Narrow market leadership in the U.S. and Emerging Markets proves challenging for active managers

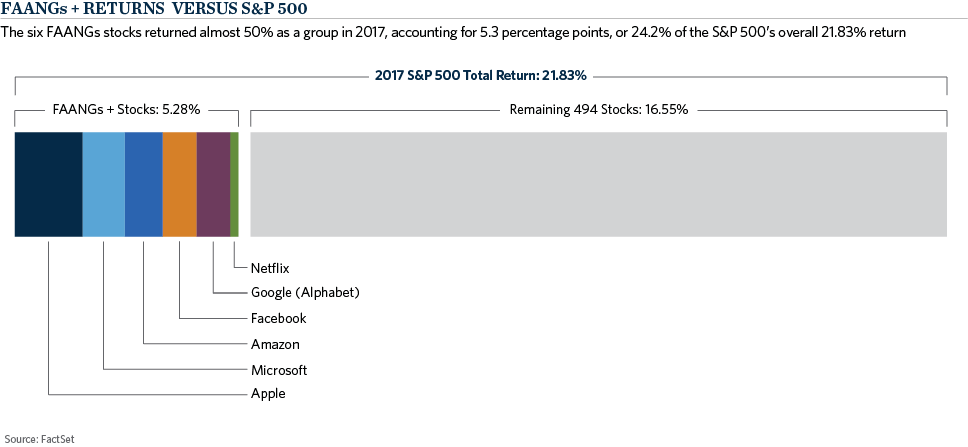

Narrow markets are not uncommon to equity investors. They tend to manifest themselves during the best of times, as bull markets lengthen, and thematic elements of investing gain popularity. Prior narrow market environments existed in the late 1990’s (we all remember the tech bubble!) and also in 2007, prior to the Great Financial Crisis. The most recent narrow market has been dominated by the headlines of FAANG’s – Facebook, Amazon, Apple, Netflix and Google. These five business models are disrupting all sorts of industries, and with it, their stock prices have soared. Collectively, as a group, the average return for the Fab Five was nearly 50 percent for 2017, compared to the S&P 500 Index return of 21.8 percent. The FAANG’s now account for over 10 percent of the S&P 500 Index and accounted for 4.3 percentage points of the 21 percent return in 2017. When Microsoft, another large technology holding in the S&P, is added in (FAANG’s +), the return contribution goes up to 5.3 percentage points, or a full 24 percent of the return contribution for the full year.

Betting against the FAANG’s + in the S&P was costly in 2017, but given the valuation profiles of these companies, understandable. Valuations for these FAANG + stocks are more than just “stretched” in comparison to the broader market. P/E ratios of 165 times (Amazon), 97 times (Netflix) or high 20’s for Facebook or Google are not easy to swallow. On the other hand, earnings and revenue growth have largely delivered. Amazon and Netflix have both increased sales around 30 percent, while Facebook’s sales growth is even higher, at 45 percent. Comparisons to the late 90’s tech bubble are probably not relevant, as these companies have sizable earnings and/or cash on the balance sheet to provide more potential upside, but one needs to be comfortable with lofty valuations to buy in at these levels.

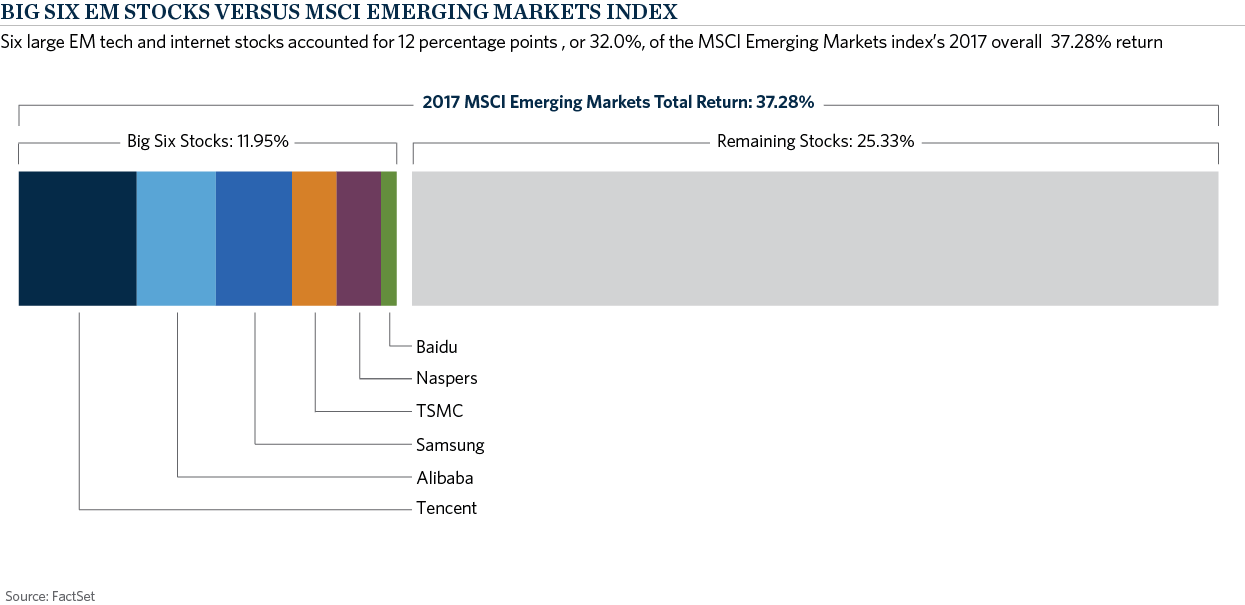

This hasn’t been a U.S. market phenomenon only, however. If we turn our attention to the emerging markets, a similar picture emerges as well. Technology represented over 27 percent of the MSCI Emerging Markets Index at year end, and contributed a full 12 percentage points of the 37 percent total return of the index in 2017. Large internet/technology holdings such as: Tencent (+113 percent); Alibaba (+96 percent); Naspers (+90 percent); Samsung (+61 percent); Baidu (+42 percent) and Taiwan Semiconductor (+40 percent) were the drivers of these outsized returns last year, contributing a third of the total index return. In combination, these six names now accounted for a full 20 percent of the index at year end (double the 10 percent that FAANGs+ account for in the S&P 500). For context, just five years ago, the entire tech sector represented just 14 percent of the emerging markets index. Similar to some of the FAANG stocks, these internet names have experienced explosive growth in a relatively short period of time.

Narrow markets are difficult for most active managers, as they are typically characterized by thematic drivers leading over broad-based approaches. Prior narrow markets were accompanied by the “average” active manager underperforming benchmarks. This was the case in 1998/1999, 2007 and in 2017. These periods are typically followed by better active management environments, but despite this, the temptation among some investors is to just throw in the towel and move to passive investing.

Alternatively, we believe that investors can weather narrow markets by focusing on three guiding principles: risk-aware portfolio construction, inclusion of diversifying sources of active return (risk-premia), and an alignment of interest with managers through performance-based fees. Risk-aware portfolio construction, focused on weighting decisions driven by underlying manager’s active risk levels, places emphasis on portfolios that will not ignore one segment of the market in order to favor another. In addition to traditional stock pickers, including strategies that generate excess returns through targeted factor exposures and quantitative approaches that are less susceptible to narrow markets challenges can be beneficial. Any decrease in flat fees, in favor of performance-based fees above the benchmark, has a direct positive impact on net returns, which is important in a market where every basis point counts.