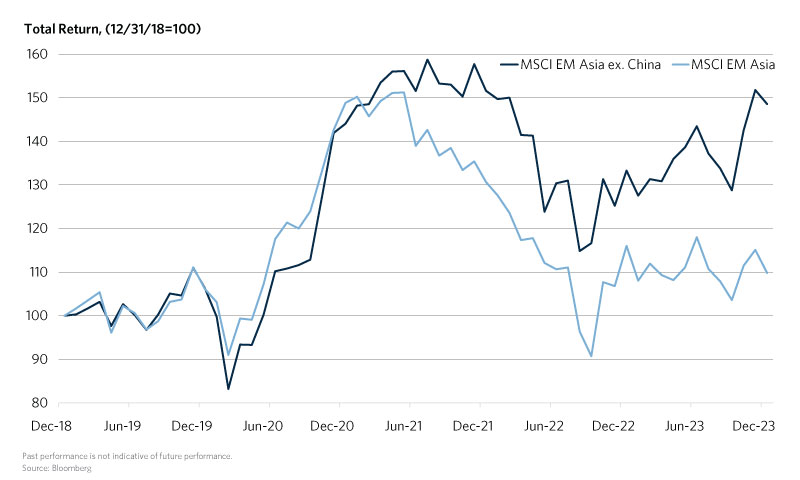

2023 marked the third year of drawdowns for the Chinese equity markets, reflecting a country still trying to emerge from the pandemic period. A combination of factors continued to hamper the once booming economy causing the MSCI China Index to tumble 11 percent during the year. In conjunction with a strong year for Taiwan and India, both posting double digit returns, the spread between MSCI Emerging Markets Asia, with and without China, was 16.3 percent in 2023.

While many viewed China’s growth prospects positively going into 2023 due to expected easing of the nation’s strict pandemic policies, the “reopening” fell flat amid continued disinflationary pressures and significant stress in the banking sector. In addition, other emerging markets including Mexico, Taiwan, Vietnam, and India have encroached on China’s share of U.S. imports in recent years. Many view this as a new regime for U.S./China trade relations in which the U.S. continues to distance itself from unilateral supply chain dependence.

On the mainland, China’s consumption did not bounce back as expected leading to a period of economic stagnation. People’s Bank of China yields have slumped while the government discusses a possible rescue package of $278 billion, on concern this will not be enough to cover for the Evergrande insolvency (and broader real estate distress) which has left the property market in a precarious situation. For reference, Evergrande, one of China’s largest property developers, was ordered liquidated by a Hong Kong court in late January.

Another stress point for the equity markets was the 2023 year’s selloff triggered in part by “snowball” derivatives, which are linked to the value of Chinese equity indices such as the CSI500 and CSI1000. Snowballs are a structured derivative sold in China that offer to pay investors bond like coupons if the indices stay within a predetermined range. The snowball market is estimated to be worth approximately $45 billion with about one third of the market near knock-in levels (index level at which the positions begin to lose money). Analysts speculate that the snowball derivative activity is not large enough to significantly impact the market but concede that the macroeconomic environment, slow real estate market, and strained U.S.-China relations are severe headwinds to overcome. In aggregate, all these factors will continue to weigh on risk sentiment in China.

This Chart of the Month shows how China’s poor performance has caused a drag on Asian emerging market performance by displaying the indexed performance of the MSCI Emerging Markets Asia as well as the MSCI Emerging Markets Asia ex. China. The indices largely tracked each other throughout 2019 and 2020. However, China’s sustained strict pandemic policy hindered returns throughout 2021 and 2022, while regional peers continued to grow. After continued weakness in 2023, paired with significant strength from countries such as India (which recently became the most populous nation and surpassed $4 trillion in market capitalization), the underperformance has amounted to nearly 39 percent on a total return basis since December 31, 2018. With an uncertain path forward for China, emerging market country selection remains paramount as regional outcomes continue to diverge.