Much has been made of the challenges endowment, foundation and nonprofit investors face in achieving a CPI+ five percent return target. One way to improve the probability of attaining this goal is to take advantage of the so-called “liquidity premium.”

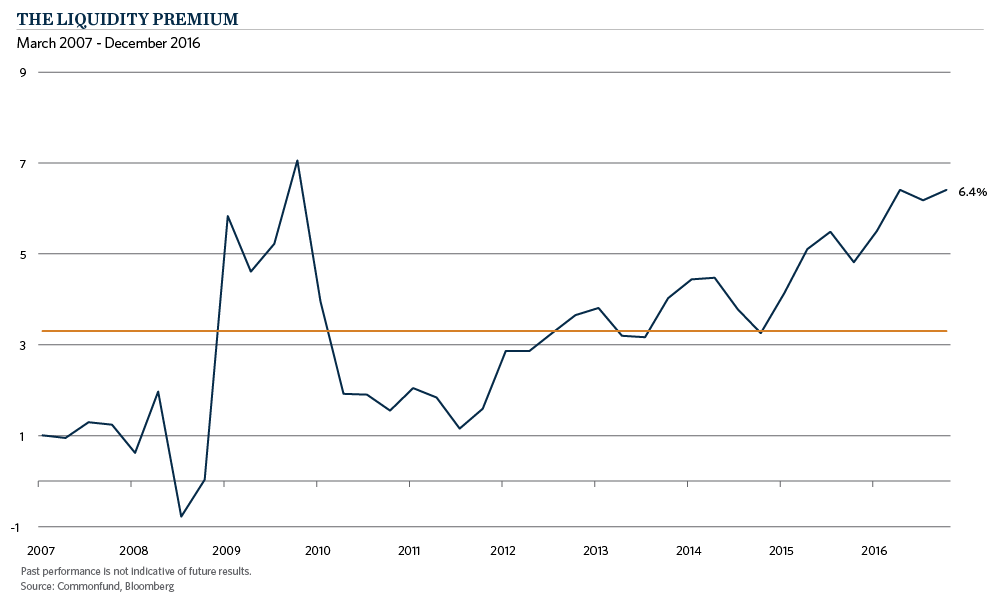

The liquidity premium is the extra return demanded by investors when an investment cannot be easily converted into cash for its fair market value. The liquidity premium has fluctuated over time, with recent readings suggesting that it could present a more attractive opportunity now than it has in recent years.

Direct lending is a fixed income opportunity that takes advantage of the liquidity premium in the credit market. Unlike long-lock private investments such as private equity, venture capital and distressed debt, the lending strategy is intermediate term in nature and is often cash-flowing soon after the first capital is called. The loans are typically floating-rate which reduces the duration risk associated with a rising rate environment. Another attractive feature is that many direct lending managers charge fees only on invested capital, which eliminates the “J-curve” problem of traditional private equity. For these reasons, direct lending is often viewed as an attractive complement to private equity investments.

Direct lending is the origination of loans by non-bank lenders, such as asset management firms, to middle market companies in generally higher yielding (below investment grade) transactions. Though definitions might vary, broadly speaking “middle-market” companies that are the target of direct lending managers generate earnings before interest, taxes, depreciation and amortization (EBITDA) of $10 million – $75 million on revenue of $100 – $300 million.

By our estimates, investors in direct lending strategies can receive additional compensation of as much as 600 basis points over similar quality high-yield bonds while being more senior in the capital structure and less exposed to the risk of rising rates. Direct lending does require use of modest fund level leverage to achieve these returns, however.

The opportunity for non-bank lenders to enter the space has grown in recent years as a result of changes forced upon the banks by regulators as a result of the Great Financial Crisis. Driven from the space by changes in regulations (Basel III, Dodd Frank/Volker Rule), money center and regional banks have had a reduced appetite for lending to middle market companies, and demand for middle market loans continues to remain high.

The U.S. “middle market” is estimated by some to be $4 trillion in size, and would be the fifth largest global economy based on combined revenue. There is an existing overhang of debt maturities that continue to put liquidity and refinancing pressures on these companies, and private equity sponsors have, by some estimates, in excess of $500 billion of dry powder to put to work in M&A transactions.

So what does one receive exposure to when buying a direct lending portfolio? Following are some key characteristics of direct lending portfolios:

-

Periodic income distributions

-

Floating-rate (LIBOR-based) interest

-

Target loan yield 8%-12% (before fund-level leverage)

-

2-3 year loan average life (due to refinancing/mergers and acquisitions etc.)

-

Highly negotiated, well-structured legal documents

As money-center and regional banks have stepped away from the sector, significant amounts of capital have entered the space to fill this void, and finding the following characteristics in a direct lending manager can to lead to meaningful and repeatable outcomes. These characteristics include, but are not limited to, disciplined underwriting, better structuring, intensive loan monitoring and workout capabilities.

Disciplined underwriting includes underwriting to exit, not “loan to own”. In addition, the lender minimizes concentrated risks, volatility and cyclical industries. The best lenders also seek to avoid industries and jurisdictions where lenders’ rights could be at risk. Examples of better structures are more robust loan covenants with favorable lending terms and stronger control over amendments than is typically seen in broadly syndicated loans. Typically, the lender can negotiate to have a board observer, and detailed monthly management reporting with key performance metrics chosen by the lender. Intensive loan monitoring includes frequent dialogue with borrowers and private equity sponsors. Finally workout capabilities become necessary if a covenant breach is likely to occur, and it is critical that lenders have the capabilities to manage the workout, restructuring and the bankruptcy process.

In the current low yield environment where income is scarce and interest rate sensitivity is a concern, capturing the liquidity premium through direct lending via floating rate loans may be a compelling building block in constructing a portfolio that will achieve challenging return targets.