Bank safety amidst a confidence crisis

It’s not hard to find sore spots in the economy. High rates of inflation have hit pocketbooks and balance sheets and initiated the steepest interest rate hikes since 1982. But since inflation has largely been driven by factors beyond national demand (e.g., global supply chain disruptions and war), intended effects of the interest rate regime have taken longer than anticipated to materialize (inflation is still 5 percent year-over-year), while unintended consequences within the banking system have mounted rapidly. The debt ceiling cliff remains dauntingly in the background.

Since the beginning of the year, three banks have failed—with assets, liabilities, and operations taken on by other financial institutions—including the second largest failure since 2008 by total assets. Higher interest rates rapidly reduced the value of bonds on bank balance sheets, creating unrealized losses large enough for uninsured depositors to question if their cash was safe. Aggressive short-selling and social media speculation catalyzed those concerns into a self-fulfilling prophecy while also spreading contagion within the sector. Today’s digital banking environment, which allows millions of dollars to move with the click of a mouse, dramatically expedited the pace of transition from concern to bank failure (SVB clients withdrew $42 billion in one day). Many banks face the same pressures, but the tipping point, which most hopefully will not reach, is determined by the rate and extent of deposit withdrawals.

Is it time to reassess your cash management strategy?

These incidents bring to the fore the specter of counterparty risk, a tail risk which all institutions face that thankfully doesn’t rise to prominence too frequently. The collapse of these three prominent banks should serve as compelling motivation to reevaluate the risks to which your institution’s cash is exposed. Here are three key items for consideration:

![]() Assess the safety of your bank relationships and consider diversifying them.

Assess the safety of your bank relationships and consider diversifying them.

Since SVB and Signature Bank failed, attention has been drawn to the role of the Federal Deposit Insurance Corporation (FDIC) and the extent to which it guarantees depositors’ funds. SVB was unique in that 90 percent of the bank’s deposits fell outside the range that the FDIC insures (generally up to $250,000 per depositor per account type). The FDIC, with backing by the Treasury and the President, “invoked the statutory systemic risk exception” to guarantee all deposits held by the two banks, but has stated it will not necessarily repeat this course of action in the future.

Ninety-nine percent of U.S. bank accounts are fully covered by deposit insurance, and in the case of uninsurance, deposits are often purchased out of a failed bank and maintained by the purchaser, at no loss to the depositor. In fact, post- Great Recession policy changes greatly diminished losses to uninsured depositors. Between 2008 and 2022, only 6 percent of bank failures resulted in any losses to uninsured depositors, compared with 43 percent from 1992 to 2007.1 But many institutions would prefer not to take a 6 percent chance of losses in their bank deposit accounts, and therefore can mitigate this risk by only having cash in any single deposit account under the $250,000 insured limit. If your institution has more than $250k in any one account consistently, consider diversifying your banking relationships across multiple banks to mitigate exposure to a single bank.

Understandably, many smaller institutions use their local bank, for convenience, ease of customer service, and relationship reasons. Having another account with a larger bank could provide an added layer of safety as larger banks face more intense regulatory scrutiny and should therefore be more resilient in the face of financial challenges. The largest banks in the world can also be deemed systemically important, meaning that in the event of trouble they are more likely to see a positive resolution, avoiding the systemic risks their failures can pose. Diversifying your banking relationships, if operationally feasible, will help ensure at least some cash is accessible at all times.

![]() Consider the potential benefits of non-deposit accounts.

Consider the potential benefits of non-deposit accounts.

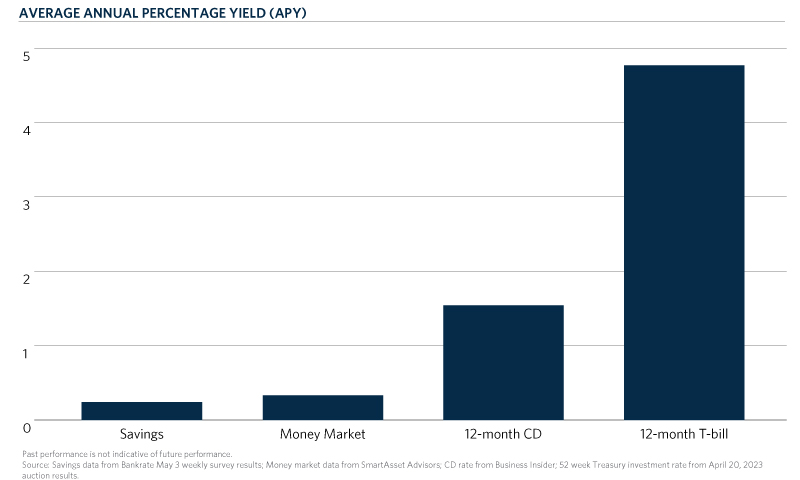

In recent history, deposit accounts were considered lower risk and often offered a lower return but offered flexibility and comprehensive services. In the current banking landscape, demand deposit accounts appear riskier, and relative to other cash strategies, there is an increasing opportunity cost to low-yield deposit accounts.

Note that these averages obscure variation based on deposit or investment size, and day-to-day changes. For money market accounts, the higher the balance, the higher the APY, on average. For example, the average APY for a $2,500 account is .17 percent, compared with .37 percent—more than double—for accounts with $250,000 (the rate shown in the chart, .33 percent, reflects the APY for accounts with $100k). And with Treasury securities, rates are based on periodic auctions. Although banks have faced pressure to increase yields on deposit accounts, the rates are still on average not as high as those offered by money market accounts, money market funds or Treasuries. Diversifying your institution’s cash strategy can, in turn, mitigate risk while garnering a higher financial return.

![]() Diversify in alignment with spending and operational needs.

Diversify in alignment with spending and operational needs.

In optimizing a cash management strategy to minimize risk and maximize returns, one last critical factor to account for is spending and operational needs. Demand deposit accounts are most likely to deliver operational ease and convenience for institutions that have diverse and frequent spending needs, like disbursing wages and salaries, paying for ad hoc maintenance costs, and setting up other automatic bill payments. But if deposit account balances exceed short term and ad hoc spending needs, or if there is leeway in when spending can occur, other account types and investments can play a role, potentially adding both yield and further risk mitigation.

For example, while money market accounts are higher yielding and generally FDIC insured up to the $250k maximum, they often require certain minimums to be met, can limit withdrawal frequency, and might incur transaction or other fees. Another option is a money market fund or money market sweep account, which offer similarly higher yields but generally require some amount of time to access your cash (usually the next day). Money market funds have the added benefit of being bankruptcy-remote from your banking counterparties. They will be held in a brokerage account and are SEC-regulated. While considered lower risk, money market funds have on rare occasion “broken the buck” in the past, referring to a market value decline in the net asset value of the fund to below $1 per share, creating a potential loss for shareholders during an extreme market environment. In such a scenario, despite a potential loss in money market fund holdings, these vehicles would still be considered one of the safest investments an institution could hold. Finally, money invested directly in Treasury bills will need to be sold on the secondary market, and cash settlement will be made the next day, or held to expiration.

It is advisable then to coordinate across your institution to map out spending needs – e.g., institute a process for a quarterly projection of cash needs – to assess the viability and potential benefits of different types of accounts.

In conclusion, a little bit of attention and planning can go a long way to ensuring the preservation of your institution’s cash during turbulent times. We recommend looking at diversifying your banking relationships and considering other account types through the lens of your organization’s spending needs and patterns.

- FDIC "Options for Deposit Insurance Reform, Section 3: History of Deposit Insurance in the U.S." See Figure 3.3