CPI plus 5% is the common short-hand formula for institutions...

Investment Manager Fees Part II: Creating Alignment

In Part I of this blog series, “Investment Manager Fees: Out of Sight, Out of Mind”, we discussed our approach to determining the value of an asset manager and how we might calculate a fair price for...

Nonprofit Hospitals - Big Business in Nonprofit Clothing?

In the last few months, high profile nonprofit institutions have come under intense scrutiny for ethical dilemmas pertaining to the stewardship of resources meant to support mission. This is Part Two...

Summer Reading from the Stewardship Academy Faculty

As the last week of June approaches, investment stewards begin to prepare for summer – a time for relaxing, reflecting, and reading. We asked faculty members from the Investment Stewardship Academy,...

Museums and Cultural Institutions: To Accept or Not to Accept, That Is the Question

In the last few months, high profile nonprofit institutions have come under intense scrutiny for ethical dilemmas pertaining to the stewardship of resources meant to support mission. In a three-part...

Commonfund Forum: A Carbon Neutral Event in 2019

In just two years Commonfund will celebrate its 50th anniversary as a non-profit investment manager for educational endowments, foundations and other tax-exempt investors. Throughout those almost...

Investment Manager Fees: Out of Sight, Out of Mind

One of the most pressing questions facing fiduciaries is that of investment management fees. We think it is a healthy and necessary discussion, as even small fees can have a big impact on performance...

Risk Management and Operations: 5 Takeaways from Commonfund Forum 2019

The majority of investors’ attention is often focused on the performance of the funds or managers in their portfolio. And rightfully so. The numbers that appear on statements month after month will...

Taking a Fresh Look at Spending Models

Investors have limited control over the returns their portfolios generate. They have more control over their spending. That doesn’t make it easy. Compared to some earlier periods, volatility in the...

Surprising Stewardship Lessons from the Miracle on the Hudson

“When you’ve suffered a complete loss of engine thrust over the largest city in America, you must act quickly and independently to address the developing situation. But, you must also trust in the...

5 Key Questions When Comparing OCIO Provider Fees

The market for Outsourced Chief Investment Officer (“OCIO”) services has boomed over the last decade. Today, OCIO assets under management are by some estimates nearly $1.5 trillion, 2.5 times the...

Donor Advised Funds: Changing the Philanthropic Landscape for Higher Education

Donor Advised Funds (DAFs) are the fastest growing giving vehicle in philanthropy. The Council on Foundations defines DAFs as: “A type of charitable giving fund that is established by a donor with an...

A sit-down with Richard Fisher

As a follow-on to the Commonfund Forum 2019 panel discussion, The Global Economy and the Return of Risk, Richard Fisher, former President and CEO of the Federal Reserve Bank of Dallas, further...

The Fallacy of Manager Diversification – How “Horse Races” Can Increase, Not Reduce Risk

On the surface, hiring two (or more) multi-asset managers to manage an entire portfolio may seem like a good idea. Intuitively, it would seem to reduce manager concentration risk, and provide...

How to get Started in Responsible Investing

The biggest challenge in implementing any type of responsible investment program is in clearly defining and prioritizing those issues most relevant to an organization. Although it may seem a...

Stormy Markets, Steady Institutional Investors

This blog is reprinted with permission by Net Assets, published by the National Business Officers Association (NBOA). The original article can be found here. Investment guidelines enable institutions...

Identifying an “E” Factor

Over the past year the Commonfund investment teams have undertaken research to identify and isolate a new factor associated with the environmental sustainability of a stock (or a portfolio of...

Applying the Endowment Model to Diversity and Inclusion

Commonfund recently launched a Diversity Office, a formal, cross departmental effort focused on diversity and inclusion. The mission of the Commonfund Diversity Office is to intentionally promote and...

A Cost-Effective Approach to Hedge Fund Allocations: Part 2

Let’s start with a quick recap of Part 1 of this story, which can be boiled down to three main points: Investors often spend too much for market beta, paying “2 and 20” for hedge funds that deliver...

A Cost-Effective Approach to Hedge Fund Allocations: Part 1

At the risk of beating a dead horse, hedge funds are not an asset class. This is especially true in the way in which Commonfund selects and constructs its hedge fund portfolios: focusing...

Are You Ready for the Next Crisis?

Ten years ago Lehman Brothers failed, representing the largest bankruptcy in history, and accelerating a global financial crisis that would knock many non-profit portfolios backward. This came on the...

7 Major Findings - Commonfund Benchmarks Study of Healthcare Organizations

Fifty-six healthcare organizations participated in the 2016–2017 Commonfund Benchmarks Study® of Healthcare Organizations. These organizations reported an average investable asset pool of $2.1...

Viewpoint: Responsible Investing - Read All About It

The new and newsworthy in this year’s Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) is headlined by responsible investing. No other...

The Four P’s of Investment Decisions: Lessons from the Commonfund Institute

Three days after becoming Executive Director of the Commonfund Institute, I found myself at Yale University in New Haven giving welcoming remarks at our annual educational program. Although I will...

Equity Portfolio Construction – Through a Risk Factor Lens

At Commonfund, we aim to build multi-manager, active risk equity portfolios with a clear objective of consistent outperformance versus passive policy benchmarks. Our approach is to take intentional...

Bonds: Unwanted and Unloved but not Unnecessary

Well, the party may finally be over. Like the college dean who shuts down the campus party, the Fed has finally taken away the interest rate punch bowl that investors have enjoyed for so long. It may...

Real Estate Credit Environment: Risk Off - Risk On

Earlier last year real estate markets received a scare as CMBS spreads widened, particularly in lower rated and more junior tranches. Additionally, one of the most respected U.S. real estate research...

Investing in Diversity

At Commonfund, we scour the globe to find investment managers that we believe have the ability to consistently produce excess returns (alpha) over and beyond their benchmark. But alpha alone is not...

Baring Their Teeth – FAANGs Take a Bite Out of the Equity Market

Narrow market leadership in the U.S. and Emerging Markets proves challenging for active managers Narrow markets are not uncommon to equity investors. They tend to manifest themselves during the best...

A Gap In Reality

With the release of the annual NACUBO-Commonfund Study of Endowments (NCSE) comes the obligatory comparison of 1-year returns. “How did we do relative to the 12.2 percent average return” is a...

Despite Strong FY2017, Endowments Report Decline in Ten-Year Return

Despite 12.2 percent return for FY2017, educational endowments report a decline in their 10-Year return while large institutions lead increase in effective spending rate Data gathered from 809 U.S....

When Leaks Turn into Floods: Challenges Facing Higher Education

2017’s tax legislation is the latest in a growing list of challenges facing higher education. The new excise taxes on endowment earnings of the largest private universities, coupled with the...

Bonds May Not Be Loved, But They Shouldn't Be Forgotten

Summary TODAY, THERE IS A GOOD DEAL OF HAND WRINGING OVER THE RISK OF RISING RATES. WHILE RISING LONG-TERM RATES COULD BE A HEADWIND FOR CORE FIXED INCOME, AS LONG AS RATES RISE FAIRLY MODESTLY THE...

Tax Reform: CPI Plus More

It was another taxing weekend (literally) at Commonfund as we digested 1,097 pages of the conference agreement for the tax reform bill (the “Tax Act”) and its implications for our country and for the...

The Tax Man Cometh (And Not Just for the Ivies)

UPDATE: Since this blog was published there have been further developments related to the Tax Cuts and Jobs Act. Please see our post Tax Cuts and Jobs Act: CPI Plus More for our latest thinking. With...

Spending Policy: Is Yours Ready for the Next Downturn?

In most Investment Policy Statements there is often a reference to two important, but conflicting, objectives: one, to preserve the purchasing power of the long-term portfolio in real terms, and two,...

Emerging Market Equities Turn the Corner

As we progress through calendar year 2017, we have witnessed the continuation of the equity bull market started in 2009. One difference however, is that leadership has turned (finally!) to non-U.S...

On Complacency | Why Risk Management Always Matters

Like nearly everything in the financial markets, risk is cyclical. History repeats itself. The echoes of past crises are always heard in present ones, yet new crises are rarely predicted and not...

A Primer on Outsourced Investment Management

Once seen primarily as a solution for small institutions with limited resources, outsourced investment management is now widespread, with a broad range of long-term investors – including those with...

How Much Beta is in Your Equity Portfolio?

Leveling the Field in the “Tug of War” Between Active and Passive… Active Equity Manager Universal Objective: Outperform the Passive Alternative It’s undeniable that every active equity manager’s...

Thoughts on the Role of Credit in Institutional Portfolios

While most institutional portfolios have allocations to investment grade corporate credit, as a strategic allocation high yield and emerging market credit (liquid credit) are sometimes overlooked....

WannaCry? WannaRun, WannaHide! Managing Cybersecurity Risk

Over the last year there has been no shortage of things to keep investors, asset managers, and risk managers concerned. Despite these exogenous shocks most equity markets have continued to shake off...

Flexing Your Global Portfolio Can Lead to ACWI Fatigue, but Don't Throw in the Towel Yet

Like the build-up of lactic acid in your muscles after a strenuous workout, the underperformance of Morgan Stanley Capital International All Country World index (MSCI ACWI) vs. the Standard & Poor’s...

Active Fee Management: Notes from the Front Lines