The Consumer Price Index continues to surprise central bankers, commentators, and market participants alike. The latest headline reading of 8.2 percent, which reflects year-over-year price increases for the month of September, confirmed what many had feared: Inflation is not falling as swiftly as predicted or hoped.

While the headline number decreased, core inflation (which strips out the volatile food and energy components) increased year-over-year and month-over-month. This suggests an increase in the rate of change of today’s inflationary pressures. This recent data has all but confirmed another 75-basis point increase of the key Fed Funds rate at the upcoming November FOMC meeting and has led market participants to begin to price in another 75-basis point hike in December.

Drivers have broadened across many components

A key takeaway from the recent inflation prints is that the drivers have shifted significantly throughout 2022. In 2021, many were quick to label inflation a story of post pandemic reopening and supply chain disruption. This brought considerable focus on categories such as airfares, hotels, and used cars & trucks. Also, the Russian Invasion of Ukraine caused turmoil in energy markets, which severely impacted the energy component of inflation. While those pressures have subsided over the past few months, the August and September inflation readings have shown increasing prices in services. It is now evident that price increases have become more broad-based amongst “stickier” categories that do not reprice as often as food or commodities, namely shelter and wages. The shelter component of CPI, Owner’s Equivalent Rent1 (OER), has increased by 6.7 percent since last September; the highest year-over-year reading since the inception of the component in January 1984. While house prices have begun to fall nationally, this will take time to reflect in the CPI, and a higher OER component will underpin high inflation in the coming months. As for the wage’s component, the Bureau of Labor Statistics recently reported that the average hourly earnings paid to employees has risen well above its long-term average of approximately 3 percent; currently hovering at the 5 percent level.

Near-term pathways

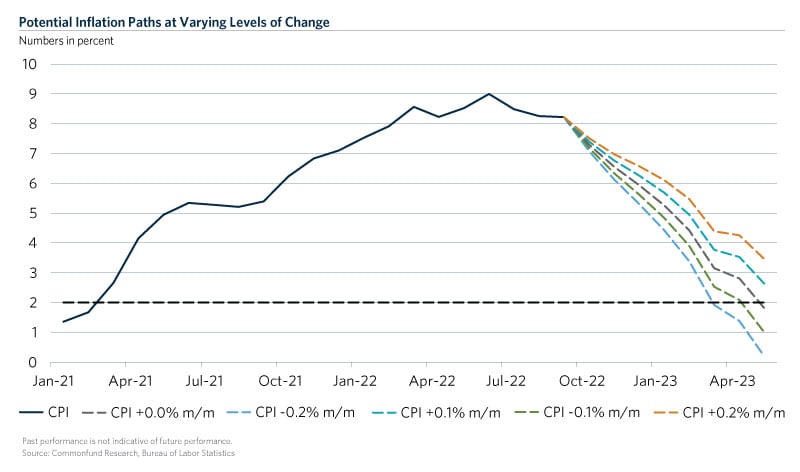

To examine some of the potential outcomes of inflation into 2023, we forecasted CPI readings until mid-year assuming constant month-over-month growth of -0.2 percent, -0.1 percent, a flat 0 percent, 0.1 percent, and 0.2 percent. For context, the month-over-month readings for July, August, and September were 0.1 percent, 0.0 percent, and 0.4 percent, respectively. Most strikingly, inflation will take some months to slow to a tolerable level – around 2 percent – for consumers and the FOMC. Even if we have 0 percent month-over-month inflation through year-end (likely a best case-scenario), 2022 inflation will still be just under 6 percent and only break 2 percent by May of 2023 given the same assumption. A worse scenario would be 0.2 percent month-over-month growth, keeping inflation well above 2 percent midway through 2023. While we expect price pressures to slow throughout 2023, the process could be a lengthy one, especially if shelter and wage inflation continues. Resilient employment data has given FOMC officials the green light for aggressive contractionary rate policy, however, the speed at which the rate hikes can lead to a tolerable rate of inflation remains in question.

- Owner’s equivalent rent (OER), which seeks to quantify shelter as a unit of consumption, rather than a unit of investment. This is one of the reasons why OER tends to lag broader housing market movements and why booming house prices in 2021 did not reflect in the calculation at the time.