Investment Strategy | Videos

Investing in Real Assets and Sustainability

In a session hosted by the Commonfund Institute, Ethan Levine and Dan Connell, managing directors of CF Private Equity's real assets and sustainability team, discuss the importance of investing in...

Investment Strategy | Videos

A Practical Guide to Buyouts and Growth Equity

Are you curious about the evolving world of buyouts and growth equity investing? In this insightful Commonfund Institute Online workshop, Tor Martinsen from the buyouts and growth equity team at CF...

Investment Strategy | Insights Blog

Why the Way You Count Matters and Why Comparing One-Year Returns Does Not

As we near the end of the performance reporting season for larger higher ed institutions this year, I am once again struck by the focus the media and others place on a single fiscal year return.

Investment Strategy | Insights Blog

A Closer Look at Higher Education Endowments Less Often in the Spotlight

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2024 NACUBO-Commonfund Study of Endowments (NCSE, or,...

Investment Strategy | Videos

Understanding the Secondaries Market

This Commonfund Institute Online video explores the evolving landscape of the secondaries market, focusing on both Limited Partner (LP)- and General Partner (GP)-led transactions.

Investment Strategy | Private Equity Insights

AI is Redefining How Startups Scale

Advancements in generative Artificial Intelligence (“AI”) and large language models are enabling early-stage companies to scale faster than ever before. Venture investors who can identify and access...

Investment Strategy | Insights Blog

Commonfund Holds Third Convening for Foundations that Support Higher Education

Last month, Commonfund hosted its third Commonfund Convenes event dedicated to advancement of investment knowledge for institutionally-related foundations (IRFs). The latest workshop focused...

Investment Strategy | Videos

Venture Capital Essentials: Principles and Market Trends

Are you curious about how investors navigate the dynamic world of venture capital? This Commonfund Institute Online workshop offers a practical roadmap for understanding the principles of endowment...

Investment Strategy | White Papers

Benchmarks for Boards

This paper attempts to serve as a guide for trustees and boards that aspire to excel, with particular emphasis on the board’s fiduciary role.

Investment Strategy | White Papers

Striking the Balance: A Fiduciary Approach to Risk and Investment Policy

Discover how to effectively balance risk and return as a fiduciary in your investment portfolios.

Investment Strategy | White Papers

Essential Not Optional: A Strategic Approach to Fundraising

Fundraising for endowments has become an essential strategic capability that endowed institutions will have to build or acquire in order to thrive.

Investment Strategy | White Papers

The Investment Policy Statement - A Commonfund Whitepaper

Successful investing for long-term funds requires a strategic investment policy statement. The plan must be specific, yet it also needs to be flexible.

Investment Strategy | Articles

Mind the Gap: The Strategic Risk of Skipping a Vintage in Private Equity

Private equity (inclusive of buyouts, growth equity, and venture capital) remains a compelling long-term asset class, but recent periods of muted distributions and below-average returns have created...

Investment Strategy | White Papers

Principles of Investment Stewardship for Nonprofit Organizations

Explore essential investment stewardship principles for nonprofit organizations, focusing on the six principles for effective decision making.

Investment Strategy | Insights Blog

Aligning Capital with Mission: Insights for Nonprofit Institutional Investors

In today's investment landscape, many institutions are reckoning with a fundamental question: Are our investments aligned with our mission? At this year’s Investment Stewardship Academy, Commonfund...

Investment Strategy | White Papers

Commonfund's Guide to Writing an OCIO RFP

Download our guide to writing an OCIO RFP and receive essential questions to effectively evaluate outsourcing your CIO for improved strategic focus.

Investment Strategy | White Papers

Endowment Spending - A Look Back

Gain a better understanding of how educational institutions evaluate spending policies today.

Investment Strategy | Insights Blog

Considerations for Foundations to Meet the Moment

In response to the current political, social, and economic challenges, numerous foundations are increasing their support and adapting their strategies to address pressing issues. There have been...

Investment Strategy | Articles

CIO Roundtable: Meeting Complexity and Uncertainty with Clarity

A foundation, a university and an insurance company operate in different worlds and have different priorities—but make investment decisions in the same environment Institutions depend on their...

Investment Strategy | Videos

Chief Investment Officers Share Their Thoughts at Forum 2025

Commonfund hosted its annual Commonfund Forum 2025, March 9-11th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Investment Strategy | Insights Blog

In Pursuit of Intergenerational Equity: Inflation is the Big Headwind

For all the differing goals and objectives laid out by colleges and universities for their endowments, one that is universally shared is intergenerational equity, or the concept that endowed...

Investment Strategy | Articles

Portfolio Construction in the Era of the Mag 7

How do you build your U.S. equities allocation when a handful of stocks account for more than half of the S&P 500’s return? The aptly named Magnificent 7 stocks (Alphabet, Amazon, Apple, Meta...

Investment Strategy | Insights Blog

A Closer Look at Community Colleges

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2024 NACUBO-Commonfund Study of Endowments (NCSE). The...

Investment Strategy | Insights Blog

Investment Committees: Preparing for the Unforeseen

In the world of investing, crises are inevitable. Yet, many investment committees find themselves unprepared when these crises strike because they haven’t taken the necessary time to scenario plan....

Investment Strategy | Insights Blog

Reflections on the NACUBO-Commonfund Study of Endowments 2024

Mid-February can be a challenging time of year. For sports fans, the lull between the end of the football season and the beginning of baseball season can feel like an eternity. For many, February...

Investment Strategy | White Papers

OCIO Model: An Overview for Decision Makers

An institution’s decision to work with an OCIO provider will likely depend on several factors. Learn more about the OCIO Model here..

Investment Strategy | Insights Blog

Determinants of Portfolio Returns – It Depends…

Asset allocation decisions have traditionally been associated with being the major determinant of portfolio returns. The Brinson, Hood, Beebower study of 19861 estimated that nearly 90 percent of...

Investment Strategy | Videos

Investing in the Creative Economy - Commonfund Coffee Talk

Investing in the Creative Economy In this Commonfund Coffee Talk, the Institute’s executive director, George Suttles, is joined by Upstart Co-Lab founding partner, Laura Callanan, to discuss impact...

Investment Strategy | Private Equity Insights

Approach to Sustainability Assessment and Reporting

In recent years, sustainability-focused investing has taken on many names and has been at the center of polarizing political conversations. CF Private Equity’s approach to mandates surrounding...

Investment Strategy | Articles

Thinking Outside the Benchmark

Twenty years ago, Mark authored an article published in The Journal of Portfolio Management titled "Thinking Outside the Benchmark" to describe a new way of pension fund management. He concluded the...

Investment Strategy | Articles

Viewpoint | Top Concerns for Community Foundations: Donor-Advised Fund Regulations

Potential regulations on donor-advised funds (DAFs) and their effect on the philanthropic sector was the most-cited concern among community foundations in this year’s Council on...

Investment Strategy | Insights Blog

Considerations for Smaller Institutions Seeking OCIO

Recent data from the Commonfund Benchmarks Studies indicate that smaller nonprofit institutions are using an Outsourced Chief Investment Officer (OCIO) for investment management more often than their...

Investment Strategy | Articles

Viewpoint | Top Concerns for Private Foundations: Financial Volatility and Target Returns

In this year’s Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the “Study”) we asked a new question: What are the top two current...

Investment Strategy | Insights Blog

How Nonprofits Eliminate the Noise to Strategically Achieve Long-Term Success

Commonfund has been partnering with boards and investment committees to design and implement investment structures that support and maintain intergenerational equity, the purchasing power of their...

Investment Strategy | Insights Blog

Educational Alpha Podcast: A Conversation with Mark Anson

In this episode of the "Educational Alpha Podcast" host Bill Kelly sits down with Mark Anson, CEO and CIO of Commonfund to explore the evolution of the endowment model and its ongoing relevance in...

Investment Strategy | Private Equity Insights

Navigating Co-Investments in Today’s Environment

The macroeconomic landscape in recent years has presented certain challenges for both private equity General Partners (“GPs”) and Limited Partners (“LPs”). Deal activity and distributions were...

Investment Strategy | Private Equity Insights

Seeking Alpha in A World of Private Equity Beta

Deep sector expertise is a differentiator in the pursuit of alpha-like private equity returns.

Investment Strategy | Insights Blog

Adding Alpha through Emerging Investment Managers

Commonfund Forum 2024 convened a panel of emerging investment managers to spotlight their unique investment approaches. Moderated by Caroline Greer, managing director at Commonfund OCIO, the...

Investment Strategy | Insights Blog

Viewpoint | Top Concerns for Independent Schools

For the first time since the inception of the Study, the FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) report asked respondents to identify the top concerns for their...

Investment Strategy | Private Equity Insights

CF Private Equity Closes its 4th Secondaries Fund at $1.1 BN

Commonfund Capital Secondary Partners IV, L.P. significantly exceeded its $750 million target.

Investment Strategy | Insights Blog

Viewpoint | The Main Purpose of Independent School Endowments

The FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) prompted survey respondents to select the main purpose of their school’s endowment for the first time.

Investment Strategy | Private Equity Insights

Unlocking Sustainable Investment: Insights from Ethan Levine

At SuperReturn Energy, Ethan Levine, Managing Director, CF Private Equity, discussed the continued focus on sustainability and ESG, touching on net zero, decarbonization and climate pledges.

Investment Strategy | Insights Blog

Key Factors in Asset Allocation Decisions for Endowments

There are several broad subjects that an effective investment policy statement (IPS) should include in its contents and address clearly and specifically as they relate to an endowed institution. This...

Investment Strategy | Insights Blog

City of the Big Shoulders: Key Takeaways from our Chicago CIO/CFO Roundtable

For more than 50 years, Commonfund has been working with boards and investment committees to design and implement investment structures that support and maintain intergenerational equity - the...

Investment Strategy | Insights Blog

Private Credit Today

On September 27th, Commonfund OCIO hosted an event in Minneapolis at the O’Shaughnessy Distilling Co. Following a tour and tasting at the facility, Nicole Melwood, Director, and Vincent Kravec,...

Investment Strategy | Private Equity Insights

Is Venture Capital Going Back to the Future? Reemergence of the Power Law of Returns

The importance of manager selection is back.

Investment Strategy | Articles

Viewpoint | The Yin and Yang of Risk and Return

The conundrum of risk and return is that you can’t have one without the other. The key is finding the right balance for your foundation.

Investment Strategy | Articles

Time to Reassess Your Cash Strategy

Bank safety amidst a confidence crisis It’s not hard to find sore spots in the economy. High rates of inflation have hit pocketbooks and balance sheets and initiated the steepest interest rate hikes...

Investment Strategy | Insights Blog

Unemployment Appears Poised to Increase

Other than the impending recession, one of 2023’s most anticipated economic changes has been a labor market slowdown, with both economists and investors expecting a deceleration in economic activity...

Investment Strategy | Articles

Celebrate! 25 Years of NBOA: The Endowment Landscape

A deep dive into independent school endowment's trends FY2005-FY2022, including analysis of asset allocation, performance, spending and contributions, plus a perspective on future developments....

Investment Strategy | Insights Blog

Including Risk Management in Your Investment Policy Statement – Where to Begin

Investment policy statements usually contain a section that purports to define the institution’s risk tolerance. But they frequently only gesture in the direction of risk, without actually examining...

Investment Strategy | Insights Blog

Yesterday's Sector Laggards are Today's Leaders

Much to the surprise of market participants, global stocks have risen at an impressive pace year to date despite significant macroeconomic headwinds and regional bank troubles. In what can be deemed...

Investment Strategy | Insights Blog

Shaping Your Board - Key Considerations for Success

The structure of a board can help, or hamper, its effectiveness, and consideration of these matters is important to improving a board’s performance. Factors such as size, board chair, diversity and...

Investment Strategy | Articles

Hedge Funds: Is Now Their Time to Shine?

Diversification may be underappreciated when both equity and fixed income allocations have been broadly positive. With both these allocations facing significant and potentially long-lasting...

Investment Strategy | Insights Blog

Drafting Your Investment Policy Statement: 10 Critical Issues

Endowed institutions differ in their missions, capabilities and resources, and investment policy statements naturally mirror these differences. In that sense, there is no single ‘right’ investment...

Investment Strategy | Insights Blog

Bond Market Expectations Take a Wild Ride

In today’s environment, commentary can seemingly become stale in periods as short as hours, let alone days. Just last month, we wrote how despite tightening lending conditions from banks, other...

Investment Strategy | Videos

CIO Roundtable - A Discussion on Investment Stewardship

At the 25th annual Commonfund Forum, in Boca Raton, Florida, we hosted a distinguished panel of CIOs who shared their perspectives on portfolio management. They discussed their best investment ideas,...

Investment Strategy | Videos

Secular Changes and Challenges Facing Nonprofits Today

Commonfund recently hosted its 25th annual Commonfund Forum, February 13-15th, in Boca Raton, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This...

Investment Strategy | Insights Blog

Spending Policy | Old Technology Still Dominates

Every year I eagerly await the release of the NACUBO Study of Endowments (NTSE) and, when I finally get it, I read it cover-to-cover. Despite reading all 195 pages, the two most frequent questions I...

Investment Strategy | Insights Blog

Rate Hikes are Impacting Bank Lending Behavior

As investors grapple with adjusting to 450 basis points of rate hikes (and likely more in sight), the debate on just how quickly monetary policy will transmit through the real economy has returned to...

Investment Strategy | Insights Blog

Markets Rally to Close 2022, but Sentiment Remains Dismal

Strong Fourth Quarter for Global Markets Following three quarters of bleak performance, global markets staged a rally to close what was a tumultuous 2022.

Investment Strategy | Insights Blog

Supply Chains Take a Wild Ride

In 2021, the word was transitory. This described the expectations of Fed officials and many other prognosticators that elevated inflation would quickly return to the pre-COVID level of at or around 2...

Investment Strategy | Insights Blog

Is Spending Policy the Other “Free Lunch” in Investing?

We believe spending policy not only should influence strategic asset allocation but should be thought of as the other "free lunch" of long-term endowment investing alongside diversification.

Investment Strategy | Insights Blog

Real Estate Takes a Hit from the Fed

In this chart of the month, it is commonly cited that monetary policy tightening has a lagged impact on economic activity. However, as the Federal Reserve drives the cost of capital higher, the...

Investment Strategy | Insights Blog

Chart of the Month | The Shape of Inflation

The Consumer Price Index continues to surprise central bankers, commentators, and market participants alike. The latest headline reading of 8.2 percent, which reflects year-over-year price increases...

Investment Strategy | Insights Blog

The Endowment Model Proves Its Worth (Again)

Unless you’ve been on a remote island with no Wi-Fi for the past nine months, you are well aware that it has been a rough start for capital markets. In fact, it has been a historically rough start to...

Investment Strategy | Insights Blog

Asset Allocation: Controlling for the Variables

Our 2021 Council on Foundations-Commonfund Study of Foundations marked our 10th year in collaboration with Council on Foundations and the Commonfund Institute to measure, analyze and document the...

Investment Strategy | Insights Blog

Research Shows 10-Year Returns for Foundations Reach Highest Point

Our 2021 Council on Foundations-Commonfund Study of Foundations marked our 10th year in collaboration with Council on Foundations and the Commonfund Institute to measure, analyze and document the...

Investment Strategy | Insights Blog

Better Benchmarking: What Makes Your Institution Unique Matters

There is no doubt that benchmarking is a good practice for institutions to follow – we publish studies each year for various nonprofit sectors for that reason. While we think that benchmarking is...

Investment Strategy | Private Equity Insights

Why Does Blockchain Matter?

We believe there is a generational platform shift underway in technology and its magnitude of impact could be as transformational as was the birth of the internet — and it is transparent,...

Investment Strategy | Private Equity Insights

Is There Method in the Madness of Today’s Crypto Market Chaos?

In recent months crypto markets have experienced extreme volatility and drawdowns, and it is self-evident that the next “crypto winter,” or prolonged bearish period, is upon us. However, these price...

Investment Strategy | Insights Blog

Aligning Spending Policy with Your Institution’s Long-Term Goals

Commonfund has designed a set of questions to help guide a committee—and staff—toward selecting the most appropriate spending policy. We have used these questions as a guideline for conversations...

Investment Strategy | Insights Blog

Endowment Management: The Business of Independent Schools

Commonfund is proud to contribute a chapter to NBOA’s new book “The Business of Independent Schools – A Leader’s Guide” – a new edition of “By the Numbers and Beyond.” This publication provides...

Investment Strategy | Insights Blog

Don’t Let Inflation be a One-Two Punch for Your Endowment

Investment committees overseeing the endowments of higher ed institutions need to think about inflation for two fundamental reasons.

Investment Strategy | Insights Blog

Diversifying Your Fixed Income Portfolio With a Private Credit Allocation

Inflation, rising interest rates, inversion in the yield curve and the war in Ukraine combined to make 1Q22 a challenge for many asset classes and strategies. While there was the isolated shelter...

Investment Strategy | Insights Blog

Is your Spending Policy Getting the Attention it Needs?

Spending policy is the most overlooked aspect of endowment management and many are likely not employing the optimal calculation for their institution. Many investment committees review "strategic...

Investment Strategy | Videos

CIO Roundtable

Fiduciaries are entrusted with fulfilling their organization’s mission largely through effective stewardship of financial assets. In the 50+ years since Commonfund was founded, perpetual investing...

Investment Strategy | Insights Blog

Hitting the Hot Buttons: Investing for the Next 2 to 4 Years

Commonfund Forum 2022 featured an expert panel representing diverse perspectives to probe beyond the headline-grabbing news that has been driving financial markets in recent months. The accompanying...

Investment Strategy | Videos

Imagining What's Next for the Global Economy

If someone had told you in January of 2020 that the world would be plunged into a global pandemic the likes of which had not been seen since 1918, you probably would have guessed that the impacts on...

Investment Strategy | Press Releases

Commonfund Survey Finds Institutional Investors Increasingly Cautious Amid Heightened Economic Risks

Institutional investors representing $170 billion in total assets cite inflation and geopolitical tensions as top economic concerns for 2022 Majority of investors expect lower-than-average U.S. stock...

Investment Strategy | Articles

Viewpoint: The Move in Marketable Alternative Strategies

In the 2021 Commonfund Benchmarks Study® of Independent schools we continue to see the allocation to marketable alternative strategies decline, raising questions about why and whether it will...

Investment Strategy | Articles

Viewpoint: The Short and Long of It

There’s a lot to consider in each annual Commonfund Benchmarks Study® of Independent Schools, e.g., asset allocation, spending, gifts and donations, responsible investing and more. This year is no...

Investment Strategy | Insights Blog

Commonfund's Third Annual Invitational Diverse Manager Day

From February 9th-11th, Commonfund held its third Diverse Manager Day event, with 20 managers identified through its Diverse Manager Portal and other sources. These diverse managers1 cover a broad...

Investment Strategy | Private Equity Insights

The Price of Liquidity - Commonfund Coffee Talk

The Price of Liquidity for Perpetual Investors Our third and final Coffee Talk focused on the most important and impactful decision endowments and foundations can make within their strategic asset...

Investment Strategy | Insights Blog

OCIO Operational Services: Four Questions to Consider

When properly implemented, outsourcing the investment of nonprofit assets can help institutions establish governance processes, manage a complex portfolio, and navigate operational complexity and...

Investment Strategy | Insights Blog

Constructing Investment Portfolios for Endowments

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship” – Purpose, Policy, Process, Portfolio, People and...

Investment Strategy | Videos

Tools for Creating Effective Strategic Policy

Commonfund has worked with nonprofit investors for 50 years. Over that time, we have developed a set of proprietary tools and data to assist boards and investment committees in their quest to create...

Investment Strategy | Private Equity Insights

Allocating to Illiquid Investments

Stewards of endowments have long been advised that allocating to illiquid investments is critical to achieving long-term returns. Rather than trust conventional wisdom, Commonfund conducted research...

Investment Strategy | Articles

Viewpoint | The Ever-Evolving 80/20

On average over the past decade, independent schools participating in the Commonfund Benchmarks Study® of Independent Schools have maintained an asset allocation that stays within a few percentage...

Investment Strategy | Private Equity Insights

The Tech Effect and Direct Venture Growth Investing

The venture growth and late stage venture capital (“VC”) market has matured over the last 10 years, and direct investing has emerged as an attractive strategy for Limited Partners (“LPs”) to...

Investment Strategy | Insights Blog

Board of Trustees and Investment Committee Roles and Responsibilities

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship”– Purpose, Policy, Process, Portfolio, People and...

Investment Strategy | Insights Blog

Investment Governance | Are You Asking These Three Questions?

In the midst of a global pandemic, many non-profit business models are being challenged which has put significant pressures on staff, governing boards and committees. These pressures on time and...

Investment Strategy | Insights Blog

Foundation Spending Strategy – Meeting the Moment in 2020 and Beyond

This year has been incredibly difficult. One of the most contentious and turbulent presidential elections and transitions in American History. COVID-19 and the consequential social and economic...

Investment Strategy | Videos

Implications of Increased Spending for Foundations

In this Commonfund Xchange, Commonfund Institute Executive Director, George Suttles, moderated a discussion with two leading practitioners: Mary Reynolds Babcock Foundation Chief Finance and...

Investment Strategy | Insights Blog

A Financial Framework for the COVID Crisis

Despite the fall semester looking much better than the worst-case scenarios contemplated in early summer, higher education in America continues to grapple with the enormous challenges that the...

Investment Strategy | Private Equity Insights

How to Measure Private Equity Investments

Private capital investors use a particular set of quantitative and qualitative measures to assess performance. While the standard benchmarks used for marketable securities are sometimes applied to...

Investment Strategy | Insights Blog

Is It Time to Issue an Investment Manager RFP for Your Nonprofit?

Best practice for nonprofits is to issue a Request for Proposal (“RFP”) for an investment management partner every market cycle. Typically, that is at least every 7 to 10 years, or as it is...

Investment Strategy | Videos

Top Hedge Fund Investors - Ten Years Later

In July 2010, I published the book Top Hedge Fund Investors: Stories, Strategies, and Advice. My co-author and I interviewed nine leading allocators to hedge funds, including one Mark Anson, who...

Investment Strategy | Insights Blog

Balancing Purpose, Payout, and Permanence: A Strategy Guide for Foundations

In partnership with the Council on Foundations, the National Center for Family Philanthropy has released Balancing Purpose, Payout, and Permanence: A Strategy Guide. Commonfund Institute is very...

Investment Strategy | Insights Blog

Chart of the Month | Inflation Expectations Surge, Driving Real Interest Rates Down

Chairman Powell’s speech at Jackson Hole during the last week of August confirmed the Fed’s dovish policy stance, giving investors ample support in terms of low rates and a flexible inflation...

Investment Strategy | Insights Blog

Observations on Diverse Manager Selection Across Asset Classes

At Commonfund, we believe diverse managers offer clients access to investment talent and valuable investment opportunities and therefore should be explored and invested in. Overlooking the merits of...

Investment Strategy | Videos

Cultural Institutions and the COVID-19 Crisis

Board members, investment committees, and senior staff are charged with the fiduciary responsibility to make informed decisions when guiding the investment activities of their organization. The...

Investment Strategy | Insights Blog

Capturing Credit Opportunities in Times of Crisis

Key takeaways During periods of dislocation in high-quality credit, investors should stay the course within fixed income portfolios and maintain active risk to benefit from the inevitable rebound...

Investment Strategy | Insights Blog

Real Estate – Can’t Touch This!

Few markets have been as heavily impacted by the onset of the global pandemic as real estate. Real estate is considered a hard asset that “you can touch and feel”, but during a pandemic no one wants...

Investment Strategy | Videos

Enhancing Investment Stewardship with Fund Governance Analytics

Strong board performance is critical for every organization dedicated to achieving its mission, which is why Commonfund Institute makes it our mission to advance best investment stewardship...

Investment Strategy | Articles

Increasing Giving During COVID-19: Thoughts for Philanthropy

The Council on Foundations has acted to support its members, their nonprofit partners, and the people and communities hit hardest by the impacts of COVID-19 by asking members to sign a pledge of...

Investment Strategy | Insights Blog

Balancing Risk and Return

Risk surrounds us, and for investment fiduciaries it is inescapable if meaningful real returns are to be sought. While risk and return constitute the axes upon which investment portfolios are built,...

Investment Strategy | Private Equity Insights

Seven Ways to Diversify Your Private Equity Portfolio

A strong private capital program requires consistent, diversified investing over time. It is also necessary to have— or obtain externally— resources for research and due diligence before you invest;...

Investment Strategy | Videos

Stewarding Foundations Through the COVID-19 Crisis

The COVID-19 crisis has put tremendous strain on local communities across the country and foundations have been asked to rise to the challenge while endowments have declined in value due to market...

Investment Strategy | Insights Blog

Crisis Response: A Framework for Strategic Decisions

With the equity markets retracing some of the losses that occurred in the first calendar quarter of 2020, endowment market values are likely recovering more quickly than we may have feared during the...

Investment Strategy | Insights Blog

Do Bear Markets Favor Active or Passive Investing? It Depends.

In the ongoing debate about active versus passive investing, conventional wisdom posits that active investing outperforms passive in recessionary or bear market environments. The question is: Will...

Investment Strategy | Insights Blog

Coronavirus: Five Key Questions for Nonprofit Institutions

There is no question that we are in unprecedented times and will likely remain so for longer than we anticipated even a few weeks ago. The speed at which a new reality has been imposed on all of us...

Investment Strategy | Insights Blog

Long-Term Equity Investors: A Global Perspective

Over the past decade U.S. equities have consistently outperformed international markets, leading many investors to question the role of non-U.S. equities in their portfolio. While the current cycle...

Investment Strategy | Videos

A Global Perspective for Long-Term Equity Investors

Watch this short video on our Global Perspective for Long-Term Equity Investors. Over the past decade U.S. equities have consistently outperformed international markets, leading many investors to...

Investment Strategy | Insights Blog

Commonfund’s First Invitational Diverse Manager Day

On January 16th Commonfund held its first invitational Diverse Manager Day. The day was made possible as a result of the success we had from submissions to the Diverse Manager Portal launched last...

Investment Strategy | Private Equity Insights

2020 Investor Survey: Private Markets Sentiment

For the third year in a row, Commonfund Capital conducted a year-end annual survey of institutional investors to gauge their sentiment about private market investments. Survey responses totaled 267...

Investment Strategy | Insights Blog

Impact Investing Trends - A Market Matures

Investment strategy influenced by altruistic intentions – broadly, impact investing – has long held sway in a small number of portfolios. Historically, impact investing has failed to gain significant...

Investment Strategy | Insights Blog

Tactical Allocation: Winning Strategy or a Fool’s Game?

Institutional investors overseeing long-term pools of capital typically define their strategic asset allocation with specific targets and bands or ranges around those targets, which allow for...

Investment Strategy | Insights Blog

Announcing the Commonfund Diverse Manager Portal

In the fall of 2018, Commonfund announced the creation of its Diversity and Inclusion Office with the mission to “intentionally promote and foster inclusion and equity across Commonfund and our...

Investment Strategy | Insights Blog

Looking at Gender Lens Investing

What is Gender Lens Investing? Gender lens investing has garnered significant traction in the last decade. Broadly speaking, it aims to achieve financial returns and benefit women. Given the breadth...

Investment Strategy | Insights Blog

Emerging and Diverse Manager Programs: Worth Doing Well

Michael Rowland was the Commonfund Institute Summer Intern in 2019. When this was published he was a rising senior at Case Western Reserve University majoring in Finance and Accounting. What are...

Investment Strategy | Insights Blog

Recession – Maybe This Time is Different

The July Federal Open Markets Committee (FOMC) meeting signaled the end of central bank rate normalization with the first rate cut in more than a decade. The last time the FOMC cut rates was in...

Investment Strategy | Insights Blog

Investment Manager Fees Part II: Creating Alignment

In Part I of this blog series, “Investment Manager Fees: Out of Sight, Out of Mind”, we discussed our approach to determining the value of an asset manager and how we might calculate a fair price for...

Investment Strategy | Insights Blog

Investment Manager Fees: Out of Sight, Out of Mind

One of the most pressing questions facing fiduciaries is that of investment management fees. We think it is a healthy and necessary discussion, as even small fees can have a big impact on performance...

Investment Strategy | Videos

CIO Roundtable: The Past, Present and Future of Endowment Investing

Fiduciaries of nonprofit organizations are entrusted with fulfilling the missions of their organizations in large part through effective stewardship of financial assets. In the 50 years since the...

Investment Strategy | Insights Blog

Taking a Fresh Look at Spending Models

Investors have limited control over the returns their portfolios generate. They have more control over their spending. That doesn’t make it easy. Compared to some earlier periods, volatility in the...

Investment Strategy | Videos

Playing to Win

In this Forum 2019 general session, Commonfund experts share research into much of the conventional wisdom around institutional portfolio management, with some surprising results into which...

Investment Strategy | Insights Blog

The Fallacy of Manager Diversification – How “Horse Races” Can Increase, Not Reduce Risk

On the surface, hiring two (or more) multi-asset managers to manage an entire portfolio may seem like a good idea. Intuitively, it would seem to reduce manager concentration risk, and provide...

Investment Strategy | Insights Blog

How to get Started in Responsible Investing

The biggest challenge in implementing any type of responsible investment program is in clearly defining and prioritizing those issues most relevant to an organization. Although it may seem a...

Investment Strategy | Insights Blog

Stormy Markets, Steady Institutional Investors

This blog is reprinted with permission by Net Assets, published by the National Business Officers Association (NBOA). The original article can be found here. Investment guidelines enable institutions...

Investment Strategy | Insights Blog

A Cost-Effective Approach to Hedge Fund Allocations: Part 2

Let’s start with a quick recap of Part 1 of this story, which can be boiled down to three main points: Investors often spend too much for market beta, paying “2 and 20” for hedge funds that deliver...

Investment Strategy | Insights Blog

A Cost-Effective Approach to Hedge Fund Allocations: Part 1

At the risk of beating a dead horse, hedge funds are not an asset class. This is especially true in the way in which Commonfund selects and constructs its hedge fund portfolios: focusing...

Investment Strategy | Insights Blog

Are You Ready for the Next Crisis?

Ten years ago Lehman Brothers failed, representing the largest bankruptcy in history, and accelerating a global financial crisis that would knock many non-profit portfolios backward. This came on the...

Investment Strategy | Insights Blog

The Four P’s of Investment Decisions: Lessons from the Commonfund Institute

Three days after becoming Executive Director of the Commonfund Institute, I found myself at Yale University in New Haven giving welcoming remarks at our annual educational program. Although I will...

Investment Strategy | Insights Blog

Equity Portfolio Construction – Through a Risk Factor Lens

At Commonfund, we aim to build multi-manager, active risk equity portfolios with a clear objective of consistent outperformance versus passive policy benchmarks. Our approach is to take intentional...

Investment Strategy | Insights Blog

Bonds: Unwanted and Unloved but not Unnecessary

Well, the party may finally be over. Like the college dean who shuts down the campus party, the Fed has finally taken away the interest rate punch bowl that investors have enjoyed for so long. It may...

Investment Strategy | Articles

Inflation is Expected to Rise. How Can Investors Protect Portfolios?

In March, capital markets entered their tenth year of post-crisis recovery. For diversified portfolios, these have been some of the most profitable times, characterized by strong returns, positive...

Investment Strategy | Insights Blog

Real Estate Credit Environment: Risk Off - Risk On

Earlier last year real estate markets received a scare as CMBS spreads widened, particularly in lower rated and more junior tranches. Additionally, one of the most respected U.S. real estate research...

Investment Strategy | Insights Blog

Investing in Diversity

At Commonfund, we scour the globe to find investment managers that we believe have the ability to consistently produce excess returns (alpha) over and beyond their benchmark. But alpha alone is not...

Investment Strategy | Videos

Evolving Asset Allocation and Policy Portfolios

In this Forum 2018 general session, Commonfund experts share research findings and techniques we employ to help investors understand not just the characteristics of their portfolio in isolation but...

Investment Strategy | Insights Blog

Baring Their Teeth – FAANGs Take a Bite Out of the Equity Market

Narrow market leadership in the U.S. and Emerging Markets proves challenging for active managers Narrow markets are not uncommon to equity investors. They tend to manifest themselves during the best...

Investment Strategy | Insights Blog

A Gap In Reality

With the release of the annual NACUBO-Commonfund Study of Endowments (NCSE) comes the obligatory comparison of 1-year returns. “How did we do relative to the 12.2 percent average return” is a...

Investment Strategy | Insights Blog

When Leaks Turn into Floods: Challenges Facing Higher Education

2017’s tax legislation is the latest in a growing list of challenges facing higher education. The new excise taxes on endowment earnings of the largest private universities, coupled with the...

Investment Strategy | Insights Blog

Bonds May Not Be Loved, But They Shouldn't Be Forgotten

Summary TODAY, THERE IS A GOOD DEAL OF HAND WRINGING OVER THE RISK OF RISING RATES. WHILE RISING LONG-TERM RATES COULD BE A HEADWIND FOR CORE FIXED INCOME, AS LONG AS RATES RISE FAIRLY MODESTLY THE...

Investment Strategy | Insights Blog

Spending Policy: Is Yours Ready for the Next Downturn?

In most Investment Policy Statements there is often a reference to two important, but conflicting, objectives: one, to preserve the purchasing power of the long-term portfolio in real terms, and two,...

Investment Strategy | Insights Blog

Emerging Market Equities Turn the Corner

As we progress through calendar year 2017, we have witnessed the continuation of the equity bull market started in 2009. One difference however, is that leadership has turned (finally!) to non-U.S...

Investment Strategy | Insights Blog

On Complacency | Why Risk Management Always Matters

Like nearly everything in the financial markets, risk is cyclical. History repeats itself. The echoes of past crises are always heard in present ones, yet new crises are rarely predicted and not...

Investment Strategy | Articles

Hedge Fund Land: An Expensive Amusement Park?

In a series of articles, we have addressed two recent investment “fatigues” experienced by institutional investors: Active vs. Passive; and Global (ACWI) vs. US benchmarks. In this article, we tackle...

Investment Strategy | Insights Blog

How Much Beta is in Your Equity Portfolio?

Leveling the Field in the “Tug of War” Between Active and Passive… Active Equity Manager Universal Objective: Outperform the Passive Alternative It’s undeniable that every active equity manager’s...

Investment Strategy | Private Equity Insights

Making the Case for Investing in Natural Resources

The natural resources sector is often characterized as cyclical, as producers and service providers experience underlying exposure to and commensurate volatility of commodities in the oil and gas,...

Investment Strategy | Insights Blog

Thoughts on the Role of Credit in Institutional Portfolios

While most institutional portfolios have allocations to investment grade corporate credit, as a strategic allocation high yield and emerging market credit (liquid credit) are sometimes overlooked....

Investment Strategy | Insights Blog

Flexing Your Global Portfolio Can Lead to ACWI Fatigue, but Don't Throw in the Towel Yet

Like the build-up of lactic acid in your muscles after a strenuous workout, the underperformance of Morgan Stanley Capital International All Country World index (MSCI ACWI) vs. the Standard & Poor’s...

Investment Strategy | Articles

Not So Free: Implications of New York’s Excelsior Scholarships

Key Insights While opening opportunity to many New York families, the recently enacted Excelsior Scholarship Program will likely stress the financial resources of small private colleges and...

Investment Strategy | Insights Blog

Active Fee Management: Notes from the Front Lines

Few topics get investors’ attention as much as fees. We wouldn’t be human if we all didn’t want to know, in detail, how much something costs. In the world of investing, fees are an even more...

Investment Strategy | Articles

The Misperception of Illiquid Investments

With many market participants expecting low nominal returns across traditional asset classes in the coming years, the challenge of structuring a portfolio to achieve CPI +5%, or long-term purchasing...

Investment Strategy | Insights Blog

Maintaining Purchasing Power in Today’s Environment | CPI + 5%

At Commonfund, we understand the challenge institutions face of maintaining the purchasing power of their endowment. In fact, achieving a rate of return sufficient to cover inflation, distributions...

Investment Strategy | Articles

CIO Roundtable: Is the Endowment Model a Crowded Trade?

Stuck in the past or ever-evolving? The endowment model gets a hard look eight years into the current market cycle. With core tenets of the endowment model seemingly under stress for the last several...

Investment Strategy | Insights Blog

The Crowded Liquidity Trade

The liquidity markets have experienced one of the largest disruptions since the inception of SEC Rule 2a-71 in the early 1970’s. Over the past few months, we have seen a massive shift of investor...

Investment Strategy | Insights Blog

Long-Term Trends for Long-Term Investors

Nonprofit institutions have the distinct advantage of having the longest time horizon of any investors – often perpetuity. This affords an opportunity to consider investments based on secular trends...

Investment Strategy | Insights Blog

What do the Cable Television and Hedge Fund Industries Have in Common?

These industries may seem an odd pairing, but both are in the midst of a disruption-led, industry-wide rationalization process. The two industries share in common a historically evolved “bundling”...

Investment Strategy | Insights Blog

Private Credit Opportunities – Direct Lending to U.S. Middle Market Companies

Much has been made of the challenges endowment, foundation and nonprofit investors face in achieving a CPI+ five percent return target. One way to improve the probability of attaining this goal is to...

Investment Strategy | Insights Blog

Healthcare Endowment Management: 3 Questions to Consider

Mounting cost pressures are forcing small and mid-sized nonprofit healthcare organizations to consider adopting endowment management practices similar to those used elsewhere in the nonprofit sector....

Investment Strategy | Insights Blog

A False Sense of Diversification?

As we have undergone the process of re-underwriting all of Commonfund’s equity managers and funds over the last 6 months, we have tackled anew the age old question of how many funds does one...

Investment Strategy | Insights Blog

Real Estate – Rates, Rates, Rates

“There are three things that matter in property: location, location, location”. While the age-old adage still holds in many respects, real estate risks, as with the risks associated with all asset...

Investment Strategy | Articles

Active Management Fatigue and What to Do About It

Active management has struggled for several years, raising questions about whether active management can ever outperform again. Traditional active manager style tilts, like value and size, have...

Investment Strategy | Articles

Ideas for Next Gen Energy Investing

Advances in alternative energy technologies promise to reduce the world’s dependence on fossil fuels. Largely, however, they remain just that—a promise. So, where are the opportunities to invest in...

Investment Strategy | Articles

Unhedged Commentary: The $3 Trillion Question

Reprinted from Institutional Investor’s Alpha Spring 2016 issue The growth of the hedge fund industry over the past decade has been tremendous, with more and more institutional and retail investors...

Investment Strategy | Articles

The Big Picture: Integrating Investments, Finance and Development

Most things function a lot better when all the moving parts work together—nonprofit institutions included. The synergies afforded by collaboration across organizational boundaries may be the most...

Investment Strategy | Private Equity Insights

Private Equity Asset Allocation

Reprinted from Volume 17, Number 1, 2016 of The Journal of Investment Consulting by Mark J.P. Anson Private assets such as private equity and venture capital have long been a thorn in the side of...

Investment Strategy | Articles

Rethinking Risk and Diversification

Asset allocation is still the foundation on which better risk-adjusted returns are built. But asset allocation has changed, along with all the associated tools for pursuing return and managing risk....

Investment Strategy | Articles

Multi-Asset Investing: Form Follows Function

The design axiom captures the purpose of multi-asset investing Interest in multi-asset investing is growing and the inflows confirm it: Institutional assets committed to multi-asset investing are...

Investment Strategy | Articles

Viewpoint: A Different Kind of Climate Change

How have cultural, religious and social service institutions’ investment portfolios changed in response to the financial and market environment that has prevailed over the last several years? While...

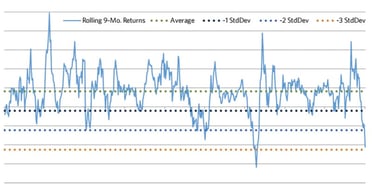

What Factors Influence Pricing in the LP-led Secondaries Market?