There is no doubt that benchmarking is a good practice for institutions to follow – we publish studies each year for various nonprofit sectors for that reason. While we think that benchmarking is important and a good way to take the temperature of what your organization is doing in comparison to others, we believe it is imperative to focus on the investment governance model and practices that are right for you.

A recent article published in the Chronicle of Philanthropy, "Foundation Investment Choices Potentially Lose $20 Billion a Year for Grantees", argues that some foundations are losing out on potential gains by trying to do what other, most commonly larger, foundations are doing with their investment portfolios, specifically when it comes to investing in alternative assets. It goes on to say that foundations with more than $100 million in endowment assets, which Commonfund considers mid-sized, have a greater opportunity to access some of the best investment managers. For smaller foundations, lack of access to these top-tier managers (due to high minimums), coupled with a different risk profile might make significant allocations to certain alternative strategies untenable. Those with smaller pools of money, however, may see the asset allocations of the larger foundations, who show higher returns, and try to mimic that using managers who aren’t as likely to produce those same gains. In fact, instead of boosting the portfolio, the higher fees associated with alternatives managers could result in lower returns than might have been possible using a more appropriate asset allocation and manager selection.

We are not suggesting those smaller foundations ignore alternative investments when constructing their endowment portfolios and benchmarking against peers. What we are advocating is that smaller and mid-size foundations be thoughtful when constructing portfolios and asset allocations—especially with regard to alternatives—that fit their size, readiness, need for liquidity, and their access to managers and funds. Based on work Commonfund has done, we understand that one of the most important questions is: “How much illiquidity do we need to achieve a foundation’s long-term return objectives?” Whether your foundation has decided to exist into perpetuity or is seeking to spend at accelerated rates and contemplating a spend down, a foundation’s need reflects the return objective required to sustain the mission based on decisions of that nature. Variables such as spending rate, inflation expectations, costs, and contributions, are some of the contributors to determining a return objective. These inputs should be paired then with asset allocation modeling to answer this question.1

We see the same fascination with benchmarking in other spaces - colleges, universities and K-12 independent schools – the desire to look at what larger schools are doing and try to replicate their investment programs. Most of these institutions undertake an annual benchmarking, review the top decile performers, and ask “how can we replicate their returns? How can we replicate their asset allocation?” With that said, although there is a strong correlation between asset allocation, asset size, a sizable investment in alternatives and performance, not all top decile performers in any nonprofit category are always the largest institutions.

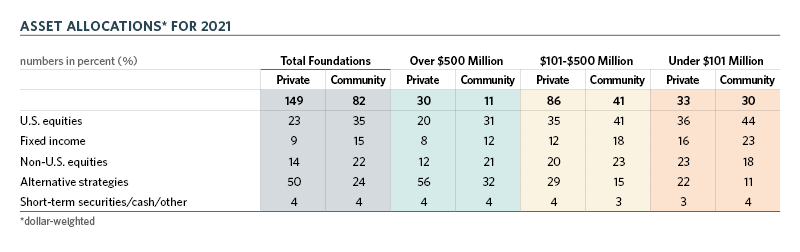

The recently released 2021 Council on Foundations-Commonfund Study of Foundations (CCSF) highlights the investment and governance trends of US private and community foundations. When we look at the asset allocations of the 231 participating foundations, segmented into three size cohorts, it is evident, as it has been historically, that larger foundations have a significantly higher allocation to alternative investments than smaller to mid-size ones. The same is true when we look at the data by type of foundation – private foundations have an allocation to alternative assets that nearly double that of community foundations across all size cohorts. Smaller private foundations and a majority of community foundations, on the other hand, typically report a higher allocation to U.S. equity investments, which are not only more accessible, but also much more affordable.

It is important to recognize that the main advantage of endowment investment benchmarking is that it can highlight areas that require attention. It forces organizations to reflect and evaluate their own processes and practices by providing comparative data. Benchmarking compares return numbers but rarely considers an institution’s specific context and circumstances, it does not account for the many micro and macro factors that can lead to any one institution succeeding or failing to hit or exceed return targets for the endowment based on its mission. It is just one of many tools an institution can use to understand how the endowment is delivering (or not) on objectives like achieving intergenerational equity and supporting current and future organizational needs. But it is necessary to keep in mind that benchmarking to both the same size and type of institution paints a more accurate picture for those looking to see what “everyone else is doing.” If not put into context it can shift from a best practice to a potentially bad one.

While we have called attention to foundations in this article, it is important to note that benchmarking for any institution should be done in comparison with true peers, defined by the institution themselves. Most universities are not Harvard or Yale, most hospitals are not John Hopkins or the Mayo Clinic, and most private foundations are not the Ford Foundation or the Bill and Melinda Gates Foundation. Instead of comparing oneself to the top decile performers, institutions should focus more on their goals and the circumstances in which they are trying to reach them, asking contextualized questions that inform how best to invest their endowment to achieve mission. Answers to more strategic, mission-focused questions provide a multi-dimensional approach to endowment decision-making and place benchmarking data in a more appropriate frame as a useful monitoring tool.

For more information on our benchmarks studies click here.

To learn more about allocating to private investments check out this article, "Your Most Important Endowment Decision", written for Trusteeship Magazine by Tim Yates, Commonfund's President and CEO, Commonfund Asset Management.

1 https://agb.org/trusteeship-article/your-most-important-endowment-decision/

To learn more about spending policy considerations, read:

Is your Spending Policy Getting the Attention it Needs?

Foundation Spending Strategy – Meeting the Moment in 2020 and Beyond

Commonfund Spotlight | Dimple Abichandani, Executive Director of the General Service Foundation