Investment committees overseeing the endowments of higher ed institutions need to think about inflation for two fundamental reasons.

First, inflation can negatively impact their investment portfolios by causing lower or even negative returns in asset classes that are inflation-sensitive (e.g., bonds often perform poorly when inflation is high). Second, inflation erodes the real purchasing power of spending dollars. In either case, the result is an erosion in real purchasing power or intergenerational equity. In the worst-case scenario, a one-two punch from inflation does both at the same time, like it did in the late 1970s into the early 1980s. With inflation, as measured by the Consumer Price Index (“CPI”), at 40-year highs today and both stock and bond markets experiencing negative returns in calendar year 2022, there’s little doubt that it has already impacted financial market returns and thus portfolio values. And while it is critically important to address the investment implications of the current inflationary environment, it is also worth considering whether the surge in the CPI is represents a commensurate rise in the cost of funding your mission. We have argued for many years that understanding inflation is a critical exercise in setting policy, specifically as it relates to establishing investment objectives (a real return target that is comprised of inflation plus spending) and spending policy (to the extent that one uses an inflation linked spending methodology). In that exercise the most important question to consider is “what is the most appropriate measure of inflation for our institution?” For many, CPI may not reflect the underlying cost structure of their organization or the cost of funding the mission. As a result, some of our college and university investors look to the Higher Education Price Index (“HEPI”) as a more relevant measure of inflation, as it calculates a basket of goods and services that more closely align with higher education, e.g., faculty and administrative salaries, fringe benefits, supplies and materials, etc.).

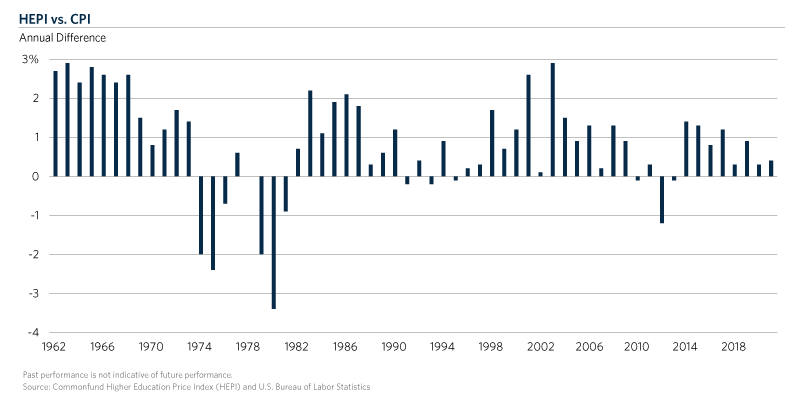

We have long believed that CPI understates inflation for colleges and universities and historically that has in fact been the case.

In the past 60 years, HEPI was 0.8 percent higher than CPI on an average annual basis and has been higher 47 years, or 80 percent of the time. HEPI has been lower than CPI in only 12 of the past 60 years, half of which occurred between 1974 and 1981. Today we find ourselves still making the case that CPI is not necessarily the most appropriate measure of inflation but for a different reason: CPI might overstate inflation for many nonprofit investors. In early April of this year, we released our latest estimate for HEPI which forecasts the index to rise by 4.2 percent in fiscal year 2022. Compare that to current levels of CPI which start with an “8” and it is reasonable to expect that 2022 will be the 13th year in the past 61 that CPI outpaces HEPI.

Read more on the case for using HEPI vs. CPI

What does this mean for policy? It means two important things. First, all institutional investors, including colleges and universities, who use CPI as a variable in their return target face an increase in that target from somewhere in the 7-8 percent range (spending of 5 percent plus inflation of 2-3 percent) to 12-13 percent (spending of 5 percent plus inflation of 7-8 percent). The implications of this increase are twofold. If one believes that their return objective experienced a step-change function increase they must then reevaluate their strategic asset allocation to ensure that the plan they established to generate a 7 percent annual return over the long term is still relevant in a world where they now need to generate 12 percent. It likely is not. Moreover, for those who are trying to measure their success in maintaining intergenerational equity the hurdle just got a lot harder to clear. The second policy implication of an elevated CPI level relates to spending policy. We continue to counsel that spending policy is a critical decision and have advocated over the years for creating alignment between the institution and the investment portfolio through a policy that considers the cost structure of the institution. One way to do this is to use an inflation factor in the spending calculation (examples of this include a 70/30 weighted average approach or a banded inflation approach). For those who have adopted such an approach the factor one uses for the inflation rate will be critically important this year for the reasons noted above. A formula that grows last year’s spending by CPI may result in unnecessary overspending from the endowment at the expense of future growth and future support. Additionally, the potential for inflation volatility going forward reinforces the need to continuously monitor it closely.

There’s no doubt that we are in an inflationary environment that many of us haven’t experienced in our professional careers. It also looks as if inflation will persist longer than perhaps originally expected and will continue to have an impact on the capital markets. How we think about the measurement of inflation in terms of our investment strategy, as well as our mission strategy, will be critical to helping navigate these challenging inflationary times.