Market Commentary | Insights Blog

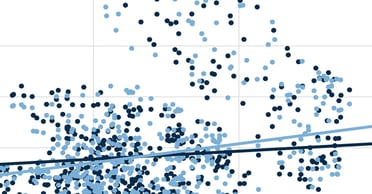

The New Era of Market Concentration

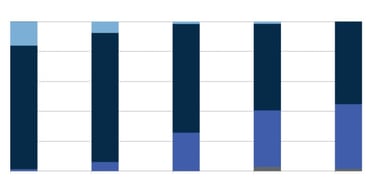

Market concentration has become a key theme, with the top 10 companies constituting more than 40 percent of the S&P 500 Index by market capitalization. This comfortably surpasses market concentration...

Market Commentary | Private Equity Insights

Private Markets Year in Review and 2026 Outlook

As we enter our 38th year, we write to share with you our year-end letter and observations of what may be ahead in 2026 in the private equity investment environment.

Market Commentary | Insights Blog

Implications of the U.S. Arrest of Venezuelan President Nicolas Maduro

This past weekend U.S. Special Forces launched a large-scale military operation in Venezuela and in the process captured and arrested Venezuelan President Nicolas Maduro and his wife, Cilia Flores....

Market Commentary | Insights Blog

Year-End Update and 2026 Investment Outlook

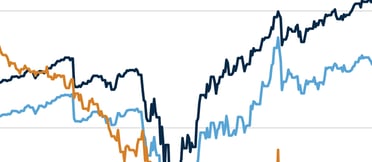

Calendar year 2025 delivered strong equity market returns globally, continuing the outsized performance of the past two years. In the U.S., the S&P 500 index returned 17.9 percent. Not to be outdone,...

Market Commentary | Insights Blog

U.S. Government Shutdown Ends: Economic Impact and Next Steps

After 43 days of political deadlock, the longest government shutdown in U.S. history finally ended when Congress recently passed a last-minute funding bill signed by President Trump. The standoff,...

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 8 In this episode of the Commonfund OCIO Point of View podcast, Julia Mord, Chief Investment Officer, Commonfund OCIO, discusses the current state of capital markets with Aaron Miller,...

Market Commentary | Insights Blog

More Than Multiples: Understanding the Broader Drivers of Equity Valuations

The S&P 500 has produced a ~25 percent annualized return for the three successive years ending September 2025, a banner period of performance.

Market Commentary | Insights Blog

AI and the Productivity Paradox: Are We Finally Seeing the Payoff?

Artificial Intelligence (AI) remains the most compelling theme in global markets today. With OpenAI and Anthropic recently valued at $300 billion and $183 billion, respectively, and tech giants, like...

Market Commentary | Insights Blog

Tariff Worries Are Likely Here to Stay

Over the last five months, tariffs have fluctuated as deadlines have come and gone. Deals have gotten done, the frameworks of deals have been announced and for countries less willing to negotiate,...

Market Commentary | Private Equity Insights

Data Center and AI Power Demand – Will Nuclear Be the Answer?

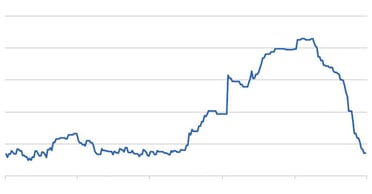

For nearly two decades, power demand in the United States was largely flat. This period of flat demand saw, setting aside an early pandemic era reversal, significant growth from 2017 to 2023. This...

Market Commentary | Insights Blog

Deficit Spending Remains a Constant Despite a Change in Leadership

A few years ago, Commonfund published a commentary on the budget battles in Washington. The world was navigating a pandemic. Joe Biden had just been elected and needed to offset the economic impact...

Market Commentary | Private Equity Insights

Regulatory Fog Is Lifting: Blockchain's Institutional Moment

The 2024 U.S. elections appear to have signaled a watershed moment for the blockchain industry. With a new wave of pro-innovation policymakers entering office, the regulatory and political landscape...

Market Commentary | Insights Blog

Fiscal Year-End and Mid-Year 2025 Market and Investment Review

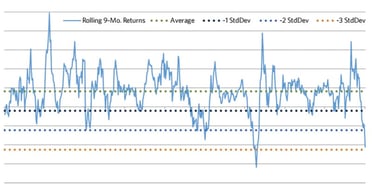

Institutional investors aim to construct long-term asset allocations to withstand bouts of short-term volatility and periods of market uncertainty. This concept was certainly tested in fiscal year...

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 7 In this episode we cover our macro-economic outlook, the markets have rebounded significantly, while concerns about tariffs have lessened. However, global growth has been downgraded,...

Market Commentary | Insights Blog

Fiscal Policy Impacts on the Economy: Maybe too early to tell….

We are now more than 100 days into the Trump administration and six weeks past the “Liberation Day” tariff announcements. In that time the S&P 500 has reached it’s all time high, sold off more than...

Market Commentary | Insights Blog

Policy Uncertainty Impacts All Assets (Not Just Equities!)

Since the February peak in the S&P 500, reams of newsprint have been dedicated to the volatility in the equity markets and to a lesser extent the U.S. Treasury markets – but what about the U.S....

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 6 In this episode we cover our macro-economic outlook, discuss the U.S. stock market, on going news of new tariffs and inflation, as well as the likelihood of a recession. Lastly, we give our...

Market Commentary | Private Equity Insights

Blossoming New Era of Secondaries

The Secondary market vaulted to a record year in 2024 and is poised for another record-breaking year in 2025. Secondary market growth is constrained by both a lack of investable and human capital....

Market Commentary | Private Equity Insights

Private Equity Trends in 2024: Year in Review and Looking Forward

In our blog published early last year, Private Equity in 2024: Where Do We Go from Here, we posited private equity trends in 2024 would rebound following a sluggish 2022-2023 period, driven by a...

Market Commentary | Insights Blog

The Housing Market Paradox

The U.S. housing market stands at a critical juncture as sectors adjust to the anticipated Trump administration. While various industries are pricing in different expectations, housing faces unique...

Market Commentary | Insights Blog

U.S. Trade Deficit Reaches Record High Amid Global Trade Shifts

As of September 2024, the U.S. trade deficit stands at $84.4 billion, marking the highest level since the onset of the Russia-Ukraine war in 2022. During that period in the conflict, the deficit...

Market Commentary | Private Equity Insights

Real Assets and Sustainability Investing Post-2024 Election

The 2024 United States election cycle appears to have handed a Republican sweep with control of the White House, the Senate, and a slender House majority. With President-elect Trump soon to return to...

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 5 In this episode we cover the macro perspective and how we analyze the Fed and interest rate risks. We also talk about fixed income and equities.

Market Commentary | Insights Blog

The Pivot Heard Around the World

A U.S. Federal Reserve (“Fed”) pivot is felt throughout global markets, affecting economies worldwide.

Market Commentary | Private Equity Insights

Challenging Headlines Abound for “Cleantech 2.0” – As Opportunities Persist

Market cycles of euphoria followed by the inevitable hangover are not new for investors – but some headaches are sharper than others, the worst of which can blur one’s vision the morning after.

Market Commentary | Private Equity Insights

Why European Private Equity? Why Now?

The Case for Private Equity Investments in Europe’s Lower Mid-Market

Market Commentary | Insights Blog

Stay the Course: Long-Term Investing Beyond Election Volatility

Presidential elections often beget new theories about how candidates might influence financial markets. This year is especially pivotal, with nearly half of the global population participating in...

Market Commentary | Private Equity Insights

Is the Generative AI Opportunity Bigger than the Software and IT Markets?

We are entering the next phase where start-ups harnessing generative AI opportunities possess the potential to fundamentally re-invent the $65T services market. This opportunity represents more than...

Market Commentary | Insights Blog

Is Your Portfolio Positioned for Lower Rates?

Until recently, investors were no doubt pleased with the continued strong equity performance in 2024 that resulted in new highs in the major domestic indices and strong returns globally.

Market Commentary | Insights Blog

Educational Alpha Podcast: A Conversation with Mark Anson

In this episode of the "Educational Alpha Podcast" host Bill Kelly sits down with Mark Anson, CEO and CIO of Commonfund to explore the evolution of the endowment model and its ongoing relevance in...

Market Commentary | Private Equity Insights

The Secondary Market is Vaulting Over Prior Records

2024 is expected to be a record year for secondaries, but the market volume should be even larger. The secondary market remains undercapitalized and under-resourced. Investors are unable to transact...

Market Commentary | Private Equity Insights

Are Mega-Cap Technology Stocks Enough to Ride the AI Wave?

The past 18 months have witnessed the dominance of a small group of tech stocks in the U.S. equity market. Collectively dubbed the Magnificent Seven (Mag 7)1, these stocks as a basket have...

Market Commentary | Insights Blog

How Long Can the Yen Carry Trade Carry On?

Since Japan's economic crash in the 1990s, the Bank of Japan (BOJ) has maintained extremely low interest rates to combat deflation. For nearly a decade, Japan's benchmark rate has been negative,...

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 4 In this episode we cover the macro perspective and how we analyze the Fed and interest rate risks. We also talk through the upcoming U.S. election and policy approaches.

Market Commentary | Insights Blog

Fiscal Year-End and Mid-Year 2024 Market and Investment Review

Over the last 12 months, the global stock markets demonstrated remarkable resilience and growth despite several challenges, including persistently high interest rates, geopolitical instability, and...

Market Commentary | Insights Blog

The Fed and Markets Expectations Start to Align

It took six months, but the FOMC and the short-term rates markets are finally in alignment with respect to the level of the Fed Funds rate as we approach the second half of 2024. Since the beginning...

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 3 In this episode we cover the employment market, our views on interest rates and artificial intelligence (AI). Lastly, our view on the most important thing investors should be looking for in...

Market Commentary | Articles

Tour de World: Global Equity Investing Now

Better valuations. Innovation hotspots. Opportunities to add value. Geopolitical tensions. Debt burdens. Trade imbalances. Equity investing outside the U.S. holds its attractions—and risks. A report...

Market Commentary | Insights Blog

What's Driving Surprisingly Low Volatility in Energy Markets?

In the current geopolitical environment, we would have historically expected much more volatility in the energy complex. Oddly, that has not been the case over the last 6 months. In fact, crude oil...

Market Commentary | Insights Blog

The Economic Equation: Solving for the Unknowns

2 + 2 = ? In the world of economics—a lot of variables may mess with the answer. Two sessions early in the agenda at Commonfund Forum 2024 brought into focus the range of scenarios in play for...

Market Commentary | Private Equity Insights

Opportunities in Sustainability Private Investing

Global macroeconomic trends signal an increased level of investment in the climate and energy transition sectors, despite broader market volatility over the past few years, as investors aim to seize...

Market Commentary | Private Equity Insights

Cash is Queen

2023 was the lowest year in 10 years for U.S. private equity distributions.1 Without the cash from exits, private equity investors are struggling to commit to new private equity funds. Lessons...

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 2 In this episode we cover our macro-economic outlook, portfolio diversification and the role of hedge funds. Lastly, we give our perspective on the markets going forward.

Market Commentary | Private Equity Insights

Private Equity in 2024: Where Do We Go from Here?

2023 WRAP-UP 2023 marked a second straight year of lower deal volumes for private equity following the record-breaking activity of 2021. U.S. private equity aggregate deal value declined to $645.3...

Market Commentary | Insights Blog

China Continues to Drag Emerging Markets into 2024

2023 marked the third year of drawdowns for the Chinese equity markets, reflecting a country still trying to emerge from the pandemic period. A combination of factors continued to hamper the once...

Market Commentary | Insights Blog

Bad News is “Good” for Markets to Close 2023

As we inch closer to 2024, domestic markets have been largely driven by shifts in sentiment surrounding the macroeconomic environment, leading many to question the relationship between “bad news” and...

Market Commentary | Private Equity Insights

The Impact of the Rising Cost of Debt on Private Equity

As the cost of debt on private equity ("PE") has risen and its availability has fallen, deal-making within PE has slowed. PE firms that have historically been overly reliant on leverage in financing...

Market Commentary | Insights Blog

City of the Big Shoulders: Key Takeaways from our Chicago CIO/CFO Roundtable

For more than 50 years, Commonfund has been working with boards and investment committees to design and implement investment structures that support and maintain intergenerational equity - the...

Market Commentary | Podcasts

Commonfund OCIO Point of View

Episode 1 In this episode we cover our macro-economic outlook, delve into public and private equities, the impact of higher inflation and interest rates on fixed income and credit strategies, as well...

Market Commentary | Private Equity Insights

Venture Capital Valuation "Marks": What’s in Your Wallet?

In order to underwrite new commitments in an uncertain market environment, it is critical to normalize valuation methodologies and deeply analyze underlying portfolio companies.

Market Commentary | Insights Blog

Yield Curve Dynamics in Focus to Close 2023

After a relatively tame summer, significant cross-asset volatility has returned with both the MOVE and VIX indices increasing by 37 and 48 percent respectively, after approaching the lows for 2023 in...

Market Commentary | Insights Blog

Private Credit Today

On September 27th, Commonfund OCIO hosted an event in Minneapolis at the O’Shaughnessy Distilling Co. Following a tour and tasting at the facility, Nicole Melwood, Director, and Vincent Kravec,...

Market Commentary | Private Equity Insights

Inflation Reduction Act: Catalyst for U.S. Domestic Solar Manufacturing

In the context of rising resource security concerns amid the energy transition, legislators and regulators across the developed West are making a concerted effort to re-orient resource supply chains....

Market Commentary | Private Equity Insights

Investing in the Sustainable Evolution of the Industrial Ecosystem

CF Private Equity’s Real Assets and Sustainability team recently hosted a fireside chat webinar with the Noveon Magnetics CEO, Scott Dunn. Preceding this conversation was a brief overview of CF...

Market Commentary | Insights Blog

Real Estate and Negative Leverage – The long and the short of it...

The recent rise of the U.S. 10-year interest rate will likely prove difficult for most real estate assets given that the historic inversion in the yield curve has provided some refuge from the sharp...

Market Commentary | Insights Blog

Lagarde Offers Little Comfort Amidst All Time High ECB Rates

Last Thursday marked the tenth hike of the European Central Bank (“ECB”) deposit rate.

Market Commentary | Private Equity Insights

Are LP Secondary Transactions Racing to a Record Year?

In the 1st half of 2023, global secondary market volume was down 25 percent year-over-year (“YoY”), decreasing from $57 billion to $43 billion1. This was partially driven by the 24 percent YoY...

Market Commentary | Insights Blog

Global Currency Returns Diverge

A year ago, the dollar was approaching multi-decade highs as global currencies coped with the most aggressive FOMC hiking cycle of the last forty years.

Market Commentary | Insights Blog

Markets Signal Higher for Longer Interest Rates

Market sentiment on bonds continues to trend lower, leaving the overall open interest in short-dated U.S. Treasury futures net short at an unprecedented level. There is the potential that these short...

Market Commentary | Insights Blog

Fiscal Year-End and Mid-Year 2023 Market and Investment Review

The end of fiscal year 2023, and mid-point of the calendar year, marks the end of the pandemic years. At this point, many have returned to the workplace, at least part time, in-person meetings have...

Market Commentary | Insights Blog

Midyear Rally or Multiple Expansion?

The long-awaited decline in earnings growth appears to be upon us nearly halfway through 2023. Expectations for S&P 500 year-end earnings per share (EPS) growth range from flat to a tepid 1 percent.

Market Commentary | Insights Blog

Is Commercial Real Estate the Next Shoe to Drop?

Over the last year, there has been relentless reporting that the next shoe to drop for the economy and banking system is commercial real estate. The drumbeat runs counter to what we are hearing from...

Market Commentary | Insights Blog

Unemployment Appears Poised to Increase

Other than the impending recession, one of 2023’s most anticipated economic changes has been a labor market slowdown, with both economists and investors expecting a deceleration in economic activity...

Market Commentary | Insights Blog

Yesterday's Sector Laggards are Today's Leaders

Much to the surprise of market participants, global stocks have risen at an impressive pace year to date despite significant macroeconomic headwinds and regional bank troubles. In what can be deemed...

Market Commentary | Insights Blog

Bond Market Expectations Take a Wild Ride

In today’s environment, commentary can seemingly become stale in periods as short as hours, let alone days. Just last month, we wrote how despite tightening lending conditions from banks, other...

Market Commentary | Private Equity Insights

Is the Future Bright for Secondaries?

The continued growth of private equity may lead to a bright future for secondaries as: ~$12.7 trillion of capital has been raised in the last 15 years in private equity, and Over 43,500 funds have...

Market Commentary | Insights Blog

Rate Hikes are Impacting Bank Lending Behavior

As investors grapple with adjusting to 450 basis points of rate hikes (and likely more in sight), the debate on just how quickly monetary policy will transmit through the real economy has returned to...

Market Commentary | Insights Blog

Markets Rally to Close 2022, but Sentiment Remains Dismal

Strong Fourth Quarter for Global Markets Following three quarters of bleak performance, global markets staged a rally to close what was a tumultuous 2022.

Market Commentary | Insights Blog

Supply Chains Take a Wild Ride

In 2021, the word was transitory. This described the expectations of Fed officials and many other prognosticators that elevated inflation would quickly return to the pre-COVID level of at or around 2...

Market Commentary | Insights Blog

Real Estate Takes a Hit from the Fed

In this chart of the month, it is commonly cited that monetary policy tightening has a lagged impact on economic activity. However, as the Federal Reserve drives the cost of capital higher, the...

Market Commentary | Insights Blog

Chart of the Month | The Shape of Inflation

The Consumer Price Index continues to surprise central bankers, commentators, and market participants alike. The latest headline reading of 8.2 percent, which reflects year-over-year price increases...

Market Commentary | Insights Blog

The Endowment Model Proves Its Worth (Again)

Unless you’ve been on a remote island with no Wi-Fi for the past nine months, you are well aware that it has been a rough start for capital markets. In fact, it has been a historically rough start to...

Market Commentary | Insights Blog

The Trouble with Europe

As U.S.-based investors, our clients tend to focus on issues closer to home when evaluating portfolio positioning. Most conversations are focused on the political climate, FOMC actions, localized...

Market Commentary | Insights Blog

The “Divorcification” of Stocks and Bonds

It has been a difficult start for traditional portfolios of stocks and bonds in 2022 as the usual diversification benefits of these asset classes have failed to materialize. As high inflation remains...

Market Commentary | Insights Blog

Real Estate Today … and the Trends Likely To Shape Tomorrow

As it burst onto the world scene in 2020, COVID-19 impacted asset classes and investment strategies across the board. While real estate was no exception, the industry managed a generally strong...

Market Commentary | Insights Blog

Are Stagflation Fears Justified?

Stagflation fears are growing among investors as inflation recently accelerated at the same time 2022 GDP growth projections declined due to weaker consumer sentiment and increased risk aversion. A...

Market Commentary | Insights Blog

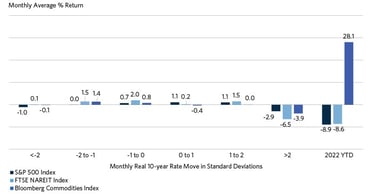

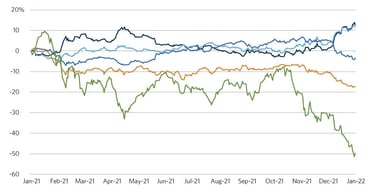

Is this Time Different? Risk Assets and Real Rate Moves

February ended in the same fashion as January, with elevated volatility across a wide spectrum of asset classes. Equities, fixed income, currencies, commodities, and cryptocurrencies all swung...

Market Commentary | Insights Blog

Commonfund Perspective on the Russian Invasion of Ukraine

Key Takeaways As widely anticipated, Russia invaded Ukraine on Thursday, February 24th, causing volatility to spike across the capital markets globally. By the closing bell in the U.S., however,...

Market Commentary | Insights Blog

Tech Stocks Lead the Market Decline in Early 2022

2022 began with one of the worst market performance periods since 2009. While the tech-heavy NASDAQ index looks to finish January with a loss of around 10 percent, value equities will likely record...

Market Commentary | Insights Blog

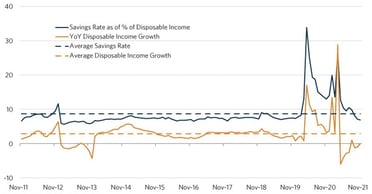

Consumer Savings and Disposable Income Under Pressure

As 2021 comes to an end, we enter 2022 with a good dose of uncertainty in the markets as the Fed begins to reduce and ultimately removes its accommodative policy which has been in place since the...

Market Commentary | Insights Blog

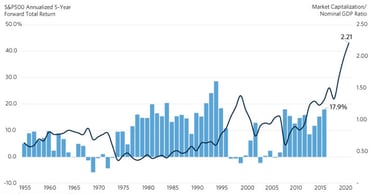

Sky High Valuations Could Spell Weaker Forward Returns

When we look for potential roadblocks that could spoil the breakneck pace of capital markets, the first risk that comes to mind is record-high valuations. While inflation risks have become more...

Market Commentary | Insights Blog

Chart of the Month | Fed Remains Patient on Rate Hikes Despite Market Expectations For A More Aggressive Move

In its latest meeting on November 3rd, the Fed announced its decision to begin scaling back its historic bond purchasing program, marking the beginning of the end of the program that was aimed at...

Market Commentary | Insights Blog

Exiting the Recovery Phase

Third Quarter 2021 Economic Outlook The end of the third quarter 2021 marks a turning point in the economic cycle. It’s the point where, despite the pandemic still being a part of daily lives,...

Market Commentary | Insights Blog

Chart of the Month | Are We on the Verge of a Global Energy Crisis?

It is hard to imagine that in the short span of less than 18 months, energy markets went from a state of overabundance to one of severe shortages and skyrocketing prices. In April 2020, Brent oil...

Market Commentary | Insights Blog

Chart of the Month | The Confusing State of the Labor Market

The U.S. labor market continues to recover from one of the worst declines in employment since the 1930s. In the early days of the pandemic last April, demand for labor plummeted and the unemployment...

Market Commentary | Insights Blog

Chart of the Month | Home Prices Are Up 32 Percent In Five Years – And Still Climbing

Housing demand appears to be slowing down in the first half of 2021, yet home prices have continued to climb at an accelerated pace. This month’s chart highlights the supply and demand factors...

Market Commentary | Insights Blog

Chart of the Month | Supply Chain Woes as the Pandemic Recedes in the U.S.

Supply chain woes continue to wreak havoc for retailers who are grappling with a strong rebound in consumer spending. Average six-month spending on durable goods, spurred by over $5 trillion in...

Market Commentary | Insights Blog

Chart of the Month | Emerging Markets Trail the Pack Despite Rising Demand and Commodities Prices

As growth continues to rebound around the world and investors return to their pre-pandemic way of life, global market performance is beginning to reflect the divergent speed of normalization within...

Market Commentary | Insights Blog

Digging Deeper into Inflation Fears

The current debate about whether the spike we are seeing in inflation is “transitory” should be reframed as “reflation vs sustained inflation.” Just like many other economic data points (ISM,...

Market Commentary | Insights Blog

A New Chapter for the Economy

The key driver of the economy, and of public sentiment, has been the aggressive distribution and acceptance of the COVID-19 vaccines. A litany of measures reflects the improved outlook for the U.S....

Market Commentary | Insights Blog

Chart of the Month | The Surprising Relationship Between Money Supply and Inflation

The potential for rising inflation is becoming a top concern for many investors and consumers. Many believe that inflation is already here as evidenced by price increases in commodities, homes,...

Market Commentary | Private Equity Insights

Trends in the Growing Secondary Market

"The secondary market has become a mainstay for investors, both as 1) more investors move into the secondary market and, 2) as a way to manage investors' existing private portfolios. Both sides of...

Market Commentary | Insights Blog

Chart of the Month | The Stock Market Rally May Finally Be Broadening Beyond Tech Names

The trend of improving performance of sectors most sensitive to the strengthening economy remained on track in February 2021. For the most part of 2020, the traditional S&P 500 market-cap-weighted...

Market Commentary | Private Equity Insights

The Tech Effect and Direct Venture Growth Investing

The venture growth and late stage venture capital (“VC”) market has matured over the last 10 years, and direct investing has emerged as an attractive strategy for Limited Partners (“LPs”) to...

Market Commentary | Insights Blog

Chart of the Month | Are Bonds Still a Good Hedge for Equity Market Declines?

In the middle of January, the Biden administration announced the details on a new $1.9 trillion stimulus package, including enhanced unemployment benefits, an increase in the minimum wage, and...

Market Commentary | Insights Blog

Chart of the Month | Beware of High Yield Bonds

Income-hungry investors continued to push yields on speculative grade bonds to new lows despite the challenging business conditions this year. The yield on the Bloomberg Barclays Corporate High Yield...

Market Commentary | Insights Blog

Chart of the Month | Are Value Stocks Finally Going to Make a Run?

The month of November saw a sharp rotation into value equities at the expense of technology and communication services companies, causing investors to wonder whether the long-run dominance of growth...

Market Commentary | Insights Blog

Chart of the Month | Recession Impacts on Employment and Wages

It may come as a surprise to many that average disposable personal incomes have increased by 6.6 percent from February prior to the pandemic through August. This is down from a high of 9.8 percent in...

Market Commentary | Insights Blog

Chart of the Month | Low Rates Make Record Government Debt Manageable – For Now

Few people would have predicted that U.S. equity markets would be higher today than at the start of 2020 if told that a virus would infect over 7.0 million people in the U.S., cause over 200,000...

Market Commentary | Insights Blog

Chart of the Month | Inflation Expectations Surge, Driving Real Interest Rates Down

Chairman Powell’s speech at Jackson Hole during the last week of August confirmed the Fed’s dovish policy stance, giving investors ample support in terms of low rates and a flexible inflation...

Market Commentary | Articles

Fiscal Year-End and Mid-Year 2020 Market and Investment Review

As we enter the new fiscal year, and Commonfund’s 50th year of operations, we leave behind what will likely be remembered as one of the most challenging and memorable fiscal years for the...

Market Commentary | Insights Blog

Chart of the Month | Markets are Running Ahead of Economic Reality

When investors open their second quarter investment reports, many will be shocked by the magnitude of stock market gains in the second quarter. Their surprise could be voiced by a rhetorical question...

Market Commentary | Insights Blog

Chart of the Month | Measuring Social Distancing with Mobility Trends

We continue to monitor the level of social distancing as an indicator for business activity and improvement in consumer sentiment. Personal spending experienced the largest month-over-month drop on...

Market Commentary | Insights Blog

When Will this Crisis End? 3 Keys to Recovery

When will this crisis end? Following are three key issues fiduciaries should keep in mind concerning COVID-19 and this pandemic recession and recovery. The path and trajectory of COVID-19 This is...

Market Commentary | Insights Blog

Chart of the Month | The Fed Rides to the Rescue

The Federal Reserve is determined to support the economy and the normal functioning of capital markets during the COVID-19 pandemic. As of April 29th, the total asset size of the Fed’s balance sheet...

Market Commentary | Videos

An Insider's Guide to the Chinese Economy

Commonfund CEO and CIO, Mark Anson, hosted Leland Miller, CEO of China Beige Book. Mr. Miller shared his proprietary research and insights in this exclusive session for Commonfund Forum registrants....

Market Commentary | Articles

Higher Ed in the Age of COVID-19

Commonfund convenes an expert panel to take on the short- and intermediate-term threats that higher education confronts in the face of a national emergency the likes of which have not been seen for...

Market Commentary | Insights Blog

Chart of the Month | The Dangers of Timing a Bear Market

It has been well documented that trying to avoid market downturns by selling out of stocks and moving to cash can be damaging to long-term portfolio values. And while there are strong behavioral...

Market Commentary | Insights Blog

Coronavirus: Five Key Questions for Nonprofit Institutions

There is no question that we are in unprecedented times and will likely remain so for longer than we anticipated even a few weeks ago. The speed at which a new reality has been imposed on all of us...

Market Commentary | Insights Blog

Chart of the Month | A Price War Erupts in the Oil Market

Oil prices declined over 21 percent on March 9, 2020, the largest single-day decline since January 1991 during the Gulf War[1]. There was optimism prior to the OPEC (Organization of Petroleum...

Market Commentary | Insights Blog

Market Commentary: Impact of the Coronavirus on Markets and Portfolios

After a strong calendar year 2019, the S&P 500 reached its most recent all-time high on February 19, up nearly 5 percent since the year began. Now, a week later, the global equity markets have fallen...

Market Commentary | Insights Blog

Chart of the Month | Central Banks Increasingly Accommodative

World markets appeared to be returning to their upward trend in the beginning of February after a volatile start of the year. While concerns about global growth caused by the coronavirus outbreak are...

Market Commentary | Private Equity Insights

2020 Investor Survey: Private Markets Sentiment

For the third year in a row, Commonfund Capital conducted a year-end annual survey of institutional investors to gauge their sentiment about private market investments. Survey responses totaled 267...

Market Commentary | Insights Blog

Chart of the Month | Election Year Market Trends

As we enter the 12th year of economic expansion since the Great Financial Crisis, investors continue to wonder whether 2020 will be the year when equity markets finally experience a correction....

Market Commentary | Insights Blog

Impact Investing Trends - A Market Matures

Investment strategy influenced by altruistic intentions – broadly, impact investing – has long held sway in a small number of portfolios. Historically, impact investing has failed to gain significant...

Market Commentary | Insights Blog

The Economy and Markets March On

Summary Positive signs on trade drove recent new highs in the U.S. equity markets The Fed continues to be accommodative and employment is strong Growth is slowing but is supported by the consumer,...

Market Commentary | Insights Blog

Recession – Maybe This Time is Different

The July Federal Open Markets Committee (FOMC) meeting signaled the end of central bank rate normalization with the first rate cut in more than a decade. The last time the FOMC cut rates was in...

Market Commentary | Articles

The Global Economy and the Return of Risk

How to think about tariffs, deficits, valuations, leverage, growth and other issues What signals should institutions be mindful of as they make portfolio decisions in the current environment? A panel...

Market Commentary | Videos

Welcome Address and Overview | Forum 2019

Mark Anson, Commonfund Chief Executive Officer and CIO opens Forum 2019 with welcome remarks and a review of the global economy. Download the slides in this presentation.

Market Commentary | Articles

Top Five Questions of Nonprofit Fiduciaries

The turbulent start to the New Year has led governing boards, investment committees and staff to question what’s next for the markets and what they should do about it. Below are the top five concerns...

What Factors Influence Pricing in the LP-led Secondaries Market?