In 2021, the word was transitory. This described the expectations of Fed officials and many other prognosticators that elevated inflation would quickly return to the pre-COVID level of at or around 2 percent.

As recently as the first half of 2022, economists were quick to cite extreme supply chain dislocations as the primary cause for the inflation pressures, particularly within goods. They weren’t wrong. Looking back, the stresses on supply chains were vast; massive container ship backlogs hindered inventories in a time of unprecedented consumer demand. Within months, supply chain management became the hottest topic of conversation across economic and political circles. In this chart of the month, we examine a chart that seems to be a clear representation of the supply chain shock and subsequent resolution.

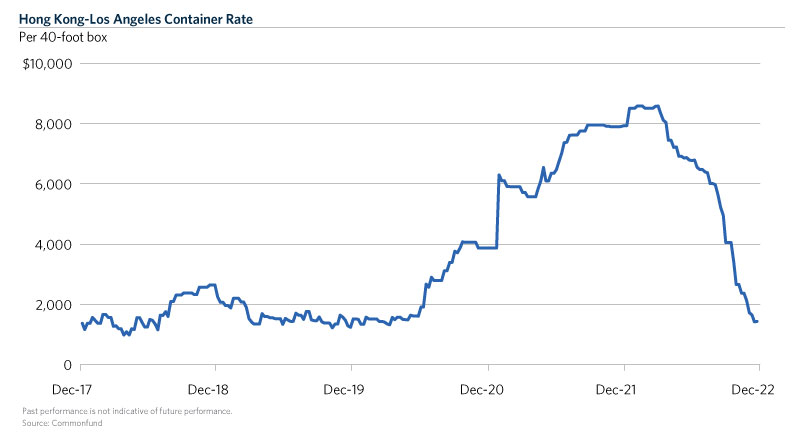

Pictured is the weekly index of the cost of shipping a standard 40-foot container from Hong Kong to the Port of Los Angeles, a key benchmark of global shipping costs as well as a reflection of overall supply chain tightness.

Over the three years preceding the pandemic, container rates were range bound and never rose above $3,000 per box. The effects of the dislocations in 2020 can be observed almost immediately; the cost had risen to $4,000 by September 2020 and continued to make new highs through year-end. The supply chain pressures remained as global fiscal and monetary authorities continued unprecedented rounds of stimulus and accommodative policies compounding inflationary pressures. This dynamic along with a shift in consumer appetites from demanding services to goods put further stress on supply chains. Ultimately, after quadrupling its pre-pandemic average, the price reached a high of nearly $8,600 per box in March 2022.

As inflation was making new highs earlier this year, Fed officials signaled that we would be entering a new interest rate regime, introducing a 25-basis point interest rate hike to their policy rate. By the end of June, they had embarked on another 125 basis points of interest rate hikes. As the second quarter ended, container rates had fallen 25 percent off the March highs. As supply chain pressures subsided from a combination of improved capacities and normalizing demand, container rates have fallen 84 percent from the all-time highs as of December 1st, 2022. Yet, inflation has not cooled commensurately as many would have hoped.

Despite significant normalization in global supply chain function (container rates, backlogs, etc.), much of the damage has been done with respect to price increases. The combination of spiking energy prices and supply chain dislocations not only spurred significant first-order effects on inflation, but second-order as well (month-over-month increases). 2022 alone has seen 5 months where month-over-month inflation came in above 0.5 percent, double the 10-year average of 0.22 percent. Additionally, inflation pressures have broadened to shelter and services as we have previously addressed in this blog. As supply chain pressures continue to abate, it is clear that moderating inflation will require multiple drivers receding – much like spiking inflation.