In the ongoing debate about active versus passive investing, conventional wisdom posits that active investing outperforms passive in recessionary or bear market environments. The question is: Will the expected pattern hold up in the current sell-off and what will almost assuredly be the ensuing recession? The answer: it depends.

Thus far in the present market environment it has not been true. That’s because what it depends on is the structure of the sell-off, how long it lasts and how much forced selling takes place. In the bear market of 2001-02, for example, the sell-off was not rapid, there wasn’t a lot of forced deleveraging and individual stocks responded to underlying fundamentals. That environment worked for active fund managers. When markets decline slowly—not suddenly as is the case currently—active managers tend to hold more cash (which, granted, can be called market timing) and they may also hold more defensive securities. On the other hand, a quick, hard-hitting bear market is characterized by significant deleveraging, correlations that go way up and stocks trading on liquidity more than anything else. It’s a sell-what-you-can environment. There were days recently when utilities were down more than the market—not what one would ordinarily expect.

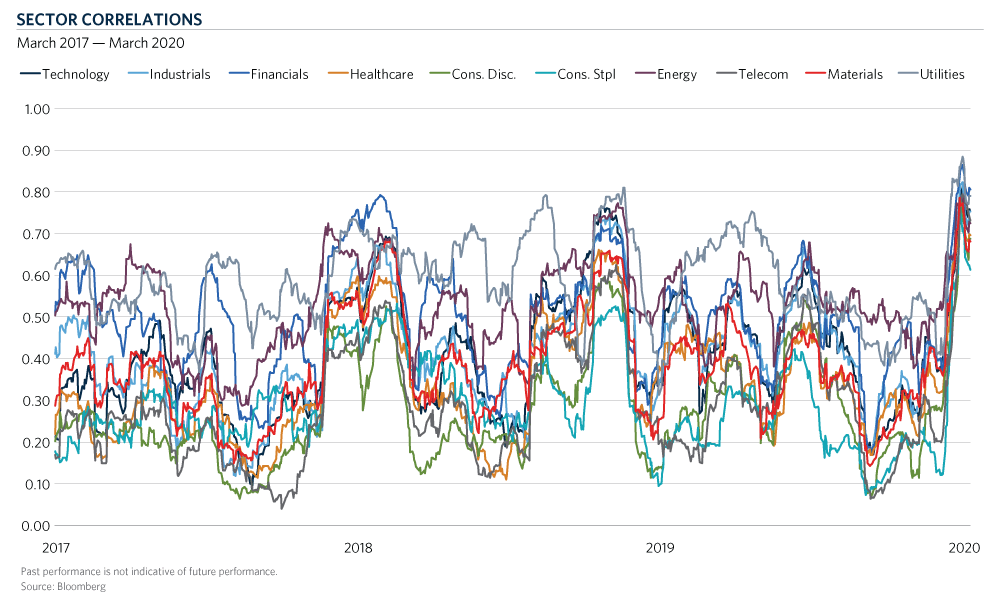

The chart below shows the correlation of various stock sectors in the U.S. Typically, correlations are between 0.3 and 0.6, reflecting price discovery and market participants’ evaluation of the fundamentals of sectors and underlying companies. That environment provides active managers with the opportunity to use their research skills to identify winners and losers and, hopefully, add value for investors on both the upside and the downside. Further, the chart also shows that sector correlations during the recent sharp equity market plunge rose to 0.9 as investors sold indiscriminately.

This is an environment that doesn’t work well for active managers, hedging or relative value strategies. Fundamentals simply take a back seat when stocks that are not even impacted by the virus are down 20, 30 percent or more in just a few days. While this is negative, of course, it does set up opportunities to capture alpha going forward. That’s what happened in the recovery of 2009, after the 2011 retrenchment and in the immediate wake of the Brexit referendum. What will lead us out of this is managers that can stay the course and take advantage of attractive pricing opportunities and benefit when the market starts to incorporate data and fundamentals into stock prices. And while we don’t know where and when those attractive opportunities will present themselves, they most assuredly will. Lastly, we also draw comfort from working with long-tenured managers who have demonstrated an ability to weather prior downturns and, eventually, benefit when the market environment begins to turn.