Our 2021 Council on Foundations-Commonfund Study of Foundations marked our 10th year in collaboration with Council on Foundations and the Commonfund Institute to measure, analyze and document the endowment management and governance practices of private and community foundations. Both organizations have long espoused best practices and we believe that reliable information is essential to the promulgation of excellence in stewardship across the nonprofit sector.

As this is a milestone Study, we have broken down this Viewpoint into three blogs that focus on the long term and review selected data points that our research has uncovered over the years—not data for data’s sake, but rather for insights into the evolution of foundations’ endowment management over the decade and the implications they may carry for the future. Perhaps most importantly, we hope to stimulate discussion among board and investment committee members and senior staff. In this first blog, we take a look at returns.

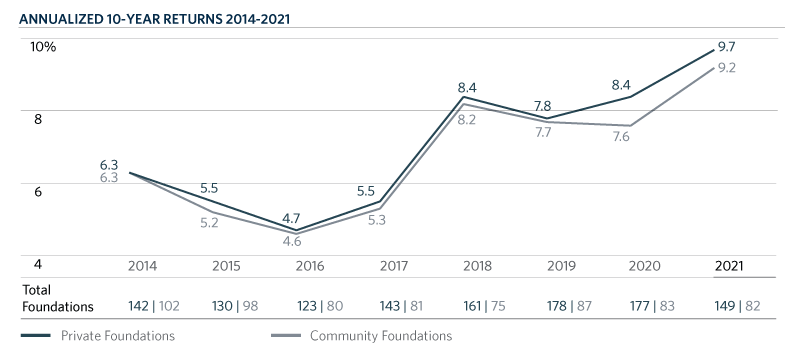

Given that the ultimate goal of investment management is long-term support for a foundation’s mission, the most meaningful data point to emerge from the 2021 report is that average 10-year returns for foundations of both types reached their highest point: 9.7 percent for private foundations and 9.2 percent for community foundations. Contrast this with average 10-year returns when they were at their lowest in 2016: 4.7 percent for private foundations and 4.6 percent community foundations—insufficient to fund grantmaking and investment management expenses and stay ahead of inflation.

The Study for 2014 was the first to segment data by type of foundation. With that as a starting point, we see a distinct difference between the first four years and the most recent four years. For the period 2014 through 2017, private foundations reported returns averaging 5.5 percent with community foundations just behind at 5.4 percent. In the years 2018 through 2021 average 10-year returns rose to 8.6 percent for private foundations and 8.2 percent for community foundations.

The figure below traces 10-year average annual returns from 2014 through 2021; for the preceding two years when returns in this Study were reported only for private foundations, 10-year returns were 7.9 percent in 2012 and 6.9 percent in 2013. Community foundation returns for the same two years, reported in the Commonfund Benchmarks Study® Community Foundations Report were 7.4 percent and 6.7 percent respectively.

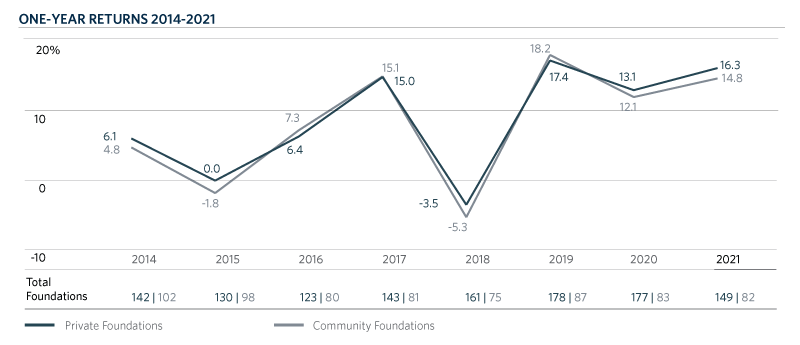

Returns were generally strong throughout the decade, of course, and foundation returns, especially in the most recent periods, reflect that: Foundations of both types reported double-digit returns in four of the past five years and these returns more than compensated for 2018, when returns were negative (-3.5 percent for private foundations and -5.3 percent for community foundations). The figure below traces one-year returns from 2014 through 2021; for the preceding two years when returns in this Study were only reported for private foundations, one-year returns were 12.0 percent in 2012 and 15.6 percent in 2013. Community foundation on-year returns for the same two years, reported in the Commonfund Benchmarks Study® Community Foundations Report were 12.2 percent and 15.2 percent respectively.

Conclusion

It is not a consensus point of view, but there are many—academicians and experienced investors—who believe that equity returns over the next several years may not keep pace with what we have almost come to expect. Reversion to the mean is one argument. Slower economic growth across the globe is another, as is the related inflationary outbreak, which we are experiencing in real time. Another factor is the geopolitical environment that threatens an end to the “peace dividend” that has sheltered investors for 25 years and longer. There are several levers that foundation investment committees have to manipulate in response, perhaps the single most important one being asset allocation which our next blog in the series focuses on.