Let’s start with a quick recap of Part 1 of this story, which can be boiled down to three main points:

-

Investors often spend too much for market beta, paying “2 and 20” for hedge funds that deliver significant embedded market return (beta), not manager skill (alpha).

-

Commonfund seeks “alpha-only” strategies in its hedge fund portfolios but aims to source equivalent amounts of total portfolio beta exposure through more cost-effective strategies.

-

Relative to peers, we advocate for a lower asset allocation to hedge funds which we believe is more cost effective.

What Should Your Hedge Fund Return Expectations Be?

We don’t believe that hedge funds, broadly defined and in aggregate, can outperform equity benchmarks over a full market cycle. Moreover, our aversion to equity beta risk in hedge fund portfolios suggests that our hedge fund exposure will underperform traditional equity and hedge fund indices in a “risk-on” market but, conversely, outperform in a falling stock market.

Let’s, however, consider a more nuanced approach to performance expectations. If our hedge fund strategy is designed to carry no beta, then the strategy’s return expectation ought to be roughly equivalent to its alpha expectation (on top of the prevailing rate paid for cash, defined as the yield on the U.S. 91-day Treasury bill). So, how much alpha is reasonable to expect?

Before we propose an answer, let’s agree that positive alpha, while always our goal, is not a given in any allocation. Hedge funds may produce negative results, especially over a short time frame, in much the same way an active equity or fixed income manager might underperform their traditional benchmark. Taking that line of thinking one step further, a reasonable minimum benchmark for our hedge fund portfolio might be the comparable excess return (alpha) component we expect from our traditional equity and fixed income managers. How do these compare?

Building Return Expectations

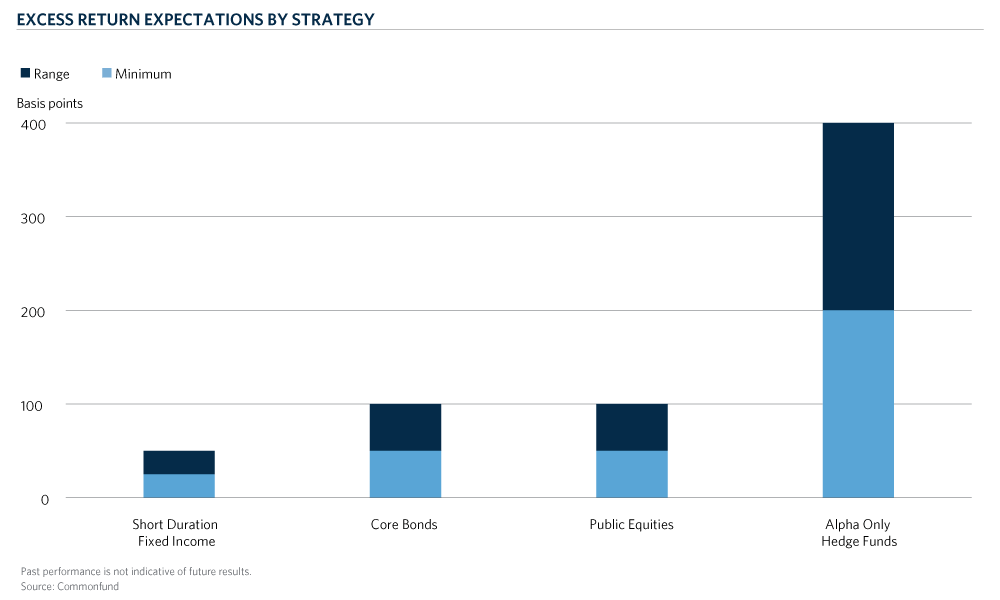

The alpha assumptions incorporated into our active risk asset allocation framework are based on long-term manager universe return data across investment types. Our excess return assumptions reflect a competitive active management environment where alpha is scarce. As shown in the chart, we would deem short-term fixed income managers minimally successful with 25 basis points of annual excess performance. We expect bond managers with a credit component and equity managers to deliver an annual minimum 50 basis points in excess of their respective benchmarks.

Hedge fund managers are advantaged relative to traditional asset class managers by a larger opportunity set, leverage flexibility and capital duration, which justifies higher alpha expectations. Their higher fees also demand that we have a higher excess return expectation than traditional long-only strategies.

A Source of Uncorrelated Return

Thus, our alpha-centric hedge fund allocation carries a minimally acceptable return target of 91-day Treasury bills plus 200 basis points. This is an ambitious minimum alpha goal as the median hedge fund has not delivered anywhere near a 200 basis point beta-adjusted return above cash over any long term time frame. It is additionally important to note that T-Bills +200 is a floor and not a ceiling and is multiples of the alpha we seek from active risk allocations in traditional asset classes. Furthermore, we are constantly on the lookout for managers who can add return potential.

A Complement to Fixed Income as a Portfolio Diversifier

Return targets, however, are only part of the hedge fund performance expectation story. We rely on hedge funds to provide true diversification benefit relative to equity risk. Typical hedge fund portfolios, in addition to producing underwhelming performance over the last 10 years, have been far more correlated to equity beta than is justified for an allocation often touted as a diversifier. Our hedge fund portfolio construction process insists upon producing returns independent of traditional equity and credit betas, and, equally importantly, independent of primary risk factors, like duration, that drive fixed income returns.

A Portfolio Ballast

Relative to traditionally constructed hedge portfolios, in addition to being more cost efficient, we believe our process improves the odds of consistent alpha generation by largely eliminating the market timing element of investing (where most perform poorly). Our approach should also reduce the negative impact of incentive fees by removing much of the volatility from market beta, thereby improving an investor’s odds of staying with a manager through a cycle. And finally, our hedge fund strategy offers the possibility of producing positive absolute return when it will be needed most, that is, when markets are down.

Most significantly, our alpha-first, beta averse approach to hedge fund investing is fundamental to our asset allocation methodology, in which we seek to optimize for drawdown recovery time. The siren call of beta in a bull market is strong, but we remain diligent in maintaining the integrity of purpose for hedge funds in portfolios.