At Commonfund, we believe diverse managers offer clients access to investment talent and valuable investment opportunities and therefore should be explored and invested in. Overlooking the merits of these managers is a lost opportunity for clients, their portfolios and the missions they serve.

Notwithstanding their demonstrable merits, over the course of our searches for diverse managers across equity, fixed income and hedge funds, we noticed divergences in the relative availability of these managers as compared to their associated broader investment groups. Using the eVestment database, which primarily covers equity, fixed income and hedge fund manager listings, we identified 268 investment firms with 25 percent or greater women or minority ownership. These firms manage 1,094 investment products, a dismayingly small subset of the total universe of 4,437 firms and 24,870 funds.

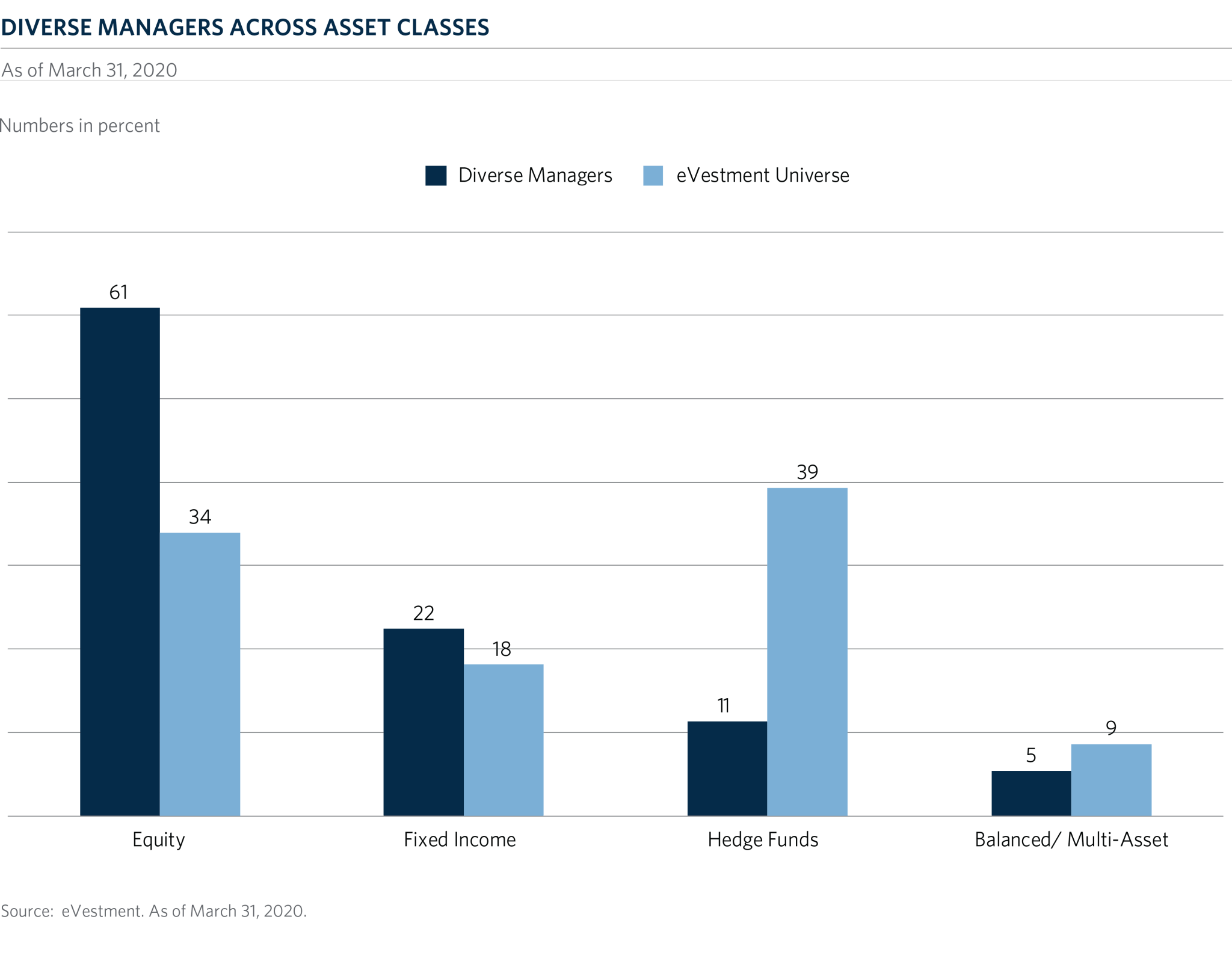

Not surprisingly, many of these managers are clustered around the traditional asset classes, and within those asset classes, they appear to invest in strategies with the highest perceived demand.

For example, of the 61 percent of managers focused on equities, 59 percent isolate their investments to U.S. equities. And indeed, this percentage is not far off the broader eVestment universe where 52 percent of equity managers invest in U.S. equities. Likewise, for fixed income, within 22 percent of the diverse manager universe, 79 percent of managers focus on investment grade or core strategies. Staying close to the locus of the strongest sources of U.S. investor demand makes logical sense, particularly given the difficulty diverse managers tend to experience in raising capital.

The flip side to this is that the distribution of diverse managers away from the core strategies and investment styles is thin, with few managers to choose from on both an absolute and relative basis. This is especially pronounced when it comes to hedge funds, where these managers are significantly under-represented. One oft-sighted reason is higher barriers to entry to launch hedge funds. For diverse managers, these barriers start with the investment industry’s broad under-investment in women and minority investment talent and mentorship. This under-investment leads to fewer women and minorities developing the necessary skill sets to launch their own funds, especially strategies which require higher levels of expertise. Other barriers include access to capital, with many minorities not having access to significant savings or friends and family financial backing. And these barriers are in addition to the usual track record, regulatory and operational hurdles to launching and running a successful hedge fund.

We are however, encouraged by what appears to be a steadily increasing flow of news and industry coverage on these managers, including the recent SEC Asset Management Advisory Committee webcast. As industry leaders become more attuned to the talent gap within their organizations and investor awareness of the benefits of investing in diverse managers rises, we hope that not only will the assets invested in diverse managers increase but that diverse managers with specialized skill sets will rise to meet this new and much deserved demand with the launch of more investment options.