As investors grapple with adjusting to 450 basis points of rate hikes (and likely more in sight), the debate on just how quickly monetary policy will transmit through the real economy has returned to the forefront.

Hopes of a rate hike pause or cuts have been the main drivers of the strong year-to-date returns, with markets even pricing rate cuts in the latter half of 2023 until late last week. A continuation of hawkish signaling from FOMC members along with a strong employment report spurred the market-implied terminal Fed Funds rate closer to 5 percent. At the center of the debate is whether Fed policy has been able to sufficiently tighten financial conditions and further slow the inflationary pressures throughout the economy.

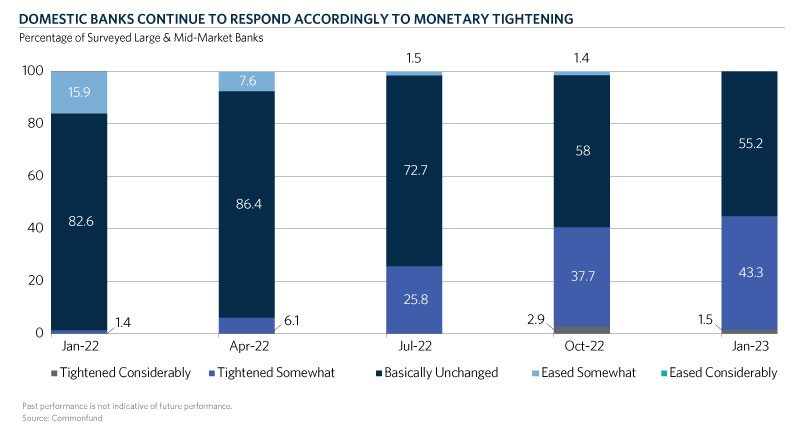

While some measures of financial conditions have shown relative easing as the tightening cycle approaches its assumed endgame, the recent Federal Reserve Senior Loan Officer Opinion Survey displayed a significant tightening amongst major lenders. The Senior Loan Officer Opinion Survey queries up to 80 of the large domestic banks and 24 U.S branches and agencies of foreign banks. The survey is broken down across five categories that range from considerable easing to considerable tightening in lending activity. This chart of the month displays the survey data over the last year. Most striking is the trend of banks that are reporting tightening, having nearly doubled since July 2022 to 43.3 percent. The stark difference in the survey results from just a year ago is one of many indicators of the new monetary regime that we have entered.

Commentary from the January survey not only reflect increasingly tightened loan standards but weakening demand for business and consumer credit, the latter a continuation of a trend that began in mortgage originations as rate hikes all but froze housing market activity. Higher standards were observed across sectors from real estate lending to auto loans and credit cards. The expectation from survey constituents is for both standards and demand to further tighten and weaken, respectively. Respondents cited the uncertain economic outlook and reduced risk tolerances as some of the main drivers behind tightening standards.

Despite the survey’s clear signal of tightening financial conditions, other indicators are displaying the opposite. For example, the widely cited Goldman Financial Conditions Index has revealed easing financial conditions as we ended 2022 and entered the new year. Also, cross asset volatility has continued to decline as the MOVE Index1 continues its downtrend off a multi-year high. Certainly, the risk asset rally that we are currently experiencing has been fueled by hopes of easing financial conditions and the topic has been a continued highlight of FOMC communications over the past few months. Amongst all this uncertainty, there seems to be one clear truth: the macro backdrop will continue to dominate markets more than ever in 2023.

- The ICE BofA MOVE Index measures U.S. interest rate volatility by tracking the movement in U.S. Treasury yield volatility implied by current prices of one-month over-the-counter options on 2-year, 5-year, 10-year and 30-year Treasuries.