This blog is reprinted with permission by Net Assets, published by the National Business Officers Association (NBOA). The original article can be found here.

Investment guidelines enable institutions to weather market volatility better than individuals, on average, and a crisis playbook can provide additional assurance. The 2017 calendar year saw just eight trading days where the stock market lost or gained more than one percent in a single day.

2018 had 64 such days. That makes the current market seem volatile, but it’s in line with historic volatility, explained Steven C. Snyder, managing director at Commonfund, a nonprofit-focused investment firm that works with more than 200 independent schools. “Coming from a period of calm, it feels more painful,” he said.

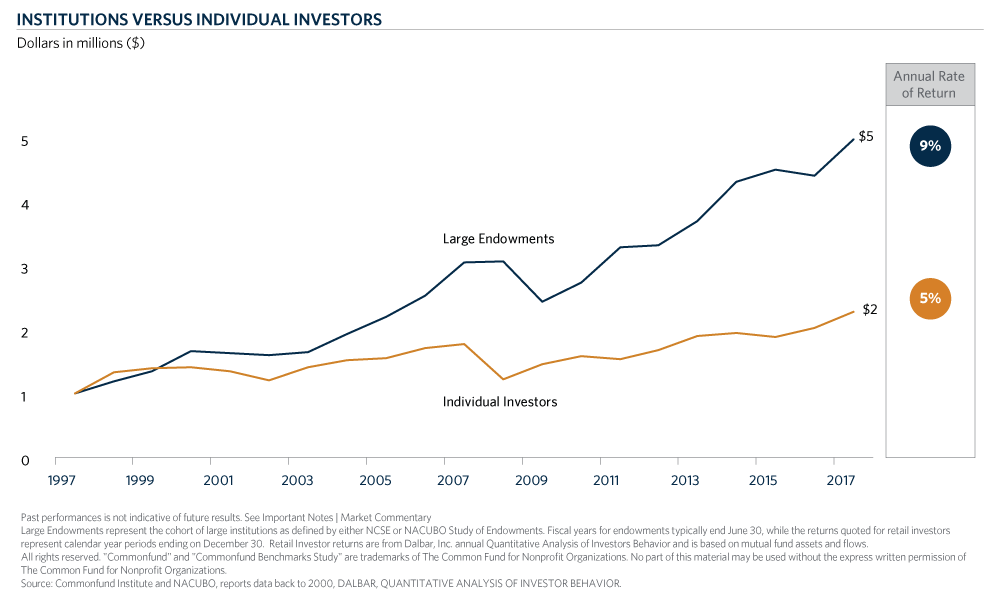

His guidance to independent schools is to stay the course and consider the advantages of being an institutional investor. Institutions with endowments follow investment guidelines – usually drawn in periods of calm – to help insure investment decisions will align with mission and vision. Individual or retail investors are far more susceptible to human emotions when making investment decisions and may be tempted to pull their money out of the market in uncertain times.

“If you analyze previous volatile periods, even huge intra-year dips of 10 to 14 percent, you’ll most often find at the end of year that the market has still made money,” Snyder said.

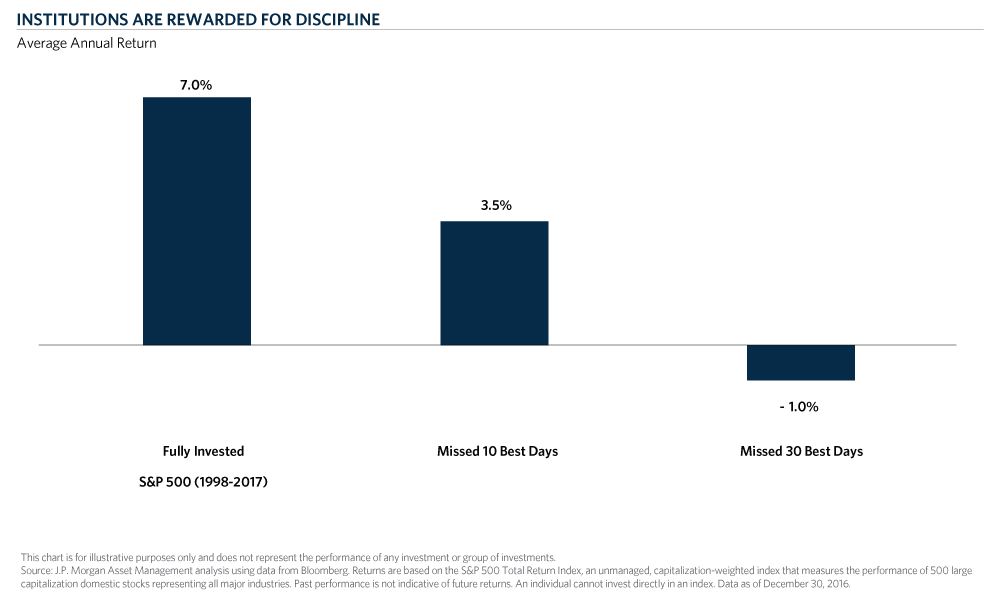

Investors would need a “crystal ball” to predict not only when to pull out of the market, but also when to put the money back in to avoid significant losses. In comparing longitudinal returns from retail funds and institutional funds, Commonfund has found that institutions do significantly better, largely thanks to clear guidance that prevents emotional decision-making, said Snyder.

Schools might consider developing a “crisis playbook,” he advised, where senior leaders and the board consider how the school would respond under possible scenarios – for example, if the market, enrollment and fundraising all dropped at once.

“Most independent schools are going to be more dependent on tuition than their endowment, so a 20-student drop in enrollment may present a bigger challenge than a 5 percent drop in the endowment,” Snyder said. But what happens if lost tuition revenue can’t be made up by fundraising, for example?

A crisis playbook would help school leaders identify stress points or triggers where operations are no longer sustainable, and then consider what actions they would feel comfortable taking. Hypothetical questions could include, What programs might we cut? What expenses could we control? In short, Snyder explained, the playbook is a sound way to guide your actions when you spot storm clouds on the horizon, without risking the ship.