Strong Fourth Quarter for Global Markets

Following three quarters of bleak performance, global markets staged a rally to close what was a tumultuous 2022.

In the fourth quarter, the MSCI ACWI returned 9.8 percent and the Bloomberg Aggregate Bond Index returned 1.9 percent, reversing the prior quarter’s performance of -6.8 and -4.8 percent, respectively. Much of this strong performance occurred in October and November, as moderating inflation drove yields lower and served as the catalyst for a rally in stocks. The market response to the October CPI report on November 10th was most notable, as the S&P 500 gained 5.5 percent, its biggest one-day rally since April 2020, when risk markets were recovering from the pandemic shock. In December, investor sentiment worsened because of stronger than expected employment data and the markets weakened into year-end.

Sentiment and Positioning have yet to Bottom

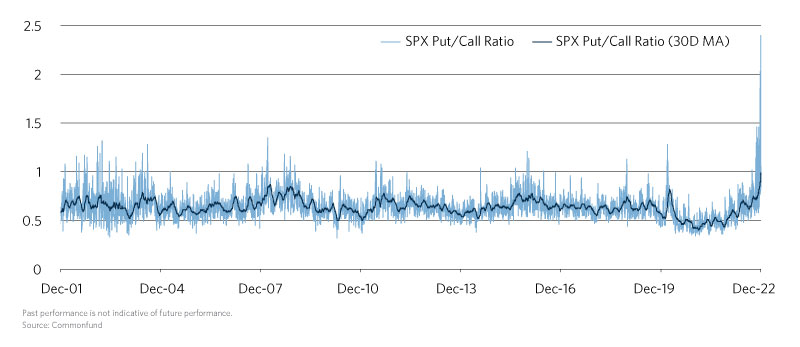

Despite the strong performance, investor sentiment remains broadly negative. This Chart of the Month depicts the S&P 500 Put/Call ratio1, along with its 30-day moving average dating back to 2001. Although the daily ratio is clearly noisy and subject to significant volatility, it reached multi-decade highs of 2.0 and 2.4 during the waning days of 2022. Fundamentally, part of the reason for such a high number can be traced to an overall shift in investor derivatives appetites. During the fourth quarter, Goldman Sachs reported that 45 percent of listed S&P 500 options volume have less than one day to expiry, as traders sought to capitalize on daily moves. This level trended between 5 and 10 percent through the 2010s but spiked to 20 percent amid a volatile 2020 and has continued an upward trend above 40 percent in 2022.

The 30-day moving average smooths out the daily spikes but has nonetheless been trending upward throughout 2022, a reflection of the overall bearish sentiment. As of December 30, 2022, the 30-day moving average was approximately 0.97. Strikingly, these levels are higher than the ratios seen during the depths of the 2002 tech selloff, 2008 Financial Crisis, and the March 2020 dislocation.

Other metrics help illustrate the dismal investor sentiment at present. The American Association of Individual Investors Survey indicates that institutional investors total stock allocations have declined from just north of 70 percent to nearly 60 percent over the last year. Additionally, according to Bank of America’s Global Fund Manager Survey, the net percentage of allocators that are overweight equities versus bonds has reached the lowest point since March 2009. Each of these indicators show that the fourth quarter rally was not embraced by many investors. As investors remain hyper-focused on macroeconomic data in the new year, it will be key to keep track of an overall sentiment shift that has not yet reflected in the data.

-

The Put/Call Ratio represents the ratio between the total volume of equity put options over call options, reported at the end of each trading day