Key takeaways

- During periods of dislocation in high-quality credit, investors should stay the course within fixed income portfolios and maintain active risk to benefit from the inevitable rebound

- Passive management fails to capture the most compelling opportunities in fixed income

- Across many different recovery scenarios, we see investment-grade corporate credit as a favorable source of potential excess return relative to Treasuries

On the heels of the dislocation brought about by COVID-19, many investors have sought to define the outlook for various sectors of the market. We have seen some managers in the core bond space materially lean into corporate credit to take advantage of the “generational wides” in credit spreads. We were curious to put the current event in context relative to other meaningful spread widening events and use this as a springboard to consider possible outcomes in credit going forward.

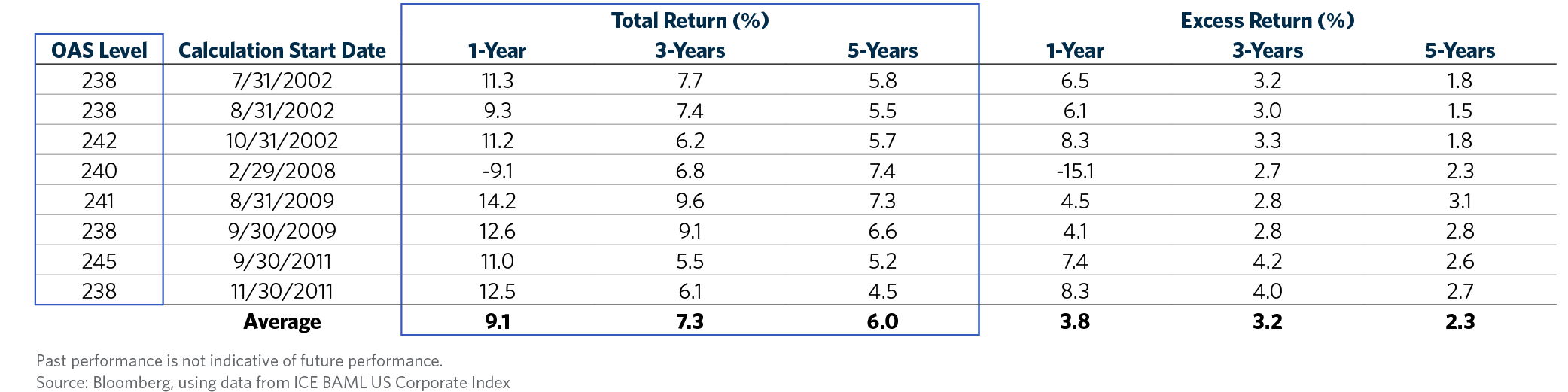

For our dataset, we compared the ICE BAML US Corporate Index and a series of daily Option-Adjusted Spreads (OAS) for a 24-year period1. This resulted in 6,115 daily observations with a mean spread of 153 basis points and a standard deviation of 83 basis points – which is significant. The Index average annualized total return and average annualized excess return over that timeframe were 6.03 percent and 0.51 percent, respectively. From this baseline, we then looked more deeply to better understand the history so that we might glean some insight into the future.

Looking at the most recent spread widening episode in the first quarter of 2020, the corporate OAS of 401 basis points on March 23rd was approximately three-standard deviations from the mean, with March 16th seeing the breach of the one-standard deviation threshold. Given the extreme nature of the move, we thought it would be interesting to look at outcomes after similar moves in the past. However, given that identifying peaks and troughs is much easier after the fact, we simplified our analysis to focus on returns of corporate bonds following one-standard deviation widenings of credit spreads. Specifically, we reviewed total and excess corporate bond returns (relative to duration matched Treasuries) over the 1-, 3- and 5- year periods following the first observation of a one-standard deviation widening of OAS2.

The table above shows that after a one-standard deviation widening from the average OAS, the “outperformance” or excess returns relative to “safe” Treasuries is meaningful and has been sustained over five years.

The table above shows that after a one-standard deviation widening from the average OAS, the “outperformance” or excess returns relative to “safe” Treasuries is meaningful and has been sustained over five years.

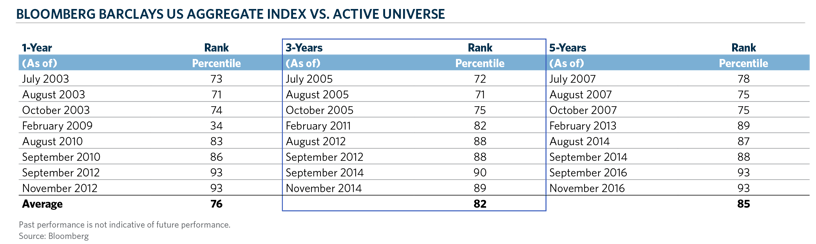

Given the attractiveness of this opportunity, and the propensity from a behavioral perspective for investors to find it difficult to buy when others are selling, we also looked at the impact of an active vs. passive approach to fixed income investments in these same time periods to understand whether an active approach benefits investors.

For this analysis, we compared the Evestment Core Bond Universe of active managers to the passive Bloomberg Barclays U.S. Aggregate Bond Index. Being a passive investor during these credit dislocation events resulted in your bond portfolio performing in the 76th percentile on average one year after the one-standard deviation moves. The best showing occurred in the year ending February 2009, when the passive index was in the 34th percentile, but broadly speaking it has not been an attractive proposition to maintain passive exposure subsequent to this type of event. This is not surprising when we consider that for these periods, on average the 10-year yield decreased by 28 basis points one year later, while corporate OAS was tighter by 45 basis points. What is interesting, is that this outcome is driven primarily by the Great Financial Crisis (GFC) which saw Treasury yields tighten significantly over the subsequent one-year period, while corporate OAS widened by 270 basis points over the same timeframe. Hence in that instance, the passive index, heavy in Treasuries and government related securities, did well relative to active managers who suffered from more credit exposure. As we look at the 3- and 5- year data we see the index in the 82nd and 85th percentiles, respectively. In analyzing the context around this performance, we see that 10-year U.S. Treasury yields, on average, decreased by 32 basis points over the three-year period and decreased by 28 basis points over the 5-year period. The averages, however, don’t tell the whole story, as observations spanning the U.S. downgrade by S&P account for much of the decline in Treasury yields in the 5-year period.3 While we have four observations where Treasury yields increased over the 5-year period, in the context of a multi-decade bond bull market, this Treasury yield increase had less of an impact than the fact that over the 3- and 5-year periods, corporate OAS tightened, on average by 111 and 104 basis points, respectively. This tends to support our belief that taking exposure to corporate debt via active management in response to a dislocation has typically provided a benefit in recent decades relative to passive exposure to the index.

Which brings us to the events of the first quarter of 2020. For the first time in U.S. history, businesses were ordered to close, and workers were told to stay home in response to the global COVID-19 pandemic. This resulted in an unprecedented self-imposed recession. As mentioned earlier, this then drove the March 2020 three-standard deviation move in corporate OAS, eventually reaching spreads of 401 basis points in late March. The huge move was in part caused by a technical issue in markets, which lacked the depth of support that had been in place prior to the GFC. The Dodd-Frank and Basel III regulations lead to an inability and unwillingness of dealers and money center banks to step in and provide liquidity. To their credit, the Fed recognized the problem and moved with stunning speed, dusting off the GFC playbook, and implementing new methods to reduce volatility and instill confidence in the markets. As a result, from the wide spreads in late March, OAS tightened by 214 basis points through May, ending the month at 187 basis points. As seen in our previous analysis, investors with credit exposure in their bond portfolio that were able to maintain or actively increase their allocation benefitted greatly.

Which brings us to the events of the first quarter of 2020. For the first time in U.S. history, businesses were ordered to close, and workers were told to stay home in response to the global COVID-19 pandemic. This resulted in an unprecedented self-imposed recession. As mentioned earlier, this then drove the March 2020 three-standard deviation move in corporate OAS, eventually reaching spreads of 401 basis points in late March. The huge move was in part caused by a technical issue in markets, which lacked the depth of support that had been in place prior to the GFC. The Dodd-Frank and Basel III regulations lead to an inability and unwillingness of dealers and money center banks to step in and provide liquidity. To their credit, the Fed recognized the problem and moved with stunning speed, dusting off the GFC playbook, and implementing new methods to reduce volatility and instill confidence in the markets. As a result, from the wide spreads in late March, OAS tightened by 214 basis points through May, ending the month at 187 basis points. As seen in our previous analysis, investors with credit exposure in their bond portfolio that were able to maintain or actively increase their allocation benefitted greatly.

The question now is where do we go from here?

Through the end of June, corporate OAS has tightened into the 160-basis point range and remains only slightly wide of the historical average as compared to the prior periods we examined, despite the significant damage sustained by the economy. The unemployment rate is above 13 percent, and while states have begun phased re-openings, concerns remain about current spikes in cases and that a second round of COVID-19 could hit in the fall/winter timeframe, if not sooner. Clearly, the anticipated beta recovery move and more has already happened. While volatility could increase again, and corporate spreads widen, there is a non-economic buyer in the mix with a virtually unlimited balance sheet – the Fed. Presuming that violent spread moves could be off the table, at least those driven by technical liquidity issues in the market, the way forward in corporate credit could be to invest with active managers with strong bottom-up bond picking skills. Granular credit analysis capabilities to discern the “haves” from the “have-nots” could help these managers better navigate portfolios through the coming quarters as downgrades, defaults and bankruptcies ramp-up in earnest.

We think investors should maintain a long-term view on their fixed income investments, and recognize that despite the pain of volatility and dislocation recently experienced, and the uncertainty that comes along with it, staying the course with active managers could be rewarded as we saw in our analysis of past spread widening scenarios. Active managers can lean into the dislocation, first benefitting from the beta trade, then transitioning to a bond-picking trade, which could result in outsized excess returns relative to duration-matched Treasuries over subsequent 1-, 3- and 5-year periods. In an environment where yields are extraordinarily low, and achieving CPI+5 percent is difficult, we see the ability to take advantage of opportunities such as this is best sourced through active management.

- Period from 12/31/1996 (the commencement of daily observations of this series available via Bloomberg) through 5/31/2020

- The returns are calculated starting the first month-end after the 1-standard deviation barrier is breached.

- Treasury yields decreased “on average” by 28 basis points over the 5-year period primarily due to a significant decrease in the observations that included the latter half of 2011 in the 5-year observation, when the 10-year Treasury yield fell from 3.43 percent at 2/28/11 to 1.88 percent at 12/31/11 for a decrease of 155 basis points. This was on the back of concerns about a U.S. debt default and its downgrade by S&P from AAA to AA+. There was additional “Grexit” noise in 2012, but the U.S. downgrade was the key driver.