While most institutional portfolios have allocations to investment grade corporate credit, as a strategic allocation high yield and emerging market credit (liquid credit) are sometimes overlooked. Yet these sectors can deliver attractive performance relative to other asset classes over long time periods with the potential for strong cash flow and diversification benefits as well.

In our last blog we discussed private credit as a way to access the potentially significant liquidity premium in an intermediate term and cash-flowing strategy. Liquid credit investments also offer strong return potential without the need to lock up capital.

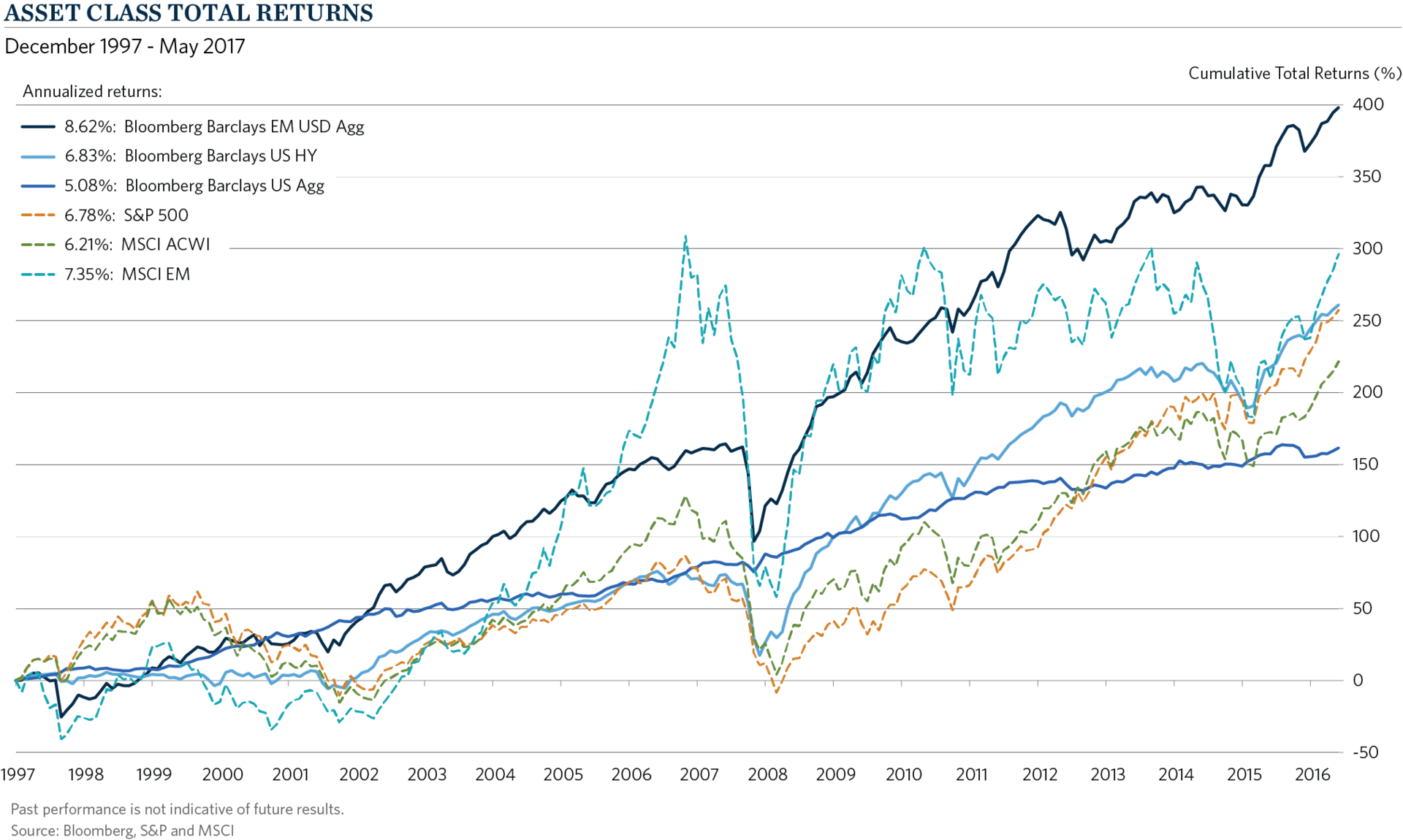

Over the past 20 years, U.S. dollar-denominated emerging market bonds (including sovereign, quasi-sovereign and corporate bonds), as represented by the Bloomberg Barclays EM USD Aggregate Index, have been one of the strongest performing sectors, outperforming even equities over the past twenty years, as illustrated in Exhibit 1. High yield U.S. corporate bonds, as represented by the Bloomberg Barclays US Corporate High Yield Index, have also outperformed most equity indexes over this time period, with considerably less volatility.

Exhibit 1

Of course, credit doesn’t always outperform equities and indeed we would generally expect equities, with their theoretically unlimited upside, to outperform credit investments during prolonged market rallies. For example, in the years since the financial crisis, the U.S. stock market has been a stellar performer, as Exhibit 2 illustrates:

Exhibit 2

The 30-year bull market in Treasury bonds has certainly been a tailwind for the credit markets (and it has arguably had a salutary impact on equity markets as well). However, on a duration adjusted basis, both high yield and emerging market bonds have significantly outperformed Treasuries over the time frames considered above. Based on data provided by the Bloomberg Barclays index service, U.S. high yield corporate bonds have outperformed Treasuries on a duration-adjusted basis by an annualized 210 basis points since 1997 and by 555 basis points since 2009. For dollar-denominated emerging market bonds, the story is similarly attractive, with annualized outperformance of 362 basis points since 1997 and 333 basis points since 2009.

Is this the right time for credit investing?

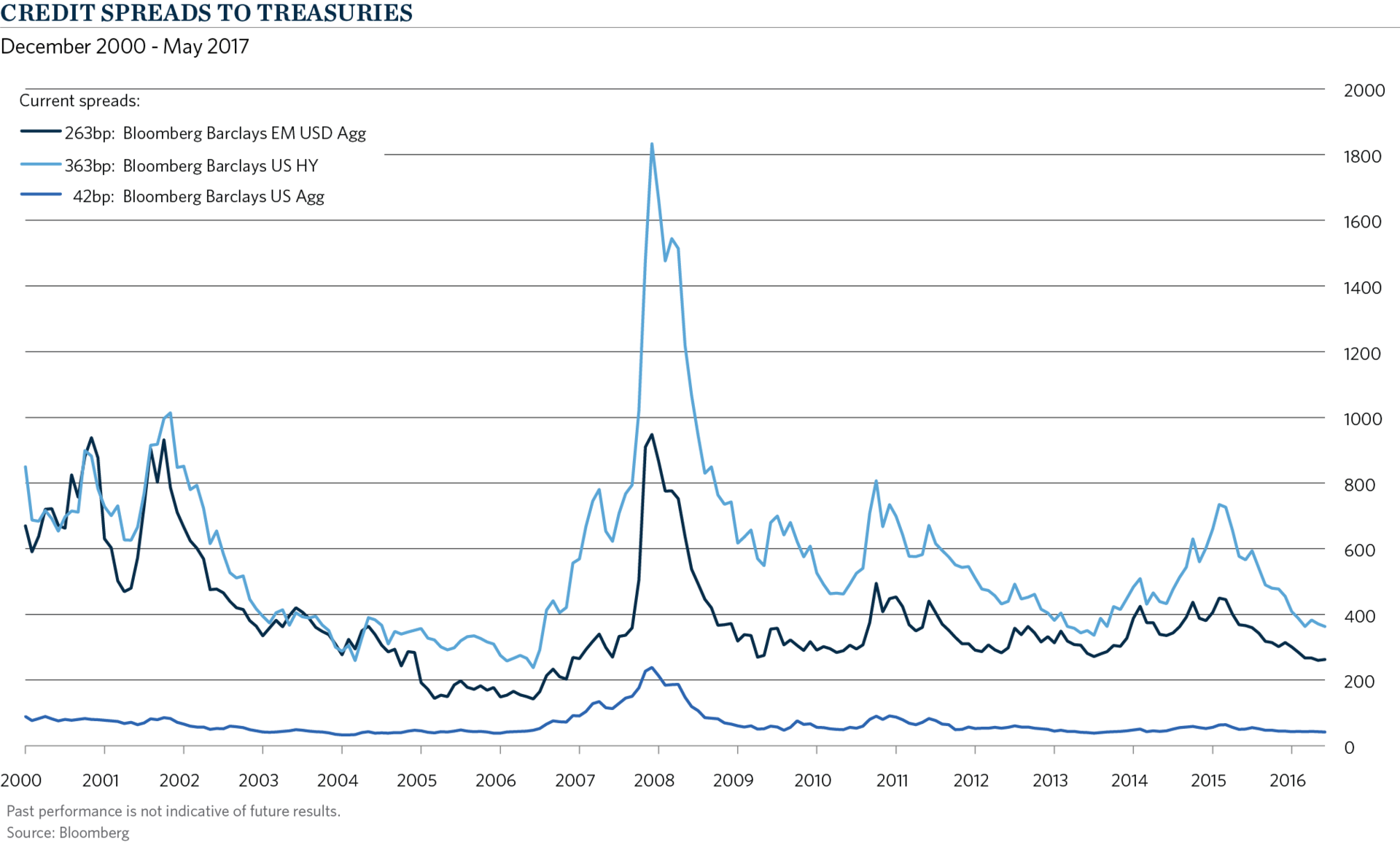

Some investors are concerned about making credit allocations at this late point in the credit cycle. While it is true that these indexes have had a nice run, with spreads relatively tight and well inside their long-term averages, they remain significantly wider than the extremes of 2007 (see Exhibit 3). At the end of May 2007, the high yield bond index spread stood at 238 basis points versus 364 basis points today, and the EM bond index spread was 143 basis points versus 263 basis points today, suggesting that spreads remain reasonable albeit not generous. Credit can continue to benefit from its relatively high yield but there is arguably only limited longer term upside from spread compression.

Exhibit 3

Who are your co-investors/managers?

In recent years retail investors have piled into high yield, loan and emerging market ETFs and mutual funds. This behavior can in some cases result in the funds/ETFs becoming price takers on bond issues, as the portfolio managers seek to put the latest subscriptions to work, while not necessarily being able to complete the same level of diligence on issuers as they otherwise might have in a more normal environment. We seek to invest in these sectors via separate accounts rather than commingled funds, where possible, to minimize the impact of the liquidity needs of others on our returns, to allow for better transparency and to exert more robust controls over the investment program through stronger mandate terms than one might find in a typical commingled program.

As to managers, credit investing lends itself to a more active rather than passive approach, given the idiosyncratic nature of corporate capital structures and individual securities and the nuances of emerging markets. We seek to partner with reputable managers that have demonstrated the expertise to navigate the credit cycle and opportunistically move both within and among sectors, up and down the capital structure and among countries and currencies to maximize risk-adjusted return.

Conclusion

While an index-like approach to bonds has worked well in the past on the back of a 30-year bond bull market, we believe that given today’s low yields and the outlook for a continuing rising rate environment, investors such as endowments and foundations seeking to achieve the goal of CPI+ 5% should consider a well-thought out diversified allocation to liquid credit markets, which can be a good companion to both investment grade allocations and private credit investments such as direct lending to middle market companies.