On January 16th Commonfund held its first invitational Diverse Manager Day. The day was made possible as a result of the success we had from submissions to the Diverse Manager Portal launched last fall.

Commonfund developed the dedicated Diverse Manager Portal1 as part of our effort to expand our Diverse Manager Database; to accelerate the inclusion of diverse managers in client portfolios; and to give clients access to a broader array of investment talent. The Portal was open for three months from September 1st to December 1st and invited equities, fixed income and credit, hedge fund and real estate managers to submit performance, a presentation and a due diligence questionnaire for Commonfund review.

Prior to the Portal’s launch, the Commonfund Diverse Manager Database had identified a known universe of approximately 994 diverse managers across all asset classes, 672 of which were equities, fixed income and credit, hedge funds and real estate focused.

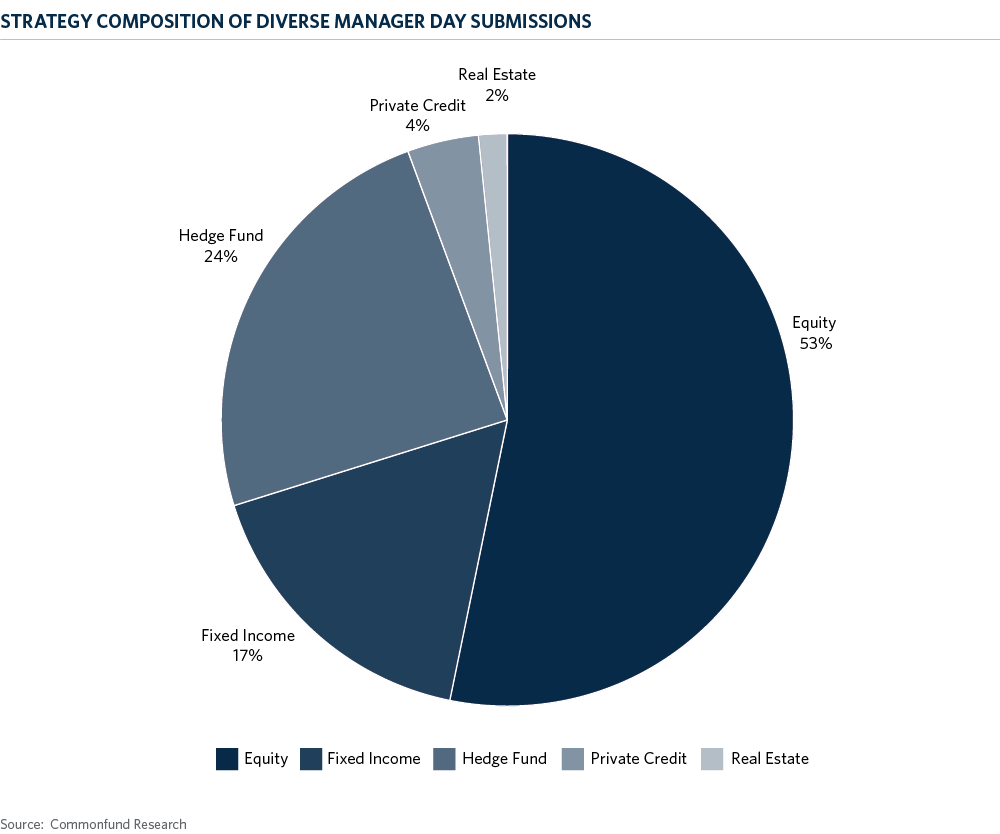

Over the three-month period that the Portal was open, we received 124 submissions from 64 investment firms. Approximately 53 percent of the submissions were for equities, 24 percent for hedge funds, 17 percent for fixed income, four percent for private credit and two percent for real estate:

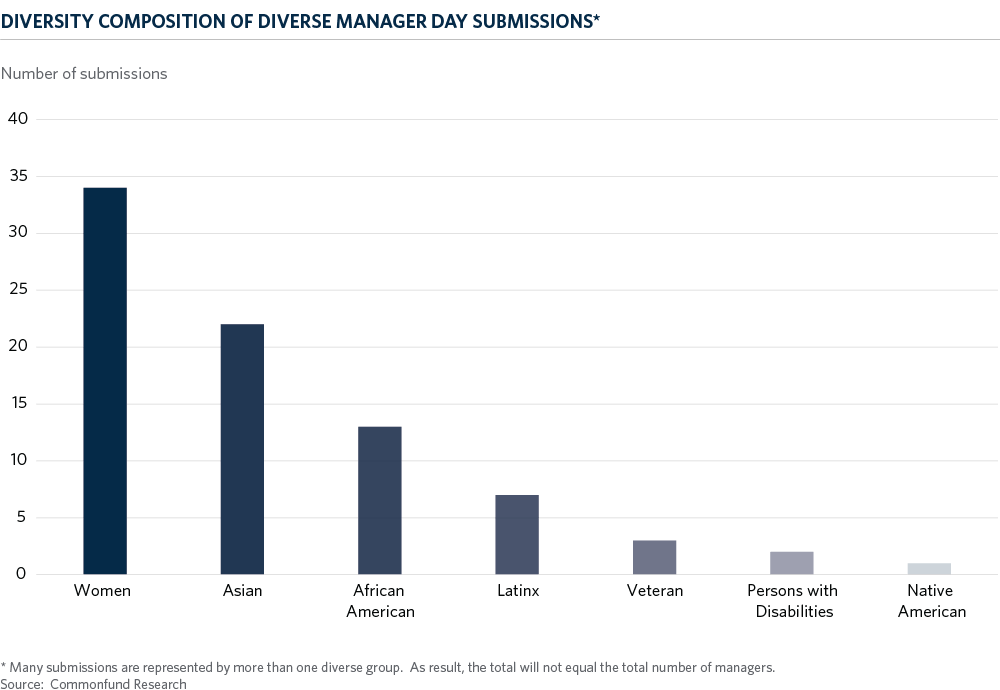

The distribution of diversity of submissions is more complex, but the following chart gives a sense of the balance of submissions among women, minorities, veterans, and those with disabilities.

After completing full qualitative and quantitative analysis of all 124 submissions, Commonfund invited nine managers to the Diverse Manager Day to present to our equity, fixed income and hedge fund teams.

We met with three equity managers, three hedge funds, and three fixed income managers that spanned strategies as varied as small cap US, emerging and frontier markets, healthcare, convertibles, fixed income and high yield.

It is too early to determine whether any of these managers will be included in client portfolios, but it is an important step in the expansion of our diverse manager investment efforts.

Read more about the differences between minority and diverse managers.

Visit our Commonfund website today to learn more about responsible investing.

1 Diverse managers are defined by 33% or greater diverse ownership at the time of investment. Private investment manager ownership stakes may be diluted over time. Diverse managers include US citizens who are people of color, women, veterans, people with disabilities and “others” not captured by the preceding categories.