Leveling the Field in the “Tug of War” Between Active and Passive…

Active Equity Manager Universal Objective: Outperform the Passive Alternative

It’s undeniable that every active equity manager’s chief competitor these days is the passive alternative against which its investors measure their performance. This is as true for a singularly focused equity mandate manager as it is for an organization like Commonfund, who assembles multi-manager active risk equity portfolios that seek to exploit the potential advantage of scouring the globe in pursuit of strategies that offer both the possibility for excess returns and excess return source diversification.

For any number of reasons, including cost, complexity and disappointing results, many investors of late have chosen the passive investing alternative. In contrast, Commonfund continues to believe in the necessity of active equity risk to help investors meet their long-term spending and capital growth needs. As our investors will remember, together with an equity bias, and a budget to extract a liquidity premium, diversification of active alpha sources is the third pillar in Commonfund’s foundation to help our clients achieve CPI +5% over a full market cycle.

Performance Attribution Primer: Betas & Alphas

The understanding of what drives passive and active equity manager results is essential for formulating a game plan to determine whether to attempt to outperform a passive alternative or to accept the market average. At the risk of over simplification and as a reminder to all of our readers, “beta” equals the market return of a prescribed and well-known benchmark. One can source a passive beta exposure to the S&P 500, the MSCI ACWI or any number of other equity benchmarks. In every case, this passive alternative will approximate a one-for-one return result commensurate to that market.

The return of an active risk equity manager, on the other hand, is comprised of some combination of beta risk and an active risk, or “alpha”, component. Active risk is any risk away from the passive risk that the benchmark offers. The amount of active risk taken can and does vary from manager to manager – “tracking error” is one metric used to measure this deviation (and will be the featured subject of an upcoming blog). The composition of active risk is equally variant – from over/underweights relative to the market (or beta) risk inherent in the benchmark, to sector risk, to single stock risk.

Beta Measurement of Active Equity Portfolios

One underappreciated truism of passive investing is that the passive alternative is always fully invested, or said another way, the passive alternative always carries 100 points of beta exposure. This insight is vital when considered in the context of Commonfund’s “equity bias” pillar in our challenge to meet CPI plus 5%.

On the other hand, it cannot be equally said of active managers that they are always fully invested. In practice, some are, some are not, some are systematically underinvested or “underbeta’d” while others are systematically overinvested or “overbeta’d”. Furthermore, these footprints are not necessarily constant over time.

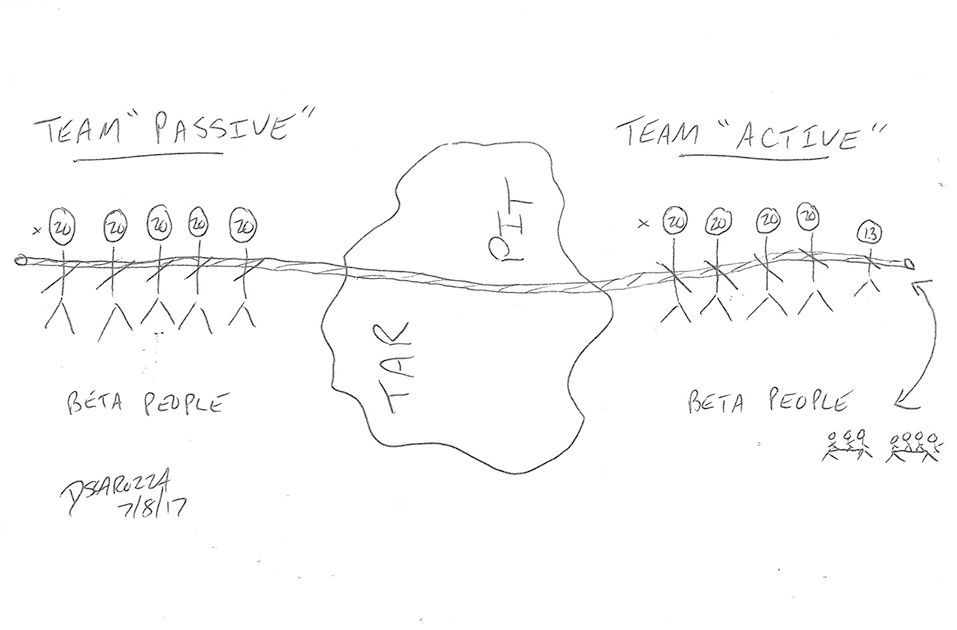

If one were to analogize the competition between active managers trying to outperform a passive alternative to a “Tug of War” match, chances are good that the two sides are not starting the fight with similar amounts of beta or market risk. Moreover, deviation in market risk from a passive benchmark is a bet and should be entered knowingly, if at all.

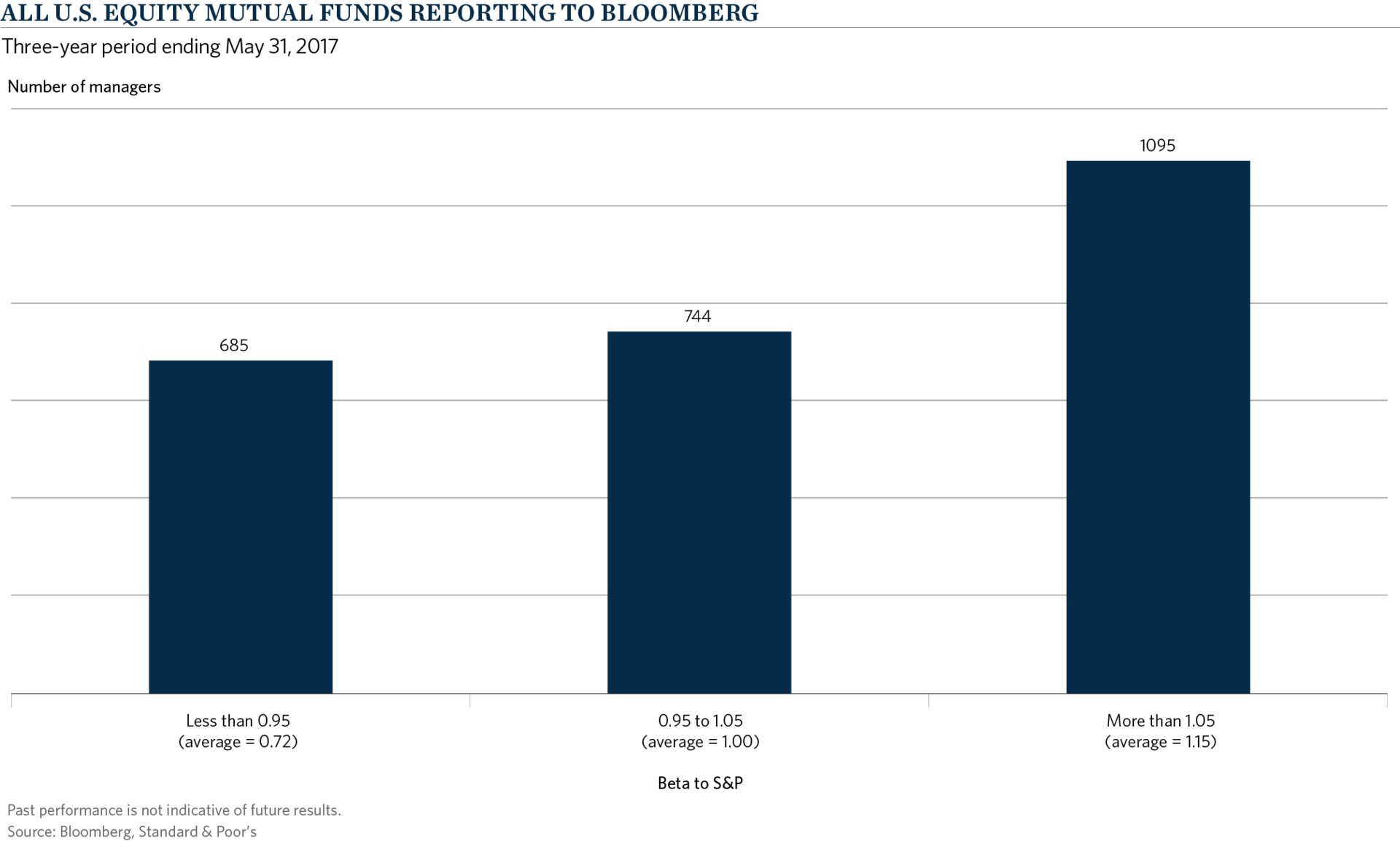

Consider the following chart. It depicts the 2,524 active US equity mutual fund managers who have reported weekly data to Bloomberg for at least three years and sorts them by beta relative to the S&P 500 over that period. As active managers’ betas vary over time, we categorized every manager who has a three year beta of between 0.95 and 1.05 as essentially being beta 1, or fully invested. The 744 managers or 29 percent of the universe that falls into this category have had an average beta of exactly 1.0. Noteworthy, however, is that 27 percent of the universe has had a beta of less than 0.95 over the same period, averaging just 0.72. And 43 percent has had a beta of more than 1.05, averaging 1.15.

Any of these managers’ beta footprints is fine in and of itself, but as one who constructs multi-manager equity portfolios with an objective of outperforming a passive alternative, the recognition that not all active equity portfolios carry equal amounts of equity beta risk seems a prerequisite.

This examination of broad universe data, and the finding that active managers’ “level of invested-ness” is all over the map, might rightly lead one to ask “How Much Beta is in My Equity Portfolio?” While a critical question irrespective of broad equity market performance, the answer might be all the more painful coming off a three year period ending in May 2017 where the S&P 500 is up just over 10 percent annualized, especially if your active manager or portfolio of active risk managers was significantly “underbeta’d” during this period.

The “average” under-invested active manager who carries a beta of 0.72, as described above, would be starting off with a three year annualized beta return contribution of 7.2 percent in the quest to outperform the passive alternative (assuming the benchmark is the S&P 500). The goal of outperforming the passive alternative is still possible, but would require a Herculean annual alpha contribution of 2.8 percent, before accounting for additional fees, just to break even compared to the fully invested portfolio.

Targeted Use of Passive Strategies to Level the Playing Field

At Commonfund, our approach to achieving active equity managers’ universal objective of outperforming the passive alternative blends an understanding of what drives the benchmark’s results with a process aimed at generating consistent outperformance. Research finds the repeatability of success in market timing or beta bets, especially in the short run, to be difficult to attribute to skill. Thus, within our equity portfolios we de-emphasize market timing. Instead, we target active risk-taking strategies and managers, where we believe a discernable advantage can be achieved at a similar amount of beta risk to respective benchmarks:

-

We negotiate custom mandates with our managers defining beta and active risk guidelines

-

We allocate region specific active risk commensurate to regional benchmark weights

-

We measure and monitor, as often as daily, the evolving betas of our underlying active risk managers and of our aggregate equity portfolios

-

Finally, in light of the aforementioned ongoing measurement and housed in our competitively advantageous fund structures, we passively acquire the requisite beta exposure to ensure that market bets, intentional or unintentional, will not be a significant source of our portfolio level tracking error

In the ongoing “Tug of War” between active risk and passive alternative equity strategies, we may not always come out on top, but any potential underperformance will not be due to our having insufficient pullers on the rope. We recognize the risk of a beta mismatch versus a benchmark, have the tools to measure it and, when necessary, the expertise and fund structures within which to call in reinforcements and level the field.