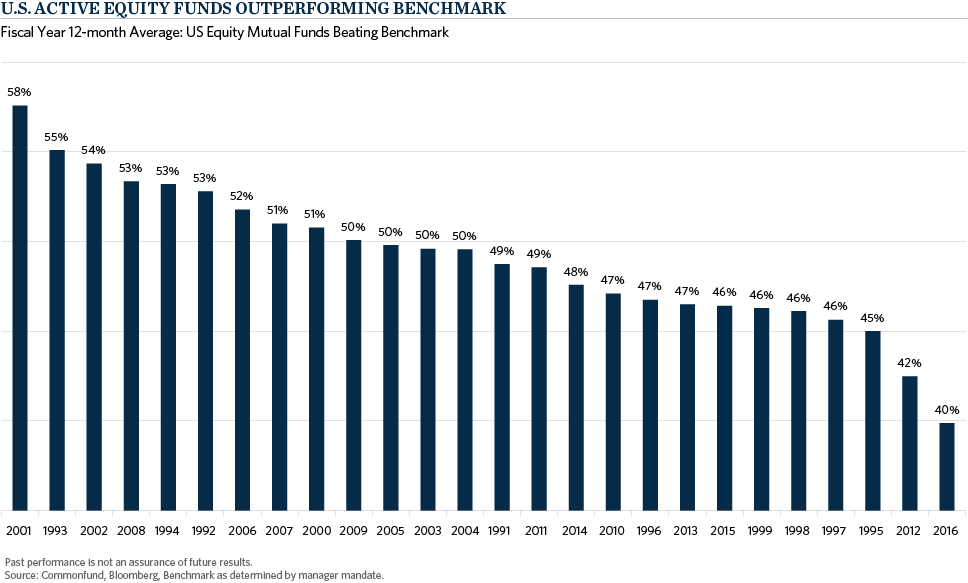

It’s not easy being an active equity manager these days. As the chart below depicts, active managers have just come through the worst period for returns in several decades. The chart shows the percentage of US Equity mutual funds that beat their benchmark for the past 26 fiscal year ends (12-months ending June 30th), with 2016 representing the worst one year result since 1991!

Think of all that has happened over those 26 years. We’ve had the great financial crisis of 2007-2008, a technology/internet bubble in 1998-1999 culminating with a sharp and prolonged bear market from 2000-2002, and most recently the European crisis in 2011. What made 2016 worse than those prior periods? There is not one easy answer to that question, but probably a series of shifts in the investment landscape that deserve mentioning.

- A prolonged period of manipulated interest rates and monetary policy globally has created a massive reach for yield. As central banks have supported monetary policy and business cycle economics through various measure of low/negative interest rates and quantitative easing, yield starved investors have looked to equities to generate income. As equities have become bond substitutes for many investors, inflows into yield oriented, traditionally defensive sectors created distorted returns. Consumer staples, utilities and telecom stocks accounted for over 80% of the return of the S&P 500 for the fiscal year ending June, 2016, while only accounting for 15% of the market cap. To make matters worse, many active managers have viewed these sectors as historically expensive on a valuation basis, resulting in underweight exposures, and challenged returns relative to benchmark.

- More so than ever, active managers now face multiple forms of competition for investment capital. Passive strategies continue to grow and take market share away from active managers. Add in additional competition from ETF’s and “smart beta” or factor-based investing, and it’s not hard to understand why fund flows have accelerated out of actively managed portfolios. These flows create a headwind to relative returns. Investors can now “replicate” active management returns through factor based products or ETF’s or even create unique exposures that help diversify their overall portfolio. The creation and compelling value proposition of these factor-based products, and a greater acceptance of passive forms of beta replication have changed the investment landscape in which active equity managers compete.

- A more nuanced discussion of correlations also merits attention. In reaction to both examples listed above, traditional forms of portfolio construction have not proven useful, as correlations have risen, both between stocks as well as between active managers. Thus, where investors (either active equity managers or investors in multiple active equity managers) thought they were getting benefit through a) holding different equities with different characteristics, or b) holding multiple different active managers, the result was often more that of a single bet going awry.

At Commonfund, we are not sitting idly by waiting for the environment to turn in favor of active management. We still want to be exposed to active managers, as we do believe successful implementation of an actively managed strategy can reap strong rewards for long-term investors, but we are actively looking to structure portfolios with better forms of diversification in addition to compelling active managers. The goal is to provide actively managed equity exposure, while recognizing that market structure and execution techniques are expanding the opportunity set on how best to implement our approach. Stay tuned in the coming weeks and months as we roll out some of these changes.