Ten years ago Lehman Brothers failed, representing the largest bankruptcy in history, and accelerating a global financial crisis that would knock many non-profit portfolios backward. This came on the heels of the tech bubble bursting just eight years earlier, which had triggered a painful recession and caused steep losses in equity markets. Investors were essentially hit with two “100-year storms” in the same decade—and had to rebuild. The good news is that markets have been relatively calm since the fall of 2008. The bad news is that another crisis will inevitably upset the financial markets. And so on the 10-year anniversary of Lehman, we should ask ourselves, are we ready for the next financial pothole?

At Commonfund, we are having important discussions with clients on their preparedness for the next crisis. For example, we are working with clients to develop a road map, or “crisis playbook,” designed to help chart what decisions clients need to make during the next crisis. For our clients, there are two types of crises they must prepare for: a market event causing significant losses in portfolio value, and an event specific to the organization, such as steep decline in a key revenue source (tuition, as an example). In a worst case scenario, these two events can be correlated, which makes understanding their interplay so critical in navigating the storm.

Most institutional investors have a strategic policy portfolio and, after a decade of favorable markets, they often say that they take a long term approach and will stick to their policy. But to paraphrase former boxer Mike Tyson, everyone has a plan until they get hit. It is never pleasant to think about negative scenarios, but it is certainly easier now than when the crisis is unfolding. Asking questions as simple as “what are we going to do if our portfolio drops 20%?” can help set expectations that can guide you through challenging conditions when they arise. But it’s important to recognize that there are many layers to explore when creating a comprehensive “crisis playbook”. Many investment committees spend time on the quantitative aspects of scenario analyses and stress testing. But it is also important to ask, “What are the likely behavioral reactions of your investment committee?”

Since we’ve had calm waters for ten years, there’s a good chance that there are committee members who were not on the investment committee the last time a crisis hit, or who have not been through a crisis before. How will those individuals react? How will the group react? Another important consideration is the impact on the broader financial ecosystem, including stress points on other sources of revenue, expenses, and overall operating dynamics. And let’s not forget, it is likely that your constituents will also be in the path of the storm—and it will be important to ask whether their needs may increase at exactly the same time your resources to meet those needs are impaired. In the end, a crisis event will have impacts that extend beyond a drop in the portfolio. The associated effects can be just as challenging, and their impacts can be felt for a long period afterward.

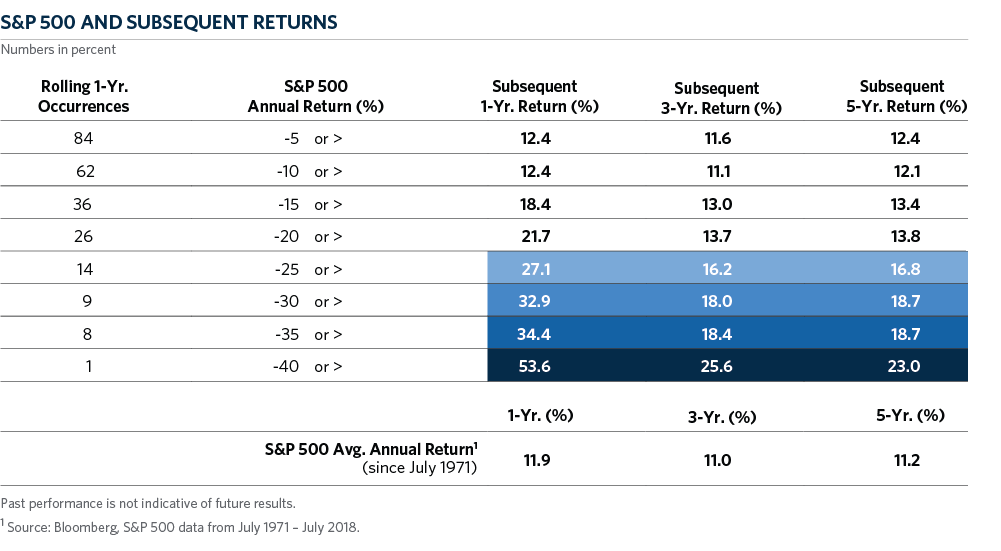

It is also important to keep in mind that doing nothing during a crisis is itself a decision that may influence the portfolio’s ability to recover to pre-crisis levels. As the chart below shows, rebalancing to policy target following a sizeable downturn in equities may help boost long term investment performance, even beyond the historical average. And potentially, it can be more difficult, if not impossible, to recover without taking some type of action.

Asking these questions can be an effective starting point to creating a framework for your crisis playbook. This playbook can serve as a roadmap to guide you when the storm is at its peak, visibility is low, and tensions are high. At a fundamental level, you will need to decide if you are going to stick with your existing strategic policy, if you are going to reduce risk in your portfolio, or if you need to cut or increase spending. While these questions seem basic, they are important to ask today, as your answers can have long term, significant impacts on how you navigate the next crisis, and the degree to which you recover…or not.