In the middle of January, the Biden administration announced the details on a new $1.9 trillion stimulus package, including enhanced unemployment benefits, an increase in the minimum wage, and support for small businesses, state and local governments and further spending on education and vaccine distribution. Additional Treasury issuance to fund the growing budget deficits, along with economists’ optimistic growth projections for 2021, led nominal 10-year yields to reach 1.19 percent, an increase of 28 bps since the start of the month. While 10-year yields bottomed in the beginning of August 2020 and have been rising since then, investors have been wondering how high yields could climb in 2021. Further, if the Fed begins to taper earlier than expected, how will a sharp increase in interest rates impact traditional equities and fixed income portfolios? Bonds have proven their worth during every crisis in the last 30 years despite investors predicting their end as a portfolio diversifier as interest rates crept ever lower. However, as 10-year yields fell to 0.5 percent in August, investors may have been right to question whether historically expensive Treasuries can hedge a potential sell-off in historically overpriced equities.

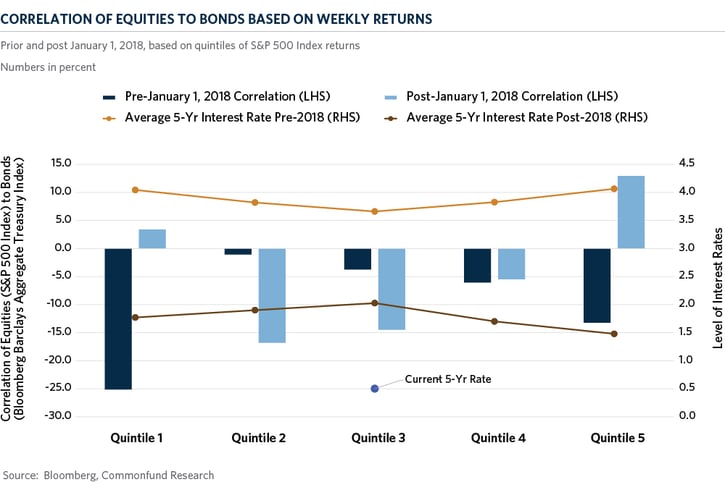

In this month’s chart, we focus on the correlation between equity and bond prices as an indication of bonds’ future ability to protect portfolios during equity declines. We analyze weekly rolling returns of the S&P 500 and the Bloomberg Barclays Aggregate Treasury indices, which are sorted from weakest to highest with Quintile 1 representing the worst 20 percent of weekly returns and Quintile 5 representing the best 20 percent of weekly returns. Then, we calculate the correlation between the weekly equity returns and the corresponding bond returns for each one of the five quintiles, performing the analysis for periods prior to 2018 and after. The correlations are shown in the dark and light blue bars, while the orange and brown lines represent the average interest rate pre- and post-2018. It is important to note that prior to 2018, bonds provided the most protection, indicated by the most negative correlation, during the largest drawdowns in equities. Correlation was also negative in periods of strong equity gains as economic growth and real rates increased, leading to negative bond returns. Post 2018, the protection from bonds during the weakest equity returns has disappeared as indicated by the slightly positive light blue bar in Quintile 1—meaning bonds declined simultaneously with equities. Bonds have also demonstrated positive correlation during the best weekly equity returns over the last three years. The low yield in Treasuries has led investors to increase allocations to high yield credit—which could be correlated with equities—increasing the total equity-like risk in the portfolio.

At Commonfund, our public credit allocations are underweight high yield credit as we expect default rates to peak in 2021 while our private credit strategies allocate to senior short-term corporate loans which may benefit from an increase in short-term interest rates. It is important to note, that a sudden tapering of Fed support is unlikely to go unpunished by both equities and fixed income markets which is why Fed Chairman Powell has been anxious to reassure investors that substantially more economic progress is needed before any tapering is considered. Similarly, most forecasters continue to expect a very slow increase in interest rates, although most of the recent move up occurred on the back of higher inflation expectations. However, in the 10+ years since the Global Financial Crisis, realized inflation has consistently fallen short of target and the sensitivity of interest rates to increases in economic growth expectations has also been diminishing. Finally, we believe that reduced industrial capacity utilization and slack in the labor market, together with a slower-than-expected roll-out of vaccines should limit the rebound in pent-up demand and keep interest rates contained in 2021.