The long-awaited decline in earnings growth appears to be upon us nearly halfway through 2023. Expectations for S&P 500 year-end earnings per share (EPS) growth range from flat to a tepid 1 percent.

Despite the evident weakness in corporate profits, the index is up over 13 percent through June 21st as investors have eschewed weakening earnings and redoubled bets on a mild recession accompanied with a Fed pause and/or easing cycle. In the face of multiple headwinds including significant regional bank stresses and persistent inflation readings that are unlikely to abate by year end, investors have been comfortable investing in equities at a relatively high price to earnings (P/E) multiple. Although down from trading nearly 31x earnings in early 2021, the S&P 500 is now trading at nearly 21x earnings (up from a low of 17x in October 2022). This is above the 20-year average of 18.4x and in the 83rd percentile of valuations over the same time frame.

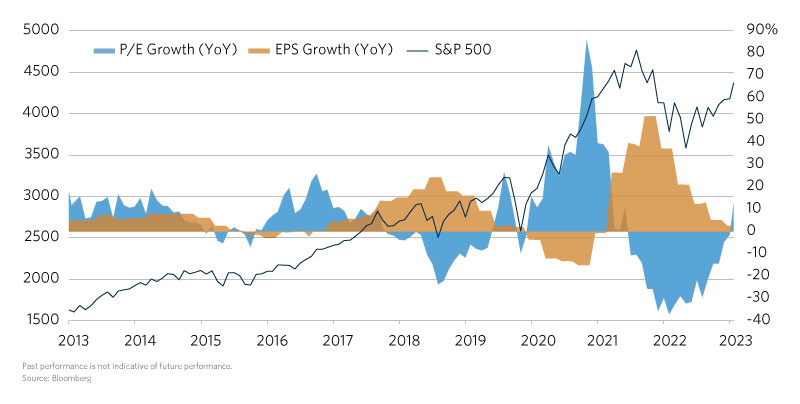

Although this may suggest that the S&P 500 is stretched in terms of valuation, strong market performance continues to be driven by multiple expansion. This chart of the month takes a 10-year lookback at year-over-year P/E growth, EPS growth, and the S&P 500 price. As the chart displays, multiple expansion has been a strong driver of S&P 500 returns throughout the last decade. In fact, there were multiple years where the index had positive returns with 0 or negative EPS growth. This is most prevalent in 2020 and 2021, where accommodative monetary policy and rates at the zero bound justified a significantly higher multiple whilst corporate earnings suffered in the face of the pandemic. The reverse was true in 2022 as firms were able to pass off higher costs on consumers and grow earnings while a swift rate hiking cycle led to significant multiple contraction.

Thus far, 2023 has been a return to the backdrop of equity returns driven by multiple expansion that dominated the last decade. This time however, short rates are 500 basis points higher, leading many to question whether equity market valuations are stretched at nearly 21x earnings. However, the S&P has often been driven by P/E expansion in the past. While many have noted the narrowness of the current rally1, market breadth has been improving this month as more index constituents make new highs with small cap and value performance closing the gap with mega cap growth. Only time will tell whether the rally can extend as uncertainty over the forward rate path continues.

- Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla contributed over 90 percent of the S&P YTD return as of May 31st.