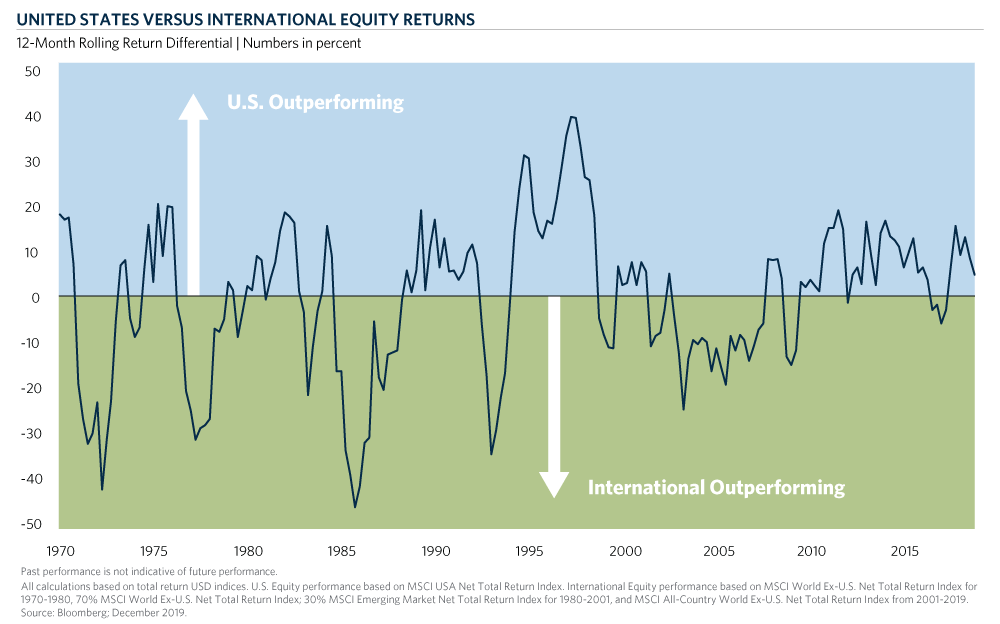

Over the past decade U.S. equities have consistently outperformed international markets, leading many investors to question the role of non-U.S. equities in their portfolio. While the current cycle of U.S. outperformance has certainly been prolonged, it is by no means unprecedented relative to history.

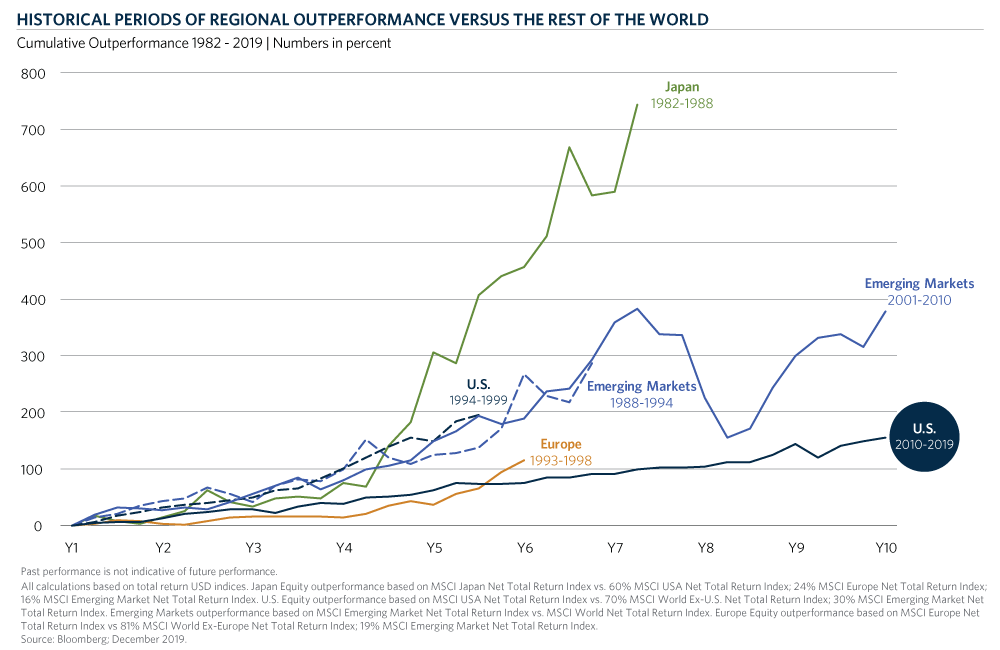

Relative performance between U.S. and international equities has always been, and in our view will continue to be, cyclical with long periods of one region outperforming the other. Furthermore, there have been several recent examples of the U.S. and other regions outperforming the rest of the world by a much greater extent than the U.S. in the past decade.

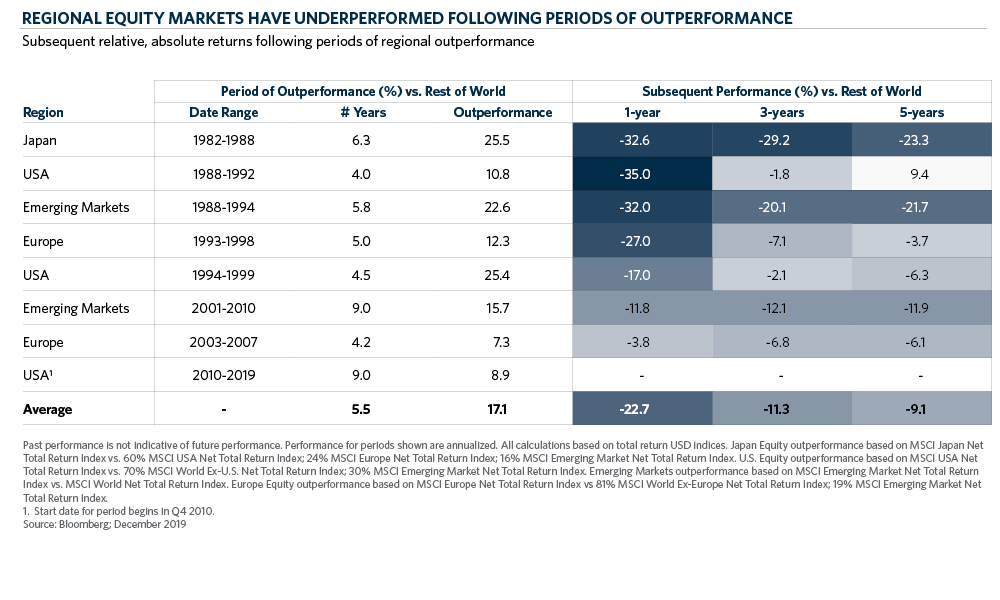

U.S. equity markets have certainly had an impressive run in the 2010s, but there is no evidence to suggest this relative outperformance can continue in perpetuity. And while it is difficult to predict when this current cycle will end, when it does it could spell trouble for relative and absolute returns of U.S. equity markets, as regional equity markets have generally struggled in the 5-year periods following similar winning streaks.

Rather than casting international equities aside due to recent performance trends, we believe international equities will continue to play a critical role in client portfolios by providing diversification, exposure to future areas of growth, and enhanced opportunities for active returns.

Rather than casting international equities aside due to recent performance trends, we believe international equities will continue to play a critical role in client portfolios by providing diversification, exposure to future areas of growth, and enhanced opportunities for active returns.

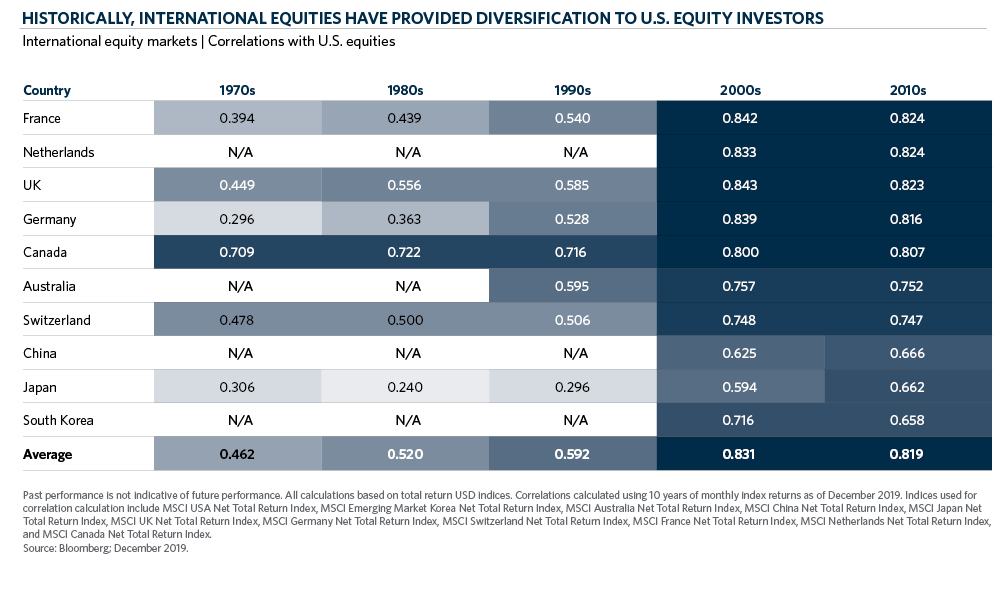

The table below illustrates the correlations between U.S. equities and the largest international market indices by market capitalization.

A correlation less than 1.0 indicates that there is some diversification benefit to investors who allocate a portion of their U.S. equity portfolio overseas. While correlations have increased across most regions over the past several decades, the benefits of diversification still exist today. Furthermore, it is possible that global trends such as the rise of protectionism will impact correlations and increase the potential benefits from international diversification in the future.

A correlation less than 1.0 indicates that there is some diversification benefit to investors who allocate a portion of their U.S. equity portfolio overseas. While correlations have increased across most regions over the past several decades, the benefits of diversification still exist today. Furthermore, it is possible that global trends such as the rise of protectionism will impact correlations and increase the potential benefits from international diversification in the future.

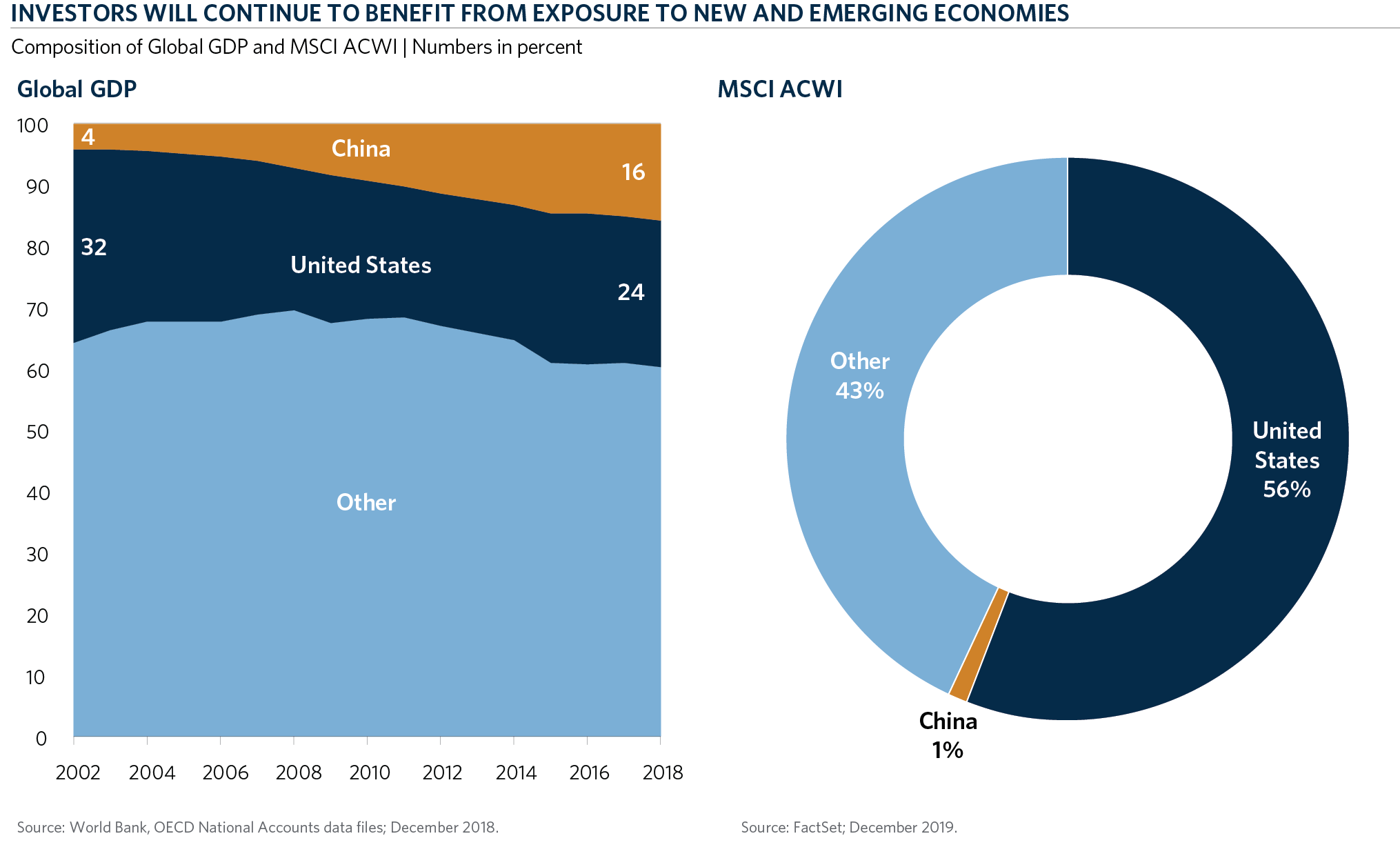

International equities can also provide U.S. investors with exposure to new and emerging economies. A clear example of this is China, which currently accounts for 16 percent of global GDP but represents only 1 percent of the market cap weight of the MSCI All-Country World Index. Investment strategies focused on emerging markets can position investors to benefit from economic growth, social development, and future investment flows to markets outside of their home country.

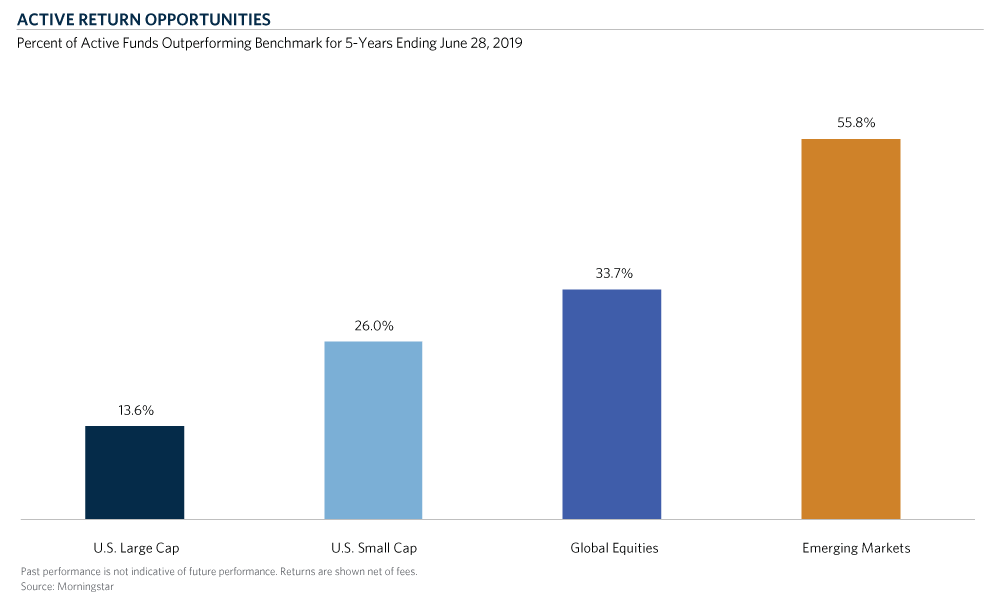

Finally, by expanding the investment universe to global companies outside of the U.S., equity managers have more degrees of freedom to identify opportunities and access to less efficient markets. Historically, this has meant that on average global and emerging markets have offered a greater ability to enhance returns through active management.

While the current cycle of U.S. outperformance has lasted nearly 10 years, we expect that relative performance between U.S. and international markets will continue to be cyclical. While it is difficult to predict exactly when this period of U.S. outperformance will end, history suggests that when it does, diversification via non-U.S. exposure will benefit investors. Beyond diversification, international equities can also provide exposure to emerging economies and enhanced opportunities for active returns. Therefore, we continue to encourage long-term equity investors to take a global perspective despite the recent outperformance of U.S. markets. View the webcast below.