At the risk of beating a dead horse, hedge funds are not an asset class. This is especially true in the way in which Commonfund selects and constructs its hedge fund portfolios: focusing unambiguously on a broad range of disparate strategies designed to produce diversifying returns that are not the result of simple market (e.g., equity or credit) or factor risks (e.g., momentum or size).

Hedge funds do, however, warrant a slice of an institution’s asset allocation pie – but not for beta exposure. We aim for pure alpha from our hedge funds and believe that the return, risk and correlation characteristics we can get from following this approach merit a strategic allocation of capital to hedge funds.

Our approach to hedge fund usage is atypical in the industry. Broadly speaking, the institutional investing community accesses a meaningful portion of their total portfolio equity market risk from hedge fund allocations. Furthermore, given the prevailing hedge fund fee structure (2 percent management fee and 20 percent incentive fee), these institutional investors are paying dearly for this market beta. To be sure, many of these same institutional investors do get some alpha from their hedge fund investments; the problem is in the packaging and pricing (see our previous blog on bundling). An increasingly less well-guarded secret of the hedge fund industry is that the market beta they provide is not special; it is, in fact, no different than the market beta one can access in an index fund. It is just far more expensive!

Our approach to sizing hedge funds in a total asset allocation context is also differentiated from the industry. We encourage a lower allocation to hedge funds than do our peers.

Examining Two Portfolios

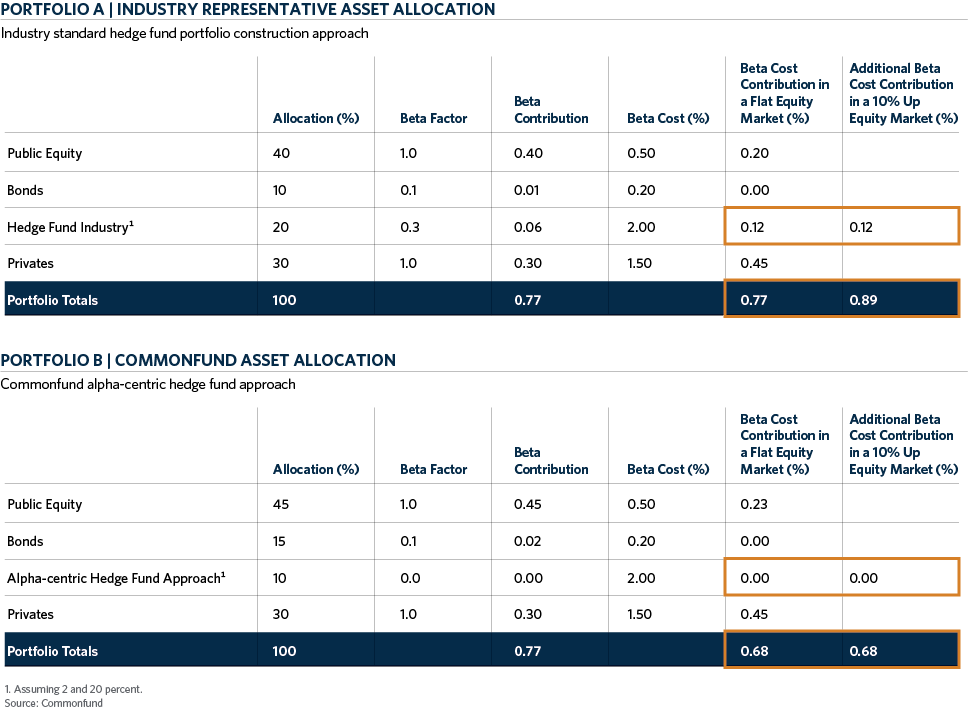

Consider the following two investment portfolios. Both deliver the same total portfolio equity market risk: an estimated beta of 0.77 to be exact. Indeed, our mission-based clients rely on this equity risk to provide for growth and to protect purchasing power of their endowed pools. The sources and costs of the beta being delivered are, however, quite different.

Portfolio A represents a typical institutional asset allocation and approach to hedge fund portfolio construction. The keys in this allocation example are that:

-

Hedge funds carry a 20 percent portfolio weight (based on the 2017 NACUBO-Commonfund Study of Endowments ).

-

The beta factor (adjusts each allocation’s weight by the amount that can be explained primarily by equity market returns) applied to the hedge fund allocation is 0.3 (representative of the long term single factor beta of the HFRI Fund-of-Fund Index to the equity market).

Portfolio B, representative of Commonfund’s asset allocation framework that seeks to optimize for drawdown recovery time highlights a few important differences:

-

The hedge fund allocation is reduced from 20 percent to 10 percent with the difference reallocated to more reasonably priced beta alternatives of public equity and bonds (in bonds we assume a 0.1 market beta .attributable to a credit component within the broader allocation).

-

The beta factor assigned to the hedge fund portfolio is zero (reflecting our approach to eliminate market exposure in hedge fund portfolio construction).

The beta cost assumptions represent an approximate market average for active management, and are constant across the two portfolios to isolate the cost of equity beta. Equally important to note is that both portfolios deliver the same amount of active risk (100 percent) in aggregate, so an investor is not giving up the potential excess return associated with active investing when they choose to allocate to the second portfolio.

An asset classes’ beta contribution is simply its allocation multiplied by its beta factor. The sum of all beta contributions represents how much beta the institution is carrying at the total portfolio level. Again, both portfolios carry equivalent amounts of beta risk.

Portfolio A is just paying a lot more for its beta allocation.

This can be seen in the beta cost contribution column. Formulaically, beta cost contribution = allocation* beta factor* beta cost.

Why Pay More?

Focusing exclusively on the price paid for beta, all else being equal, in a flat equity market, Portfolio A is 9 basis points more costly than Portfolio B. If the market goes up 10 percent in a year, tack on another 12 basis points to the cost of Portfolio A as an investor would pay a 20 percent incentive whether a hedge fund’s return is attributable to alpha or beta. Why start out your investing day at this sort of disadvantage if you don’t have to?

In the context of our clients’ total asset allocations, we look to a hedge fund portfolio to serve as a ballast, a fixed income complement and a source of uncorrelated absolute return – not a source of market return which can be purchased for far less.

Stay tuned…In Part 2 of our blog we will examine reasonable expectations for hedge fund performance when portfolios are constructed with the alpha-centric approach we advocate.