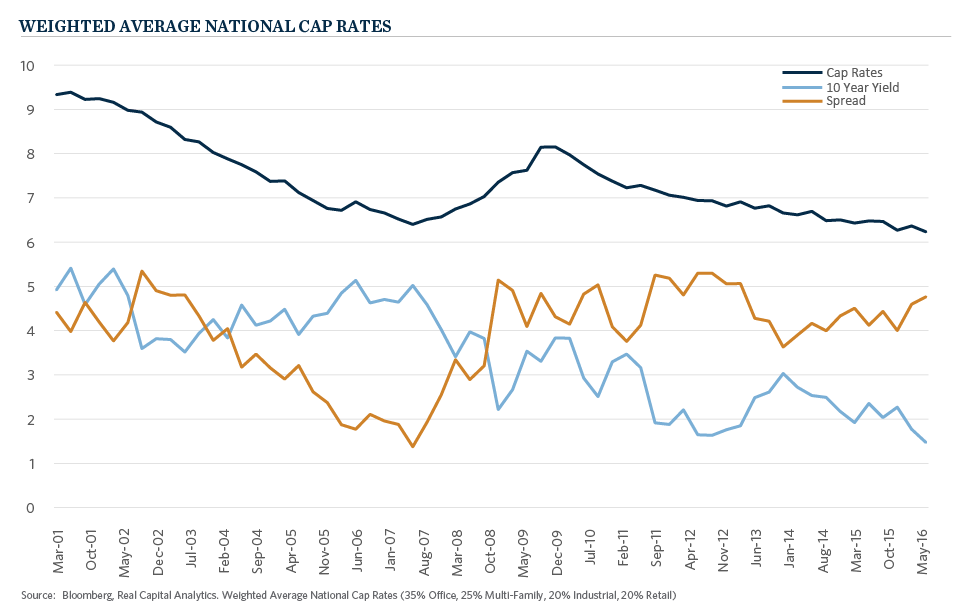

“There are three things that matter in property: location, location, location”. While the age-old adage still holds in many respects, real estate risks, as with the risks associated with all asset classes, evolve and change over time. Over the last six years, U.S. real estate markets have been buoyed by positive economic growth, muted supply growth, strong employment gains, significantly positive foreign capital flows and declining interest rates – a goldilocks scenario for the asset class. As a result, prices paid for real estate properties have reached all times highs. The most commonly used valuation tool for stabilized real estate assets, is the capitalization rate or “cap rate.” A cap rate is the ratio of net operating income to a property’s asset value, effectively how much an investor is willing to pay per unit of income generated from a real estate investment. It is akin to the equity markets earnings yield. The lower the cap rate, the higher the price being paid for the property. Capitalization rates have declined below levels last seen in 2007, directly preceding the Global Financial Crisis (“GFC”).

These historically rich valuations might seem to signal bubble-like conditions ripe for a correction. However, there are some important distinctions to be drawn between this cycle and the one that preceded the GFC. First, leverage use remains lower and lending standards have remained tighter. Second, supply of new real estate product remained subdued until very recently. Finally and most importantly, while capitalization rates have declined to new lows, so have interest rates. In 2007, spreads (capitalization rate minus 10 year treasury yields) reached 137 basis points, approximately 200 basis points lower than the 15 year historical average, while the current spread is approximately 475 basis points, or nearly 80 basis points wider than its historical average. This is important for two reasons: First, the use of leverage remains substantially accretive to real estate equity investor returns. Second, should interest rates rise, there remains some cushion before there is upward pressure on cap rates and, therefore, real estate prices.

These historically rich valuations might seem to signal bubble-like conditions ripe for a correction. However, there are some important distinctions to be drawn between this cycle and the one that preceded the GFC. First, leverage use remains lower and lending standards have remained tighter. Second, supply of new real estate product remained subdued until very recently. Finally and most importantly, while capitalization rates have declined to new lows, so have interest rates. In 2007, spreads (capitalization rate minus 10 year treasury yields) reached 137 basis points, approximately 200 basis points lower than the 15 year historical average, while the current spread is approximately 475 basis points, or nearly 80 basis points wider than its historical average. This is important for two reasons: First, the use of leverage remains substantially accretive to real estate equity investor returns. Second, should interest rates rise, there remains some cushion before there is upward pressure on cap rates and, therefore, real estate prices.

At Commonfund, we expect the positive dynamics of the current cycle to continue for some time but are cognizant that we are in the later innings of the cycle. As a result, we are adjusting our real estate exposure to focus on sectors and strategies we expect to reduce economic cyclicality, benefit from positive demographic tailwinds, and generate higher cash flow yields which should provide a buffer against rising interest rates.