After a relatively tame summer, significant cross-asset volatility has returned with both the MOVE and VIX indices increasing by 37 and 48 percent respectively, after approaching the lows for 2023 in mid-September. A combination of macroeconomic factors and U.S. Treasury market dynamics wreaked havoc on equities and rates.

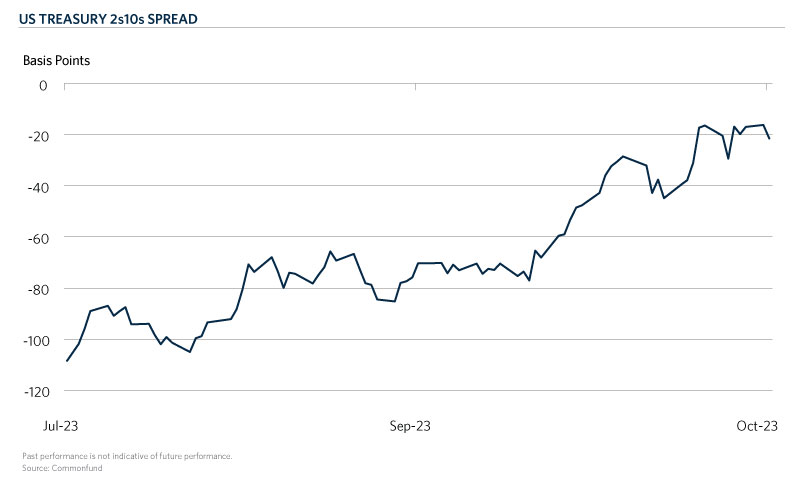

Although there tends to be summer lulls in volatility, recent interest rate volatility has been especially notable this year with significant moves at the long end of the curve. Since September 15th, the 10- and 30-year yields have increased by 53 and 60 basis points, respectively. The ratio of the MOVE Index to the VIX (which serves as a measure of rates volatility relative to equity volatility) is at 6.9 times, slightly below the midsummer high of 8.8 times but over one standard deviation from the long-term average. Despite such drastic moves in the longer tenors, the 2-year yield has only increased by 3 basis points over the same timeframe. The resulting “bear steepening” (where long rates rise at a higher pace than short rates) has left the key 10- and 2-year Treasury yield spread (2s10s) inverted by -20 basis points, from nearly -110 basis points in mid-June. This Chart of the Month displays the 2s10s spread since mid-July.

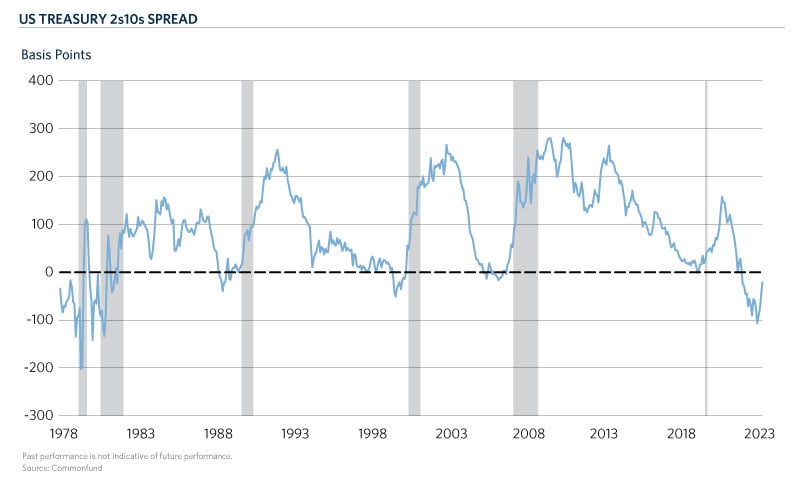

While much has been said about yield curve inversions and steepening, “bear steepening” is much less common than other curve dynamics. Additionally, the current move is particularly uncommon given that the starting point was a deeply inverted curve, which previously occurred in 1980-82, 1989, 2001, and 2007. The second chart displays the time series of the 2s10s spread dating back to 1978 (recessionary periods are shaded in grey). The historical track record of each episode (all of which occurred amidst or presaged an NBER recession), has led to widespread fears of the implications of the aggressive curve steepening at present.

The latest steepening episode has been driven by multiple factors. Concerns about a structural shift in demand dynamics for U.S. Treasuries across both primary and secondary markets continue. As foreign buyers seek to onshore their reserves and stabilize their currencies, expectations of demand have declined amid a period in which issuance has increased significantly. This new issuance has been necessary for the U.S. Treasury to replenish its General Account and fund continued deficit spending. Moreover, demand from the Federal Reserve has waned as it rolls U.S. Treasuries and other asset-backed securities off its balance sheet.

Resilient economic data (primarily from the consumer and labor market) and the resulting fears of reaccelerating inflation have also led to upward pressure on long-dated yields. As both headline and core inflation appear to have reached the end of their linear declines, long-term U.S. Treasuries have suffered. The recent retail sales release that beat analysts' expectations spurred further increases in long yields, with the 10-year yield briefly surpassing 5 percent (a level not seen since July 2007). Despite all these developments, history tells us that the 2s10s spread is unlikely to steepen beyond inverted levels without short yields falling due to recession fears and the subsequent monetary response. With labor market data cooling but continuing to surprise to the upside, such a move in short yields has yet to materialize.